Here’s how Americans say their finances have changed since Trump took office

Many Americans say that their financial situation has stayed about the same since President Donald Trump took office, according to a new Bankrate survey, even as a pandemic-induced recession put the most workers out of a job since the Great Depression.

But some Americans don’t have optimism for the future. Roughly 1 in 4 individuals (or 26 percent) expect that their finances will be better a year from now. Meanwhile, many Americans are split over which presidential ticket will be better for their wallet.

Bankrate commissioned YouGov Plc to conduct this online poll from Aug. 19-21, with a total sample size of 2,418 adults. The figures have been weighted and are representative of all U.S. adults.

Key takeaways:

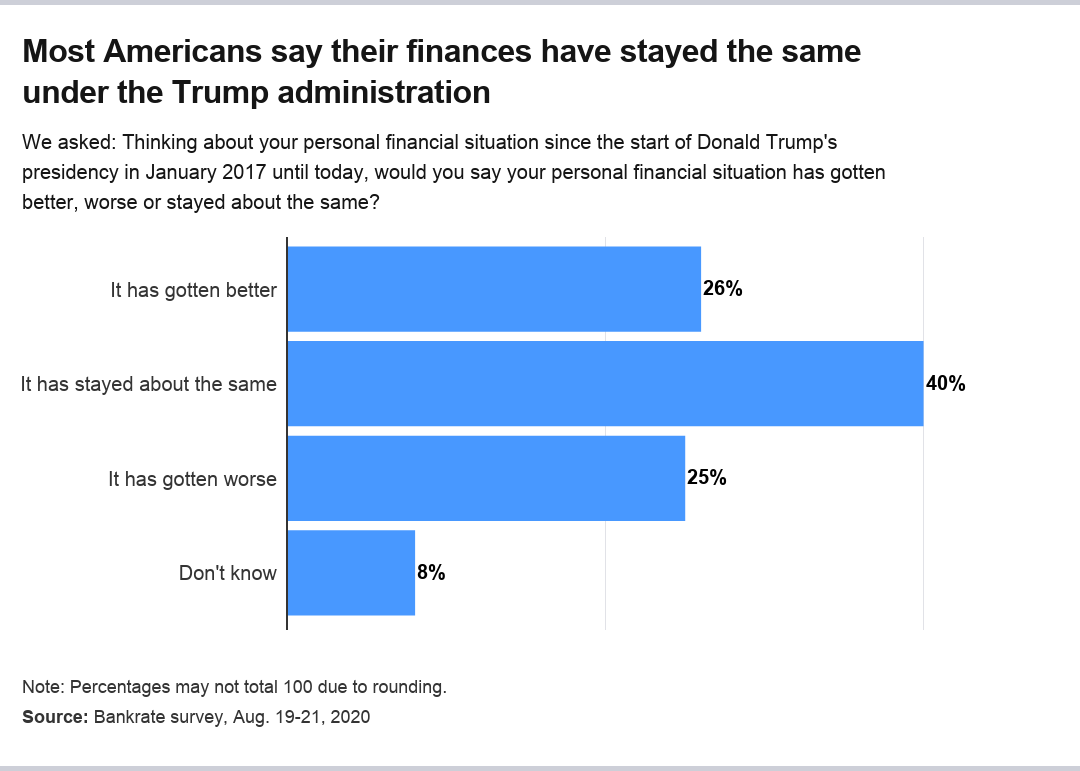

- About 2 in 5 Americans say their finances have stayed the same since Trump’s inauguration.

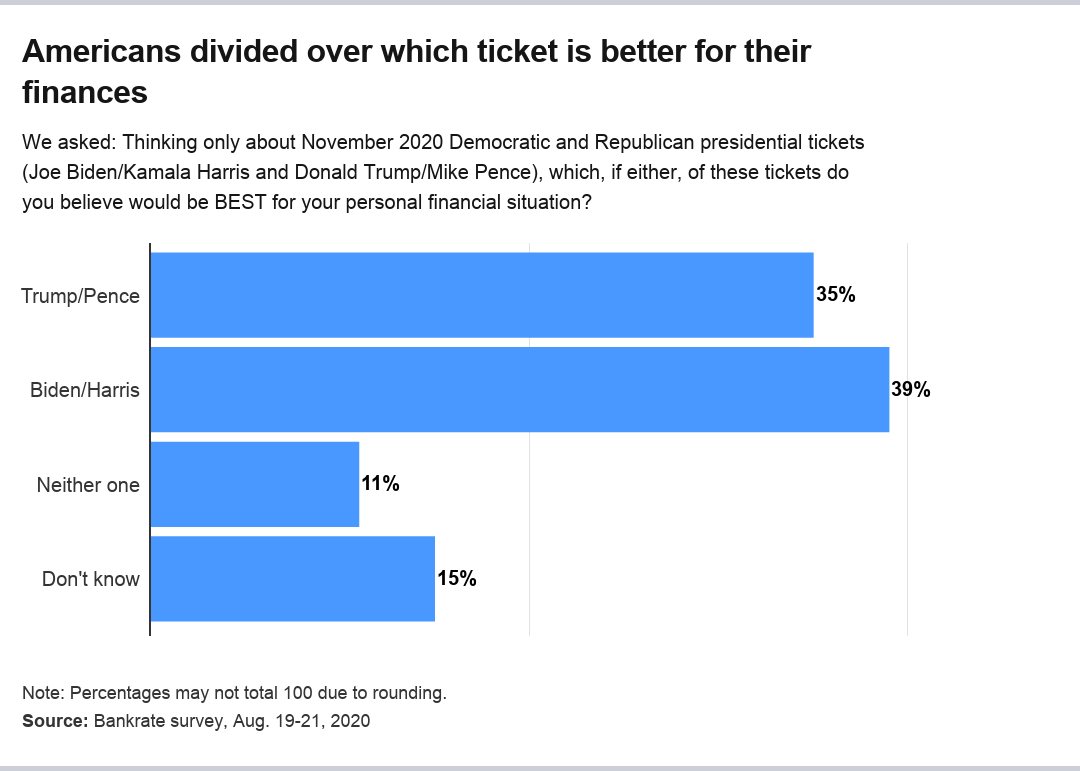

- Americans are split on whether a Biden or Trump ticket will be better for their financial situation.

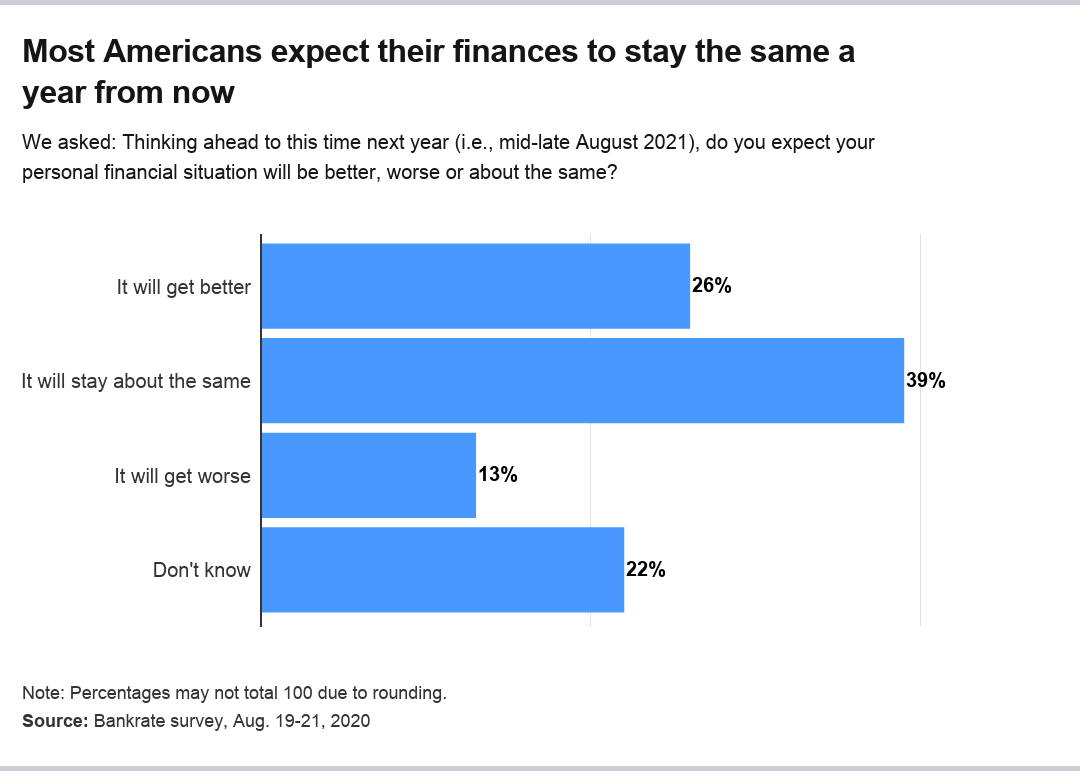

- Even with a high-stakes election, 2 in 5 see their finances faring the same about a year from now.

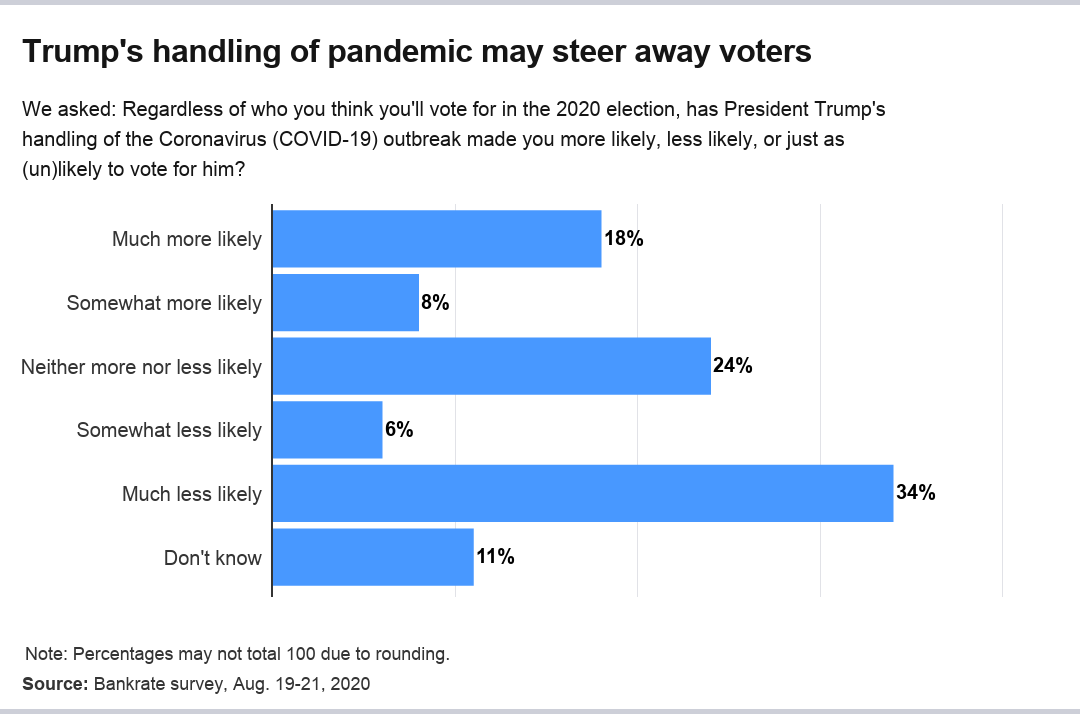

- 39 percent say they’re less likely to re-elect Trump after his coronavirus response.

Americans mostly say their finances have stayed the same since Trump took office

While 40 percent of Americans in Bankrate’s poll said their finances have stayed the same over the course of Trump’s term, 1 in 4 said their finances have gotten worse and 26 percent report improvement. About 8 percent said they didn’t know how to rate their situation over the past three and a half years.

But not all groups share that prosperity. White respondents were nearly two times as likely as Black respondents (31 percent vs. 16 percent) to report that their finances have gotten better since Trump took office. Meanwhile, individuals making more than $80,000 annually disproportionately reported that their finances have improved (41 percent) under the Trump administration, compared with 19 percent of those earning less than $30,000.

It highlights the unequal distribution of wealth that burdened the longest expansion on record long before the coronavirus pandemic. That divide has only widened, with moderate- to low-income communities bearing the brunt of the pain as lower-wage jobs vanished while the U.S. economy shut down to control the spread of the virus.

“One of many unique aspects to the current economic environment is the wide division between the haves and the have-nots,” says Mark Hamrick, Bankrate senior economic analyst and Washington bureau chief. “Those able to work from home and have avoided the loss of a job or income have been relatively unscathed, at least financially. At the same time, unemployment remains historically elevated, and the path of the economic recovery remains uncertain.”

Americans divided over which ticket is best for their finances

Analysts often blame George H. W. Bush’s and Jimmy Carter’s unsuccessful re-election bids on the economy having entered a downturn that year. Experts have wondered whether the coronavirus pandemic could create that result for Trump.

But even during the worst downturn in generations, no candidate clearly stood out when Americans were asked whether the Republican or Democratic ticket would be best for their finances, Bankrate’s survey finds.

Americans were almost evenly split over each party, though favoring the Democratic ticket only slightly. About 35 percent of Americans preferred a Trump and Pence administration, while 39 percent selected Biden and Harris. That close split pervaded even among registered voters, with 43 percent preferring Trump and 45 percent selecting Biden as the better choice.

Overall, 11 percent said neither one would be beneficial for their wallet, while 15 percent reported that they didn’t know.

Those preferring the Republican ticket tended to be White, male and older than 55, the survey found. Meanwhile, Biden and Harris’ supporters were more often women, minorities and college-educated.

Higher-income individuals (those making above $80,000) were closely split, with 41 percent favoring Trump and 45 percent choosing Biden.

Younger people were more likely than older individuals to not know which candidate would be best for their individual financial situation. About a quarter (23 percent) of millennials were undecided over Biden and Trump. That indecision was even more prevalent among Generation Z, the youngest generation between the ages of 18 and 23, with about 27 percent saying they didn’t know which candidate would be best.

About 2 in 5 Americans see their finances fairing the same a year from now

Many Americans aren’t expecting their financial situation to change much in the next year, regardless of who occupies the White House.

About 2 in 5 Americans (39 percent) say they expect their finances to be about the same in August 2021, the most of any category. By that time, whoever wins the election would be about seven months into his presidency. About 26 percent think they’ll be doing better a year from now.

Reflecting the tremendous amount of uncertainty in the months ahead, 22 percent said they don’t know. And only 13 percent of Americans expect their finances to be worse a year from now. That could be because of prevailing views that the U.S. economy can only go up from here.

Democrats were more than twice as likely as Republicans (16 percent vs. 6 percent) to say that their finances will get worse a year from now, according to the survey. Meanwhile, 38 percent of Republicans say their finances will likely improve over the next year, compared with 26 percent of Democrats and 21 percent of independents.

Hispanics are the demographic most worried about the future, with 20 percent expecting their finances to get worse. Meanwhile, 18 percent of older millennials (those between the ages of 31-39) and 17 percent Generation X (40-55) expect to be doing worse, the most of any generation.

One in 5 individuals making less than $30,000 annually expects their finances to be worse a year from now, nearly two times as much as those making $50,000 or more annually.

President’s handling of pandemic a key issue for Americans

The coronavirus pandemic has taken the spotlight during a year that was initially bound to be all about the presidential election.

Some 39 percent of Americans said they’re less likely to vote for Trump because of his handling of the pandemic, while 26 percent said they’re more likely. About 11 percent said they didn’t know, while 24 percent said their opinions hadn’t changed because of the coronavirus.

White respondents were more than two times as likely as Black respondents (30 percent vs. 14 percent) to say the president’s handling of the coronavirus made them more willing to vote for Trump. Among registered voters, 42 percent said they were less likely to vote for Trump because of the pandemic, while 31 percent said they were more likely.

Critiques of the chief executive’s coronavirus response include acting too slow to stop the spread of the virus, allocating minimal funding for testing, appearing in public without a mask and continuing to organize large-scale events on the campaign trail. Others praise the president’s response to the economic devastation by signing the largest stimulus package in American history (the CARES Act) into law, though lawmakers in Capitol Hill appear to be gridlocked over the next round of aid.

How to navigate your finances in the months ahead

The devastating effects of the coronavirus pandemic are likely to linger for years to come, with the unemployed outnumbering the number of jobs on the market and growth subdued well into 2022, according to the Fed’s latest forecasts. It’s smart to safeguard your finances, no matter which administration is voted into office.

“No matter which candidate is sitting in the White House after Inauguration Day in 2021, significant economic challenges will persist,” Hamrick says. “Unemployment is likely to remain substantially higher than pre-pandemic levels. Some industries will continue to struggle, dampening hiring prospects.”

- Cut back on expenses and continue padding your emergency savings: No one knows how long the hardship will last. Think twice before making any big-ticket purchases, and boost your emergency savings, which experts recommend having in a savings account for quick and easy access to funds.

- Consider refinancing to free up money: Mortgage rates have come down significantly this year, and many experts expect that they’ll only fall further. Consider refinancing into a lower rate, which could shave hundreds of dollars off your monthly payment that you could use to put toward your emergency fund.

- Work with any lenders in case you face hardship: Federal student loan borrowers, for example, have been granted a forbearance program until the end of this year. Stay in touch with your lenders or any institution you regularly pay a bill to, in case of unexpected job loss. It doesn’t hurt to see if you can work out a new payment or forbearance program that suits your individual financial situation.

Methodology

Bankrate commissioned YouGov Plc to conduct this online poll from Aug. 19-21, with a total sample size of 2,418 adults. The figures have been weighted and are representative of all U.S. adults.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.