Biden administration forgives $1.2 billion in student loans through SAVE Plan

The Biden-Harris administration announced early this morning that it will automatically discharge $1.2 billion in federal student loans for eligible borrowers. This move is anticipated to impact nearly 153,000 qualifying borrowers enrolled in the Saving on a Valuable Education (SAVE) Plan.

Borrowers must qualify to be eligible for forgiveness

The Department of Education specified that borrowers who qualify for the shortened forgiveness time benefit under the SAVE plan will be eligible. This forgiveness component was announced in January and aims to “provide borrowers the relief they have earned as quickly as possible,” reads today’s press release.

In order to qualify for today’s forgiveness, borrowers must meet the SAVE requirements and the following:

- Be enrolled in the SAVE plan.

- Have been making federal student loan payments for at least 10 years.

- Have taken out $12,000 or less for college.

There are 7.5 million federal borrowers enrolled in SAVE, with 4.3 million qualifying for a $0 monthly payment under the program. “As of today, we have approved loan relief for nearly 3.9 million borrowers who were counting on the Biden-Harris Administration to fix the broken student loan system and provide the forgiveness they earned and have been waiting for,” says U.S under Secretary of Education James Kvaal in a statement.

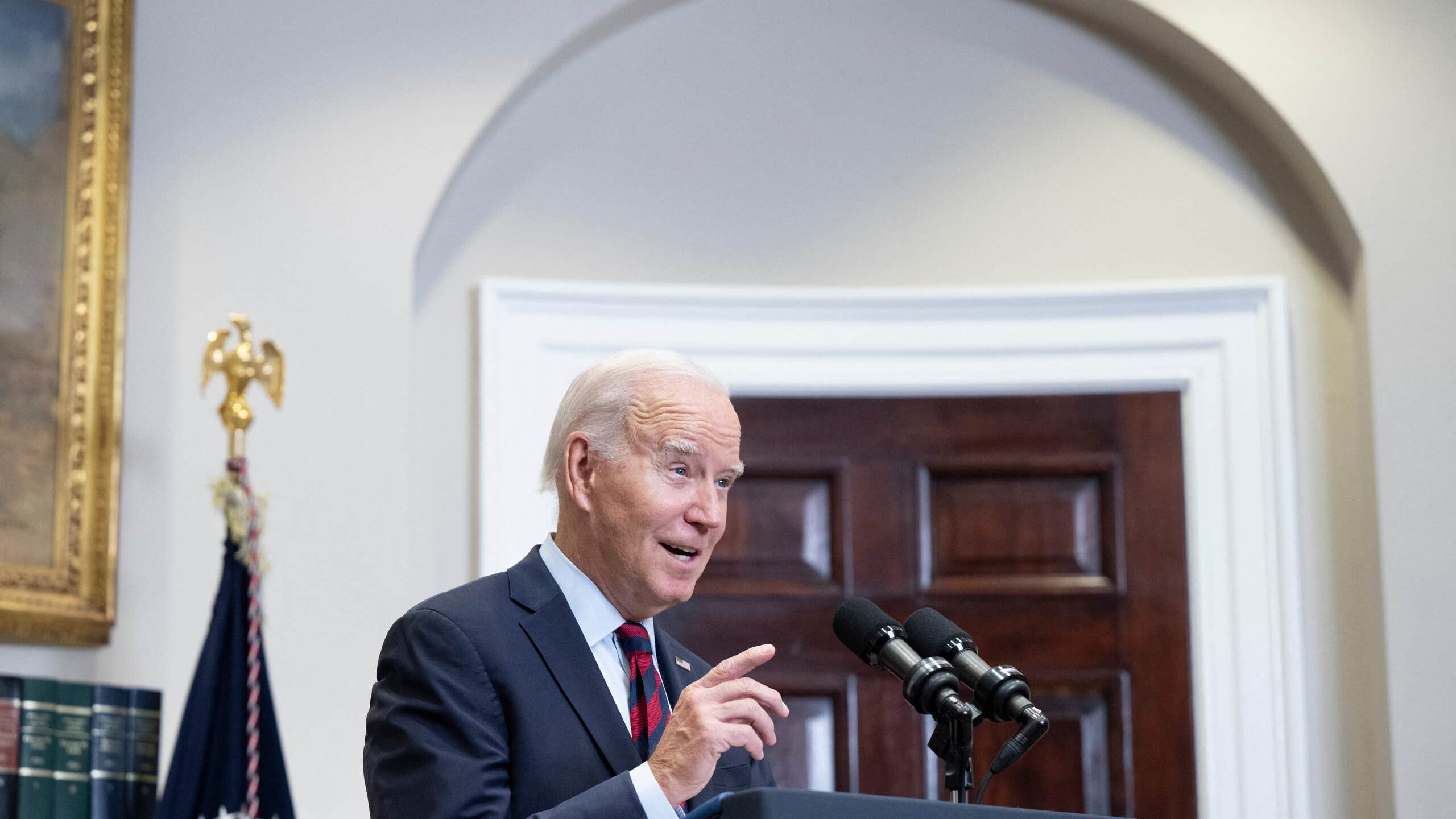

President Biden to notify eligible borrowers via email

President Biden is expected to notify individuals who meet the forgiveness requirements through email. According to the Education Department, the email will outline a confirmation of eligibility and highlight that borrowers don’t need to take further action at this time.

In the coming days, borrowers will see the forgiveness reflected within their federal student loan balance housed on their servicer account.

What can borrowers do to get student loan forgiveness?

If you don’t qualify for forgiveness but think you will in the future, the Department asserts that you won’t have to take any action. “Moving forward, borrowers who meet the eligibility criteria for forgiveness under the SAVE Plan will have their loans automatically discharged with no action needed on their part,” reads today’s release. This will be completed through constant account monitoring by the Department.

Starting next week, borrowers who qualify for relief if they enroll in SAVE will be notified through email. However, those who believe they may meet the criteria are strongly encouraged to sign up for SAVE as soon as possible to reap the relief benefits sooner rather than later.

Private student loans will not qualify

As with any federal forgiveness program, student loans from private lenders will not qualify. If you are having trouble making payments on a private student loan, you may want to consider refinancing.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Pros and cons of private student loans