How are women affected by the student loan crisis?

Despite efforts by the Biden administration to cancel student debt and revise income-driven repayment plans to better suit borrower needs, the student loan debt crisis continues to plague millions of Americans. The average borrower holds a balance of $39,487 in student loan debt. As the future of student debt relief remains unknown, many college graduates are entering the workforce with a negative net worth while facing immense hurdles regarding buying a home, building wealth or achieving other financial goals.

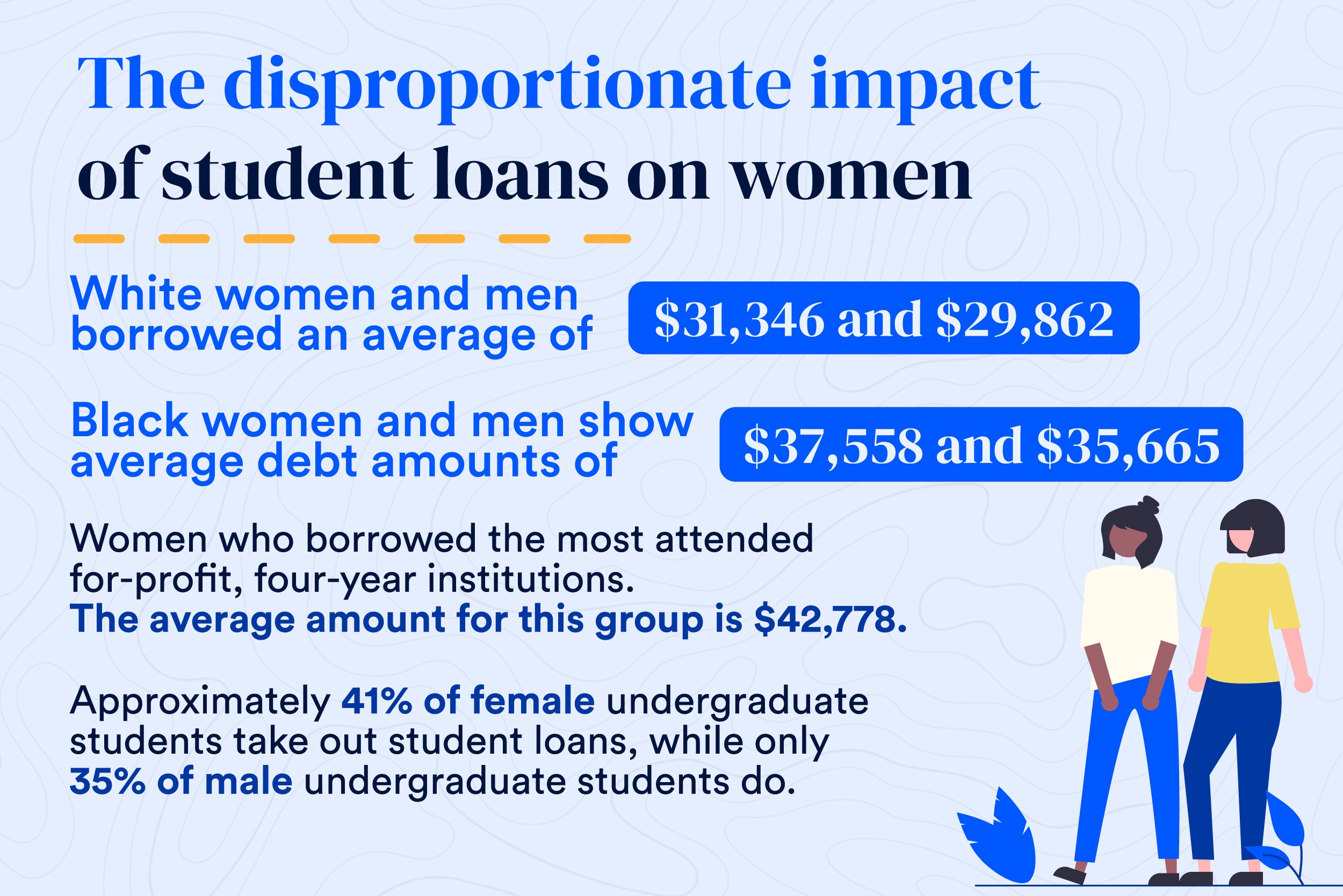

But some Americans have taken a bigger hit regarding student loan debt. A 2021 analysis from the American Association of University Women (AAUW) shows that women hold approximately two-thirds of all student loan debt in the United States. Not only that but BIPOC (black and indigenous people of color) women, in particular, graduate with more undergraduate debt than other women.

If we hope to solve the student loan debt crisis, we have to look at the root causes of this issue and why women, particularly BIPOC women, struggle more to repay their loans after they graduate.

Rising cost of living and college tuition

The COVID-19 pandemic and its fallout have caused significant inflation and financial turmoil over the past few years. Inflation reached historic highs in 2022, and many Americans have struggled to make ends meet.

The student debt crisis has intensified as costs continue to rise and wages do not. College tuition rates have increased by nearly 180 percent in the past 20 years, rising by 9 percent a year on average. This dramatic increase in both tuition costs and general expenses means that more people than ever are taking out student loans. In fact, 83.8 percent of students rely on student loans and financial aid to cover their tuition.

Many students from low-income backgrounds see attending college as a way to escape generational poverty, but the student debt they acquire can be crippling, especially as the cost of living continues to soar and wages remain low in comparison.

The gender and racial wealth gap

Rising costs and mounting debt are a huge problem for people with student loans overall, but women and people of color, particularly Black Americans, tend to be hardest hit by the student debt crisis. Women and people of color tend to borrow more on average than white men and earn less after graduating.

On average, women make about 26 percent less than their male coworkers and are more likely than men to pursue advanced degrees. Recent research shows that women often have to obtain more advanced degrees to make the same money as men with less education. For example, women with Bachelor’s degrees make less on average than men with Bachelor’s degrees. Their wages are more comparable to men with Associates degrees.

The racial wealth gap also poses a significant problem. On average, Black and Latinx households earn half as much as white households. This disparity is intensified for women of color, particularly Black women, who have more student debt than any other demographic.

Research from the AAUW shows that women take approximately two years longer than men to repay their student loan debt. They are also more likely to struggle financially as they pay down their student loans.

Recent figures from the Center for American Progress show that women earn between 54 cents and 90 cents per dollar compared to white men. Here’s what the gender wage gap looks like broken down by ethnicity:

- White women: 79 cents per dollar.

- Black women: 62 cents per dollar.

- Hispanic or Latinx women: 54 cents per dollar.

- Asian women: 90 cents per dollar.

- Alaska Native women: 57 cents per dollar.

It is clear that both gender and race significantly impact how much student debt a person has and how difficult it may be for them to repay it.

How women can reduce their student loan debt

While the deck appears to be stacked against women regarding student loan debt, there are steps women can take to improve their situation. It all starts with doing plenty of research and making sure that the facts inform any higher education decisions. For example, women and men borrow less when they choose public, in-state institutions over for-profit institutions or community colleges for their first two years of school.

Other tips to reduce student debt include:

- Choose the right repayment plan. Borrowers with federal student loans can repay their loans over the standard 10-year repayment plan, but they can also opt for an extended or graduated repayment plan that lasts up to 30 years. With private student loans, repayment terms can range from five to 20 years. These options won’t reduce your debt or the interest you pay over time, but they can help make student loan payments more affordable.

- Explore income-driven repayment plans or Public Service Loan Forgiveness (PSLF). Federal student loan borrowers can also look into income-driven repayment plans or Public Service Loan Forgiveness, which let you cap student loan payments at a percentage of your discretionary income. Income-driven repayment plans forgive any remaining loan balance after 20 or 25 years, while PSLF forgives remaining balances after 10 years.

- Ask your employer to chip in. Updates to the CARES Act in March 2020 and the Consolidated Appropriations Act in December 2020 mean that employers can contribute up to $5,250 per year to employee student loans, with the amount tax-free for both parties.

- Refinance private loans. Consider refinancing private student loans with a new lender if you’re now eligible for a lower interest rate. Doing so won’t reduce your principal balances, but it can help you save on interest, pay down balances faster or both.

How the U.S. can reduce student loan debt for women

While anyone with student loans has some options when it comes to reducing their debt, saving on interest or securing a lower monthly payment, many major institutions think that the United States government could be doing more to help. Specifically, the AAUW makes the following suggestions:

- Congress should protect and expand Pell Grants for low-income students.

- Congress should increase funding for public colleges and universities to move toward tuition-free higher education.

- The U.S. Department of Education should make it easier for all borrowers to enroll in income-driven repayment plans.

- Institutions should create new programs to address some of the financial challenges of attending college, including the cost of child care.

- Employers should provide employee matches for student loan repayment.

The Biden administration announced a student debt forgiveness plan in 2022 that would forgive up to $20,000 for borrowers who earn less than $125,000 per year. Applications opened in October of 2022. However, this decision remains tied up in the Supreme Court.

Recently, President Biden has announced updates to his student loan repayment plan, planning to overhaul the Revised Pay As You Earn plan (REPAYE). This plan would reduce monthly payments to 5 percent of the borrower’s discretionary income. It would also mean $0 monthly payments for low-income borrowers and prevent interest from accumulating while the borrower makes regular payments.

Student loan payments have been paused since 2020 due to the COVID-19 pandemic. The payment pause has been extended several times, and payments will not resume until 60 days after the Supreme Court decides student debt relief. If the legal issues surrounding student debt relief have not been resolved by June 30th, 2023, payments will resume 60 days after that.

The bottom line

The American student loan debt problem only seems to get worse, and that’s true regardless of gender or ethnicity. However, the issue has become a crisis for women, particularly for women of color.

Unfortunately, the fate of student loan forgiveness and repayment is somewhat unknown. In the meantime, women struggling with their debt may take a closer look at repayment plans, including income-driven ones, to ensure that they’re repaying student loans with a plan that makes sense.