Survey: Experts see the 10-year Treasury hovering around 4% a year from now despite recession fears

Investment analysts expect the yield on the benchmark 10-year Treasury note to be somewhat lower a year from now, according to Bankrate’s First-Quarter Market Mavens survey. The survey found that analysts expect the rate to fall to 4.08 percent, from 4.25 percent at the end of the survey period on March 28. Forecasts ranged from 3.32 percent to 4.75 percent.

“This is a unique point in time in which neither the administration nor the Federal Reserve are seen providing a backstop for stocks,” says Mark Hamrick, Bankrate’s senior economic analyst. “Unlike Trump term v1, the president seems to be agnostic to the stock market’s performance or even signaling that investors should be prepared for more volatility and/or declines.”

“As for the Fed, it remains to be seen whether it will be more attentive to supporting employment or stable prices,” says Hamrick.

Forecasts and analysis:

This article is one in a series discussing the results of Bankrate’s First-Quarter 2025 Market Mavens Survey:

- Survey: Market pros see stocks recovering from tariff shock, favor international stocks over next year

- Survey: Pros agree that crypto is too high risk for most investors

- Survey: Experts see the 10-year Treasury hovering around 4% a year from now despite recession fears

Experts predict 10-year yield to be lower in a year

The yield on the 10-year Treasury note has bounced around a lot in the last two years as concerns swirl about stubborn inflation, the Fed’s slow-to-act posture, the U.S. government’s debt and President Donald Trump’s tariffs, among other things. The 10-year yield began to rise in September, just as the Federal Reserve was beginning to lower short-term interest rates.

The market watchers surveyed by Bankrate expect the 10-year yield to be 4.08 percent at the end of the first quarter of 2026 — down from 4.25 percent when the survey closed. For context, respondents in Bankrate’s fourth-quarter survey expected the 10-year yield to be 4.14 percent at the end of 2025.

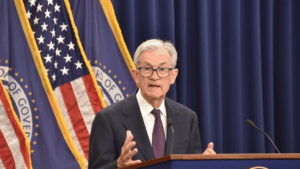

While most analysts still expect the Fed to cut short-term interest rates this year, the central bank is standing pat on rates for now. Fed chair Jerome Powell has said the Fed prefers to take a “wait and see” approach to Trump’s tariffs and the overall direction of inflation.

Investors navigating uncertainty amid Trump’s tariffs, Fed’s posture

The 10-year Treasury has been on a roller coaster the last six months or so as investors position themselves for the future. The 10-year yield was already rising when Trump was reelected, and the expectation of further deficit spending and now the effects of tariffs have investors working a lot harder to figure out how the market may move under Trump’s presidency.

The potentially inflationary effect of tariffs is keeping the Fed on the sidelines for now, even with inflation above its 2 percent long-run target. But if tariffs and uncertainty slow the economy, it could tip over into a recession.

“The Fed finds itself stuck between a rock and a hard place, as new tariff and counter-tariff policies go into effect,” says Patrick J. O’Hare, chief market analyst, Briefing.com. “Faced with the prospect of slower growth but higher inflation, the Fed will have its hands tied.”

“The Fed has left inflation too high in pursuit of a soft landing it could not reach,” says Robert Brusca, chief economist, FAO Economics. “Now tariffs pose a threat to inflation performance and the Fed will try to smooth it over despite having reduced credibility and having missed its inflation target for 45 months in a row.”

If these various factors do lead to a recession, then the 10-year yield is likely to fall and the Fed would likely reduce short-term rates to support the economy. For now, Trump has unleashed a lot of uncertainty with his tariffs, which are much wider in scope than in his first term.

“Washington’s policy mix is having a material impact on sentiment,” says Dec Mullarkey, managing director, SLC Management. “Households, markets and global partners have been surprised by the scope and intensity of the tariffs and related threats. The uncertainty is starting to stall decision making and some forecasters have already cut their GDP forecast.”

Lower Treasury yields in recent weeks may reflect investors’ risk aversion amid the uncertainty. Greater demand for Treasurys pushes their yield down, as bond prices and yields move inversely.

“DC and Trump policy will remain volatile and unpredictable. Volatility tends to result in more cautious, less aggressive investors,” says Michael K. Farr, president and CEO, Farr, Miller & Washington.

“The answer is still outstanding as to whether tariffs are more rhetoric than reality,” says Sam Stovall, chief investment strategist, CFRA Research. “The longer high and broad-based tariffs remain in effect, the greater the likelihood of recession and a new bear market.”

So the direction of the 10-year Treasury in the year ahead may depend a lot on how Trump’s tariffs play out. Here are legendary investor Warren Buffett’s top tips for surviving a bear market.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

6 best investments for beginners