New student loan relief plan faces restraining order

The U.S. Department of Education’s latest student loan debt relief plan is not fully finalized. That hasn’t stopped seven Republican-led states from suing to block borrowers from relief. In response to a lawsuit filed on September 3, a U.S. district judge on September 5 issued a temporary restraining order against the plan.

With forgiveness through the SAVE repayment plan on hold due to ongoing litigation, federal student loan relief, even through existing programs, is looking less likely for borrowers.

Judge blocks loan forgiveness before Education Department publishes final rules

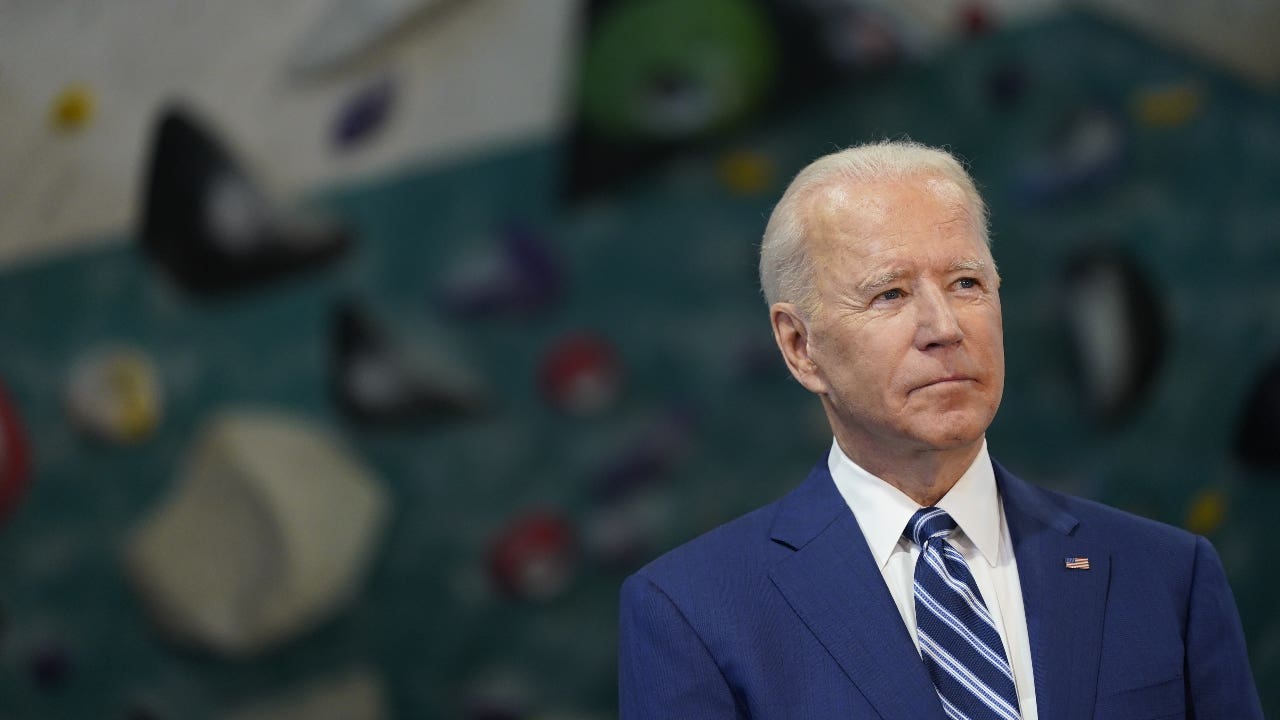

In late July, the Department of Education announced President Joe Biden’s latest student loan forgiveness proposal. At the time, borrowers were told that the program rules would be announced this October.

The sweeping forgiveness plan would impact 25 million federal student loan borrowers who meet the eligibility criteria. Those wanting to opt out of the potential forgiveness were told to email the Education Department by August 31.

The plan targeted borrowers whose loan now is higher than it was when they started repayment, borrowers who’ve been repaying a loan for 20 or more years and those who would be eligible for forgiveness through income-driven repayment but have yet to apply. That’s according to draft rules published in April, though the final rules must still go through the negotiated rulemaking process.

Current student loans news

Use the student loans news hub to stay updated with the latest news that could impact your balance and your wallet.

Learn moreBut the seven suing states (Missouri, Georgia, Alabama, Arkansas, Florida, North Dakota and Ohio) contend that even this scaled-back version of Biden’s student loan forgiveness plans is illegal. They also claim the Education Department “has quietly instructed federal contractors to ‘immediately’ begin cancellation as early as September 3, 2024” rather than completing the rulemaking process first.

Just two days after the states filed their lawsuit, Georgia’s U.S. District Judge Randal Hall issued a temporary restraining lasting 14 days, though the court may opt to extend it. The order prevents the Education Department from forgiving any principal or interest under the plan or instructing loan servicers to do so.

“Today is a huge victory for every working American who won’t have to foot the bill for someone else’s Ivy League debt,” said Missouri Attorney General Andrew Bailey.

“I paid for my education in blood, sweat, and tears in service to my country, so this fight is personal for me. We will continue to lead the way for working Americans who are being preyed upon by unelected federal bureaucrats in Washington D.C,” Bailey added.

What this means for borrowers

The restraining order does not immediately and directly impact borrowers’ balances. However, it signals that mass forgiveness is looking less likely as the election approaches. Litigation over this and the administration’s other forgiveness plan may go on for months.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.