Survey: Americans say this is the biggest threat to the US economy

The U.S. economy has been firing on all cylinders for much of the year, with strong job growth and record-low unemployment. But the divisive and highly partisan state of the nation’s politics is leading to concerns that the biggest threat to U.S. economic progress might come from within, according to a new Bankrate.com survey.

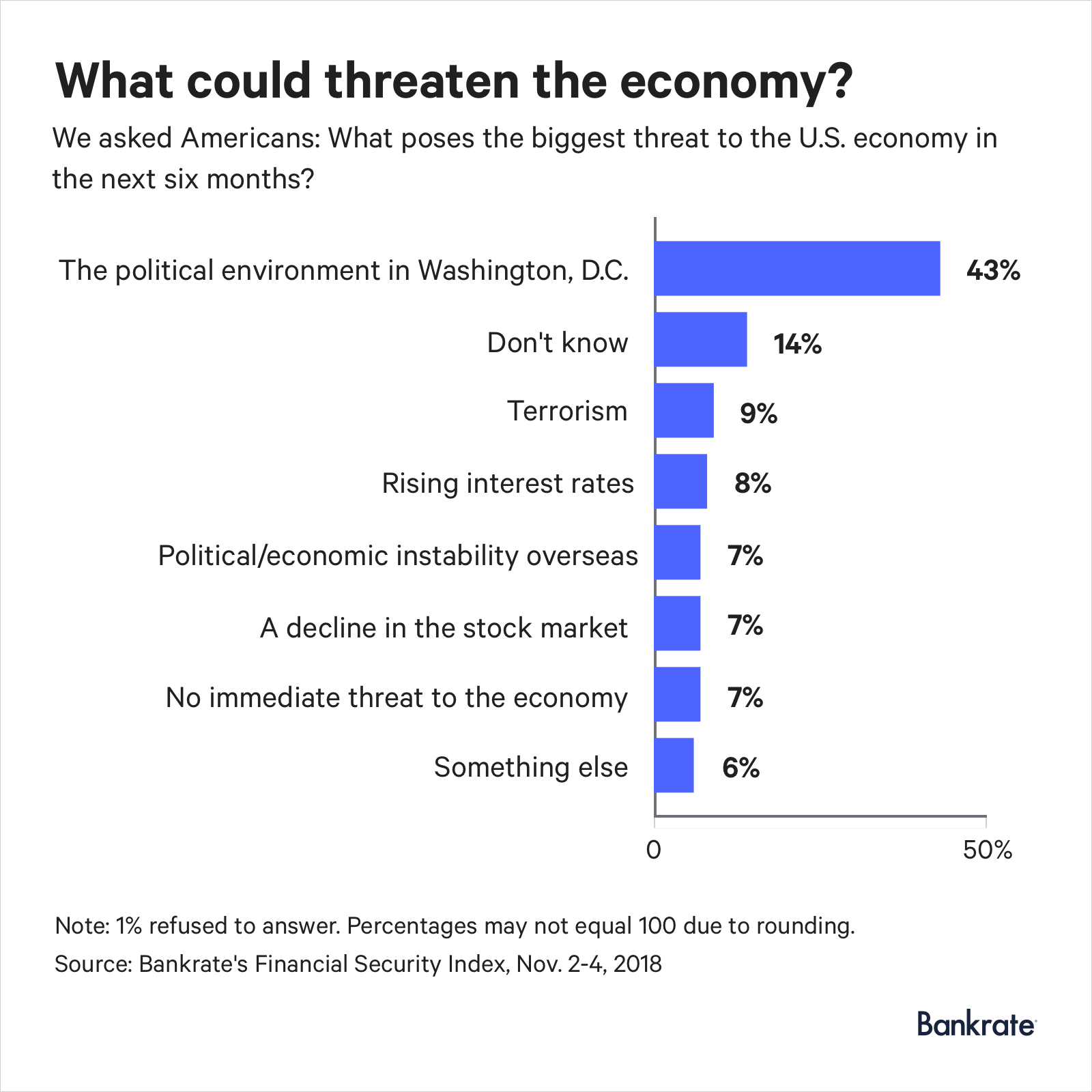

More than 4 out of 10 Americans (43 percent) say the current political environment in Washington poses the biggest threat to the U.S. economy over the next six months, according to Bankrate.com’s latest Financial Security Index survey. That’s nearly five times more than the next highest threat (terrorism, at 9 percent).

Americans are also concerned — though to a lesser extent — about the impact of rising interest rates (8 percent), a decline in the stock market (7 percent), and political or economic instability overseas (7 percent). Another 7 percent of respondents see no threat to the economy.

Older Americans were most concerned about the current political climate and its impact on the economy. More than half of Americans age 73 and older cited it as a top threat, followed by 32 percent of younger millennials (ages 18 to 27).

“With the U.S. economy seemingly on solid ground in the near term, the turbulent political environment is generating an increasing sense of unease extending to personal finances,” says says Mark Hamrick, senior economic analyst at Bankrate.com. “Resolution of the midterm elections doesn’t change that.”

Americans prepping by saving more

Signs of an economic slowdown are evident in recent forecasts from top finance and economic experts.

JPMorgan updated its 2019 forecast, calling for slower GDP growth of 2 percent or less in 2019 and beyond, down from an average of 3 percent for 2018. In a recent CNBC survey of 10 economists, including the Federal Reserve, economic growth is expected to fall to 2.4 percent in 2019, and a recession is possible by 2020. Economists pointed to three key factors that will slow growth: trade wars and tariffs, the Fed’s continued rate hikes and the diminishing impact of tax cuts, CNBC reported.

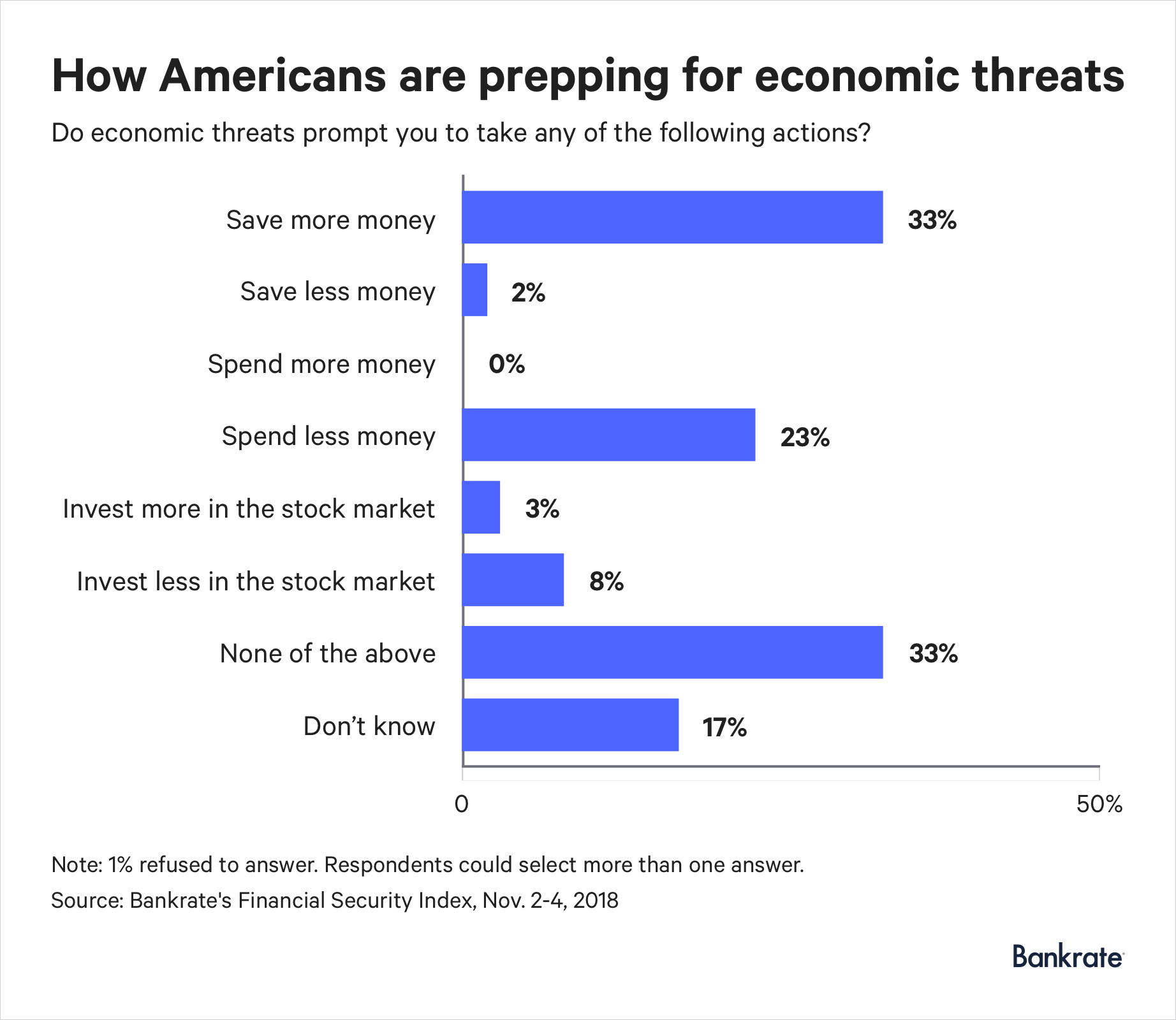

Bankrate’s survey found that one-third of Americans say they’re saving more money, and nearly one-quarter are cutting spending in response to economic threats. Thirty-nine percent of older millennials (ages 28 to 37) — who came of age during the Great Recession and have record-high levels of student debt — say they’re saving more money.

“It’s good to see many Americans making savings a higher priority, but the reality is that still others would benefit by doing the same,” Hamrick says. “Low unemployment won’t last forever. We just don’t know how long. The time to make financial hay, to put more money in the bank, is while the sun is still shining.”

One-third of respondents aren’t taking any action in response to these economic threats. This apathy is more pronounced among older Americans, with 44 percent of older baby boomers (ages 64 to 72) and nearly half (49 percent) of the silent generation (ages 73 and older) who say they are leaving their personal finances as-is. Just 8 percent of Americans said they’re investing less in stocks, while 3 percent are investing more in the stock market.

Political tensions have tangible economic impact

The tumult in Washington has led to policy uncertainty, and it’s likely to get even nastier, says Ryan Sweet, director of real-time economics at Moody’s Analytics. So far, the economic costs have been minimal. But if trade tensions continue to escalate, that will rattle investors — especially if President Donald Trump’s administration pushes forward on tariffs on China, Sweet says.

The newly split Congress — a Democrat-led House and a Republican-led Senate — is another wrinkle that will create legislative gridlock and make it harder for Trump to push his economic agenda through, Sweet says.

“Sometimes that (gridlock) can be good because it can prevent lawmakers from doing harm,” Sweet says. “They’ll need to work together, though, to raise the debt ceiling and pass a budget to avoid a shutdown. They’ll take the fight to the eleventh hour, and sometimes financial markets can react to that.”

The nation’s debt and federal deficit can have negative economic impacts, ranging from the short term to the long term, Hamrick says.

“In the short term, it becomes harder for elected leaders to justify expenditures on needed items such as infrastructure spending. In the long term, the burgeoning debt will become increasingly costly and threaten to place upward pressure on interest rates.”

How to protect your personal finances in a recession

While it’s difficult to time if — and when — a recession may hit, consumers can do several things to lessen the blow when the hammer does fall.

For starters, if you don’t have an emergency fund it’s a good idea to start saving now, financial planners say.

Having at least three to six months of household expenses saved is a minimum recommendation, but it’s even better to have 12 to 18 months of your spending needs set aside in cash or cash equivalents, says Paul K. Fain, a financial planner in Knoxville, Tennessee.

Job losses are another concern in a slower economy. In case you find yourself in that situation, consider making the maximum contribution to a health savings account, or HSA, says David R. Silversmith, a financial planner in Plainview, New York.

“In addition to the tax benefit, this can help defray the cost of medical expenses that might happen when someone is between jobs and without medical insurance,” Silversmith says.

For folks closer to retirement, being more conservative with investment risk is important, Fain says.

“Although I am not a market timer, there is some merit to downshifting your portfolio’s risk profile as you transition into retirement,” Fain says. “This could possibly reduce some exposure to sequence of return risk. At the end of the day, we need to just take a deep breath and follow good financial practices: patience, diversification, controlling spending, investment costs and taxes.”

Methodology

The study was conducted online in Ispos’ Omnibus using the web-enabled “KnowledgePanel,” a probability-based panel designed to be representative of the U.S. general population. The sample consists of 1,000 nationally representative interviews conducted Nov. 2-4, 2018, among adults aged 18 and older. The margin of error is +/-3 percentage points.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.