State of the Economy

Exclusive Survey

Add the state of the economy to the long list of topics Americans can’t seem to agree on.

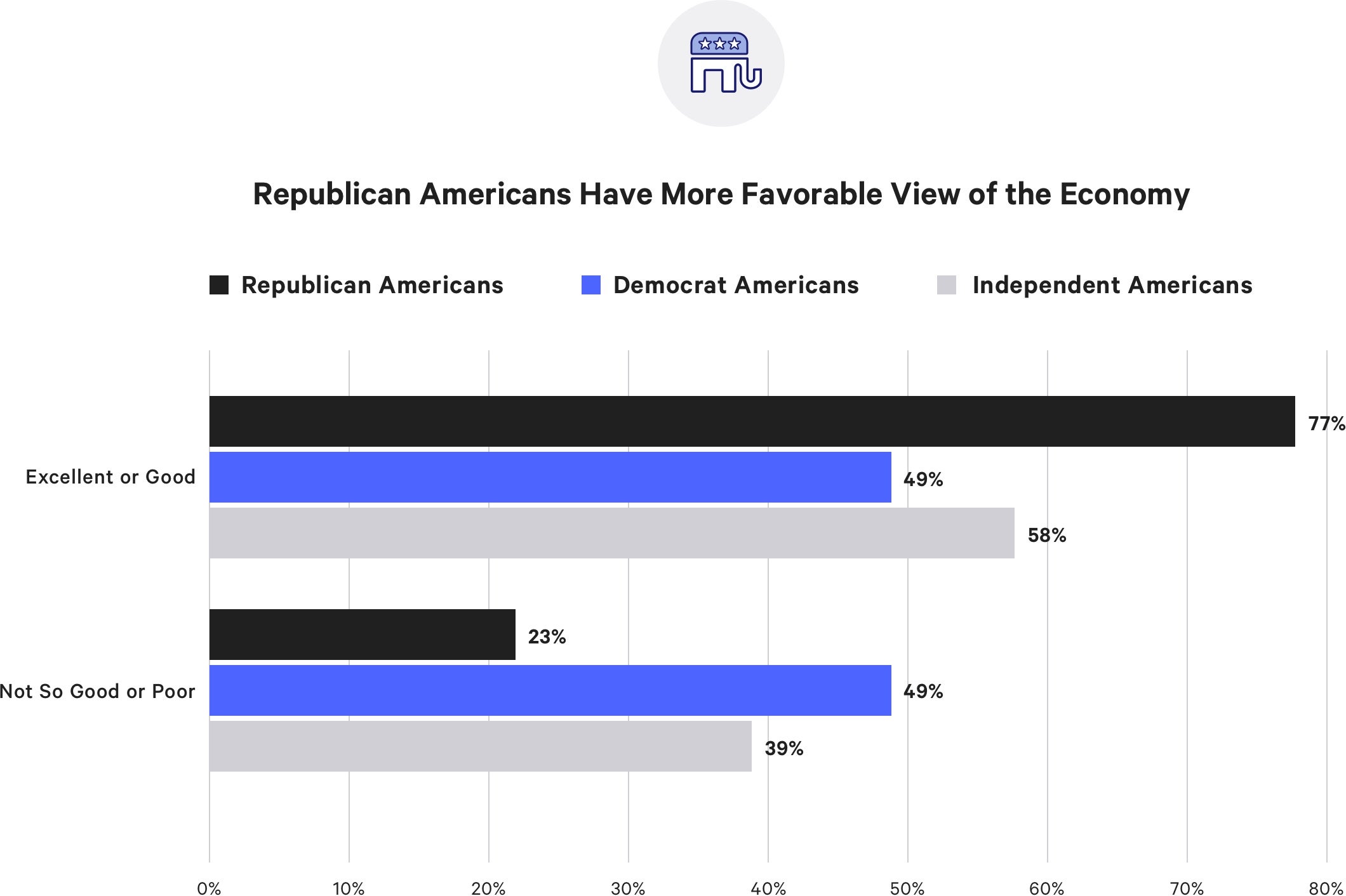

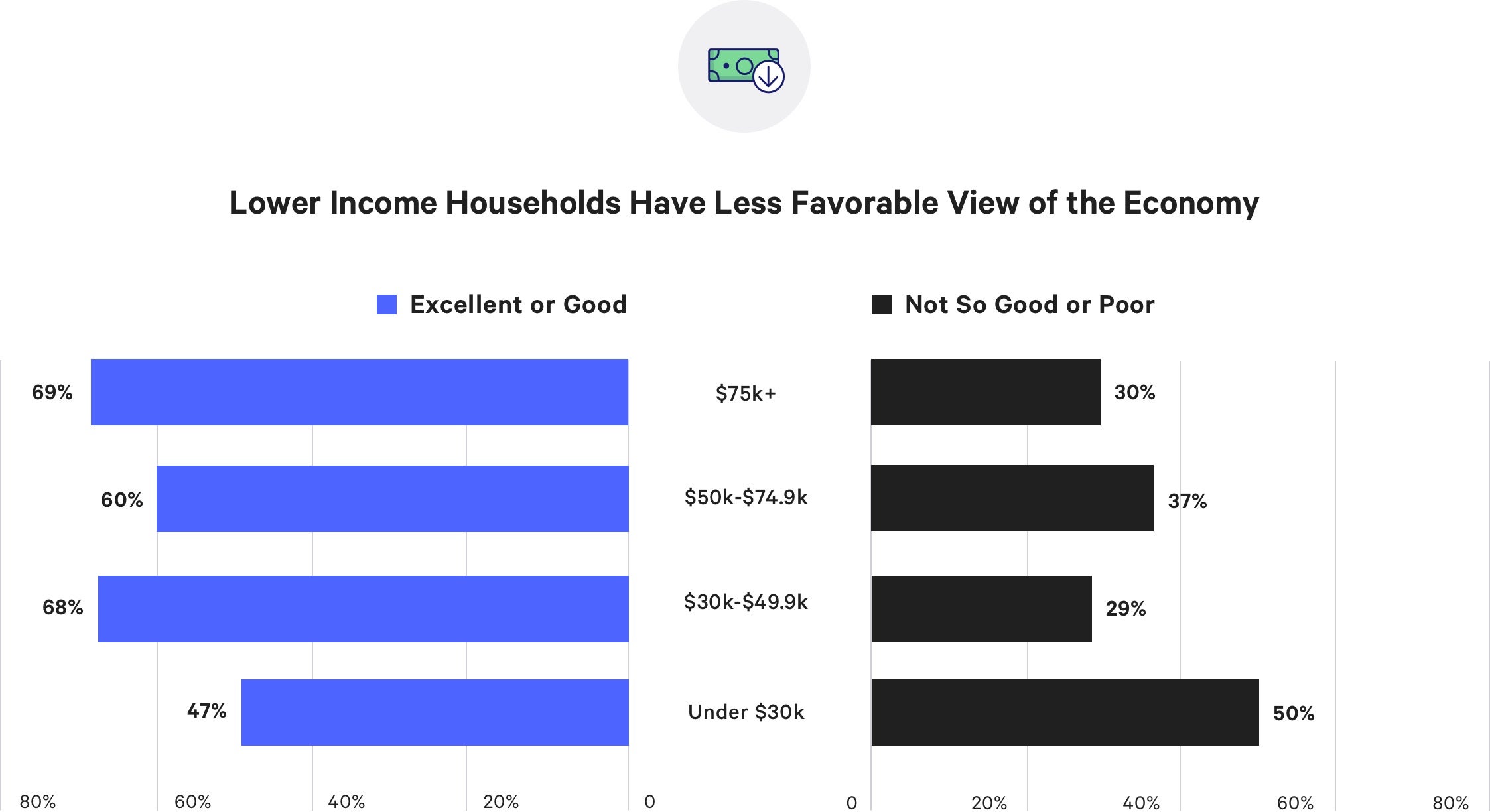

Inflation and unemployment are historically low, and the labor market overall remains strong. But Bankrate’s latest survey finds that opinions on how well the economy is doing -- and how close we are to the next recession -- vary depending on your household income and the political party you’re affiliated with. And financial experts’ opinions on the economy are at odds with what you’re hearing from everyday citizens, like your friends and next-door neighbors.

The biggest takeaway? Regardless of whether you believe the economy is chugging along or on the brink of collapse, most of us aren’t ready to face another slowdown. We looked at the status of Americans’ emergency savings and picked experts’ brains on the best ways to prepare for the worst.

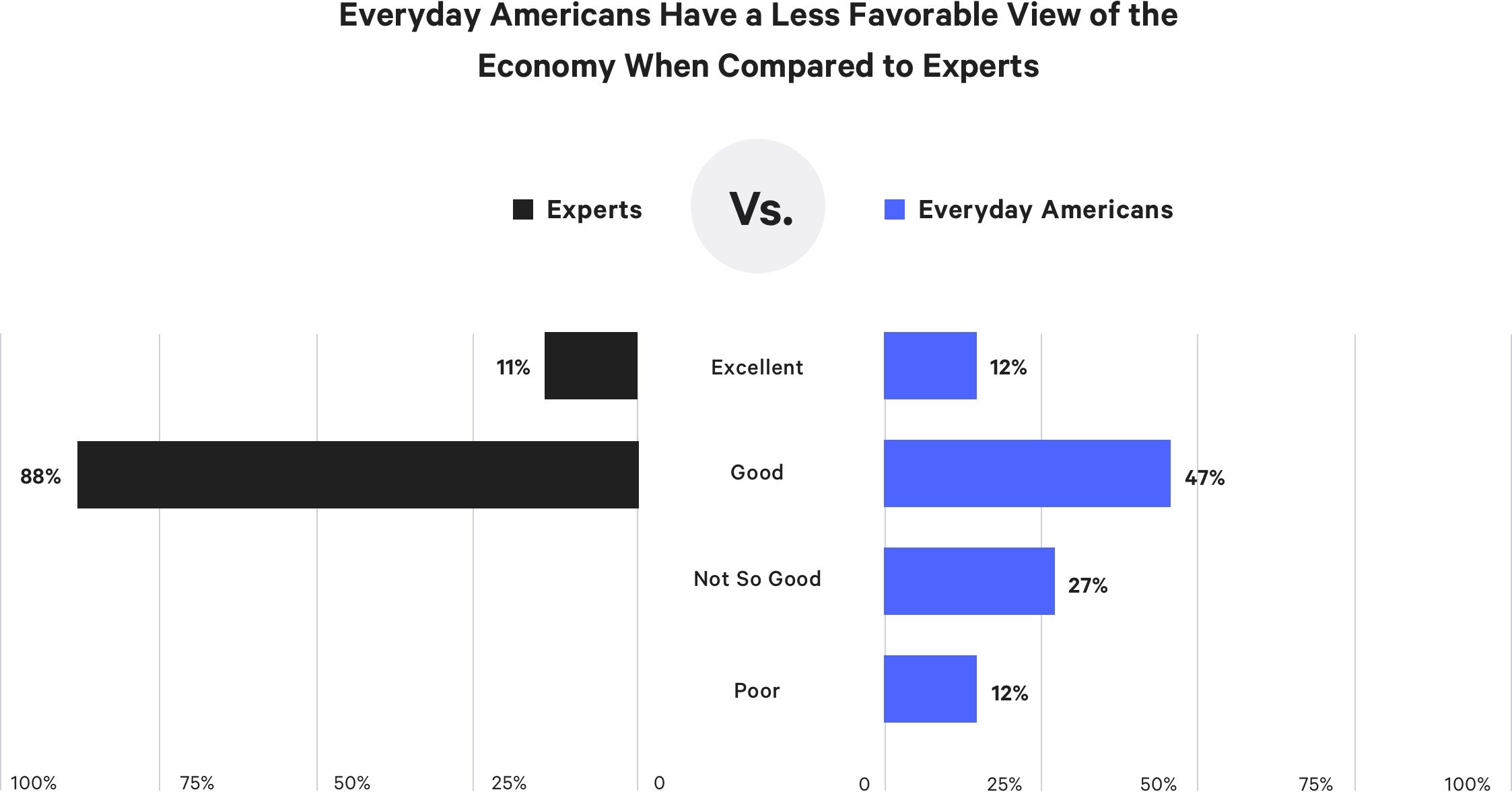

Experts and Everyday Americans Rate The Economy

Everyday Americans Have a Less Favorable View of the Economy When Compared to Experts

Republican Americans Have More Favorable View of Economy

Lower Income Households Have Less Favorable View of Economy

President Trump's policies are the main reason for the good economy: deregulation, reduced corporate taxes has incentivized corporations to increase hiring and capital expenditure.

Marilyn Cohen

CEO, Envision Capital Management Inc.

The Macroeconomic indicators are great - the unemployment rate is at a fifty year low, GDP growth has been solid, market are buoyant and inflation is low and stable. However we know there is an issue with rising inequality of both income and wealth that leaves many households still feeling vulnerable. There is a generational dimension to rising inequality — millennials came of age in a bad labor market and are still struggling to build saving and wealth and job security.

Julia Coronado

President, MacroPolicy Perspectives

Jobs and wages are the backbone of the economy, but if the economy were growing at a higher rate consistently, 3% or more, it would be more robust and better able to sustain shocks. Then it would be excellent.

Robert Frick

Corporate Economist, Navy Federal Credit Union

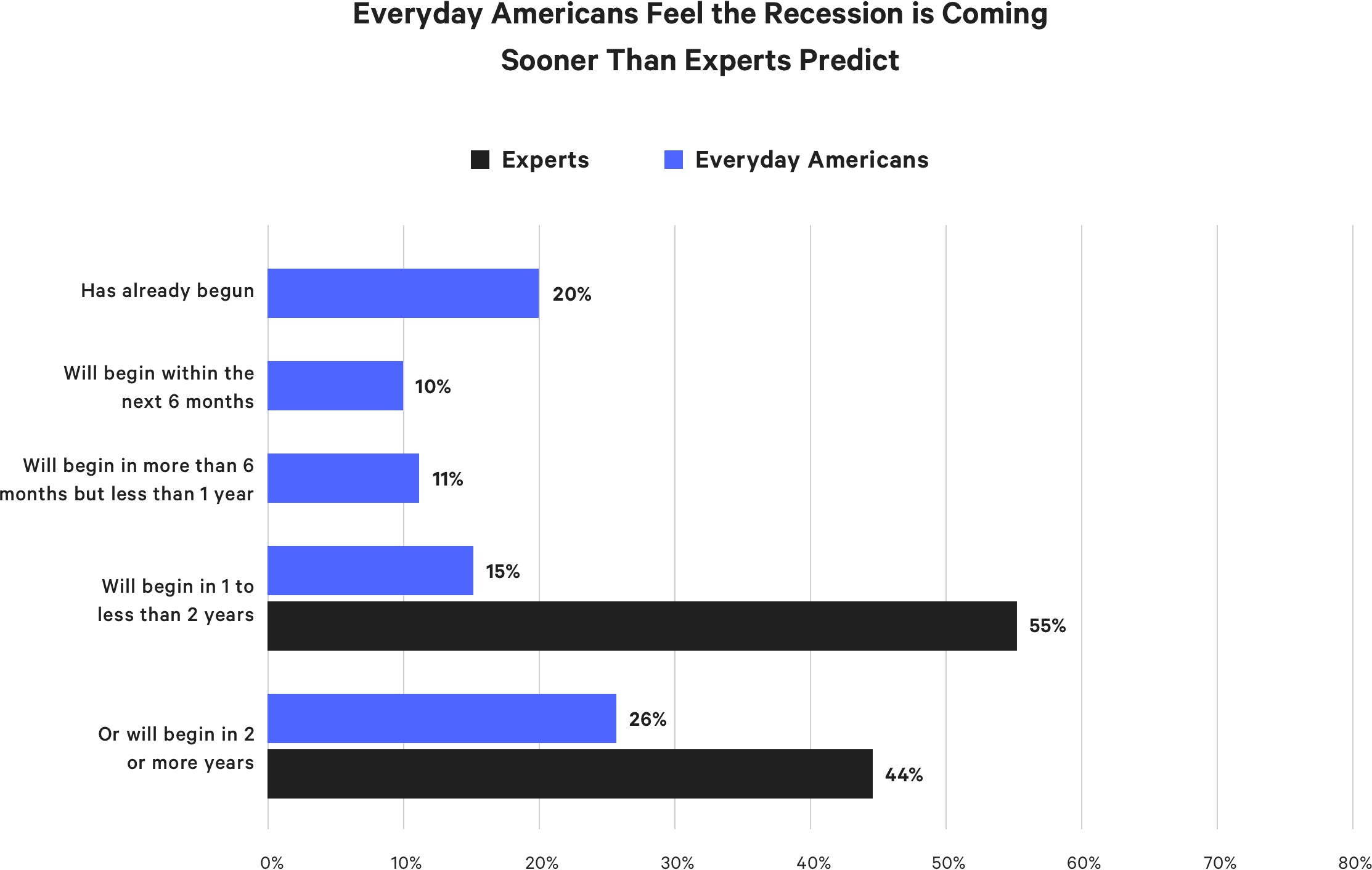

Experts and Everyday Americans Predict The Next Recession

Everyday Americans Feel the Recession is Coming Sooner Than Experts Predict

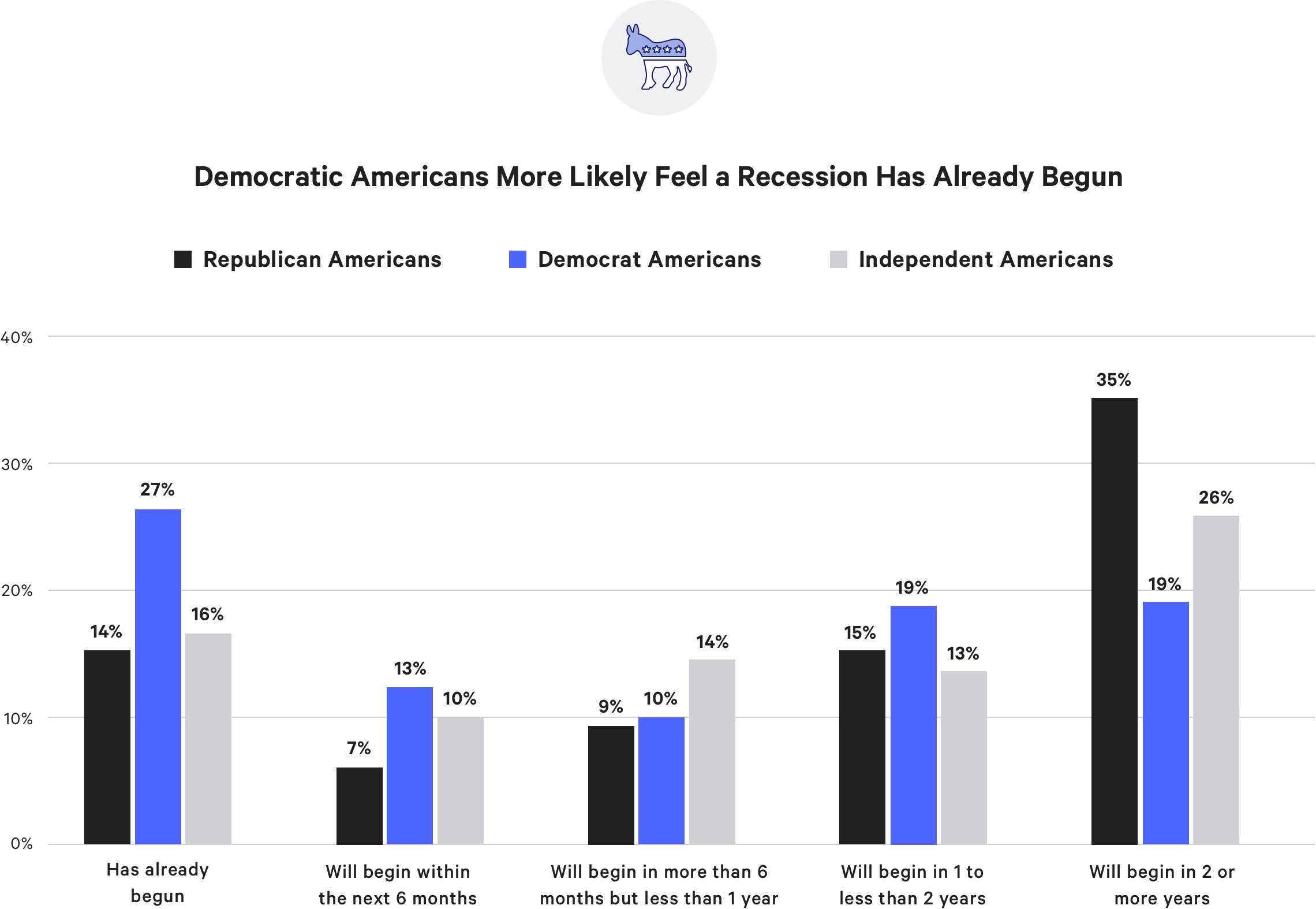

Democratic Americans More Likely Feel a Recession Has Already Begun

The usual advanced indicators of a recession (such as a fully inverted yield curve for at least 2-3 months) are not present. Moreover, the Conference Board's index of leading economic indicators continues to show growth ahead. Tariffs could be a shock that knocks the economy off its growth path, but they are not serious enough yet to do that. Eventually inflation will rise sufficiently to cause further Fed tightening and an inverted yield curve — presaging a downturn in the economy 10-18 months later.

David W. Berson

Senior Vice President & Chief Economist, Nationwide

Rising inflation and interest rates do not appear to be on the near-term horizon. A major trade war between the U.S. and China represents our greatest economic risk as it could pummel global trade and growth along with stock markets throughout the world.

Lynn Reaser

Chief Economist for the Fermanian Business & Economic Institute at Point Loma Nazarene University.

Current strong economic fundamentals mean economy is not at risk of recession over the next year. [The] Trump administration has a very strong incentive to ensure there is not a recession in 2020.

Gus Faucher

Chief Economist, PNC Financial Services Group

Experts to Everyday Americans: Are you prepared?

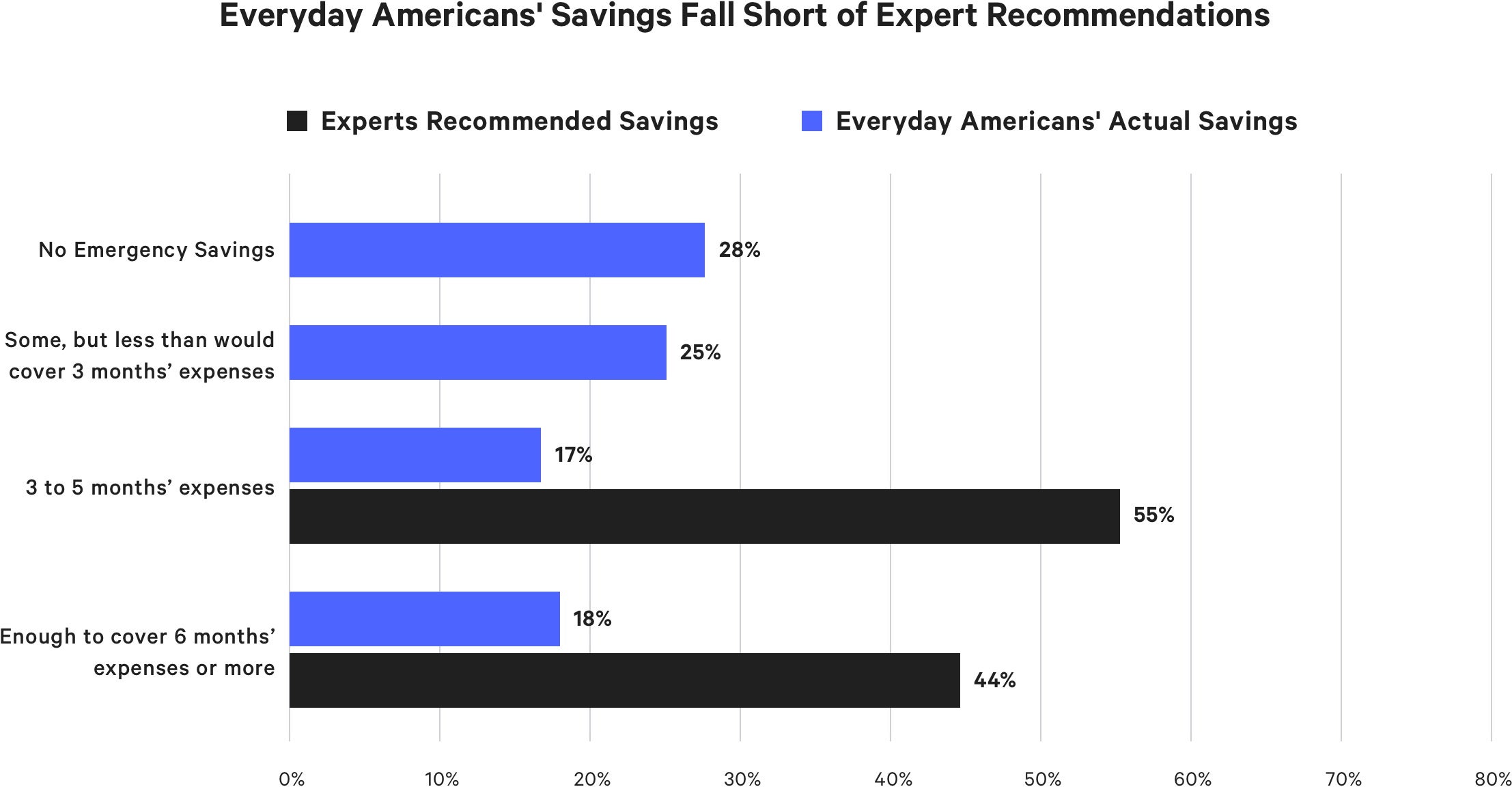

Emergency Savings Fall Short of Expert Recommendations

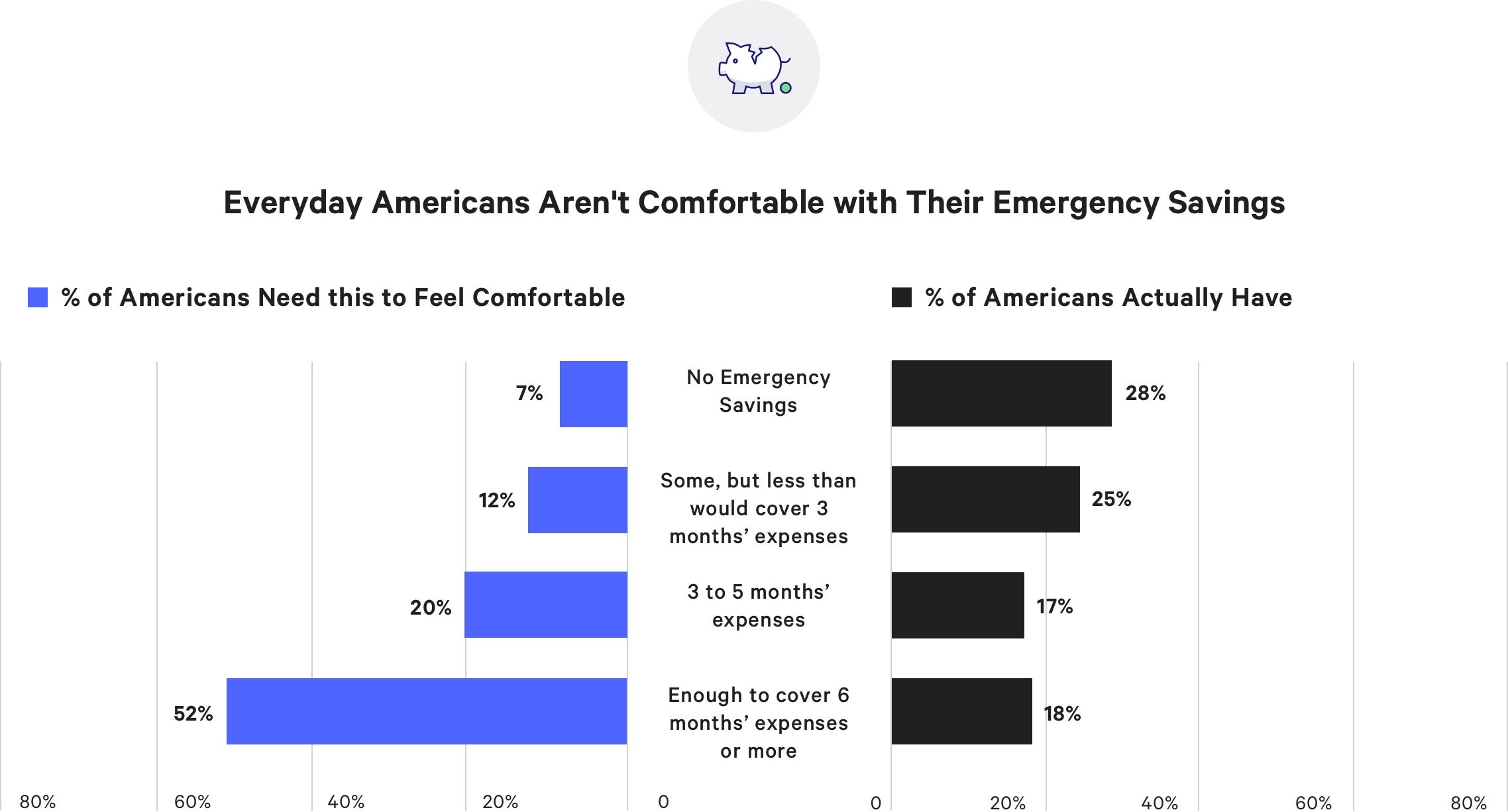

Everyday Americans Aren't Comfortable with Their Emergency Savings

In the last recession, more than 6 million Americans had been out of work longer than 6 months, so aim for a six month cushion. Sole breadwinners and those in business for themselves may well need 9 or even 12 months of expenses in emergency savings.

Greg McBride, CFA

Chief Financial Analyst, Bankrate.com

The amount of emergency savings you need is dependent upon many factors. While the standard suggested level of savings is between 3-5 months of expenses, if you work in a profession that is unstable or subjects you to variable income it may be wise to keep even more cash in reserves. Further, cash reserve requirements should also be influenced by whether or not you have disability insurance and specifically what the elimination period of the insurance is - this is usually between 90 and 180 days, depending on the type of policy. Additionally, cash reserves should also take in to account any near term events or plans that would require larger sums of cash than normal from your budget (ie. home projects, tuition payments, etc.)

Cathy Pareto

President, Cathy Pareto and Associates

More is better, but for most people it is a question of feasibility. For many their 401k plans are their primary vehicle for saving and they might max out their contributions for purposes of employer matching and/or tax deductibility. That may leave them a little tight on setting aside additional cash, but at lease a couple of months is best. More than a third of households in a recent Fed study reported not being able to manage an unexpected $400 expense. That is a sobering take on the vulnerability of many households.

Julia Coronado

President, MacroPolicy Perspectives

About this survey

Meet the Author

Amanda Dixon is a senior reporter covering banking. Prior to joining Bankrate, she served as a writer and editor for SmartAsset, a New York-based fintech startup. Originally from the metro Atlanta area, she's a University of Georgia alum. She enjoys providing an inside look into what banks and credit unions are up to and offering tips and tricks to help consumers save money and build wealth at every stage of their financial lives.

About the survey

This study was conducted for Bankrate via landline and cell phone by SSRS on its Omnibus survey platform. Interviews were conducted from May 21 – May 26, 2019 among a sample of 1,011 respondents. The margin of error for total respondents is +/- 3.55% at the 95% confidence level. SSRS Omnibus is a national, weekly, dual-frame bilingual telephone survey. All SSRS Omnibus data are weighted to represent the target population.

/>

/>