Survey: Majority of Americans don’t expect their finances to improve in 2019

The start of a brand-new year should give us something to look forward to. But many folks don’t feel good about where their finances are headed.

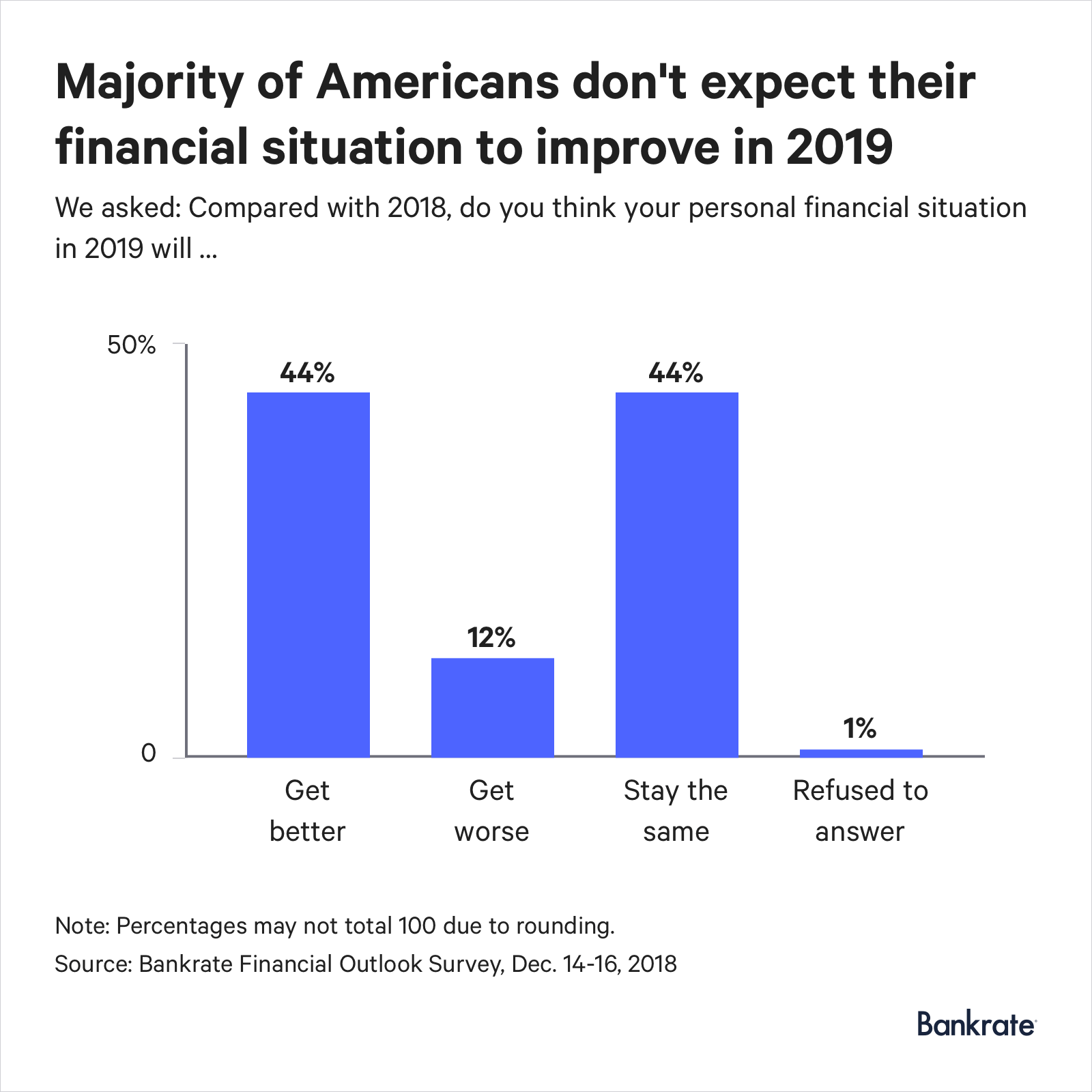

According to Bankrate’s Financial Outlook Survey, 55 percent of Americans don’t expect their financial situation to improve in 2019. This includes 12 percent who think their situation will be worse and 44 percent who think it will stay the same.

Business owner Steve Silberberg is among those who expects their financial situation to get worse this year.

Silberberg guides groups interested in getting fit and backpacking through national parks and forests. But because of the government shutdown, many parks have closed and some facilities aren’t accessible at all.

He doesn’t qualify for back pay, so Silberberg has had to take on a temporary job writing software.

“Let’s say I was writing software for a living, that was it, and I didn’t even have a business dependent on the government,” Silberberg says. “I still think my situation would be worse because the increase in wages won’t cover the extra expenses I will have to put towards health care, just anything that taxes are going to stop covering.”

Consumers point the blame at Washington

Silberberg isn’t the only one saying that political affairs are affecting their financial lives. Among the respondents who think their financial circumstances will get worse in 2019, 49 percent say that’s due to the work being done by political leaders in Washington.

“If you think about, first of all, just that in general, the erosion of confidence in institutions and then you think about essentially developments in recent years with respect to government shutdowns, the divisive nature of national politics and the lack of the ability on the part of elected leaders to forge productive and constructive solutions to major problems — it is understandable why people may feel that way,” says Mark Hamrick, Bankrate’s senior economic analyst.

Aside from political gridlock, more debt and an increase in the cost of living are two other common reasons the financial outlook this year for many Americans seems bleak. When asked what will cause their financial situation to get worse this year, nearly 1 in 5 say rising interest rates.

| Negative factors | Response |

|---|---|

| Note: Among respondents who expect their finances to get worse compared with 2018. Respondents could select more than one response. Source: Bankrate Financial Outlook Survey, Dec. 14-16, 2018 |

|

| Work done by political leaders in D.C. | 49% |

| Cost-of-living increase | 38% |

| Having more debt | 37% |

| Some other reason | 32% |

| Less money from savings/investments | 21% |

| Rising interest rates | 19% |

| Less money at work | 18% |

Brent Weiss, co-founder of Planning Facet Wealth in Baltimore, says it’s important to take what’s happening in the political arena and the broader economy with a grain of salt. Focus on what you can control, he says.

“I can’t do anything about trade or the economy or a government shutdown, but you know what I can do? I can start to pay down that debt that I have,” Weiss says. “I can start to look at my cash flow and my lifestyle. Oh, I can start to save for retirement and take incremental steps to do it.”

Millennials are optimistic about their finances

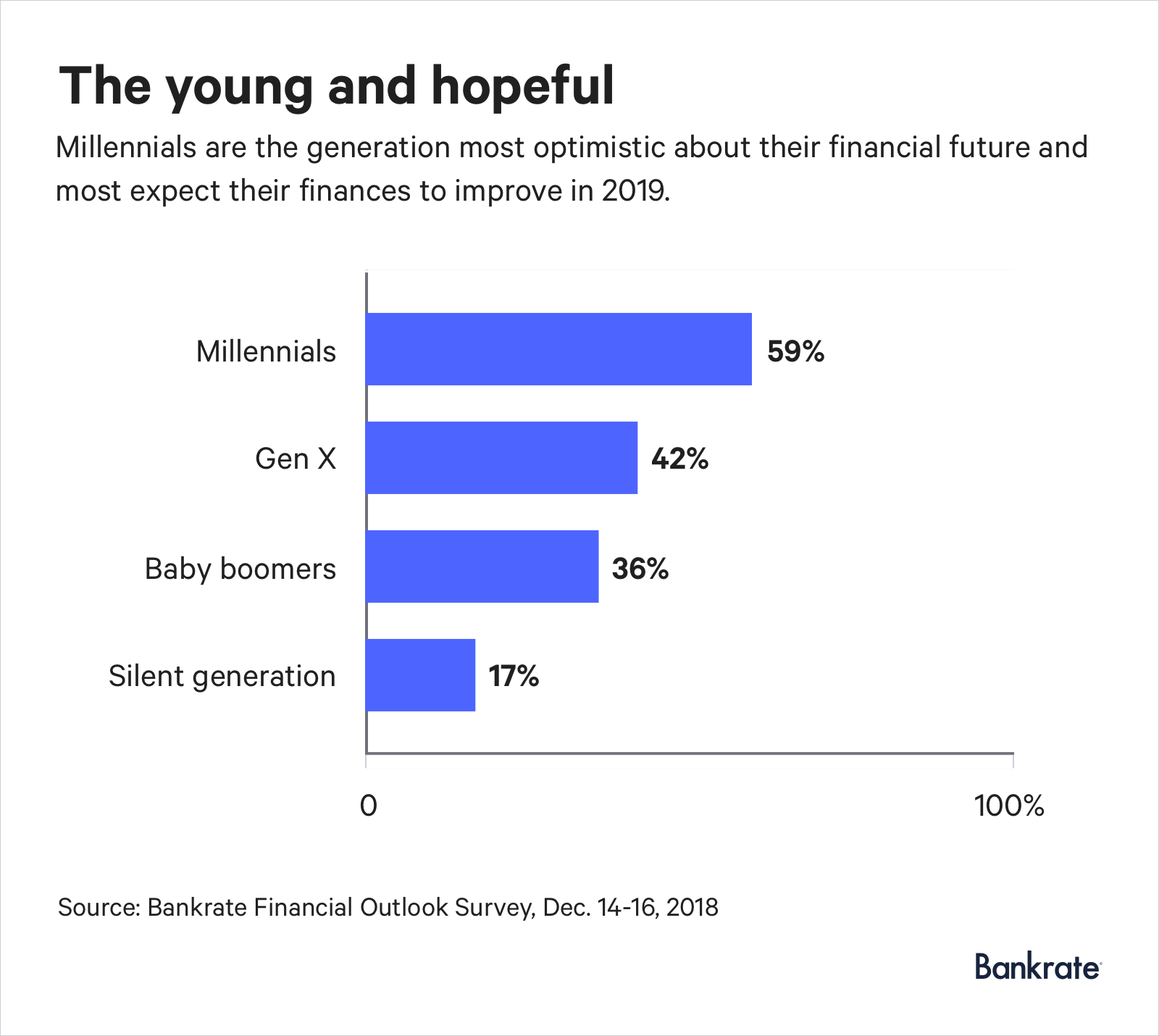

Not everyone expects 2019 to be a bad year for their personal finances. Compared with their parents and grandparents, millennials are more likely to think positively about the state of their financial future.

Nearly 60 percent of young adults between the ages of 18 and 37 say their financial circumstances this year will get either somewhat better or much better. Given the crushing amount of student debt they’re managing, to some people, that may be surprising.

But there’s hope for the biggest generation in the U.S. labor force. As a recent Bankrate survey shows, millennials are more likely than anyone to get a raise by taking on new responsibilities at work or getting promoted. Many of them have started their own companies or plan to do so at some point, Weiss says.

Hamrick adds, “The good news for millennials is that they represent the most upwardly mobile cohort in this society, particularly for those who are qualified for employment and are well-trained or well educated.”

There’s much to admire about millennials’ positive mindset. But Weiss notes that they could fall short of achieving their goals without a solid plan they can implement.

“Where I see a lot of millennials challenged is they have these amazing goals, but they don’t really have a plan to achieve them and that will eventually catch up to them,” Weiss says. “So the advice I would give to millennials is it is amazing that you have these goals and yes you can achieve them, but understand, break them down into more manageable action plans to start taking the next right step to achieving these goals because it won’t happen overnight.”

Optimists anticipate more money at work

It’s not just millennials — 44 percent of survey respondents think 2019 will be a better year for them financially than the previous year. Among those respondents, more than half (52 percent) think they’ll earn more money in 2019. Nearly 4 in 10 think they’ll end up with less debt.

Men are more optimistic about their financial outlook: 47 percent think their financial circumstances will get better or much better in 2019. Just 40 percent of women would agree.

| Positive factors | Response |

|---|---|

| Note: Among respondents who expect their finances to improve compared with 2018. Respondents could select more than one response. 1% refused to answer. Source: Bankrate Financial Outlook Survey, Dec. 14-16, 2018 |

|

| More money at work | 52% |

| Having less debt | 38% |

| Some other reason | 18% |

| More money from savings/investments | 17% |

| Work done by political leaders in D.C. | 10% |

| Cost-of-living decrease | 5% |

Minorities also feel better about their financial prospects. Fifty-nine percent of blacks and 53 percent of Hispanics think 2019 will be a more financially prosperous year. Only 40 percent of white Americans feel the same way.

“We know that on some of the cohorts such as African-Americans, etc., that we have seen some historically low levels with respect to the unemployment rate, let’s say, over the course of the past year,” Hamrick says. “And so to that extent, that reflects the benefit of a tight labor market that probably is getting relatively close to the point where it can’t get much tighter.”

Americans’ top financial goals for this year

Most Americans (89 percent) have some financial goal they’re hoping to accomplish in 2019. Paying down debt is the most common financial goal, followed by budgeting better.

Many families don’t have enough money saved for retirement or even short-term emergencies. But only 10 percent of the study’s participants want to work on growing their savings for a rainy day this year.

| Other responses: No financial goals (11%); something else (8%); refused to answer (1%). Source: Bankrate Financial Outlook Survey, Dec. 14-16, 2018 |

|

| Pay down debt | 30% |

| Budget spending better | 13% |

| Save more for retirement | 12% |

| Save more for emergencies | 10% |

| Invest more money | 5% |

| Buy a new home | 4% |

“I would say that probably more people do need to be making that a priority because over time we haven’t actually seen that people are making that much progress on that front and at least in terms of a cross section of the population,” Hamrick says. “And so to me that suggests that we have more work to do when it comes to raising financial literacy and helping people to accomplish their financial goals.”

Having a goal is a good start, but carrying it out comes down to breaking it up into small, concrete steps you can take and having discipline and patience, Weiss says.

“It’s great to have longer-term, sort of aspirational goals, but then we need foundational elements that help us achieve it day in and day out,” Weiss says. “Once we have that, the key here is — and this is not secret sauce, it’s the hardest part — it’s discipline. If we don’t have the discipline to stick to, whether it’s (putting) additional money towards debt because we go and spend it on something fun, we start to lose control of those goals. And the last thing is patience.”

Methodology

The study was conducted online in Ipsos’ Omnibus using the web-enabled “KnowledgePanel,” a probability-based panel designed to be representative of the U.S. general population, not just the online population. The sample consists of 1,000 nationally representative interviews, conducted between Dec. 14-16, 2018, among adults aged 18+. The margin of error for the full sample is +/-3 percentage points.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.