Survey: Biggest threat to the economy? More Americans say it’s coronavirus and not election outcome

Americans have a lot to worry about in 2020 when it comes to the U.S. economy. But a new Bankrate survey finds that the most pressing concern is the ongoing coronavirus pandemic, rather than the looming 2020 presidential election.

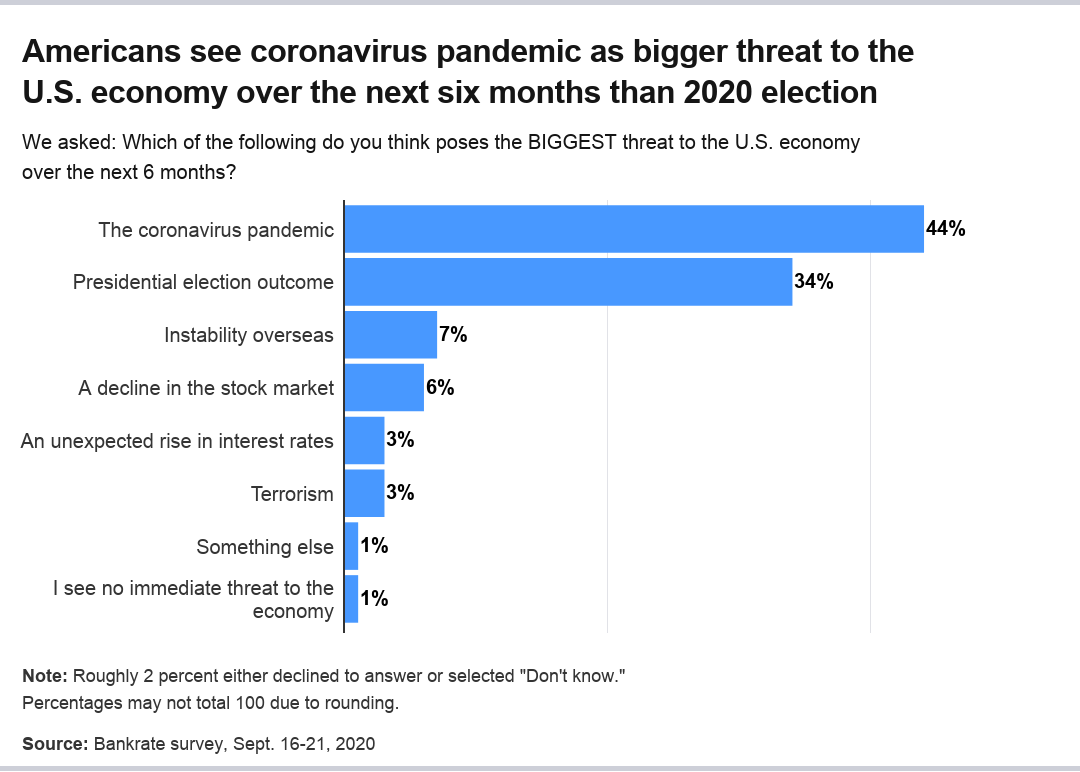

More than 2 in 5 Americans (or about 44 percent) say the novel contagion that’s infected about 38 million people worldwide so far and unleashed the worst economic downturn in generations is the biggest threat to the financial system over the next six months. That compares with 34 percent who point to the outcome of the November vote.

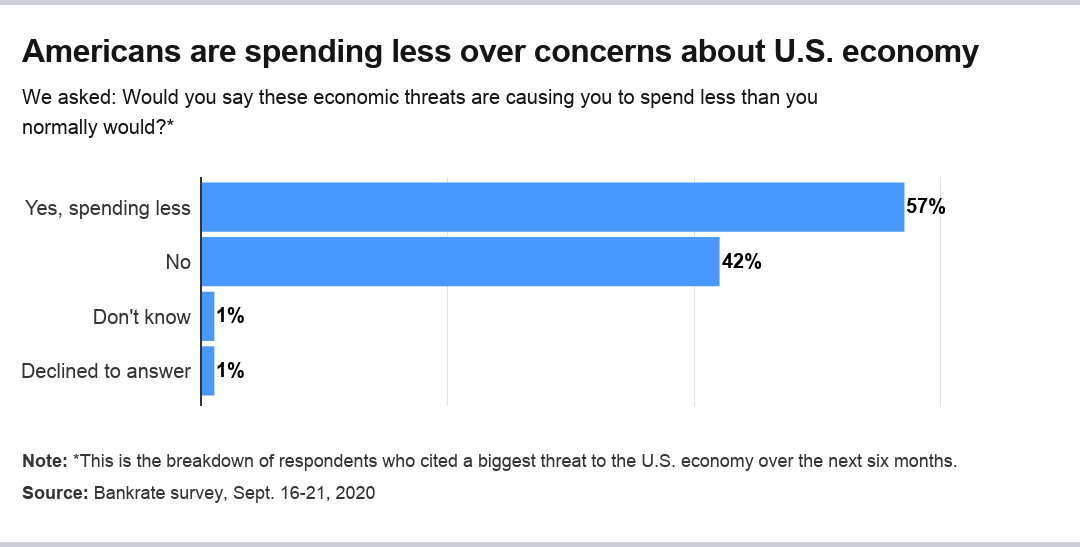

This comes at a time when economists are warning about a second wave of infections as winter weather, holiday travel and the flu season approaches. When it comes to the elections, fears include a close-call vote that travels all the way to the Supreme Court or an unpeaceful transfer of power. All of that could mean trouble for the U.S. economy, and more than half of Americans (57 percent) are bracing for it by spending less, Bankrate’s poll found.

“The pandemic and the outcome of the presidential election are the two biggest immediate threats to the economy in the eyes of most Americans,” says Greg McBride, CFA, Bankrate chief financial analyst. “What’s concerning is that Americans are cutting back spending because of these threats at more than twice the pace seen in 2018 and 2019. While that is likely a byproduct of the recession, it becomes an obstacle to economic recovery.”

Bankrate commissioned SSRS Omnibus to conduct this poll from Sept. 16-20 via telephone interviews, with a total sample size of 1,010 adults. The figures have been weighted to represent the target U.S. population.

Key takeaways:

- Fewer Americans than in the past are pointing to the presidential election outcome as the biggest economic threat

- About 48 percent of Republicans say the presidential election is the biggest economic threat, more than any other category

- More than half (or 57 percent) of Americans say they’re spending less over these economic worries

Americans say the biggest economic threat over the next six months is the coronavirus pandemic, not the election

Americans are breaking with tradition by fixating on a different downside risk than the election, according to separate iterations of Bankrate’s downside risk survey from previous election years.

Respondents right before the 2016 elections were almost 1.8 times more likely than today to point to the Oval Office outcome as the biggest economic risk, with 61 percent listing it as their top concern over the next six months. Even in non-election years, Americans have pointed to discord in Washington as a significant source of economic worry, with 38 percent citing it in April 2017, 36 percent in September 2017, 43 percent in November 2018 and 44 percent in April 2019.

The survey’s findings underscore the tumultuousness of 2020 and might reveal just how worried Americans are about the contagion, especially given the unprecedented amount of contention surrounding the 2020 vote.

The pandemic’s effects have implications for employment, economic growth and borrowing costs in the future, along with health care. When it comes to the election, however, some experts are fearing whether mail-in ballots might take days to count or that a Supreme Court decision could delay knowing the final results for weeks.

“The Supreme Court didn’t decide until Dec. 12 in 2000 that George W. Bush had actually beat Al Gore,” says Greg Valliere, chief U.S. policy strategist at AGF Investments. “This could be a period of great uncertainty for the markets.”

Beyond the 44 percent of Americans who cite the pandemic and the 34 percent of respondents who point to the election as their biggest worries, a marginal group of respondents are also giving a nod to political or economic instability overseas (7 percent), a decline in the stock market (6 percent), an unexpected rise in interest rates (3 percent) and terrorism (3 percent) as a concern.

Slightly less than 2 percent combined marked “something else,” “don’t know” or that they didn’t see a threat on the horizon. Another near 2 percent declined to answer.

Opinions about the pandemic being the No. 1 risk were shared across age groups, gender, race, employment status and geographic region.

Millennials (those between the ages of 24-39) were 1.5 times more likely to say that the coronavirus pandemic was a bigger threat than the election, with 42 percent pointing to the contagion compared with 28 percent worrying most about the presidential race. Generation X (those between the ages of 40-55) and baby boomers (ages 56-74) were more evenly split, with slightly less than half (45 percent) of each citing the pandemic as their biggest worry, instead of the election (37 percent for Generation X and 40 percent of baby boomers).

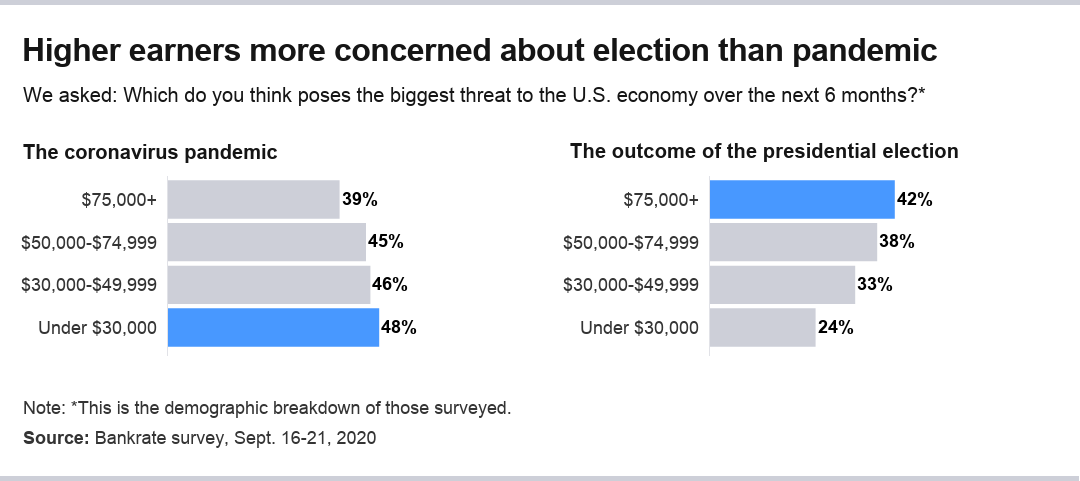

Fears about the election over the pandemic tended to increase the more money a respondent reported earning, while concerns about the pandemic were higher among those who make less money. The lowest-income households (those who make under $30,000 a year) were twice as likely (48 percent) to say that the pandemic is the biggest economic threat, compared with 24 percent of those in this income bracket who cited the presidential election. On the flip side, the presidential election outcome was the biggest concern (at 42 percent) for those who earn at least $75,000 a year.

Those diverging concerns might be because the economic upheaval has disproportionately hurt lower-income earners, with nearly 40 percent of those who lost their job in April falling on households with incomes of less than $40,000, according to a Fed survey.

Republicans more worried about the election’s outcome than the pandemic

Republican respondents didn’t see eye-to-eye with their Democrat-identifying counterparts, according to Bankrate’s survey.

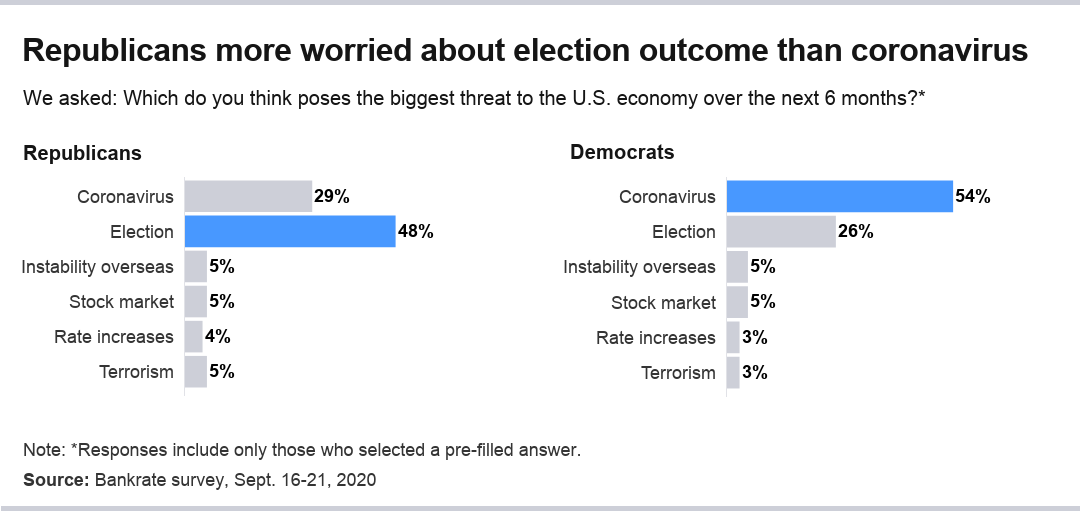

Nearly half of Republicans (48 percent) said the election outcome would be the biggest threat to the U.S. economy over the next six months. That’s higher than any other category, with just 29 percent pointing to the coronavirus pandemic. Meanwhile, about a quarter (or 26 percent) of Democrats listed the election as their greatest concern and were more than two times as likely to report that the pandemic was the biggest threat.

At the heart of that divide might be diverging levels of comfort Republicans have with President Donald Trump’s handling of the pandemic. A separate Bankrate survey from September found that Republicans were disproportionately more likely than Democrats to say that their finances would improve over the next year, while more than 3 in 5 (or 63 percent) said they would be either much more likely or somewhat more likely to vote for Trump in November because of the way he responded to the outbreak.

“If Trump wins, he’s going to win because people around the country think he’s well equipped to handle the economy,” Valliere says. “If he loses, it’s no question he’s going to lose due to his handling of COVID.”

More than half (or 57 percent) of Americans say they’re spending less over these economic worries

But when it comes to the U.S. economy’s performance over the next six months, what matters most isn’t the specific fears Americans are citing — but how they adjust their spending patterns because of them.

Bankrate’s survey found that these worries are weighing on American’s wallets. More than half (or 57 percent) of Americans who’ve said they’re worried about a downside risk say they’re also spending less — specifically because of it. That compares with 42 percent who said they weren’t spending less and roughly 1.4 percent who either declined to answer or marked that they didn’t know how exactly their spending patterns have changed.

Two-thirds of Generation Xers (at 66 percent) were the most likely of any age group to cut their spending, compared with 52 percent of millennials and 56 percent of baby boomers. Another almost two-thirds (or 65 percent) of those who make less than $30,000 a year are cutting back on their purchases, as are 63 percent of Democrats versus 47 percent of Republicans.

Also spelling trouble for the rebound, the percentage of those who are spending less because of economic fears over the next six months has increased more than two-fold since previous surveys, with almost a quarter in both April 2019 (25 percent) and November 2018 (23 percent) reportedly cutting back on spending.

What this means for you

All of this might point to a vicious economic cycle. Americans should prioritize getting their finances in order, which means building up an emergency fund and reducing expenses. But with consumption making up almost two-thirds of growth, that might be a headwind for the U.S. economy over the next few months.

Bankrate’s latest quarterly survey of economists finds that the pandemic’s devastating effects are unlikely to disappear anytime soon. Unemployment is forecasted to hold at about 7 percent a year from now, while job growth is likely going to average out to 369,000 each month, economists reported. If that’s the case, it means it might take nearly two and a half more years to bring back all of the 22.2 million positions lost at the height of the pandemic. Roughly half have been recovered so far, and Federal Reserve officials are echoing concerns that momentum is slowing and bringing back the rest will only get harder from here.

There’s still, however, some steps you can take to both prod the economy toward a better outcome and help safeguard your finances. That includes refinancing your mortgage. Mortgage rates have come down significantly this year, and many experts expect that they’ll only fall further. If you weigh the pros and cons and realize that refinancing into a lower rate could help you shave hundreds of dollars off your monthly payment, you could use that freed up cash to apply toward your emergency fund. Otherwise, the rest might be left up to lawmakers.

“If we go through the fall, past the election and into the holidays without a deal, the economy could hit a wall,” Valliere says. “The biggest concern right now in the markets is that the economy could stall out because of a lack of stimulus.”

Methodology

This study was conducted for Bankrate via telephone by SSRS on its Omnibus survey platform. The SSRS Omnibus is a national, weekly, dual-frame bilingual telephone survey. Interviews were conducted from September 16-20, 2020 among a sample of 1,010 respondents in English (974) and Spanish (36). Telephone interviews were conducted by landline (304) and cell phone (706, including 423 without a landline phone). The margin of error for total respondents is +/-3.68 percent at the 95 percent confidence level. All SSRS Omnibus data are weighted to represent the target population.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.