Survey: More than 1 in 4 Americans to tap retirement accounts during coronavirus pandemic

The coronavirus is hitting not only Americans’ health but also their ability to save for retirement, as millions of Americans are tapping their accounts to offset lost income and contributing less to their accounts than before the pandemic.

According to a new Bankrate survey, more than 27 percent of those working or recently unemployed have already taken a withdrawal from their retirement savings accounts, such as a 401(k) or IRA, or plan to use them as a source of income. The survey also reveals that nearly 1 in 5 Americans are contributing less to their retirement account now than before the crisis.

“In addition to the 1-in-4 working households that hadn’t been contributing to retirement savings before the pandemic, a further 18 percent are now contributing less toward retirement,” says Greg McBride, CFA, Bankrate chief financial analyst. “The runaway culprit is loss of income, cited nearly twice as often as the next most common reason of keeping more cash on hand.”

Bankrate surveyed 1,326 working or recently employed American adults about retirement savings. Below are the main findings from the survey.

Key takeaways:

- 18 percent of Americans have reduced retirement contributions since the coronavirus crisis started.

- 62 percent of those tapping retirement accounts cite loss of income as the main reason.

- More than 27 percent of those with retirement accounts have already tapped them or plan to do so.

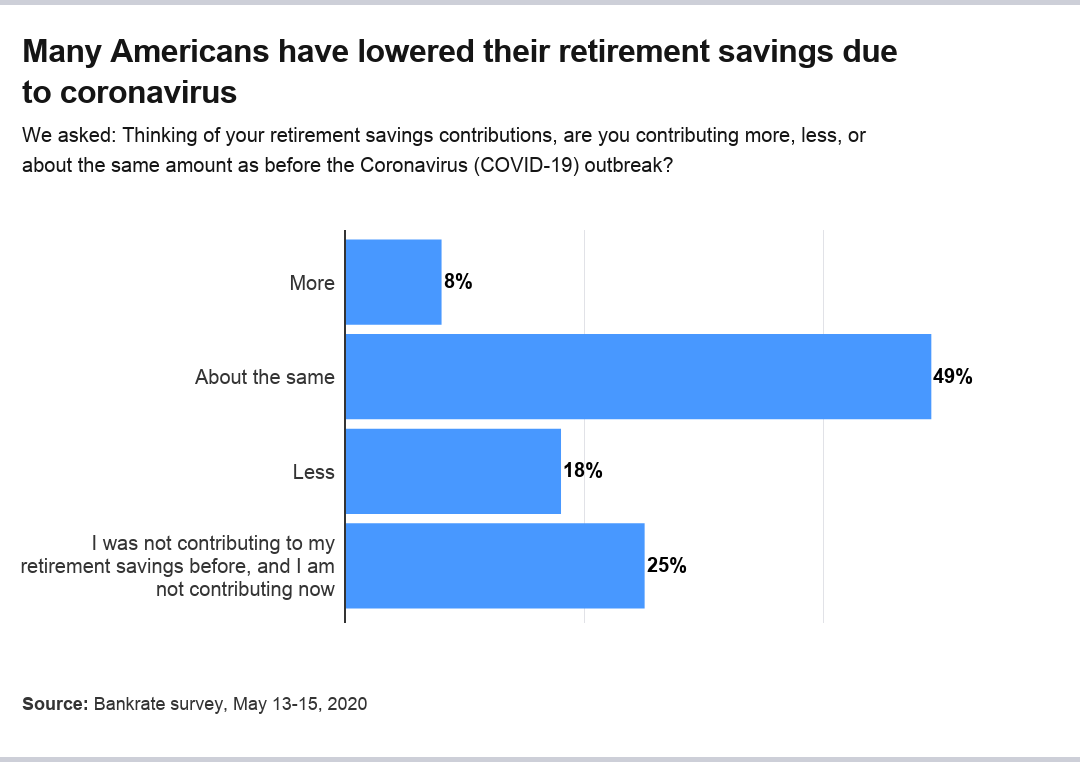

Many Americans are saving less, but most are saving about the same

The results show a sizable portion of Americans have had to reduce retirement contributions during coronavirus pandemic. About 18 percent of Americans are contributing less to their retirement account now than before the crisis. However, 8 percent are contributing more, while around 49 percent are contributing the same. One-quarter of working or recently unemployed adults were not contributing to retirement savings either before the pandemic or now.

The number of Americans saving less squares up with the fact that about 1 in 5 workers have filed for unemployment since March 13. Overall, about 30 percent of households have experienced a decline in income, according to another recent Bankrate survey.

For those who are recently unemployed, retirement contributions are more than twice as likely to decline as for those who are still working, with 31 percent contributing less compared to 14 percent. The recently unemployed were also less likely to have been contributing before or since the pandemic hit (37 percent) than those currently employed (22 percent).

Of those still employed, 56 percent are contributing the same amount as before the outbreak, compared to only 22 percent among the recently unemployed.

Higher incomes were associated with a higher likelihood of contributing about the same to the their retirement accounts now and before the crisis:

- Of households earning less than $30,000, about 35 percent saved about the same for retirement.

- Of households earning between $30,000 and $49,999, about 43 percent said they were saving the same amount now as before the crisis.

- For households earning between $50,000 and $79,999, nearly 54 percent said they were saving about the same.

- About 62 percent of those earning more than $80,000 said they had maintained about the same saving rate.

In contrast, about 23 percent of respondents with income between $30,000 and $49,999 said they were contributing less now – greater than the 15 to 16 percent in each of the other three income groups.

Respondents earnings less than $30,000 were almost three times as likely to not have been contributing before or now as those earning $80,000 or more, 39 percent to 13 percent.

Retirement savings differed somewhat from generation to generation, although Generation X, millennials and boomers all looked broadly similar to one another:

- Generation Z: About 27 percent are contributing less to their retirement than before the pandemic, while 35 percent were not contributing before or now. More than 12 percent are contributing more, while around 26 percent are contributing the same amount.

- Millennials: Around 15 percent of millennials are contributing less to their retirement savings than before, and 24 percent were not contributing then or now. About 14 percent are contributing more since the crisis began, and 48 percent are saving the same.

- Generation X: Almost 18 percent of Generation X are contributing less to retirement savings than before, while 24 percent were not contributing then or now. Just 5 percent are contributing more since the crisis began, while 52 percent are saving the same.

- Boomers: About 16 percent of boomers are contributing less to their retirement than before, and 23 percent were not contributing before or now. Only 2 percent are contributing more since the crisis began, while 58 percent are saving the same.

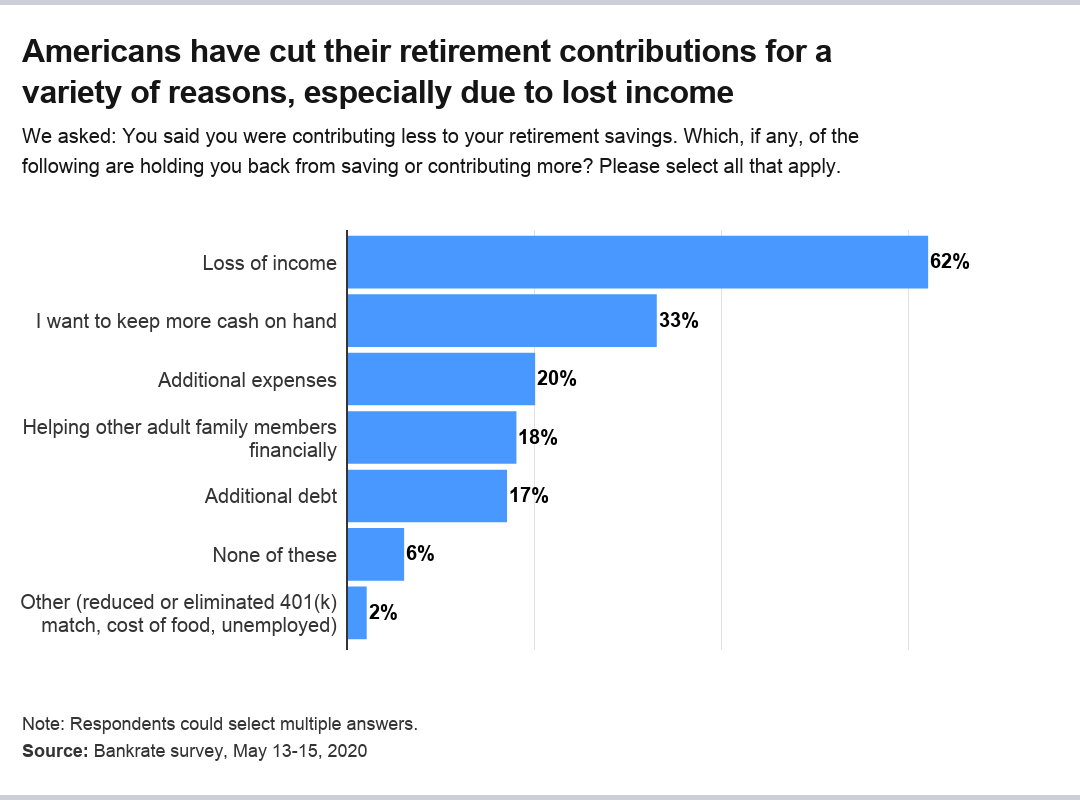

Loss of income is primary culprit for lower retirement savings

Americans are cutting back on retirement savings for a variety of reasons, but most reasons cluster around one of a few broad areas.

The top reasons cited include the following:

- 62 percent cited loss of income.

- 33 percent said they wanted to keep more cash on hand.

- Additional expenses were cited by 20 percent.

- About 18 percent said they needed to help adult family members financially.

- 17 percent noted they had additional debt.

- Nearly 6 percent cited none of the reasons.

- About 2 percent cited other reasons, including being unemployed, a decreased or eliminated 401(k) match from an employer, the cost of food and maternity leave.

Americans are tapping retirement savings to replace lost income

To replace their lost income, Americans are hitting their retirement savings, a move that may alleviate momentary concerns but has the potential to create long-term problems.

More than 27 percent of those working or recently unemployed have already tapped into their retirement savings (14 percent) or plan to use it (13 percent) as a source of immediate income during the crisis.

“This is most pronounced among younger households, who may miss out on decades of future compounding if forced to turn to their retirement savings during these trying times,” says McBride.

About 50 percent of the recently unemployed with retirement savings have already hit up their account for money or plan to do so, compared to 22 percent of the currently employed.

About 20 percent of millennials and Generation Z with retirement savings have already used some to replace their income since the coronavirus crisis started. That compares with 8 percent of Generation X and nearly 10 percent of boomers.

In total, more than 45 percent of Generation Z and nearly 38 percent of millennials have used a retirement account for money or plan to do so. Those figures compare to more than 18 percent of Generation X and more than 14 percent of boomers.

Lower-earning households tended to be more likely to use retirement accounts than higher-earning households, with one notable exception:

- The lowest income households (less than $30,000) were most likely to tap retirement accounts, with almost 45 percent saying they had done so or planned to do so.

- About 30 percent of households earning between $30,000 and $49,999 said they had used retirement savings or would do so.

- Nearly 34 percent of households making between $50,000 and $79,999 said that they had used retirement savings or planned to do so.

- Less than 17 percent of households earning $80,000 or more had used retirement savings or planned to do so.

Methodology

This study was conducted for Bankrate via online interview by YouGov. Interviews were conducted from May 13 – May 15, 2020 among a sample of 1,326 adults. Data are weighted and are intended to be representative of all U.S. adults, and therefore are subject to statistical errors typically associated with sample-based information.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.