How to boost your personal loan approval odds: 5 tips

Key takeaways

- A good or excellent credit score gives you the best chance of getting a personal loan with attractive terms.

- If your credit score isn’t up to par, try improving it or finding a co-applicant to help boost your approval odds.

- The amount you borrow and your debt-to-income ratio also play a role in the lender’s decision.

Improving your odds of getting approved for a personal loan using expert strategies like strengthening your credit or recruiting a co-applicant aren’t just a nice-to-have for a lot of consumers, they’re necessary. In fact, 11 percent of personal loan applicants were rejected in the past 12 months since December 2023 based on their credit score, credit history or income, according to Bankrate’s annual Credit Denials Survey.

Fortunately, there are even more ways to boost your personal loan approval odds, including working on your debt-to-income ratio and minimizing your requested loan amount. Narrowing your search to the right type of lender and personal loan can also help your chances of receiving funding, among other expert strategies.

1. Strengthen your credit

Lenders check your credit report and credit scores to determine how risky of a borrower you may be. The better your credit score and history, the better your chances of approval. Consider these tips to clean up your credit:

Review your credit report

Before applying for any credit product, request a copy of your credit report from each of the three national bureaus (Equifax, Experian and TransUnion). This is free of charge via AnnualCreditReport.com.

Be on the lookout for serious errors, such as accounts or credit inquiries you don’t recognize or balances that seem off. It’s more common than you might think: About 44 percent of consumers found at least one error in their credit report — and 27 percent identified an error that could affect their credit score — according to a 2024 Consumer Reports survey.

Also, remember to review your reports well before you apply for a personal loan — it may take up to 30 days for the bureau to respond and for the error to be corrected.

Make on-time payments

Your payment history makes up 35 percent of your FICO credit score. That’s why it’s critical to stay on top of your bills and contact any creditors if you’re having trouble making payments. Some lenders may offer the ability to temporarily pause your monthly dues or lower the minimum amount due.

You might also get credit for making other types of on-time monthly payments — perhaps for rent and utilities, among others — using Experian Boost.

Pay down revolving balances

A high credit utilization ratio can have a negative impact on your credit score. Experts recommend not using more than 30 percent of your total available credit. Creating a budget and eliminating unnecessary expenses could help you drop below that threshold.

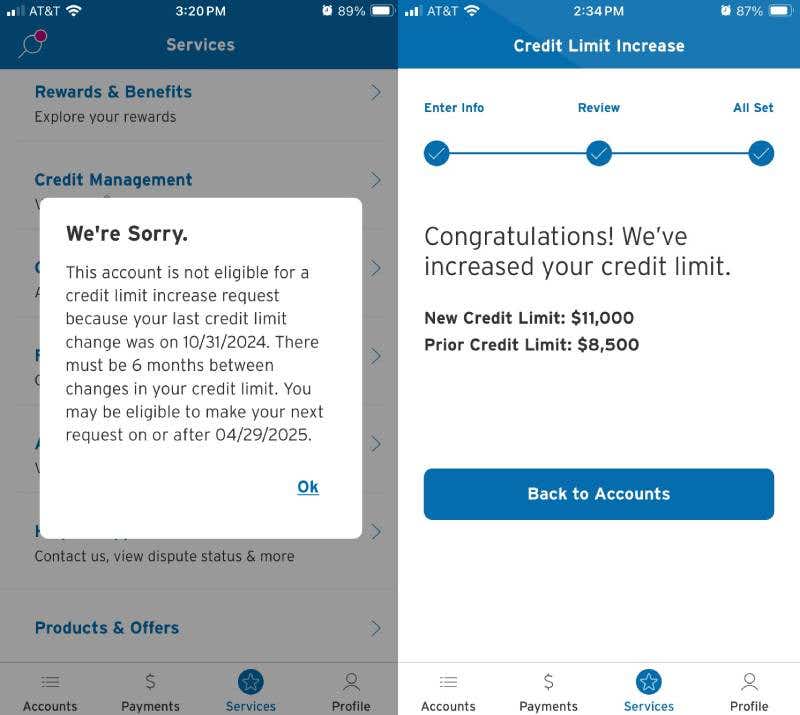

You can also decrease your credit utilization ratio by asking your credit card issuer for a credit limit increase. Keep in mind that your utilization ratio would only improve if your spending remained static.

You may be asked to update your income in the process of requesting this increase. Just keep in mind that many credit card companies won’t approve a larger limit more than twice per year.

Avoid opening or closing accounts

Whenever you apply for new credit or close an existing account, your credit score may drop temporarily by less than five points. When thinking about applying for a personal loan, avoid making any sudden changes to your accounts that could affect your credit. The average age of your accounts is another indicator of your credit history, so be mindful of closing a credit card you’ve had for years, for example.

2. Improve your debt-to-income ratio

In addition to considering your credit, lenders review your debt-to-income (DTI) ratio to evaluate whether you can likely afford to repay the personal loan you’re seeking. Your DTI compares your monthly debt payments to your monthly gross (or pre-tax) income. The lower your DTI, the better, though you might gain personal loan approval with one as high as 50 percent, depending on other factors in your application.

Though easier said than done, there are practical strategies to push your DTI downward:

| Decrease your debt |

|

| Increase your income |

|

3. Shop around with multiple types of lenders

Each lender has its own set of eligibility requirements for loan approval. By prequalifying with multiple lenders, you can compare potential offers without dinging your credit score.

Though it’s wise to prioritize financial institutions that offer prequalification, don’t forget to survey all sorts of lenders, including banks, credit unions and online companies. While federal credit unions require membership, they also cap interest rates at 18 percent if you don’t have the best credit.

Additionally, contact lenders that you already have an account with. Some offer loyalty discounts to current or longstanding customers.

When comparing multiple lenders’ offers, pay close attention to the annual percentage rate (APR). It includes both your interest rate and the lender’s administrative or origination fees, providing a more complete view of a loan’s cost and a fairer point for comparison.

Bankrate writer Seychelle Thomas has borrowed personal loans from SoFi and Citi in recent years and said shopping around — in part, by reviewing online loan marketplaces — was key to choosing her lender.

“The main things I’m looking for are the loan rate, any origination fees, what the monthly payment would be and the loan term,” says Thomas.

While I see the importance of building a relationship with a financial institution in some cases, nine times out of 10, I'm going to go for the best deal.— Seychelle Thomas, Bankrate Writer

4. Minimize your requested loan amount

As you may already know, personal loans are a type of installment loan issued as a lump sum. Applying for the lowest-possible loan amount is wise, as it will increase your chances of personal loan approval (and ease your eventual repayment). After all, the less you borrow, the less risk lenders may see in your application.

If you’re aiming to borrow a personal loan for debt consolidation, your requested loan amount may be immovable. You’d need to borrow just enough to pay off your existing debt, no more and no less.

But let’s say you’re hoping to fund a home improvement project. Before settling on a loan amount, you might:

- Get multiple estimates from contractors to lower your project cost.

- See if you can “DIY” at least parts of the renovation.

- Tap some of your savings without draining your emergency fund.

Once you establish your ideal loan amount, use a personal loan calculator to determine which rates and terms will result in a monthly payment that fits your budget. Average personal loan rates range between 8 percent and 36 percent, and term options typically span two to seven years.

5. Consider a co-applicant

If you don’t have a good credit score or if your income is on the lower end, consider applying for a loan alongside a cosigner or co-borrower.

- Cosigners agree to be equally responsible for your loan. This means they’re required to make payments if you don’t.

- Co-borrowers share the same repayment obligations and positive or negative impact to their credit. However, they also share equal access to the loan proceeds.

To improve your chances of approval, select a co-applicant who has good credit and sufficient income. The lender will consider these factors as part of your application.

Though it’s typically best to pick someone you trust, such as a close friend or family member, protect your relationship by outlining a repayment plan before you borrow. Having a contingency plan in place — such as when you, the primary borrower, struggle in repayment — can help avoid harm to your relationship.

6. Consider a secured personal loan

Most personal loans are unsecured, meaning that lenders rely on your credit, DTI and other factors to determine whether to approve your application. Secured personal loans, while not as widely available, could be a solution if your credit score is too low, your debt-to-income ratio is too high or you don’t have a co-applicant with strong enough credit available.

The catch is that secured loans require collateral, such as your car, savings or other asset of value. Plus, if your repayment doesn’t go according to plan, the lender could seize your collateral.

The potential forfeiture of your collateral makes secured loans riskier than unsecured loans in at least one respect. Still, a secured loan could be a wise option if supplying collateral is your best path to approval and securing a low interest rate — and you have a realistic path toward a successful repayment.

7. Double-check your application

Once you choose a lender and fill out a formal application — ideally, after prequalifying — carefully review your information. This will help boost your loan approval odds, as omitting details or providing incorrect information could result in your loan application being denied.

Also, avoid the temptation to stretch the truth about your personal financial situation. Keep in mind that you’ll be asked for supporting documentation anyway. On that note, having bank statements and other financial records handy can expedite the final stages of applying.

What’s your next step?

Before you submit a loan application, compare personal loan rates and terms from several lenders to get the best deal for your situation. Reading personal loan reviews can also help jumpstart your search.

If, on the other hand, the strategies above don’t strengthen your personal loan application quickly enough for your funding needs, take heart. There are personal loan alternatives for bad-credit borrowers.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How to get a short-term business loan

How to get a $40,000 personal loan

How to get an unsecured business loan