Here’s how this finance expert creates her “lazy” investment portfolio

When Chloé Daniels was 28 years old in 2019, she made the biggest financial mistake of her life. She gave her then-boyfriend roughly $30,000 in just over a year as “an investment” in his business of flipping houses in the Chicago area.

“It was my entire life savings at the time,” says Daniels, now 32. “I didn’t even have an emergency fund. And every time I had money, I would re-invest. I just kept funneling more money into it.”

When the pandemic hit, the house flipping operation fell apart. Labor costs ballooned. Lumber prices skyrocketed. It wasn’t long before the relationship fell apart, too.

Daniels soon realized she was never going to get her initial $30,000 investment back. To this day, she says she’s never recouped the money.

“I didn’t know anything about investing then,” says Daniels.

The experience spurred Daniels to learn the best practices of investing and personal finance, knowledge she parlayed into her current role as a full-time financial educator at her company Clo Bare Money Coach.

“After picking the riskiest investment I could have ever made, I don’t want to risk my money like that,” says Daniels.

Since 2021, Daniels has attracted a legion of mostly Gen Z and millennial followers on social media by teaching people “how to invest the lazy way.” Her content, courses and webinars focus on learning how to automate savings and create simple portfolios with low-cost funds.

Instead of betting on hot stocks, buying gold or yes even investing in super risky private money lending deals, Daniels emphasizes a set-it-and-forget-it approach to building wealth. She’s created dozens of videos explaining the perks of Roth IRAs and the historically positive long-term returns of buying index funds.

“My approach is still aggressive – most of my portfolio is all in stocks — but it’s a more tried-and-true approach to investing,” she says.

Her current philosophy that index funds are best for most investors— an idea touted by investing legend Warren Buffet as well as a growing number of financial influencers — is a stark departure from the dicey gamble with her ex’s real estate venture.

As Daniels notes in an April 2023 video: “The lazy way I’m investing is way simpler, way less risky and incredibly easy.”

Daniels’ ‘lazy’ investing strategy explained

Daniels is a strong believer in using tax-advantaged retirement accounts like 401(k)s and individual retirement accounts (IRAs) to build simple portfolios with a handful of inexpensive index funds.

An index fund serves as a collection of stocks, offering investors instant diversification with the purchase of a single share. Take the S&P 500, for example, which tracks the 500 best performing companies in the U.S. By purchasing an S&P 500 index fund, you acquire fractional ownership in all the companies the index tracks, from Apple and Microsoft to Coca-Cola and Disney.

You can buy low-cost index funds as either an exchange-traded fund (ETF) or a mutual fund. Both function very similarly, though some 401(k) plan platforms only allow you to purchase mutual funds, while ETFs are generally available at all brokers that allow stock trading.

Index funds are considered less risky than picking individual stocks, since your money is spread over hundreds of companies instead of just one or two. Most are also cheap, with the best index funds featuring expense ratios of less than 0.03 percent, or $3 for every $10,000 invested.

Daniels began her investing journey in earnest by maxing out her 401(k) retirement plan in 2020 while working full-time as a communications specialist at an engineering firm. She contributed about 25 percent of her six-figure salary to the account and earned a company match, which is essentially free money.

She’s expanded her investment accounts since then, adding a Roth IRA, traditional IRA, solo 401(k), a taxable brokerage and even investing the funds within her health savings account. In March 2024, her net worth was $296,000, according to documents reviewed by Bankrate.

But she’s used the same low-cost passively managed funds to build wealth across all her accounts.

Here are the main funds Daniels uses in her investment accounts:

- QQQ: Invesco QQQ Trust (Nasdaq)

- VTSAX: Vanguard Total Stock Market Index Fund

- VOO: Vanguard S&P 500 ETF

- VOOG: Vanguard S&P 500 Growth Index Fund ETF

- VOOV: Vanguard S&P 500 Value Index Fund ETF

- VIMAX: Vanguard Mid-Cap Index Fund

- VIOG: Vanguard S&P Small-Cap 600 Growth Index Fund ETF

Putting investing on auto-pilot

Daniels not only keeps her portfolio simple, she also puts her contributions on auto-pilot.

By transferring a percentage of her earnings directly to her investment accounts each month, she’s practicing dollar-cost averaging, a strategy where you invest a fixed amount of money at regular intervals. This helps buy more shares when prices are low and fewer when prices are high, smoothing out the impact of market turbulence without trying to time the market — a notoriously difficult task.

“If the guys on Wall Street – who not only have more education but also more access to information — can’t consistently time the market correctly, then I’m not going to,” Daniels says.

If consistently buying index funds sounds super boring, that’s the whole point.

“We have movies like ‘Wolf of Wall Street’ or ‘Dumb Money’ that make us think investing is like gambling, it’s day trading, it’s super risky,” says Daniels. “There’s not a single movie out there about index funds because it’s not exciting. It’s very boring.

“‘Oh, index funds are doing fine again’ doesn’t exactly make for exciting headlines,” adds Daniels.

Investing over paying off low-interest student loan debt

While the idea of consistently buying cheap index funds isn’t new, Daniels holds a somewhat unconventional attitude toward investing and paying off debt.

Unlike some voices in the world of personal finance, Daniels says there are more important things than being entirely debt-free as quickly as possible.

It’s a stance in stark contrast to influencers like radio host Dave Ramsey, who built a multi-million dollar financial education empire on the premise that people should eliminate all debt before ever putting money in the stock market.

“That’s an insane idea,” Daniels says. “There’s so much in between ‘be debt-free’ and ‘only invest.’ I think you should be doing both.”

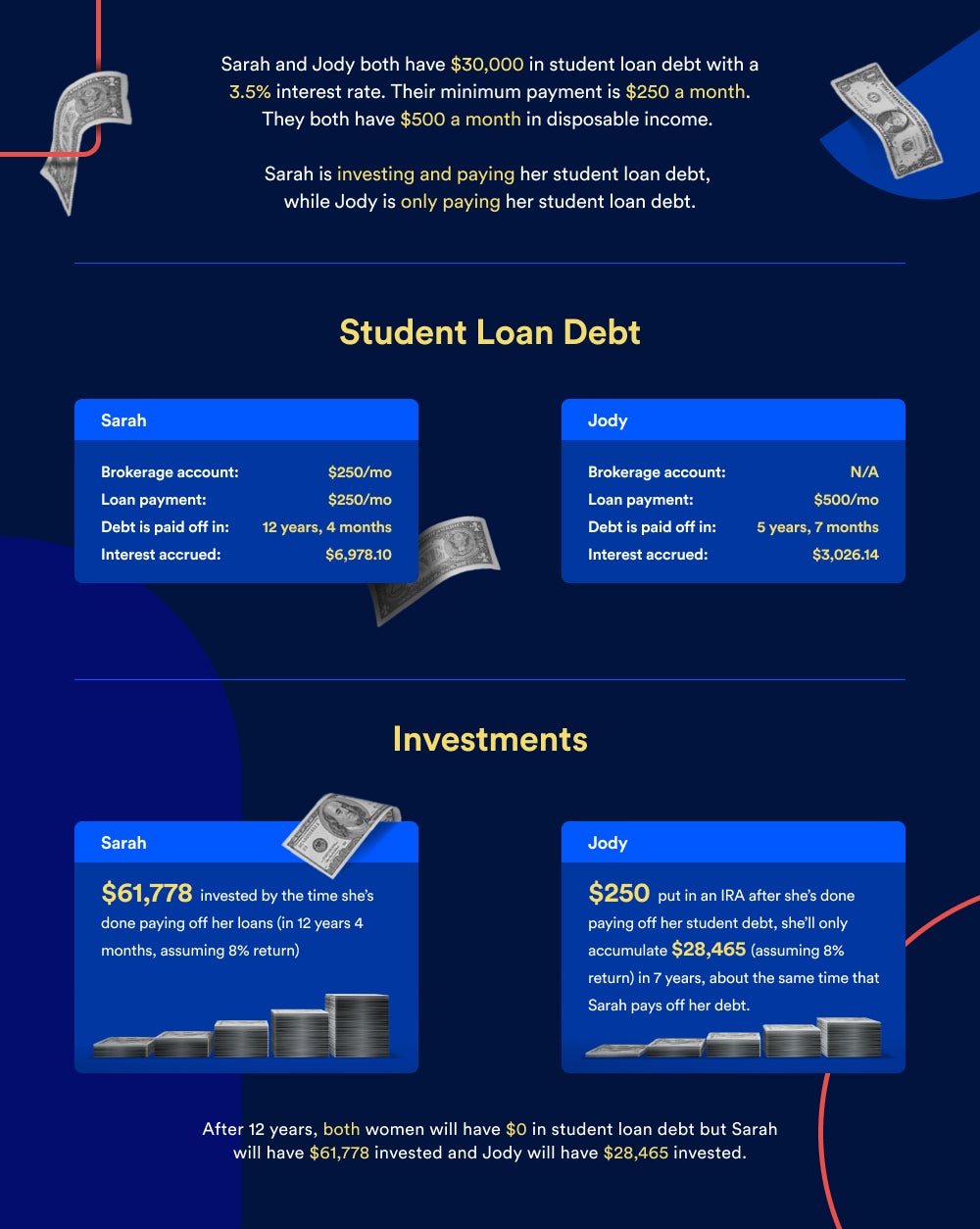

Daniels believes paying off high-interest credit card debt is essential, but as she points out, most millennials and Gen Zers are saddled with tens of thousands of dollars in low-interest student loan debt.

She thinks it often makes more sense to make a small or minimum payment on student loan debt — so long as the interest rate is below about 5 to 8 percent — while investing at the same time.

Putting extra cash in the market instead — especially in your 20s and 30s when the power of compounding interest is really on your side— can yield better returns over time, Daniels says, even when accounting for interest charges.

That’s because the stock market has historically earned average returns of 8 percent or more, while low-interest student loan debt may only charge an interest rate of 4 percent or less. It’s not costing you much to hold that debt, but you miss out on the potential growth of investing at least a portion of your money.

“When you run different scenarios, you can see if it makes sense to decide if you want to pay off your debt early, do I want to do a combination of both or do I just want to (make the minimum payments) and be investing,” Daniels says.

Daniels acknowledges she didn’t follow this approach in her late 20s, when she paid off almost $40,000 in student loans in two years. She refers to it as her “debt-free mistake” and her other biggest financial regret.

“I’ve done the calculations, and that’s cost me about $1 million long term,” says Daniels. “Yes, I saved about $18,000 in interest by paying off that much debt when I did. But I don’t think anyone would really choose to save $18,000 in interest over making $1 million over time.”

Daniels still carries about $10,000 in student loan debt at a 3.5 percent interest rate. She plans on making the minimum payment until the debt is eventually paid off.

Quitting her 9-5 to to run Clo-Bare full time

In October 2021, Daniels left her job as a communications specialist to pursue Clo Bare Money Coach full time.

In addition to posting daily content about saving and investing on Instagram and Tik-Tok (where she now has over 120,000 followers on each), Daniels offered 1-on-1 financial coaching. She earned about $5,000 a month in the six months leading up to quitting her 9-5 job.

But after devoting all her time to her growing business, Daniels says the profits really started rolling in.

By December, Daniels debuted her Lazy Investor’s Course where 91 people signed up to get access for $379 each — a nearly $35,000 launch. Just over two years later, the self-paced Lazy Investor’s Course retails for $997.

What began as blogging part-time about her personal experiences saving and budgeting money back in 2018 has transformed into a six-figure full-time career managing an education platform built around her personal brand.

“I knew I would regret it if I didn’t try it,” she says.

Daniels is always quick to point out that she’s not a certified financial planner, or licensed to provide specific investment advice. She’s offering educational resources and sharing both the wins and failures she’s experienced along her journey.

Different aspects of that journey really resonate with people, especially other women in their late 20s and 30s. Whether it’s struggling to decide whether to pay off student loans or invest, or escaping a financially abusive relationship, her videos are filled with comments like “Oh man, I can relate” and “Definitely been there, and then some.”

Instead of downplaying her mistakes, Daniels has made a small fortune embracing them and using them as examples to teach others about how to be smarter with their money. Her nobody’s-perfect approach works, and it’s helping thousands of people learn about investing.

“Over and over again, my students say they chose me because they saw themselves in me,” she says. “And the fact I tell people they can get rewarded for being lazy with investing — I think that really resonates too.”

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.