Young adults are struggling with overspending — buy now, pay later is making it worse

Over the past few years, Amanda Agyapong, a 26-year-old living in New Jersey, has bought piles of new clothing — most of which she’ll likely never wear.

At the time, buying so much felt like it made sense. Agyapong frequently travels internationally — as much as every other month — and every time she prepared for a trip, she would spend hundreds of dollars on cheap, trendy clothes online. But by using buy now, pay later, she rarely actually dropped hundreds of dollars at once.

“I have the money. The money is just sitting in a bank account somewhere. But psychologically, (using a BNPL service) just feels better when purchasing these things,” Agyapong says.

She’s not alone. Half (50 percent) of buy now, pay later (BNPL) users say they use the service to pay in installments or spread the cash flow, according to Bankrate’s latest Buy Now, Pay Later Survey. But for many users, the allure of buying something now without paying a lot of money all at once leads to overconsumption: 29 percent of BNPL users say they spent more than they should have because of the services.

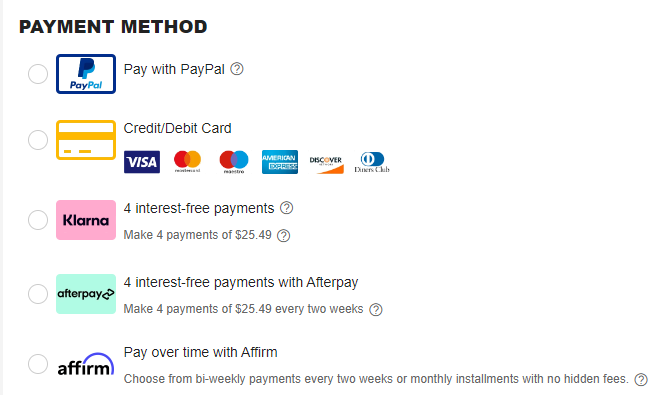

BNPL services, such as PayPal Pay in 4, Affirm, Afterpay and Klarna, are a type of installment loan that allow consumers to finance purchases interest-free over several weeks. These services are still relatively new, and Agyapong was skeptical that they were legitimate at first. But she quickly got used to them, so much so that she financed most of her holiday shopping through BNPL services. The next month, she received a notification about a different upcoming payment every few days.

Younger Americans, who may not be used to paying in installments, may feel they’re making a safe financial decision by using BNPL services while shopping online. But they’re not always aware that they may later regret taking on debt for items they didn’t really want in the first place.

Buy now, pay later services can encourage overspending because this financing is quick and easy to obtain. And they can trick you into focusing on the installments rather than the total price.— Ted Rossman, Bankrate Senior Credit Card Analyst

Bankrate’s insights on buy now, pay later services

- Americans are frequently using BNPL services. 39% of U.S. adults have used at least one BNPL service before.

- Users typically want to spend big without paying now. 50% of BNPL users used the service to pay in installments or spread the cash flow. Additionally, 37% used the service for a low (or nonexistent) interest rate, 33% used it to know exactly what they owe and how long the plan will last and 27% used it because the services make it easy to obtain credit.

- But they’re running into problems. 56% of buy now, pay later users have run into at least one problem with the service: 29% say they spent more than they should have, 18% missed a payment and 18% had difficulty returning a purchase or obtaining a refund.

Around 1 in 3 Gen Zers who’ve used a BNPL service spent more than they should have

More than 1 in 3 (39 percent) U.S. adults have used at least one BNPL service before, according to Bankrate’s BNPL Survey. Usage is especially high among younger Americans: 51 percent of Gen Zers and 55 percent of millennials say they’ve used a BNPL service before:

- Gen Zers (ages 18-27): 51 percent

- Millennials (ages 28-43): 55 percent

- Gen Xers (ages 44-59): 31 percent

- Baby boomers (ages 60-78): 25 percent

Gen Zers overwhelmingly use BNPL services because they want to pay in installments or spread the cash flow (42 percent). However, they also say the services let them know exactly what they owe and how long the plan will last (34 percent) and they want a loan with low (or no) interest rate (26 percent).

- Buy Now, Pay Later

- Buy Now, Pay Later (BNPL) services, like PayPal Pay in 4, Klarna, Afterpay or Affirm, allow consumers to finance online or in-store purchases interest-free over a set period of time. Payments are usually once a week over four to six weeks. While these services tend to not do a hard credit pull or charge interest, they can come with fees, especially if you miss a payment.

However, as more younger Americans use BNPL services, Gen Zers are also more likely to report problems. Gen Zers, in particular, are the most likely generation to regret a purchase made with a BNPL service (25 percent) or miss a payment (24 percent):

Note: Participants could select more than one answer.

Source: Bankrate, March 4-6, 2024

Gen Zers and millennials are also the most likely generations to say they have spent more than they should have when using BNPL services (34 percent and 35 percent, respectively). That was the most common issue among the two generations.

BNPL services make it easy to delay paying — sometimes too easy

Anyone can overspend, no matter what payment method they use. However, the low barrier to entry for BNPL services can make them more inviting for younger Americans who are unused to taking out loans or using credit. BNPL services typically do not require a hard credit check and some companies don’t require an initial deposit. More than 1 in 4 Gen Z or millennial BNPL users say they used the service because it was easy to obtain credit (26 percent and 30 percent, respectively).

As BNPL services become more ubiquitous, it’s becoming easier to sign up for a new service and finance a purchase impulsively when purchasing items online. While you can apply for financing through a service’s app, many major retailers, from big box chains like Walmart to fast fashion sites like Shein, partner with BNPL services and advertise a low monthly payment at checkout:

At checkout, Shein offers customers the option to pay with Klarna, Afterpay, Affirm or ZIP (not shown), which all offer four payments of $25.49 on a $102 purchase.

Bankrate Senior Industry Analyst Ted Rossman says the allure of those lower monthly figures can make people feel like they’re paying less for their purchases.

“As in, it’s not a $200 purchase, it’s just four easy installments of $50,” Rossman says. “If you have multiple plans running at the same time (and many people do), $50 here and $50 there can add up in a hurry.”

Though Agyapong consistently saves and tries not to buy things she doesn’t need, she says buying items through BNPL services makes large purchases feel more manageable — as if it’s a small, recurring bill and not a single large discretionary purchase. That has led to her repeatedly buying more than she intended to when shopping online.

“I initially went from a cute top or skirt I saw, and then buy now, pay later allows you to just be like, ‘Well, if it’s really only $50 upfront right now, I might as well go buy some more things,’” she says.

Read the fine print when signing up for a BNPL service

Unlike other types of installment loans, BNPL services typically don’t charge interest. But someone quickly financing a purchase online may not be aware if what they are signing up for is technically a BNPL loan, or if there are any additional costs involved.

Rossman points to different plans provided by Affirm and Afterpay: While both services offer traditional BNPL financing paid over a few weeks without interest, they also offer separate payment plans that are paid monthly at up to 36 percent APR — more similar to a traditional credit card.

What’s more, companies often issue late fees for missed payments, even on their typical BNPL loans. Afterpay, for example, charges $8 per missed installment payment and Klarna charges up to $7. Both companies cap late fees at 25 percent of the total purchase price.

In an emailed statement provided to Bankrate, Afterpay differentiates itself from credit card lenders by saying its BNPL financing doesn’t provide a high spending limit and requires the first repayment upfront. As of the first quarter of 2024, 98 percent of purchases didn’t incur late fees, according to Afterpay.

Similarly, only 4 percent of Klarna BNPL customers paid late and incurred a late fee, according to a separate statement from a Klarna spokesperson.

“We restrict the use of our services until any missed payments are fulfilled to prevent debt accumulating. These guardrails clearly work as 99 percent of lending is repaid globally,” says the Klarna spokesperson.

3 methods to keep from impulsive spending

After three years of overspending, Agyapong has sworn off impulsively buying huge orders of clothing and using BNPL services. Now, she’s focusing on slowly accumulating a small collection of high-quality clothes, without financing them.

“I stopped shopping at Shein because I felt like I was over-consuming,” Agyapong says. “I would just put a bunch of stuff in the cart and buy it, buy it, buy it, then realize that I probably wouldn’t wear 25 percent of the clothes. At that point, it’s just wasteful.”

If you think you use BNPL services too much, or you just want to cut down on impulsive discretionary spending, consider these tips to spend more intentionally:

1. Wait before you buy.

If you know you tend to shop impulsively, make a habit of waiting at least until the next day to click “Buy” on that online cart. “Sometimes waiting 24 hours is enough to deter you from making an impulse buy that you’d later regret,” Rossman says.

Additionally, consider removing your credit card information from your browser and, instead, input your number every time. This gives you a moment to stop and think if you really want those items.

2. Find a replacement for spending money.

If you know you tend to spend more when you’re bored or you want a pick-me-up, consider choosing a new activity for when you’re craving the rush of a shopping trip. Shopping was a fun way for Agyapong to spend time with family or plan for her trips, but to save money without giving up having fun, she replaced shopping by watching TV, drawing, painting or just window shopping. It gives her the same mental boost, but without the hit to her wallet.

3. Set up a discretionary spending budget.

Rossman says that when people have a budget, they tend to only account for costs like housing, utilities or food — not non-necessities. But inflation makes everyday goods more expensive, and it’s causing some Americans to spend emotionally.

For some, that can mean engaging in hate spending. Someone hate spending may be frustrated by rising prices, but will continue to spend more on the same products out of spite or helplessness.

If you’ve made snap financial decisions recently, know that it’s common, but it can lead to spending more than you want to. That’s why it’s important to make a budget for your discretionary spending, so you can have the lifestyle you want while spending more purposefully.

“It’s important to build in a cushion for extras,” Rossman says. “You may not know exactly what they will be, but you need to account for them — everything from new clothes and accessories to vacations, concert tickets and more.”

-

Bankrate commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,276 U.S. adults, of whom 875 have used Buy Now Pay Later services. Fieldwork was undertaken between March 4-6, 2024. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

You may also like

Struggling with buy now, pay later? You’re not alone.