NFTs explained: What they are and how they work

You might not have heard of non-fungible tokens (NFTs), but they’ve enthralled a fast-growing segment of digital speculators who are ready to pay big bucks with the hopes that they can resell an NFT for much more in the future. The price of some of the hottest NFTs, such as Bored Ape Yacht Club and Cryptopunks, zoomed higher almost overnight. Why are so many people betting on a cryptocurrency-like asset that produces no cash flow and generates no royalties?

Here’s what you need to know about NFTs, why they’ve been a hot product in the trading world and why those plunking big money down on them face the prospect of losing a hefty sum on what amounts to digital art or virtual sports cards.

What is an NFT?

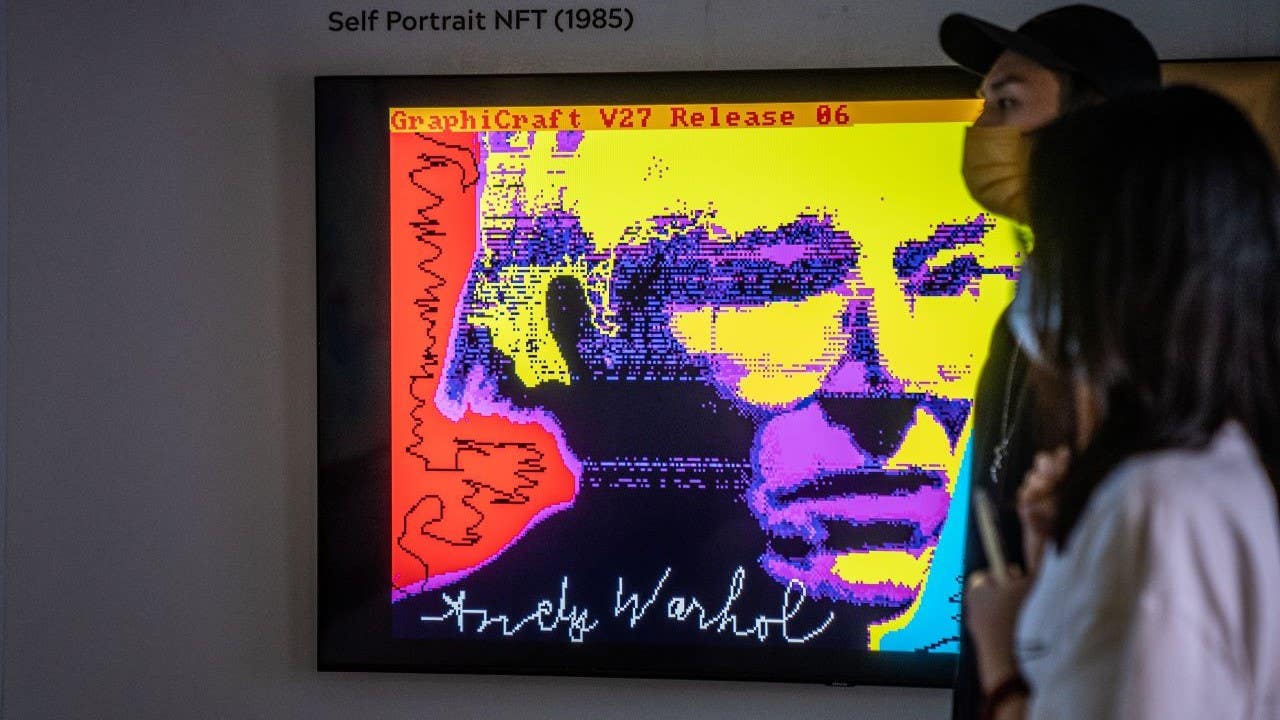

An NFT is a kind of digital asset that is unique – that is, non-fungible. An NFT can represent a number of digital properties, including artwork, collectibles, video snippets, an item from a video game or even a music album, among others. Music group Kings of Leon issued its 2021 album via an NFT that entitles users to download the album and related artwork.

“It can’t be traded with another one, like a dollar can be traded for another dollar,” says Dr. Richard Smith, CEO of The Foundation for the Study of Cycles, explaining non-fungibility.

NFTs are built on the same kind of infrastructure – blockchain – that cryptocurrencies are. Because they use blockchain, the transfer of an interest in NFTs is recorded on the blockchain, putting ownership on a permanent record, making it impossible (or at least very hard) to falsify.

“Each time an exchange on the blockchain occurs, whether that’s buying and selling an NFT or transacting in Bitcoin, the transaction is made public on the blockchain and marked with a unique digital signature,” says Aubrey Strobel, advisor at Lolli, a Bitcoin rewards app. “This distinct signature verifies the transfer of ownership of an NFT.”

But would-be buyers should be clear what they’re getting here. An NFT is not a royalty and does not give you an economic interest in, for example, the broadcast of a sports clip. Rather, it’s more akin to a piece of digital art or a digital sports card. Or in the case of an album NFT, it gives you the right to a certain asset, which you can then use and enjoy.

Some businesses, such as those in the music industry, envision the NFT as a future way to track the interest in a specific asset and then quickly pay the artists responsible for it. Similarly, when owners sell the asset to someone else, the original producer may even be able to take a cut of the sales price. Blockchain tech enables the hard-to-falsify record of ownership.

And NFTs have the other advantages of blockchain technology, says Alex Salnikov, co-founder of Rarible, an NFT marketplace: They’re instantly and verifiably transferable, and your ownership is borderless and independent of the platform.

“NFTs actually have an advantage over physical art,” says Strobel. “Whereas a painting can be stolen from a museum in a heist, stealing an NFT would usually involve hacking an individual user’s private key – no easy feat if they’ve secured it offline like most people do or should.”

NFTs exploded in popularity – then crashed

While NFTs seemed to explode on the scene, interest in them had been building for a while. But just as suddenly they’ve seemingly flamed out. As of September 2022, daily dollar volume in NFTs on the popular OpenSea exchange is down a stunning 99 percent since its peak in May 2022, according to DappRadar.

Several factors working together may have led to the recent explosion in interest.

“High-profile investors like Mark Cuban have been talking about them, the NBA is using them in their new Top Shot site, several major artists are jumping on board, and let’s not forget the nosebleed-level surges in cryptocurrency prices such as Bitcoin and Ethereum,” says Anthony Citrano, founder of Acquicent, an NFT marketplace. “It feels like a perfect storm here.”

Because NFTs are denominated in cryptocurrencies, their prices surged as crypto prices skyrocketed, explains Citrano. But in 2022, cryptocurrencies plummeted in value, with Ethereum – the key cryptocurrency involved in trading NFTs – down 66 percent from its all-time high.

Meanwhile, the growing longer-term interest in cryptocurrencies such as Bitcoin and Ethereum and the ease of getting started with them also powered interest in NFTs, says Salnikov.

“It’s a whole new non-financial use case for people, not only geeks,” he says.

“The pandemic has increased the amount of time that people are spending online, making digitally native products like NFTs more attractive, as we’re living digitally now more than ever before,” says Strobel.

How to buy NFTs

If you’re looking to buy NFTs, there are a few things you’ll need to understand before getting started.

First, you can find a large offering of NFTs available on popular marketplaces such as OpenSea or Rarible. These marketplaces typically function a lot like an auction house. If you’re an interested buyer, you can place a bid and wait to see if you’re the top bidder for your chosen NFT. Some of these sites also offer the option to “Buy Now” at a fixed price.

When it comes to payment for NFTs on these marketplaces, prices are usually listed in ether — the currency of the Ethereum blockchain. (Don’t worry, you’ll also see the price shown in dollars too.)

You’ll need to either send the amount in ether from a crypto exchange or connect a supported cryptocurrency wallet before you can complete your transaction for any NFTs you purchased. In some instances, you can also buy ether directly with a credit card.

It’s not all that different from how investors might add money into an online brokerage account to buy stocks or a robo-advisor to get invested in index funds.

What are the risks of NFTs?

But NFTs are not a sure investment. In fact, they look much more like a speculative furor. Again, the comparison with sports cards looks apt, though one could consider them like other speculative assets such as sneakers, handbags or art. They produce no cash flow, and conservative investors such as Warren Buffett won’t touch them.

Misunderstanding of the investment

Naturally, you could also view or digitally save a video clip online for free, but collectors are still paying serious money for the right to own the “authorized” version of the clip or art.

“There’s a lot of room for misunderstanding and mispricing here,” says Smith. “NFTs don’t give you any royalties, and there’s no guarantee how many of one sort are out there.”

Because NFTs don’t produce cash flow, the only way to make money is if someone else comes along and is willing to pay more for them, what’s called the “greater fool” strategy of investing. Smith says it’s “treacherous times” for those buying high-priced collectibles.

“There’s a lot of greater fool theory speculation driving the markets right now,” says Smith. “I’m excited about them, but I’m not pulling out my wallet to buy them.”

Liquidity risk

NFTs also suffer from liquidity risk: If no one wants to buy your NFT, you won’t be able to resell it soon or at all. That’s in sharp contrast to the stock market, which provides ready liquidity.

Salnikov also points to counterparty risk, where the original producer of the NFT may not have had rights to the sports clip, for example.

Still, many traders are turning to NFTs as a way to turn a quick profit. That kind of market usually turns out poorly for those who mistime when to enter and exit.

“I’d urge speculators to be very careful here, and, as with any speculative investment, only invest what you can afford to lose,” says Citrano. “I’m bullish on the space but – like any asset class – they will experience their highs and lows.”

“If you’re buying an NFT because you really like it and want to own it, there is very little risk because it will be yours forever, or for as long as you wish to own it,” says Citrano. “If you’re buying NFTs to speculate, that’s another story.”

Bottom line

As with all collectibles, buy them because you love them, not to make money. Buy art because you like to look at it or it brings you joy. Buy handbags because you derive pleasure from them. Do not expect to make money on these speculative assets, because the odds are not great.

Still, if you would like to get involved, you may not have to pony up huge amounts to get started.

“Some NFTs are relatively inexpensive, making it possible for people to get a part of the action at less extravagant prices,” says Strobel.

However, you’ll want to be content if you’re never able to sell the NFT again. And that means being comfortable with losing your entire investment.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like