Is there real magic in the market? Unmasking the Halloween Effect

If you’re a stock investor, you may be in for a treat. That’s according to an indicator called the Halloween Effect. The Halloween Effect is the tendency of the stock market to go up more during the six months after Halloween than it does the other half of the year. But investors should beware using this theory as investment advice, since long-term investment works better.

Here’s how the Halloween Effect works and what returns you might expect.

Key takeaways

- The Halloween Effect is a phenomenon where the stock market typically rises more during the six months after Halloween than it does the rest of the year.

- No one seems sure why it happens, but researchers speculate that it may have something to do with the timing and length of summer vacation.

- Investors should not use this effect as investment advice, but instead continue investing regularly over time and take advantage of dips in the market.

Historical analysis of the Halloween Effect

The Halloween Effect is the tendency for the market to perform better from Nov. 1 to Apr. 30 than it does over the other months. That’s according to a 2002 paper titled “The Halloween Indicator, ‘Sell in May and Go Away’: Another Puzzle” by Sven Bouman, CEO of Saemor Capital in The Hague and Ben Jacobsen of Erasmus University Rotterdam.

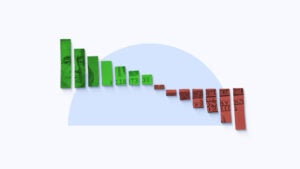

How strong might this effect be? Here are the monthly historical returns on the Standard & Poor’s 500 Index from 1928 to September 2023, according to Yardeni Research:

Add up the returns in months November to April, and you find a total of 5.3 percent. In contrast, the returns from the six months from May are a mere 2.4 percent.

Also odd: the summer period has both the strongest historical month (July) and the weakest (September), while the winter period seems to perform more consistently, with the second, third and fourth best months.

The difference in returns is certainly not helped by an abysmal September, the worst month by far. October has some real doozies as well, including some of the market’s worst days ever: the Black Tuesday plunge on Oct. 29, 1929 and 1987’s Black Monday, when the S&P dropped more than 20 percent in a single day. But March 2020 also added the third- and sixth-worst days of all time, as the market grappled with the economic effects of COVID.

Overview of seasonal stock market patterns

As Bouman and Jacobsen suggest, the Halloween Effect is the flip side of that old trader’s adage, “Sell in May and go away.” And it does seem to have some truth to it.

- Halloween Effect: The stock market performs better in the six months following October 31.

- “Sell in May and go away”: The six months starting May 1 underperform the other half of the year, though strangely they do contain the market’s strongest month.

While it’s not fully clear why the Halloween Effect occurs, it’s important to understand some factors in the U.S. that could be contributing to it, include:

- Strong retirement inflows at the start of the year: Money from retirement accounts such as 401(k) plans washes into the market heavily in January.

- Tax effects: Stocks that have seen a gain for the year may continue to rise at the end of the year, as investors put off selling them to defer taxes.

Of course, many other things influence the market throughout the course of the year, including corporate earnings, macroeconomic data and trends such as interest rates, geopolitical events and just overall investor sentiment, which can rise and fall according to its own whims.

Why does it happen?

As weird as it is, no one’s quite sure why the Halloween Effect seems to persist, though it does.

Even more oddly, the Halloween Effect seems to work not only in the U.S. but also around the world. Bouman and Jacobsen say the effect happened in 36 of the 37 countries they analyzed.

But the paper’s authors suggest its persistence might have to do with the timing and length of vacations in the summer, though they say that countries in the southern hemisphere still experienced the effect at the same time as those in the northern hemisphere.

How can you take advantage of it?

The Halloween Effect is an interesting anomaly in the stock market, but long-term investors needn’t worry too much about it. Instead, stick to your investing discipline, and if the market dips, you can consider it a treat – not a trick – to buy in at a lower cost.

“Investing is a game we play over the course of decades – decades before retirement and hopefully decades in retirement,” says Greg McBride, CFA, Bankrate chief financial analyst. “The key to building wealth over a lengthy time horizon is the time your money is invested in the market, not an ability to time the market. Consistent investing in low-cost, broad-based index funds and allowing for decades of compounding will do wonders for your long-term financial security.”

There are no guarantees that the market goes up in any given year, and currently with interest rates at a high point, the economy may be softening and so the market may well do poorly in the near future. But here’s advice that will usually perform well in any season:

- Buy when everyone is fearful. While it might feel good to buy when everyone else is buying, you’ll get better returns when everyone else is too afraid to buy. Plus, it’s great advice for a phenomenon called the Halloween Effect.

- Stay diversified. One of the quickest and easiest ways to keep a diversified portfolio is to buy an S&P 500 index fund. You’ll get a diversified set of stocks immediately, and it’s what legendary investor Warren Buffett advises almost all individual investors should do.

- Avoid timing the market. Yes, despite the Halloween Effect, it’s better to avoid timing the market, because you never know how the market will turn. Use dollar-cost averaging to buy into the market so that you don’t risk buying at a high point.

They’re part of the 10 golden rules of investing and are a great way to pursue investing sensibly.

More ways to invest

Index investing is one of the most popular ways to invest in the market and one of the easiest ways to do well. Here are some of the best index funds.

As we near the holidays or a birthday any time of the year, it can be a great opportunity to give stock as a gift. Here are a few things you should know about giving stock as a gift.

New to investing? Get ahead of the new year and figure out what financial advisor is right to get you financially on track for the new year.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.