The top-paid CEOs: Median CEO rings up $15.7 million

The compensation of chief executive officers seems to spiral ever higher, and that was the case in 2023, as CEOs at the biggest companies saw median payouts rise to a record $15.7 million, per the Wall Street Journal. The most recently available data show the median pay of chief execs jumped last year from a still-lofty median compensation of $14.5 million in 2022.

Here are the top-paid CEOs, why their compensation can’t be compared to those of regular folks and how to use CEO compensation to invest better.

America’s highest-paid CEOs and how they earn it

The compensation of America’s CEOs has risen briskly over the last decade, with median pay rising from $7.39 million in 2013 to $15.71 million in 2023. In 2023, most CEOs received pay raises of 9 percent or more, and one in four scored a 25 percent bump, according to MyLogIQ.

But just who were the top-paid CEOs for 2023? Here are the top five, with the amounts broken out by type of compensation:

- Hock Tan, Broadcom: $160.5 million equity, $1.2 million cash

- Nikesh Arora, Palo Alto Networks: $145.4 million equity, $2.3 million cash, $3.8 million other compensation

- Stephen Schwarzman, Blackstone: $119.4 million other compensation

- Christopher Winfrey, Charter Communications: $83.7 million equity, $5.2 million cash

- Will Lansing, Fair Isaac: $64.3 million equity, $2.0 million cash

As you can see, the highest-paid CEOs earn a relatively small amount of their total annual compensation from traditional sources such as cash pay. Instead, equity (including options) plays an enormous role in their overall compensation. For example, for Broadcom CEO Hock Tan, cash compensation was less than one percent of overall compensation in 2023.

Overall, stock comp comprised about 65 percent of median total pay of the top 100 CEOs tracked by Equilar, an executive intelligence company.

That fact leads to another point about CEO compensation. These massive equity awards are often sporadic in nature. A CEO’s pay package may have special payouts based on corporate targets, the completion of a specific objective or hitting a specific tenure with the firm. As such, this list of high earners tends to turn over from year to year, with new faces populating its ranks.

For example, Fair Isaac’s Will Lansing benefited from a one-time $30 million equity grant for retention and leadership vesting over five years.

Still, some CEOs at the largest companies do hit the upper echelons year after year:

- CEO Tim Cook at Apple hit 2nd place in 2022 and 6th place in 2023, according to Equilar

- CEO Satya Nadella at Microsoft claimed the 6th spot in 2022 and the 9th spot in 2023, says Equilar.

- CEO Hock Tan at Broadcom took 4th in 2022 and 1st place in 2023.

Many executives have packages that pay out higher equity bonuses if the stock itself does well. So CEOs get to earn more shares of stock at a higher price, if shareholders do well. That kind of alignment can be attractive from a governance perspective if it’s well-structured, but it also means many executives can wind up with utterly enormous pay packages in a given year.

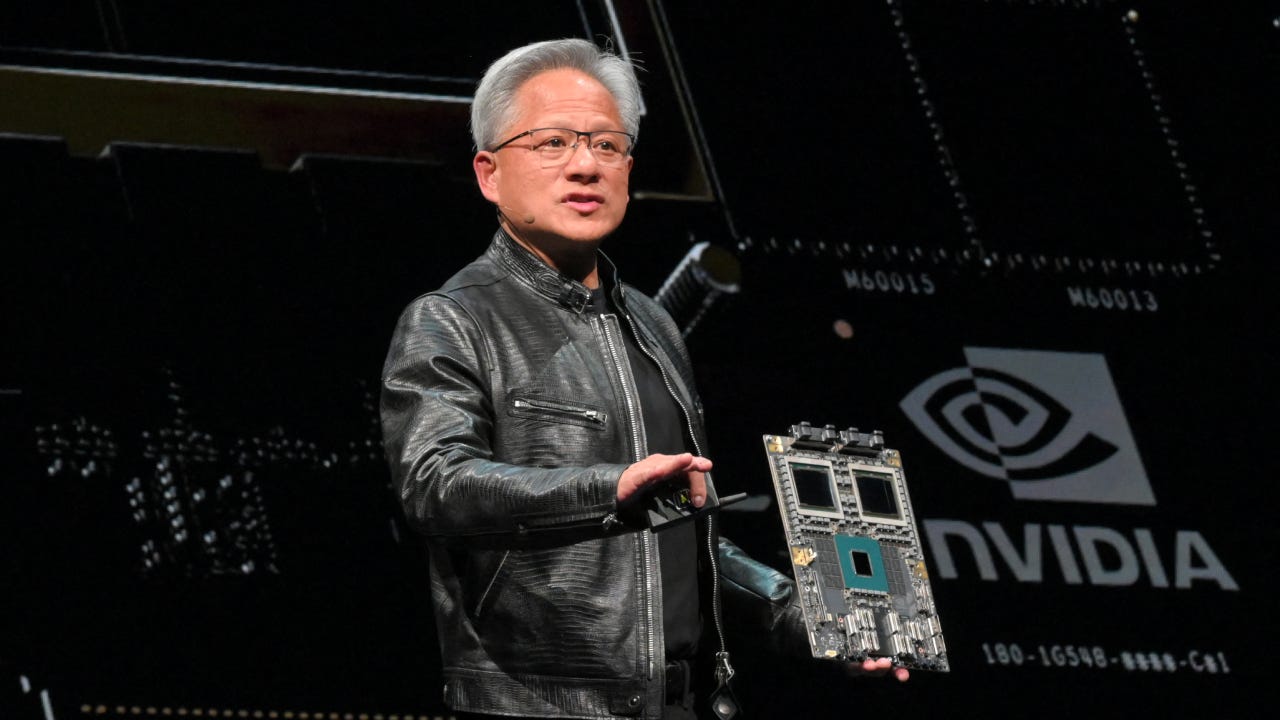

Of course, equity compensation can be the pay that keeps on paying. If the company’s stock continues to rise in subsequent years, CEOs stand to benefit from that as well. Nvidia CEO Jensen Huang, for example, has seen his equity compensation balloon over the last two years, as the semiconductor company fills record orders for its AI chips and the stock skyrockets.

So CEO compensation is different from the pay of average workers not only because of the massive amounts at stake but also due to how it’s structured.

How to use CEO compensation to invest better

Beyond just admiring – or disdaining – these gaudy pay packages, looking at CEO comp can help investors anticipate how a stock may perform.

One good place to begin is actually analyzing these CEOs’ pay packages to see what they’re being paid to do. The structure of their compensation can be a good signal to judge how a CEO is going to act and the type of decisions that might be made:

- CEOs may be paid based on specific financial metrics that do not always align with investors’ best interests. For example, some execs are rewarded to grow the company at any cost, regardless of whether it’s good for the company or investors.

- Execs may be compensated based on how the stock performs, meaning they may be incentivized to do what moves the stock higher – a potentially good sign for investors.

- CEOs may be rewarded if they sell or spin off a division, so investors may anticipate that kind of action and prepare accordingly.

- Companies that award CEOs their performance-based compensation regardless of performance may be good companies to steer clear of.

- CEOs who consistently earn exorbitant pay relative to the firm’s profit can be a useful sign that the stock will be a poor investment until a change in management happens.

You can investigate CEO compensation in a company’s annual proxy filing on Form DEF 14A, which many top brokers link to in their research.

Bottom line

While these pay packages may be reserved for CEOs, average Americans can still earn returns from America’s top-performing stocks – the same as executives. The structure of a CEO’s pay can be a good place to understand how a stock may perform and how a CEO may act.

You may also like

How to turn $1,000 into $1 million, according to a top wealth advisor