Survey: Nearly half of U.S. households have had incomes cut during coronavirus pandemic

The idea came to Ramona Ferreyra in 2017 while her four-month-old nephew spent five days in the ICU with meningitis. While singing lullabies to him about their shared Hispanic heritage, the Bronx, New York-based resident decided to start a business that put those folklores to life — a journey that would come to fruition nearly a year later as Ojala Threads, a baby and children’s clothing company that features designs inspired by her culture’s histories.

But it would also ultimately put her on the front lines to a devastating recession caused by a novel, contagious disease.

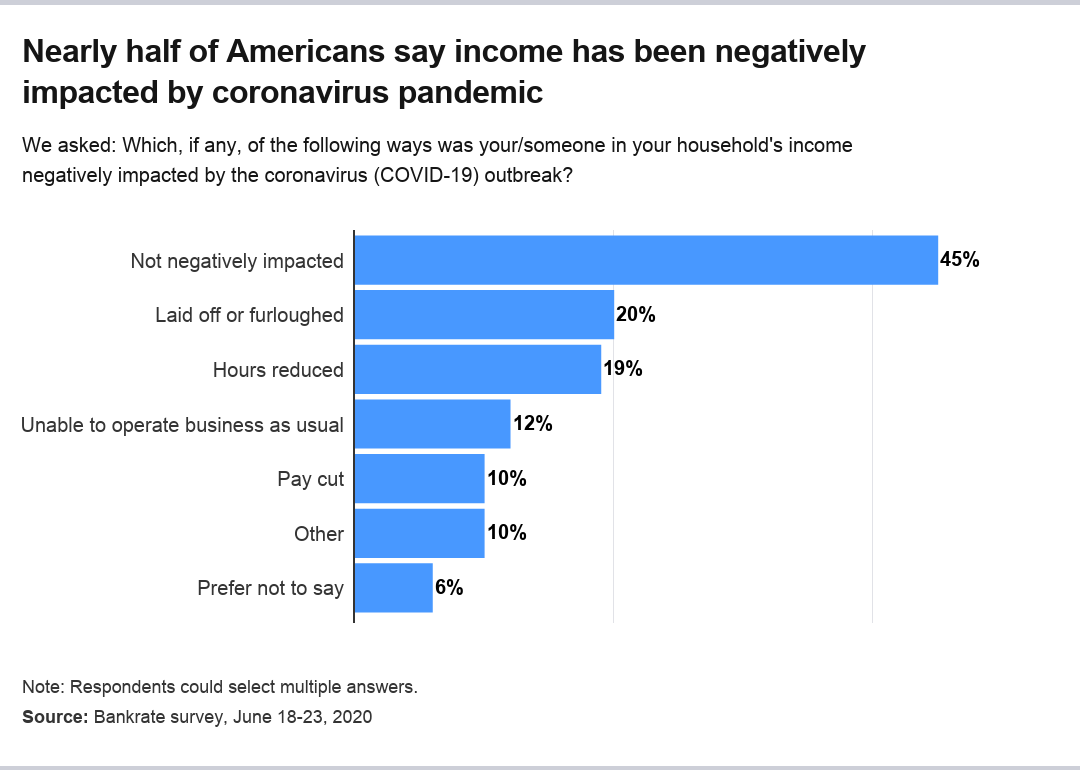

Ferreyra is among 49 percent of U.S. adults who, according to a new Bankrate survey from June, report that their income has been hurt by the coronavirus pandemic and related shelter-in-place orders that have kept millions of consumers at home, eroding the fuel of a consumption-driven economy and inducing one of the worst economic crises in generations. The most common impacts include layoffs, furloughs and a reduction in hours or pay, the poll found.

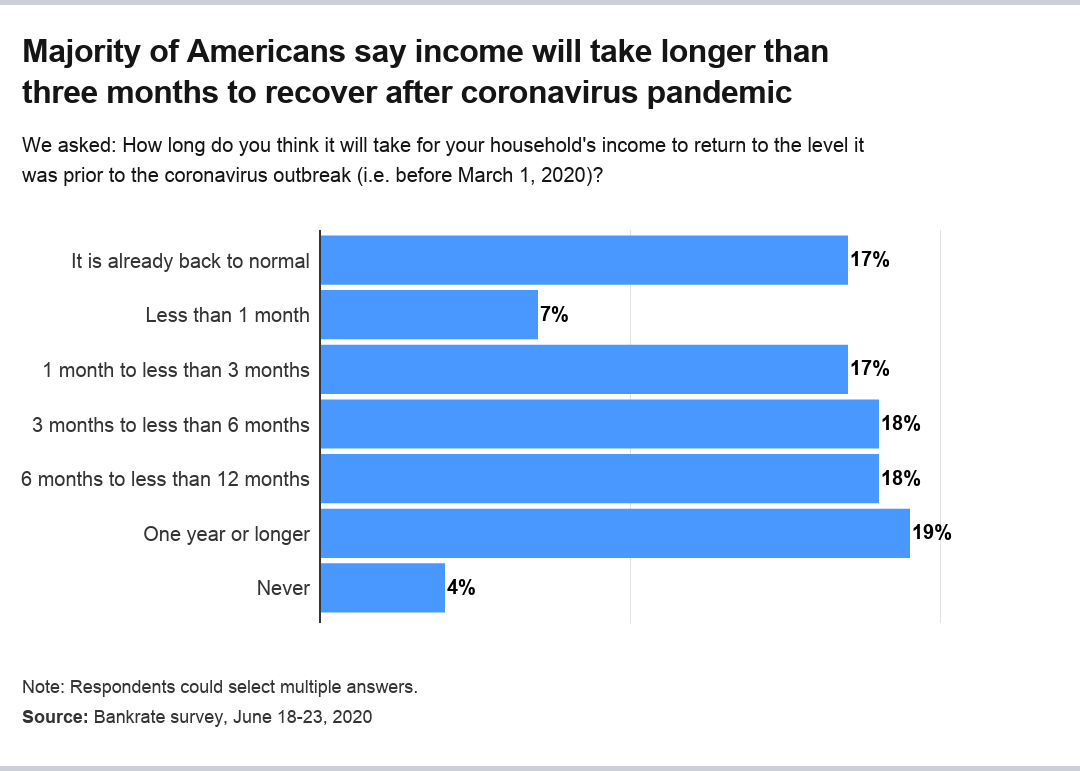

Of those whose incomes have been negatively impacted by the coronavirus crisis, just 17 percent say it is already back to normal. Meanwhile, 2 in 5 (or 42 percent) expect their income to return to normal within the next six months, while 37 percent say it will take longer. About 4 percent say it will never recover.

“The widespread hit to household income from the pandemic, the length of time for that income to recover, and a pervasive fear of it happening again will all weigh on the economic recovery,” says Greg McBride, CFA, Bankrate chief financial analyst. “Lower income and worries about lower income have a direct effect on consumer spending.”

Bankrate surveyed 3,753 Americans between June 18 and 23 about how their incomes have weathered the coronavirus pandemic. Below are the key findings from the survey.

Key takeaways:

- Just 45 percent of U.S. adults say their household income wasn’t negatively impacted by the pandemic.

- Nearly 6 in 10 U.S. adults suffering income disruption (59 percent) expect recovery will take longer than three months.

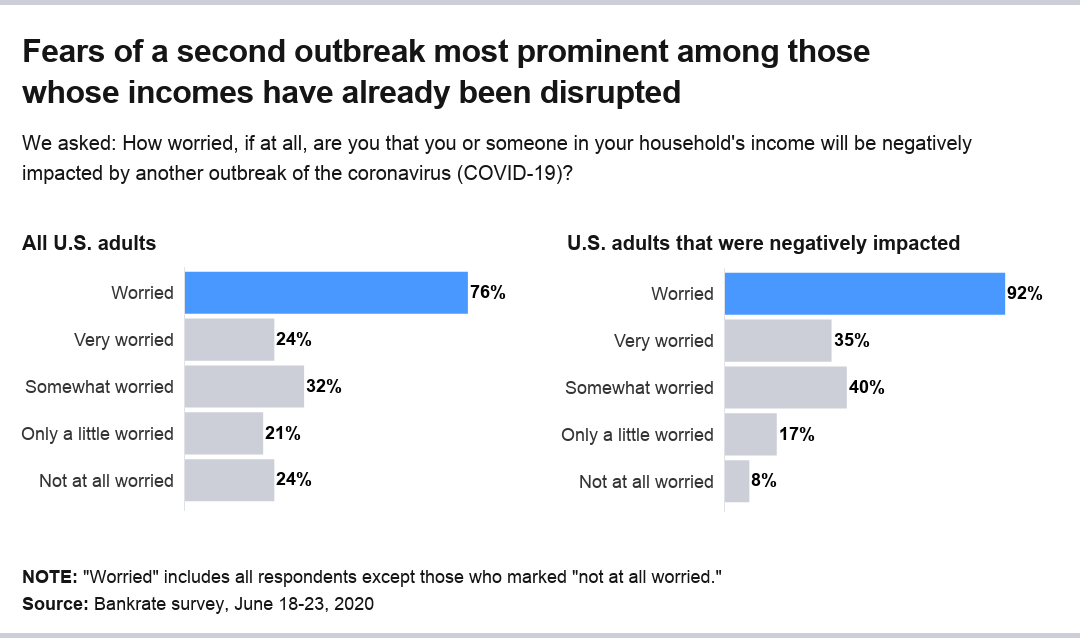

- Seventy-six percent of adults are worried about financial harm from another outbreak, while 92 percent of those who’ve already experienced income disruption are worried.

Impact on household income caused by the coronavirus crisis

When it comes to being impacted by the coronavirus, more Americans have felt a squeeze than not. Just 45 percent of U.S. adults report not being negatively impacted by the pandemic, according to the poll, compared with the near-half who have been affected.

When it comes to the individual impact, Americans were most likely (at 20 percent) to report being laid off or furloughed. Another 19 percent report that they had their hours reduced, while 1 in 10 report that either they or someone in their household took a pay cut.

The coronavirus pandemic has caused the unemployment rate to skyrocket to its highest since the Great Depression, eclipsing even the 10 percent peak during the Great Recession more than a decade ago.

While hiring is showing a faster-than-expected rebound, just about 7.5 million positions of the near 22.2 million (or 34 percent) lost during the outbreak have been recovered, according to the most recent employment reports from the Bureau of Labor Statistics. Adding to signs of worries, permanent layoffs increased in June at the fastest pace since 2009.

Those having experienced a reduction in household income due to the pandemic skews higher among younger generations. More than half of individuals belonging to Generation Z (ages 18-23), millennials (ages 24-39), and Generation X (ages 40-55) were negatively affected. That compares with 45 percent of younger baby boomers (56-65) and 28 percent of older boomers (66-74)

When it comes to the regions, individuals living in the Northeast were disproportionately more likely to report experiencing an income disruption due to the pandemic, with 56 percent of those residents reporting a negative impact, compared with 46 percent in the Midwest and South, as well as 48 percent in the West.

But the coronavirus’ negative impact hasn’t been limited to just a layoff, furlough or cut in pay or hours. Another 12 percent said their income was harmed because they were not able to operate their business as usual — a situation that has become all too familiar for many like Ferreyra.

Ferreyra: ‘It makes me feel very vulnerable’

In the case of Ferreyra, sales were booming at first for her new business. When Ojala Threads opened its online shop in the final quarter of 2018, she managed to generate about $976 in revenue. In 2019, she pulled in about $1,929. She had hoped it would double in 2020 — but then the coronavirus came along.

Shelter-in-place restrictions, which began March 20 for the state of New York, forced Ferreyra to cancel her planned pop-up events at physical stores around her community, a crucial source of promotion and revenue for her business, which doesn’t have a brick-and-mortar storefront.

Ferreyra normally makes about five pop-up appearances a month, but with it unclear when stores and shopping malls will reopen, there’s no end in sight for Ferreyra’s situation. New York City just moved forward with Phase 3 of Governor Andrew Cuomo’s reopening plans, which mainly paves the way for restaurants to open back up at half-capacity for outdoor dining.

Every little bit of income helps for Ferreyra, who lives in a one-bedroom apartment with her 89-year-old grandmother in the Mott Haven neighborhood of the Bronx. Ferreyra has an autoimmune disease, which has sapped her of her physical energy, resulted in other chronic health issues and makes working most jobs painful. The pair live each month off of her grandmother’s social security income, as well as $200 in Ferreyra’s disability payments, $215 in rental assistance and $200 in food stamps, plus whatever in profits she makes from Ojala Threads.

“You try to be as smart as possible, and you hope for a good month, but there’s just no way that every single month I can avoid ending up with $5 in my bank account,” Ferreyra says. “It makes me feel very vulnerable. There is so much shame associated with that financial situation.”

Recovery from income disruption

Ferreyra hopes sales will pick back up again in the latter half of the year, but it isn’t set in stone. More than half of the adults who’ve suffered income disruption during the pandemic like Ferreyra say it will take longer than three months to recover.

That total includes 4 percent who say their financial situation will never rebound, as well as 18 percent who say it will take between three and six months to recover and another 18 percent who say their income will need anywhere between six months to a year for a full bounce back. Another 19 percent of respondents say it will take a year or longer for their finances to improve.

While just 17 percent say their income is already back to normal, another 17 percent say it will take between one month and less than three months, while 7 percent say their finances will need one month to return back to normal.

Of those already seeing their income return to normal, there is little difference among ages. But younger workers who’ve experienced a cutback in their income expect that a recovery will happen more quickly. More than half (or 55 percent) of individuals in Gen Z and half of millennials feel that their income will come back within six months. That compares with 37 percent of members of Gen X and just one-third (33 percent) of baby boomers.

Individuals in low- and moderate-income communities, however, report the least confidence in their pay snapping back quickly. About two-thirds of households (or 61 percent) who make under $30,000 a year report that their income will take longer than three months to recover, which includes 5 percent who say it won’t ever recover, the most of any income group. That compares with 56 percent of households earning $80,000 or more a year.

Approximately 1 in 5 households with incomes of $50,000 or more annually who reported a pay reduction say it has already returned to normal. That’s up considerably from households earning less than $30,000 annually, with just 1 in 8 (or 12 percent) saying their income has already recovered.

Americans are concerned about financial harm from another outbreak

When it comes to the pandemic, a second outbreak is a big worry for most Americans.

About 76 percent of all U.S. adults surveyed for Bankrate’s poll report that they’re worried about another outbreak and its impact on their household’s income. That includes nearly a quarter (or 24 percent) who say they’re very worried, nearly two-thirds (or 32 percent) who say they’re somewhat worried, and 21 percent who say they’re only a little worried.

But worries about another outbreak negatively impacting their wallet are significantly higher for those that have already suffered an income reduction. About 92 percent of those who reported an income disruption say they were worried, including 35 percent who say they were very worried and 40 percent who were somewhat worried. Just 17 percent said they were only a little worried, while 8 percent weren’t worried at all.

That comes as states across the West and South are reversing plans to reopen their economies, most notably the states that were the earliest to reopen including Florida and Texas, after a surge in coronavirus cases. While the nation’s top infectious disease expert Dr. Anthony Fauci referred to the U.S. as being still “knee-deep in the first wave,” reports of new cases have skyrocketed to record levels in June and July. Hospitalization rates are also rising, with many experts saying it suggests that increased testing can’t be explained for the surge, according to a June 22 news conference with Mike Ryan, executive director of the World Health Organization’s emergency program.

What this means for you

Ferreyra recognizes the economic implications of her business’ near-shutdown and what it means for her community in the Bronx, the borough that she calls “the last frontier for development in New York City.”

“I have a printer that’s local, and he employs people, so if I can’t run my print, that means that he’s not keeping his staff on, that means he’s having to work longer hours by himself, so it just gets harder and harder,” she says. “How we navigate all of that tactfully — that was hard in the beginning.”

She’s focusing on applying for grants, filing an application each week since the shutdown in March began. She’s managed to secure one so far: a $1,000 grant through Neighborhood Trust in partnership with Andrew Yang’s foundation Humanity Forward. She used the funds to help pay off credit card debt and hopes to eventually put them toward ads on Facebook and Google to help replace the income she’s lost through her lack of pop-ups. She wasn’t eligible for Payroll Protection Program (PPP) funds with no employees on her payroll.

For Americans facing an income disruption, don’t be afraid to turn to creditors and agencies for help. Keep track of everyone you regularly work with, including firms that you regularly pay a bill to. It’s worth a shot to see if you can work out a forbearance program or lower your monthly payment in general.

“Seeking payment relief from creditors and reducing household expenses wherever possible are steps households can take to weather a period of income reduction,” McBride says.

Still, Ferreyra recognizes how difficult that process can be, saying she’s felt it hard to stay inspired by life lately. The few grants she’s been eligible for have been inundated with applications — as many as 1,500 applicants in some cases, she says, for only 15 eligible spots. While PPP has helped millions stay employed, funds have also gone to investment firms managing billions of dollars, law firms and companies connected to federal lawmakers, according to Treasury Department data released on Monday, a fact that’s made it even more painful for Ferreyra.

“You’re constantly having to justify your actions, what you mean to your community and why your community needs you,” she says. “There is a place for both small and big, but it’s just been really hard to see that in action. It’s just such an overwhelming amount of people applying for grants that it’s hard not to get upset when you don’t get it.”

Methodology

Bankrate.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 3,753 adults. Fieldwork was undertaken on June 18-23, 2020. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

Featured image by Adobe Stock; Illustration by Bankrate

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.