Investing 101 for teachers: Learn the basics and how to get started

Teachers are some of the most important members of society, guiding our children’s education and inspiring future generations to become the leaders of tomorrow. However, about 40 percent of public-school teachers do not qualify for Social Security benefits, according to the National Association of State Retirement Administrators. Despite this challenge, there are options for public educators to secure their financial future when it comes to how to invest and plan for their retirements.

This handy guide outlines some of the investments that could set up teachers – and their families – for financial success.

Why investing is so important for teachers

For teachers and the broader public alike, saving and investing over long periods offers the most significant opportunity to build wealth. Whether it is investing in the stock market, real estate, or both, investing is how many Americans reach their financial goals. And the sooner you start, the better.

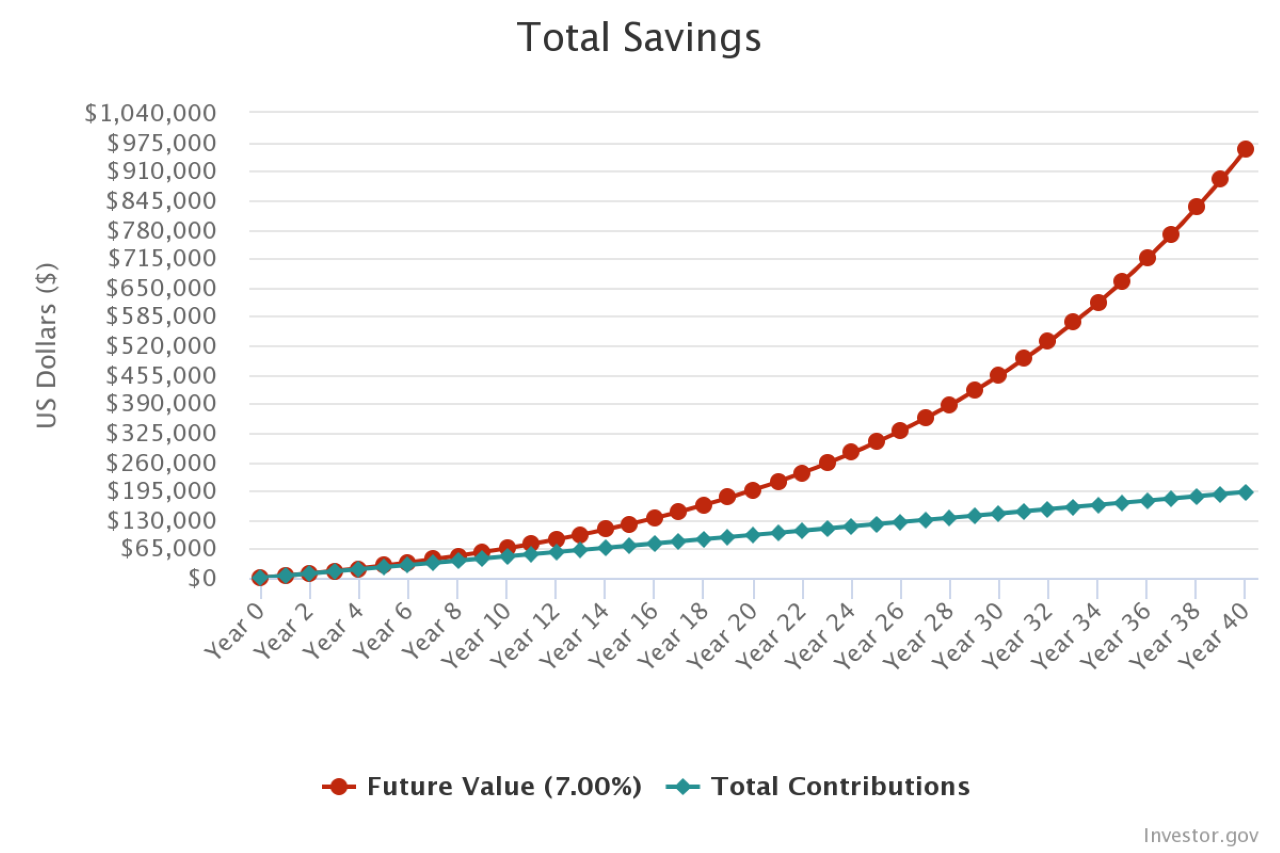

Consider a theoretical example where Susan, a public-school teacher in New York, starts investing at age 25, contributing $400 per month to a fund that tracks the S&P 500 index. By age 65, Susan would have contributed a total of $192,000. Assuming a 7 percent annual compound return for the S&P 500, her total investment would have grown to about $958,000.

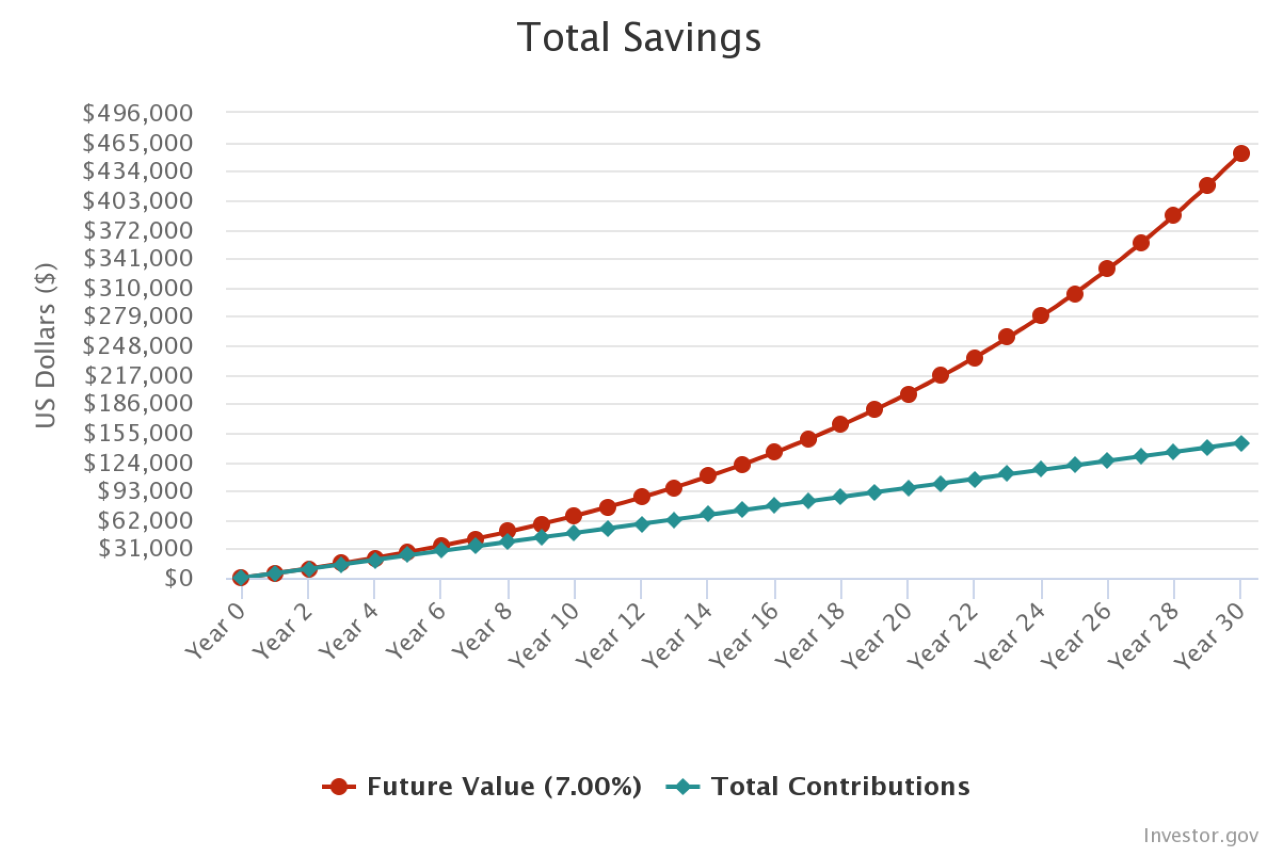

Now, consider Joe, a public-school administrator in New Jersey, who doesn’t start investing until age 35. He also decides to contribute $400 per month to a fund tracking the S&P 500. By age 65, Joe would have contributed $144,000. However, by delaying his decision, the return on his investment is around $453,000, or about half the amount Susan received.

The total earnings in these two scenarios aren’t unrealistic. For example, over the past 30 years, the S&P 500 posted an average annual gain of around 10 percent.

However, the difference in how these two scenarios play out is due to compounding interest and time. By investing sooner, Susan benefits from letting her money grow through cumulative returns. That’s one of the many reasons top investors like Warren Buffett strongly advocate for long-term investing.

Investment options for teachers

Teachers have a range of choices when saving for retirement. Apart from state pensions, public educators have access to tax-advantaged accounts like 403(b) and 457(b) plans. With these plans, teachers can lower their tax liability and increase their retirement savings, among other benefits.

Pensions

State and local governments fully fund pensions. After retirement, beneficiaries receive a fixed recurring payment for life. That amount depends on factors like length of service. (Try our pension calculator here.) However, these benefits can vary significantly among the teachers who qualify for a pension. Plus, many educators worry about the sustainability of these payments in their retirement years, especially since many state-run plans are underfunded.

403(b) and 457(b) plans

In essence, 403(b) and 457(b) accounts are like 401(k) plans, allowing teachers to contribute money (either on a pre-tax or after-tax basis) during working years, so the funds in these accounts grow tax-advantaged until retirement. Nevertheless, the IRS caps the contributions to them, with the limit set at $20,500 in 2022. Teachers aged 50 and over can make an additional catch-up contribution, up to $6,500 in 2022.

Since pre-tax contributions to 403(b) and 457(b) plans are not considered taxable income by the IRS, participants can reduce their annual tax liability while their investments grow tax-deferred. In some instances, public schools, colleges, and universities help educators fund these accounts by matching contributions up to a certain amount – another benefit of such retirement accounts.

The IRS then taxes withdrawals as ordinary income (any funds you access before retirement may carry additional penalties and taxes).

Teachers can also set up Roth versions of these accounts, where contributions are made with after-tax income. In a Roth account, you won’t enjoy a tax break on your contribution, but your money can grow tax-free and any qualified withdrawals in retirement are tax-free, too.

Traditional and Roth IRAs

Individual retirement accounts (IRAs) are another great option to save for retirement. Choosing the IRA that best fits your needs depends on your age, taxable income, and investment goals.

A Roth IRA account, for example, allows you to invest with after-tax money, and your investments grow tax-free. In addition, any capital gains, interest, or dividends inside the account are tax-exempt if you follow the IRS’s redemption rules. Plus, you can withdraw your original contributions without incurring penalties or fees, so the account can also serve as an emergency fund.

Unlike 403(b) or 457(b) plans, which limit investments to the plan’s investment choices, IRAs don’t have such restrictions. You can invest in many different kinds of assets in an IRA.

With any of these plans, you can set up regular contributions directly from your paycheck, and you will have full rein over how you allocate your investments. The key is to stay engaged with your finances and remain diversified, increasing the odds of reaching your long-term financial goals.

Choosing investments and how to build your portfolio

There are various strategies for building an investment portfolio. How you approach investing depends on your goals and life stage.

For example, starting a family may mean you want to allocate more of your money toward a college savings account. Planning to buy a house might mean having more cash on hand for a down payment. Getting a promotion might translate to maximizing your retirement accounts.

Once you determine your financial goals, you can calibrate your portfolio accordingly.

When it comes to retirement, many investment professionals advocate for steady returns versus swinging for the fences. And one of the best ways to achieve that is through diversification and the types of assets you choose, such as index funds.

With index funds, for example, investors aim to mimic the performance of stocks that make up an index like the S&P 500. In this case, an investor would purchase an exchange-traded fund (ETF) or a mutual fund. Through one of these investments, you gain exposure to all the stocks in that index. Other funds may contain a portfolio of bonds that mimics an index.

Another option is thematic investing through ETFs or mutual funds. There are thousands of them tracking investment themes such as electric vehicles, artificial intelligence, real estate and sustainability — to name a few.

But contrary to index funds, where fund managers follow an index, active investing is tied to a fund manager’s ability to select stocks. As a result, these types of investments tend to be more volatile and often carry higher management fees.

Target-date funds could also be advantageous for those investors who prefer a more hands-off approach. These managed funds change the risk profile based on your expected retirement age, selecting more conservative assets as you get older.

Many investors are still most comfortable working with a financial advisor. Of course, that personalized attention may come with an advisory fee. Still, many brokerage firms like Fidelity and Charles Schwab offer free resources, including complimentary consultations with a financial planner.

How to get started

When you are ready to choose your investments, review if there are any minimum initial investment requirements, the types of fees you’ll pay, and any clauses related to withdrawing money or closing your account.

For example, certain mutual funds have early redemption fees or even load fees. A load fee is a commission an investor pays when buying or selling mutual funds. Mutual fund companies and their intermediaries determine these fees.

In the long run, fees are an essential consideration for investors because they reduce your overall returns.

All the information you need about a specific fund is available in a fund’s prospectus. Take the time to review it in detail, and make sure you are comfortable with all the conditions.

As you get started, here are four steps to follow:

1. Determine your financial goals

The type of investments you choose depends on what you are trying to achieve. For example, someone about to retire will likely have a different asset allocation than someone just out of college with decades to invest. So, remember to let your financial objectives drive your decision-making as often as possible.

2. Research your investments

When selecting mutual funds or ETFs, for example, pay attention to factors like expense ratios, the fund’s past performance, trading volume, top holdings and fund flows.

3. Outline your asset allocation

Before investing, do an inventory of what you own and how you want to allocate your assets. Remember, the key is to remain diversified.

4. Know what you own

By periodically reviewing your investments, you can take charge of your finances and make any adjustments needed. Utilize any free resources from your broker, like meeting with a financial advisor, and plan to ask questions. Ultimately, there’s no such thing as a hands-off investment.

Teachers and Social Security

When President Franklin Delano Roosevelt signed the Social Security Act in 1935, teachers and other public-sector workers were left out, mainly over concerns about whether the federal government could tax state and local governments. By 1950, there were amendments to the Social Security Act that allowed governments to enroll their employees, but many states refused.

To this day, 15 states do not offer teachers Social Security benefits.

- Alaska

- California

- Colorado

- Connecticut

- Georgia*

- Illinois

- Kentucky*

- Louisiana

- Maine

- Massachusetts

- Missouri

- Nevada

- Ohio

- Rhode Island*

- Texas*

(* Note: Certain local jurisdictions in Georgia, Kentucky, Texas and Rhode Island allow teachers to opt in to Social Security benefits)

Teachers and other public employees in those states do not participate in the Social Security system and instead contribute to state pension plans. But to qualify for those benefits, they often must adhere to a series of conditions, such as having at least 10 years of combined service.

Another disadvantage includes the reduction of retirement, disability, and survivor benefits tied to Social Security contributions, especially if public educators also have a pension plan. Legislative reforms like the Windfall Elimination Provision and the Government Pension Offset prevent state and government employees from receiving full Social Security benefits alongside state pensions. Of course, these provisions only apply if teachers pay into the Social Security system throughout their careers.

Bottom line

While everyone needs to plan for retirement, teachers need to be even more mindful about taking care of their financial future – particularly if Social Security is not an option. And with so many resources available to them, they can ace this assignment.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.