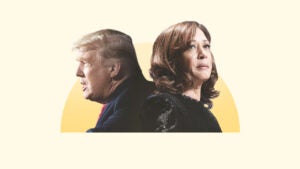

How Trump and Harris’ policies could impact the cost of insurance

On September 17, 2024, former President Donald Trump took to X.com (formerly Twitter) to address an unusual campaign issue: the cost of car insurance.

“Your Automobile Insurance is up 73%,” he wrote; “— VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF!”

While auto insurance rates are on the rise, Trump’s numbers are off: According to Bankrate’s analysis of average quoted premiums from Quadrant Information Services, the leading provider of property and casualty insurance pricing data, the average cost of a full coverage car insurance policy rose by around 13 percent from June 2023 to June 2024.

Nevertheless, the tweet mirrors the anxious reality many Americans face: that the cost of car insurance has become unmanageable, driven by factors like extreme weather, inflation, supply chain disruptions and irresponsible driving habits.

Trump isn’t alone in identifying insurance costs as a key area of concern for American voters. In her first debate with Trump on September 10, 2024, Vice President Kamala Harris linked the issue of climate change to the steep increase in home insurance rates observed in the past few years. “What we know [about climate change] is that it is very real,” Harris said. “You ask anyone who lives in a state who has experienced these extreme weather occurrences, who now is either being denied home insurance or is being jacked up.”

Historically, healthcare is the key insurance topic that looms large in election years. But in 2024, things are different. The rising cost of auto and home insurance is among the crucial economic concerns that Americans will bring to the voting booth. To help voters make informed decisions, Bankrate’s insurance editorial team reviewed each candidate’s positions on key issues related to insurance — and how they might impact the cost of coverage.

Could Trump or Harris really lower the price of insurance?

Realistically, the president has no power to directly affect car or home insurance premiums for the American public. Property and casualty insurance is priced based on risk using proprietary algorithms developed by insurance companies. When the government intervenes in this process, it’s at the state level: insurance commissioners in all 50 states review and regulate the prices set by insurers, working to strike a balance between permitting competition for carriers and avoiding an undue financial burden for consumers.

The president doesn’t play a role in this process. Nevertheless, both candidates have pinpointed the cost of insurance as a key economic issue facing Americans — and many voters see in one candidate or the other a cure for their economic woes. Bankrate’s Election and the Economy Survey found that 55 percent of Americans think the U.S. economy is headed on the wrong track. Diving deeper, 42 percent of Americans think former President Donald Trump’s election would be the best for their personal financial situation, while 38 percent of people say Vice President Kamala Harris would be best — 12 percent say neither is best.

With insurance playing a growing role in Americans’ personal finances, it’s worth exploring how a Harris or Trump presidency could impact the cost of coverage. Although neither candidate has released details of their plans to fight rising insurance costs, they could influence the insurance industry through policy in two key areas: climate risk management and automotive technology.

Climate risk management could be a key area of presidential oversight for the insurance industry

Among the factors driving the historic increase in home insurance rates over the past two years — an increase as high as 48 percent in some states — is increased climate risk. Historically, coastal areas like Florida and California attracted the most attention from the insurance industry and incurred the greatest costs due to climate risks like hurricanes and wildfires. But recent years have seen an increase in severe — and costly — weather events across the nation, and the Environmental Protection Agency (EPA) warns that the trend will continue.

Climate change is more than a scientific or political issue; it’s an economic one. Bankrate’s Extreme Weather Survey found that more than 1 in 4 (26 percent) of U.S. homeowners say they are unprepared for the potential costs associated with extreme weather events in their area.

If severe weather events continue to increase, home and auto insurance premiums have the potential to increase as well to cover the rising cost of climate disaster for insurance companies. In this context, the ability to predict severe weather events and mitigate the risk they present to insured property will become increasingly important in reducing the impact of climate change on consumers’ insurance costs.

The president can’t stop hurricanes in their tracks or prevent wildfires — but the next president’s climate policy could help to shape the environment that insurance companies and policyholders face together.

Where Harris stands on the climate

Harris’ remarks at the second presidential debate explicitly linked the stakes of the climate debate to the cost of home insurance. The vice president has a history of vocal support for climate change initiatives, but she has not yet released a detailed plan for environmental policy.

What we do know about Harris’ climate stances comes primarily from her time in the Biden administration. As vice president, Harris helped to pass key legislation channeling federal money towards disaster preparedness initiatives as part of the White House’s National Climate Resilience Framework — a framework which explicitly mentions the increasing cost and inaccessibility of property and casualty insurance as a reason for investing in climate resilience.

The framework cites two key pieces of legislation from the Biden administration — the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) — as drivers of climate resilience. Harris cast the tie-breaking vote to pass the IRA, which includes federal spending and grant money for measures like the acquisition of hurricane forecasting aircraft and projects to build the resilience of coastal communities to hurricanes and storm surge. Resilience is a key portion of the BIL, which appropriated $8.25 billion for wildfire management and $3.5 billion for FEMA’s Flood Mitigation Assistance Program.

Wildfires, hurricanes and flooding are among the major climate risks driving up the cost of home insurance. If Harris continues the Biden administration’s commitment to investing in mitigation strategies for these climate disasters, as well as research and forecasting equipment to help insurers predict and prepare for these costly events, it could help to slow the increasingly unmanageable cost of home and auto insurance — and potentially reduce costs for policyholders.

Where Trump stands on the climate

Former President Trump has been vocal in his rejection of climate science. While in office from 2017 to 2021, Trump rolled back over 100 climate rules. However, Trump’s previous administration also passed the bipartisan Disaster Recovery Reform Act of 2018, which provided additional funding and streamlined administrative processes to promote disaster resilience and reduce the cost of weather-related disasters to communities and individuals.

A Trump administration could also see a restructuring or even destruction of government agencies that currently play crucial roles in the insurance industry. The Project 2025 Presidential Transition Project proposes to break down the National Oceanic and Atmospheric Administration (NOAA), privatize weather forecasting and end FEMA’s National Flood Insurance Plan (NFIP) — a controversial subject among insurance experts.

While the Trump campaign has distanced itself from Project 2025, the plan is widely understood as a potential forecast of what a second Trump administration could look like.

Because increased climate risk is a major driver of insurance costs, a presidential administration that downplays the danger of climate change could mean an insurance industry that’s more vulnerable to costs from severe weather events. In particular, if Trump gains the presidency and chooses to dismantle or defund the NFIP, FEMA or NOAA, an increase in insurance costs for individual homeowners could be one of the ripple effects.

Automotive technology investments could drive higher car insurance costs

When car insurance rates spiked in 2021 and 2022, industry insiders pointed to a major culprit with a small stature: the humble semiconductor. These tiny computer chips, about the size of a fingernail, play a crucial role in many modern vehicle systems, particularly the advanced driver assistance systems that promise a lower risk of collisions.

They may also be raising the cost of car insurance. When supply chain disruptions led to a semiconductor shortage starting in 2020, car values and repair costs shot up — and, in response, so did the cost of auto insurance. Between June 2022 and June 2024, the average full coverage car insurance premium rose by 20 percent, and some policyholders experienced even sharper increases.

The semiconductor shortage is over, but the semiconductor’s impact on car ownership costs may not be. With this in mind, it’s worth examining where the candidates stand on issues facing the automotive industry.

Where Harris stands on the automotive industry

Electric vehicles (EV) take center stage in questions about Harris’ automotive policies. Among the provisions of the Inflation Reduction Act is a goal to reduce carbon emissions by 40 percent by 2030, with a major focus on EV incentives. The IRA provides:

- $3 billion in federal loans to support the manufacture of low- or zero-emission vehicles through the Advanced Technology Vehicles Manufacturing Loan Program (ATVM)

- $1 billion in grants and rebates to replace heavy-duty commercial vehicles with zero-emission alternatives

- $2 billion in domestic manufacturing conversion grants to support the production of hybrid, plug-in hybrid, fuel cell and electric vehicles

Opponents of the Harris campaign have accused the vice president of supporting an “electric vehicle mandate” or a total ban on gas-powered cars. While Harris previously supported such measures — as a senator in California, she was a co-sponsor of legislation to transition the U.S. to 100 percent zero-emissions vehicles — her campaign recently clarified that she no longer supports an EV mandate.

Safety is another key area where a Harris administration could impact the automotive industry — and by extension, the cost of car insurance. The Bipartisan Infrastructure Law, passed under the Biden-Harris administration, increased funding for the National Highway Traffic Safety Administration (NHTSA) and called for new rulemaking to require increased safety technology in vehicles. Increased vehicle technology is also a priority of the Biden-Harris administration’s National Roadway Safety Strategy, announced in 2022.

Investing in low- and zero-emissions vehicles has the potential to reduce not only greenhouse gas emissions, but one of the hidden costs of car ownership: fuel costs. However, insurance is the greatest hidden car ownership cost — and while EVs are approaching gas-powered vehicles in upfront costs, insurance for green vehicles still costs more, according to the National Association of Insurance Commissioners. If the Harris administration sets steep goals for EV adoption, the overall cost to insurers could raise premiums even for policyholders who choose not to buy a hybrid or EV.

Investing in more advanced safety technology could also contribute to rising insurance costs, as research by AAA shows that advanced driver assistance technology adds to the cost of auto collision repairs — and thus to the severity of insurance claims. However, Harris’ roadway safety plans could also help communities to reduce the rate of accidents, thus bringing down claim frequency and allowing insurers to ease up on price increases.

Where Trump stands on the automotive industry

Trump’s stance on the electric vehicle industry is very clear: “I will end the electric vehicle mandate on Day 1,” he vowed at the Republican National Convention in July, adding that this measure would save Americans “thousands and thousands of dollars per car.” During his previous presidential term, Trump attempted to eliminate tax credits for EVs, characterizing them as a waste of government funds. Since his endorsement by Elon Musk in August, Trump has pulled back on anti-EV rhetoric, but commentators expect his policies to continue to oppose the mass electrification of America’s roadways.

Trump has also promised to increase U.S. auto manufacturing and put tariffs on cars manufactured in Mexico. And while he hasn’t made any statements about road safety or vehicle technology, it’s worth noting that his previous administration allowed manufacturers of autonomous vehicles to cut certain safety corners in order to bring down production costs.

While Trump hasn’t backed his promise to reduce the cost of car insurance by 50 percent with any specific policy aims, his statements on the auto industry emphasize a goal of reducing costs for U.S. drivers. It’s possible that pulling back on EV adoption initiatives could prevent the potential rate hikes associated with an electric transition. However, it’s unlikely to reduce the cost of coverage outright, and Trump’s lack of concern for road safety — another key driver of insurance costs in 2024 — may also prove to be a blind spot.

3 things to keep in mind at the voting booth in November

- Insurance pricing depends on a ton of factors — and many are personal: Insurance companies’ pricing algorithms pull on huge amounts of data to estimate policyholder risk and set the cost of coverage for each individual. While Harris or Trump may be able to influence economic and environmental policy, personal rating factors like driving history, home value and credit will likely play a bigger role in determining the cost of your insurance.

- State and local elections may have a greater impact on insurance costs: While the president’s environmental and economic policies could impact the insurance industry overall, the cost of insurance in your state is regulated by an insurance commissioner, who may be elected or appointed by the governor.

- Shopping around — before or after the election — could help you lower the cost of insurance: Your shopping decisions may play a bigger role than your vote in securing affordable home and auto insurance. Experts advise getting quotes from at least three to five insurers every year to make sure you’re getting the best price for the coverage you have. You can also speak with a licensed insurance agent to review your coverage selections and look for new savings opportunities.

Elections and politicians come and go, but the need to save (both for emergencies and retirement), pay down debt, and invest all stand the tests of time. When it comes to personal finance, one really must focus on the things that we can control, such as utilizing a high-yield savings account or always shopping around for the best rates, and the other things will fall into place.— Mark Hamrick

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.