Timing the market? 3 investing strategies to use instead

Key takeaways

- Timing the market most commonly refers to buying securities when the price is low and selling them when the price is high.

- Trying to time the market can be tempting because it might seem like you can make a lot of money, but it’s not without risks.

- Even professionals who try to time the market usually fail.

Buy low, sell high — that’s what timing the market means.

While it’s simple in theory, in reality, it’s highly unlikely you will be able to time the market successfully. Chances are you will buy and sell at the wrong moments, creating times when you actually buy high and sell at a loss. It’s all too common, and why you should avoid trying to time the market.

Fortunately, you have options. Depending on your goals, one of these alternatives might be a better choice.

Why timing the market is a bad investment strategy

Timing the market is difficult. Actually, that is probably an understatement as very few people can time the market consistently. In fact, even professionals who try to time the market usually fail. For instance, a report from S&P Dow Jones Indices showed that over a 15-year period ending in 2024, the majority of actively managed U.S. stock funds didn’t beat the index.

Market timing can also sacrifice potential gains. Sure, you lose money if you have to sell stocks or other securities at a loss but even buy-and-hold investors can lose money trying to time the market.

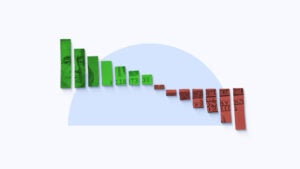

Charles Schwab ran a scenario that compared five investors who put $2,000 every year into the market for 20 years. It found how much money they would each have at the end:

- An investor with perfect market timing: $151,391

- An investor who immediately invested their money: $135,471

- An investor who performed dollar-cost averaging: $134,856

- An investor with bad market timing: $121,171

- An investor who left their money in cash: $44,438

In the experiment, the investor with perfect market timing did, in fact, fare the best. But the second-best result was from the investor who immediately invested their money, paying no attention to market timing — once again showing that time in the market beats timing the market. And the second-worst investor was the one with bad market timing.

Remember, the vast majority of investors who try to time the market fail. That means that after 20 years, your portfolio is more likely to look like the second-worst result above. But if you immediately invest your money in a low-cost index fund, you will likely be among the best performers in the long term.

3 tried-and-true alternatives to market timing

Timing the market can be tempting, but it’s not a viable long-term strategy for most investors. These alternatives can produce better results.

1. Diversified portfolio

Diversifying your portfolio means maintaining a portfolio of several assets, such as stocks, bonds, real estate and cash. This approach has several benefits, including spreading your risk across multiple assets.

In addition, investing in several types of assets gives you exposure to different markets, which can have negative correlations with one another. This helps protect you against volatility as you aren’t concentrated in a single type of investment. Diversifying your portfolio can give you better results while reducing your long-term risk.

2. Dollar-cost averaging

As we saw above, dollar-cost averaging doesn’t always produce the best results in the long term. However, investing all your money immediately can be scary. It can feel like you are giving up control of your portfolio, and not all investors are comfortable with that.

That’s where dollar-cost averaging comes in. Rather than invest all your money immediately, you invest periodically, such as once per month or every paycheck. The idea behind this strategy is to avoid the possibility that you just happen to invest your lump sum when the market is at its high point for the year. Instead, you would get exposure to a variety of market conditions, thereby producing better results overall. Again, it may not always beat investing right away, but it’s still better than trying to time the market in most cases.

3. Long-term investing

If you want your portfolio to grow, one of the most important things to do is invest for the long term. Markets go up and down in the short term — sometimes very quickly with the very best days following the very worst days — but markets generally rise over the long term, eventually moving higher than the previous high.

Simply keeping your money in the market and investing consistently regardless of what the market does will allow you to take advantage of this growth. While the big drops can seem scary, history has shown that the market always recovers, only to come back stronger.

Bottom line

Timing the market can be tempting, but it’s not a viable long-term strategy for most investors. For most of us, combining a diversified portfolio with long-term investing is best. In addition, it would be wise to meet with a financial advisor who can help you set up a portfolio tailored to your situation.

— Bankrate’s Brian Baker contributed to an update of this story.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.