Insurance News

Find news about homeowners, renters, auto and life insurance.

Insurance News

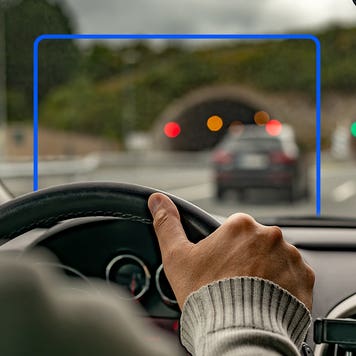

Misconceptions about your home and auto insurance policies could cost you.

An agent’s tips on spring home maintenance to avoid costly insurance claims.

Can your insurer drop you before a wildfire? Know your rights and what to do next.

February CPI shows stubborn inflation in motor vehicle insurance.

An NFIP lapse would halt new flood policies and renewals.

Is it fair that drivers with poor credit are paying significantly more for car insurance?

“Don’t be a passive homeowner.” An insurance agent’s lesson in saving money with winter weather prep

Are you doing enough to protect your home from extreme winter weather?

The Northeast’s staggering spike in wildfires could push up home insurance premiums.

A teen driver could add thousands to your annual car insurance bill, and a little-known industry quirk could push it even higher.

Insurance is the priciest hidden cost of car ownership.

Experts say that 2024 saw record insurance shopping, even among loyal customers.

Has inflation left you underinsured? Bankrate investigates.

Tariffs will raise prices, but the strategies for insurance savings remain the same.

Rsing temps and road rage are a costly combo. discover the mental and financial impact on drivers and their car insurance rates.

Telematics impact insurance rates and driver behavior — California’s missing out.

Bankrate explains how CA, NC, UT and VA car insurance laws are changing in 2025.

Home insurance takes center stage in real estate deals.

Extreme weather puts more than a quarter of all U.S. homes at risk.

Could you pay your deductible if you had an insurance claim?

These deductibles are calculated as a percentage of your coverage limit.

Insurance companies may be taking advantage of states with limited regulation.

Bankrate explores what dorm insurance is and if your student needs it.

If you’ve received a letter from your insurance company asking for updates, you’re not alone.

Understanding how coinsurance works can help you avoid unexpected expenses and confirm that your coverage meets your needs.

The trusted provider of accurate rates and financial information