Economists survey: Future looks good for saving, bad for growth

Leading experts say it’s going to be tough to keep the party going for the U.S. economy in the months ahead, according to Bankrate’s Fourth-Quarter Economic Indicator Survey.

A tight labor market paired with a shaky global situation threaten the economy in the next year to year-and-a-half, according to economists surveyed for the indicator. Among the 24 experts surveyed, not one sees economic growth getting a boost in the intermediate future.

Bankrate asked economists from across the country to weigh in on whether they believed risks for the U.S. economy in the intermediate term are tilted toward the upside, downside or about the same. Just five economists predict businesses leaders, policymakers and consumers will be able to balance the economic risks they’re facing. Nineteen of the economists say the risks for the economy are tilted toward the downside, and none of the economists see the risks tilted toward the upside (down from 14 percent in the third-quarter survey).

The top concerns cited by the group were about a global economic slowdown creating headwinds at home, the trade war and tariffs hurting businesses and consumers and companies struggling to find new workers and/or meaningfully boost pay for their existing employees to keep the momentum going.

“As we see the positive growth impact from the tax cuts start to dissipate, there is also an expectation that global growth will start to slow. Additionally, as rates rise and corporate profits are under pressure because of the broader economic slowdown, there may be significant volatility in financial markets,” says Mike Fratantoni, chief economist for the Mortgage Bankers Association.

Without the stimulus of monetary and fiscal policy, the economy will be left on its own, says Lynn Reaser, chief economist at Point Loma Nazarene University in San Diego.

“The global economy will not provide much support and certain U.S. sectors, such as autos and housing, will weaken,” Reaser predicts. “Consumers and businesses will be left to carry the U.S. economy’s weight, and they may not have the strength needed.”

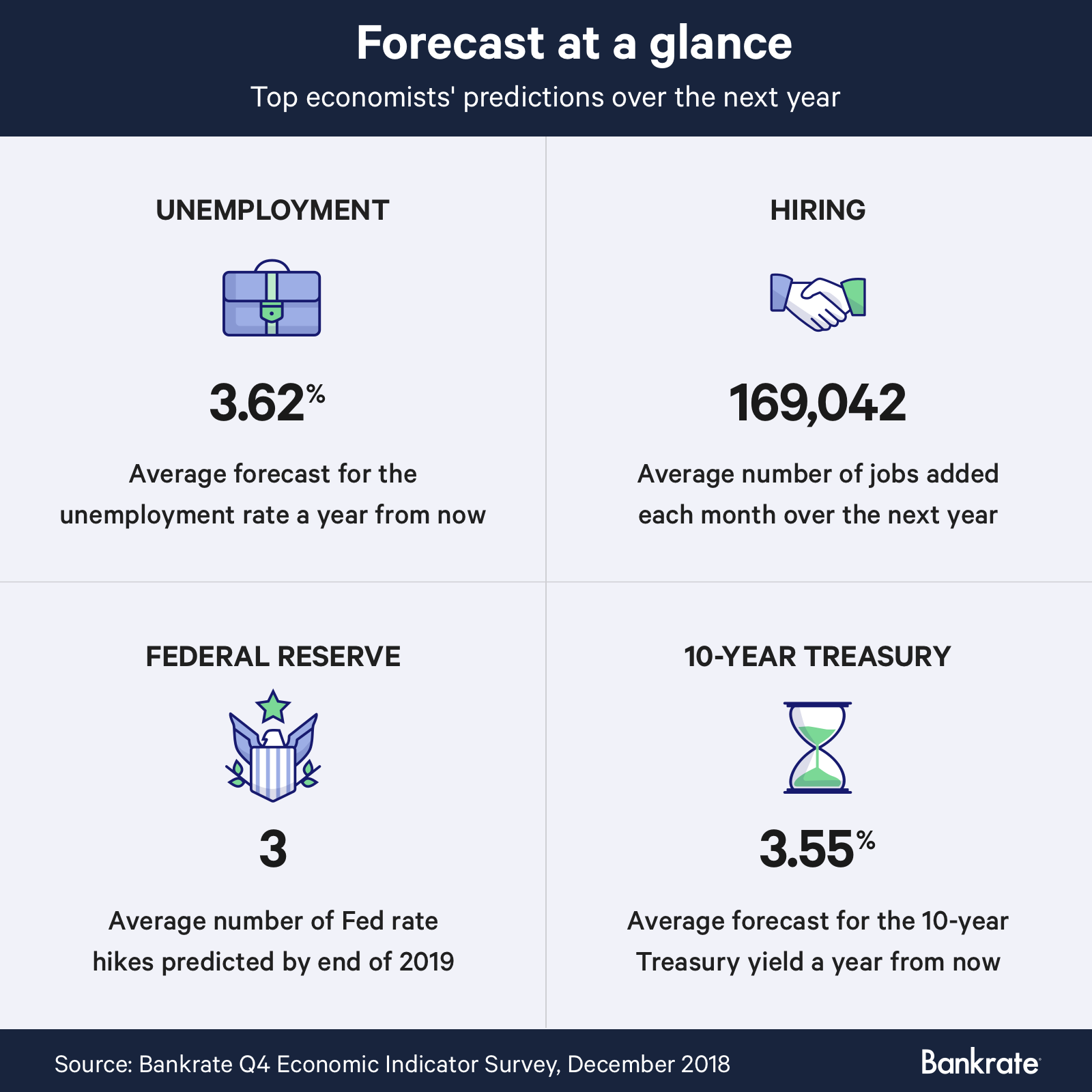

Survey respondents were also asked about their predictions on a range of topics, including Federal Reserve interest rate hikes, the 10-year Treasury yield and hiring.

How many Fed rate hikes through 2019?

Economists surveyed by Bankrate expect to see more rate hikes from the Federal Reserve, with 83 percent predicting to see the federal funds rate go up at least three times by the end of 2019. This would include the expected rate hike from the Fed’s December 2018 meeting. The economists are split between those predicting a total of three rate hikes (42 percent) and those predicting at least four rate hikes (42 percent) by the end of 2019.

Among the 10 economists predicting four or more rate hikes is Ryan Sweet, director of real-time economics at Moody’s Analytics.

“If the Fed does pause, it should be an extended pause of more than just a few months,” Sweet says. “The case for a pause will likely be strongest toward the end of 2019, particularly if financial market conditions are less frothy, inflation isn’t running above policymakers’ target and the fiscal stimulus is fading. There is a chance that rates will keep moving higher for now, though the federal funds rate may peak sooner and lower than we expect this cycle.”

The Fed raised rates to the 2 percent to 2.25 percent range in September and is expected to hike rates another quarter-percentage point at its December meeting.

Rate hikes are typically thought to be good for savings accounts and bad for credit card bills. Rate hikes typically lead to higher yields on savings instruments such as savings accounts, certificates of deposit and money market accounts, so savers stand to benefit. For those with credit card debt, however, your credit card annual percentage yield is likely to increase after rate hikes. Work toward paying down your debt and consider transferring your balance to a 0 percent balance transfer credit card to give you time to pay down your debt interest-free.

What will the 10-year Treasury yield be 12 months from now?

Buying a home likely won’t get cheaper in the near term. The forecast for the 10-year Treasury note — the benchmark for 30-year fixed mortgage rates — is slightly higher than the three past quarters. On average, the economists predict a yield of 3.55, according to the survey.

The average 10-Year Treasury Constant Maturity Rate was 3.15 for the month of October, according to the Fed.

If you’re shopping for a home loan, compare mortgage lenders to make sure you’re getting the best rate for your situation.

How many jobs will be added each month over the next year?

Economists expect companies will add an average of 169,000 new workers per month in the year ahead, signaling slightly faster hiring is predicted now compared to when economists were last polled. Several experts forecast that the tight labor market will push up wages for workers, luring some people not currently looking for work from the sidelines.

Robert Frick, corporate economist at Navy Federal Credit Union, is among those who say we may balance the risks facing the economy.

“It’s impossible to know, but higher wages and better-paid workers could mean more consumer spending, which makes up 70 percent of GDP,” Frick says.

A year from now, economists predicted an unemployment rate ranging between 3.2 percent and 4.4 percent. The average prediction fell at 3.62 percent, according to the indicator.

The unemployment rate hung at a historic low rate of 3.7 percent as of October 2018, according to the Bureau of Labor Statistics.

What you should do: Save and reduce debt

With interest rates expected to rise and the possibility of an economic slowdown, experts recommend building your savings and paying down debt.

“Build your cash cushion in case those downside economic risks materialize in the coming 12 to 18 months,” says Greg McBride, CFA, chief financial analyst for Bankrate.com.

McBride recommends opening an online savings account, setting up direct deposit from your paycheck and adding to the new account when receiving a bonus, tax refund and a pay raise. And keeping tabs on how much is owed on credit cards, mortgages, home equity lines of credit and other debts is especially important going forward.

“Interest rates are expected to rise further, so avoid adding high-cost credit card debt during the holiday shopping season and remain focused on paying it down as aggressively as possible,” he says. “Consider fixing the interest rate on your outstanding home equity line of credit balance. Both credit card and HELOC rates will rise further over the next year.”

Methodology

The Fourth-Quarter 2018 Bankrate Economic Indicator Survey of economists was conducted Dec. 13-20. Survey requests were emailed to economists nationwide, and responses were submitted voluntarily online. Responding were: Scott Brown, chief economist, Raymond James; Joseph Brusuelas, chief economist, RSM US LLP; Gregory Daco, chief U.S. economist, Oxford Economics; Robert Dietz, chief economist, National Association of Home Builders; Bill Dunkelberg, chief economist, NFIB; Mike Fratantoni, chief economist, Mortgage Bankers Association; Robert Frick, corporate economist, Navy Federal Credit Union; Robert Hughes, senior research fellow, American Institute for Economic Research; Daniil Manaenkov, chief U.S. economist, RSQE, University of Michigan; Bernard Markstein, president and chief economist, Markstein Advisors; Chad Moutray, chief economist, National Association of Manufacturers; Joel L. Naroff, president, Naroff Economic Advisors; Jim O’Sullivan, chief economist, High Frequency Economics; Satyam Panday, senior economist, S&P Global; Lindsey Piegza, Ph.D., chief economist, managing director, Stifel Nicolaus & Co.; Lynn Reaser, chief economist, Point Loma Nazarene University; John E Silvia, president, Dynamic Economic Strategy; Sean Snaith, director, Institute for Economic Competitiveness – College of Business Administration, University of Central Florida; William E. Spriggs, chief economist AFL-CIO; Phillip Swagel, professor, University of Maryland School of Public Policy; Ryan Sweet, director of real-time economics Moody’s Analytics; Diane Swonk, chief economist, Grant Thornton; Scott Wren, senior global equity strategist, Wells Fargo Investment Institute; Lawrence Yun, chief economist, National Association of REALTORS(r).

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.