25 million borrowers to be notified of potential student loan forgiveness, and other student loans news

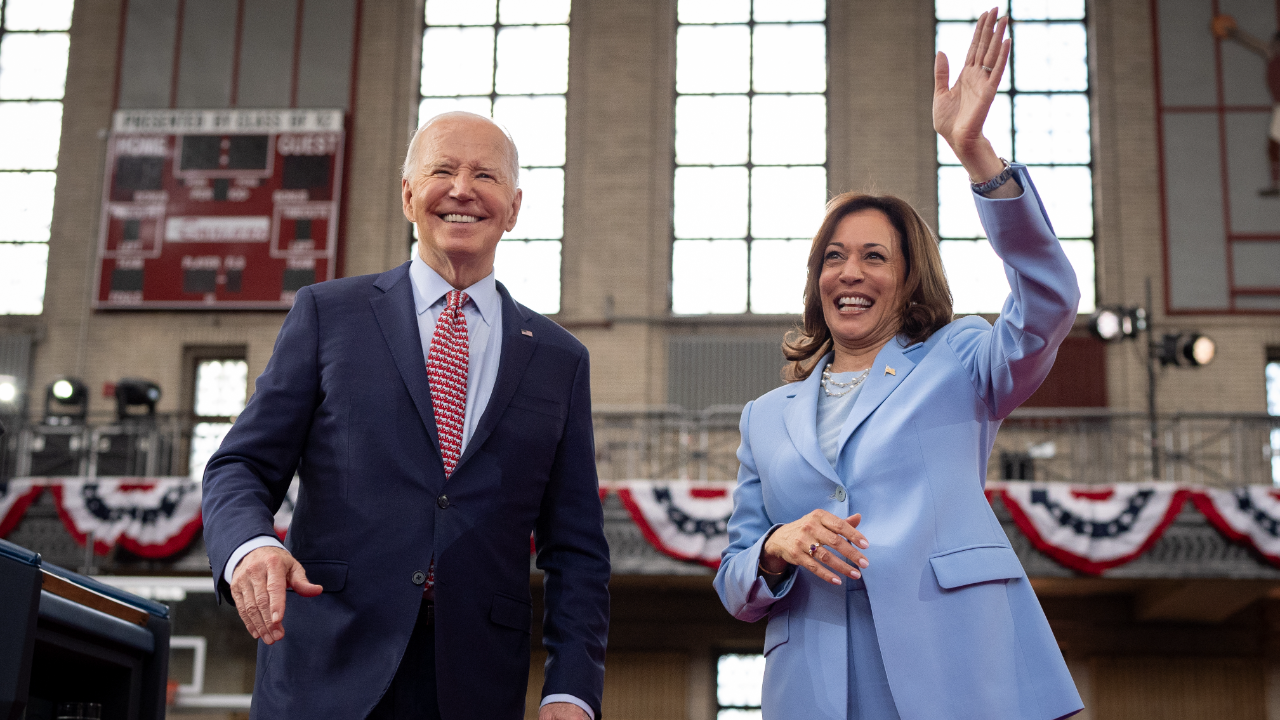

The Biden-Harris administration today announced its next step toward a round of student debt relief planned for this fall. If the plan is approved and implemented, 25 million federal student loan borrowers may receive student loan forgiveness.

In other student loan forgiveness news, the U.S. 8th Circuit Court of Appeals issued an order on July 19 blocking the entire SAVE plan. As a result, the U.S. Department of Education placed SAVE enrollees under temporary administrative forbearance until a final decision is reached. This is the latest development as two separate lawsuits by Republican-led states seek to have the plan declared unconstitutional.

Plus, federal student loan servicer MOHELA is facing a lawsuit filed by the American Federation of Teachers. The union cites alleged mismanagement causing harm to borrowers, especially around Public Service Loan Forgiveness, as a primary reason for the lawsuit.

Biden administration “takes next step” toward student debt relief for millions

Tens of millions of federal borrowers may receive yet another round of targeted student debt relief this fall. Today, the Education Department announced that it will be emailing all federal student loan borrowers outlining the potential debt relief starting tomorrow.

The program is not yet active and needs to undergo the negotiated rulemaking process at the Education Department. Should the current proposal be approved and carried out, the following borrowers could receive partial or full forgiveness:

- Those who owe more now than they did when they first started repayment.

- Borrowers who have at least one undergraduate loan that’s been in repayment for at least 20 years.

- Borrowers who have at least one graduate loan that’s been in repayment for at least 25 years.

- Those who would be eligible for forgiveness though income-driven repayment (IDR) but haven’t yet applied.

- Students who attended an institution that provided low financial value or failed to meet the Education Department’s accountability standards.

What this means for borrowers

The proposal is not currently active and there is a chance that it could get shut down during the rulemaking process. Those who think they could qualify need to be on the lookout for an email from the Education Department outlining the details. If you want to opt out of the potential forgiveness, call your servicer and let them know by August 30.

The notification email isn’t a confirmation of relief or eligibility. If the plan passes the negotiated rulemaking process, the official details will be released this fall.

Current student loans news

Use the student loans news hub to stay updated with the latest news that could impact your balance and your wallet.

Learn moreU.S. appeals court temporarily blocks all SAVE Plan provisions until further notice

As a result of ongoing litigation, 8 million federal student loan borrowers enrolled in the Saving On A Valuable Education (SAVE) plan will not have to make their monthly payments until further notice. As with the COVID-19 federal forbearance, interest won’t accrue during the pause.

The Education Department made it clear in a press brief that payments will be paused through August at least.

This ruling follows multiple rounds of federal courts blocking and unblocking parts of the program.

The Biden administration introduced the SAVE plan as an income-driven repayment option that provides most borrowers with lower monthly payments and a faster route to forgiveness than existing IDR plans.

Early this year, the Education Department announced that it would be rolling out regulatory changes to SAVE. These plans would make it easier for millions of individuals to qualify for forgiveness by slashing payments in half.

Two groups of Republican state attorneys general filed lawsuits against the Department. One group, led by Kansas, filed in March, and the other, led by Missouri, followed suit in April. They argue the Education Department lacks the authority to make these changes.

In June, a Kansas federal judge issued a preliminary injunction blocking the lowered payments, while a Missouri federal judge blocked forgiveness under the plan. The Education Department appealed these decisions and put online IDR plan applications on hold.

On July 1, a 10th Circuit Court of Appeals judge granted a stay on the Kansas injunction, allowing student loan payment cuts to proceed. The Kansas-led states in that case have appealed the decision to the U.S. Supreme Court.

Meanwhile, the Missouri-led litigants appealed the Missouri decision to the 8th Circuit Court of Appeals. The 8th Circuit then issued the July 19 order that the Education Department interpreted as blocking the entire SAVE plan from operating. The final ruling is still to come and will likely also be appealed to the Supreme Court.

“Today’s ruling from the 8th Circuit blocking President Biden’s SAVE plan could have devastating consequences for millions of student loan borrowers crushed by unaffordable monthly payments if it remains in effect,” said Education Secretary Miguel Cardona in a statement. “It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers.

Asked about a potential timeline for the appeals process, national student loan expert Mark Kantrowitz says it’s unclear. “This is a wait and see situation,” he adds.

What this means for borrowers

Borrowers enrolled in SAVE who have monthly payments will be placed on an automatic forbearance until further notice. Individuals who have received a bill for August do not need to make the payment at this time.

The department’s fact-sheet states the pause will last “until the legal situation changes or servicers are able to send bills to borrowers at the appropriate monthly payment amount.”

“Borrowers enrolled in the SAVE Plan will be placed in an interest-free forbearance while our administration continues to vigorously defend the SAVE Plan in court,” Cardona stated. “The department will be providing regular updates to borrowers affected by these rulings in the coming days.”

To make sure you receive these updates, update your contact information with your federal student loan servicer and with studentaid.gov. Keep a sharp eye out for new emails or communication from your servicer or from the Education Department. You can also check the Education Department’s SAVE resource for recent updates and new information.

MOHELA faces lawsuit for alleged misleading lending practices

MOHELA, one of six federal student loan servicers, is facing a lawsuit over claims of mismanaging federal loan accounts. On July 22, the American Federation of Teachers (AFT) filed the suit over alleged illegal lending practices it claims harmed millions of borrowers.

According to the Student Borrower Protection Center’s fact sheet, the AFT’s allegations include that the servicer “illegally overcharged borrowers on their monthly student loan bills, failed to timely process paperwork, and actively misled borrowers about their student loan accounts.”

It also states MOHELA has not properly tracked public servants’ progress toward student loan forgiveness.

Many of AFT’s members are seeking forgiveness under PSLF. The union states it has had to spend thousands of dollars and employee hours educating AFT members on PSLF, helping members interface with MOHELA and publicizing the situation.

The lawsuit points the finger at corporate greed, stating, “MOHELA’s systemic failures have been ongoing for years, fueled by corporate indifference and prioritizing exponential growth and its own bottom line at the expense of borrowers on whom America relies to educate our children and keep us well.”

It also alleges that MOHELA failed to adequately staff and train its call centers and that many borrowers are “deflected” away from these centers toward inadequate self-service resources.

The lawsuit seeks monetary damages and an order that MOHELA “remedy the systemic deficiencies” it claims have harmed the AFT, its members and the public.

While MOHELA has not yet issued a press release in response to this lawsuit, it denied similar claims in an April cease and desist letter to the SBPC. It stated its customer service strategies conformed to guidelines from the Education Department’s Office of Federal Student Aid.

“Despite claims falsely made to the contrary, it is in MOHELA’s best interest that the borrowers we serve receive forgiveness when they are eligible,” it added.

Leading policymakers and the Education Department have repeatedly criticized MOHELA in the last year.

In October, the Education Department withheld a $7.2 million payment from MOHELA as a penalty for failing to deliver 2.5 million billing notices on time. The billing delays resulted in 800,000 borrowers becoming delinquent.

In April, Sen. Elizabeth Warren held a Senate hearing about the servicer, calling attention to the servicer’s alleged “3.9 million billing errors by servicers during the return-to-repayment.”

Democratic senators — including Senate majority leader Chuck Schumer — are now calling on the Education Department to take action on behalf of borrowers in light of the recent lawsuit.

“Given the findings from AFT’s lawsuit brought forward today, we urge the Department of Education to take action to hold MOHELA responsible for its harms and to protect borrowers from future abuses,” reads an online joint statement from Schumer, Warren and Sen. Bernie Sanders.

What this means for borrowers

MOHELA borrowers do not need to take action besides maintaining their monthly payments so they don’t fall behind.

If you identify with any of the lawsuit’s claims, you can report your experiences to the Consumer Finance Protection Bureau’s Consumer Complaint Database. If you’re having trouble making your payments, consider applying for a federal forbearance or deferment period to give yourself some breathing room.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.