Moving truck insurance: Does car insurance cover a moving truck rental?

Key takeaways

- Most regular auto insurance policies do not cover truck or trailer rentals, making rental truck insurance a crucial part of the moving process.

- Moving truck insurance can help cover liability for injuries and damage others incur, as well as coverage for repairs, cargo and towing.

- It’s important to carefully consider the coverage options and rates offered by rental truck companies to make an informed decision on purchasing insurance.

Renting a moving truck is a standard part of the moving process for many people, but it comes with some unique insurance hurdles. While most personal auto insurance policies will cover a regular car rental, your standard policy probably won’t cover a moving truck rental. To help you navigate the moving process, Bankrate’s insurance editorial team delves into why most personal insurance policies won’t cover moving truck rentals — and what you can do to make sure you’re protected financially during your move.

What is moving truck insurance?

Moving truck insurance — also called rental truck insurance — is a type of coverage designed to financially protect you during a do-it-yourself move. Unlike your personal auto insurance policy, which you purchase through a traditional auto insurance company, you’re more likely to buy moving truck insurance through the rental company.

Rental truck insurance can also cover your vehicle if you’re towing it with your truck. If you’re using a truck to tow a car, consider a policy that offers auto-tow protection for the vehicle when in transit and while loading or unloading. Supplemental liability insurance is also available, providing coverage beyond the state minimums up to the policy’s specified limits.

Why is moving truck insurance important?

Moving truck insurance is crucial because operating a moving truck can be quite different from driving your personal vehicle. The size of the vehicle can present significant challenges if you’re not used to driving a large truck, which raises the risk of an accident — and while the rental company you got the truck from likely has some amount of basic liability insurance, you could end up with significant coverage gaps if you assume that your own insurance policy covers you in the rental.

You may also need additional coverage for your belongings while they’re being moved in a rental truck. Home and renters insurance cover your personal possessions while they’re in your home but may not offer financial protection for items in transit. That’s why moving companies offer basic liability coverage — but if you choose to rent a truck, you’ll need to provide that coverage yourself.

Does my personal auto insurance policy offer rental truck protection?

While your personal auto policy will typically cover you in a standard rental car, most moving trucks exceed the weight limits on a typical car insurance policy. You may want to check with your insurance company to see if it will cover the truck you’re planning to rent, but be prepared to hear that you won’t have coverage.

Does my credit card have rental truck protection?

Similar to auto insurance policies, credit cards usually won’t cover a rented moving truck. A truck’s higher weight class may disqualify it for coverage through your debit or credit card provider, so it’s worth checking the fine print to see what’s covered and what isn’t. For instance, Visa excludes all trucks and vans that seat more than eight people, while American Express excludes cargo vans and box trucks. This is usually a standard exclusion across credit card companies, so your debit or credit card likely won’t offer additional coverage for your moving truck rental.

Types of moving truck insurance

The five primary types of rental truck insurance include damage waivers, supplementary liability insurance, personal accident, cargo protection and auto tow protection. Here’s what to know about each.

Damage waiver

You can think of a damage waiver as an alternative to collision or comprehensive insurance. It can help pay for damage to a rental truck that might not be covered by your personal car insurance policy.

Damage waivers are usually optional, but many insurance professionals recommend them. Note that you may be responsible for paying a deductible in the event of a collision resulting in rental truck damage, but deductible amounts are typically low.

Supplemental liability insurance

Your truck rental company will likely offer supplemental liability insurance in addition to the standard liability coverage you can select with your reservation for the vehicle. This add-on raises your bodily injury and property damage liability limits above the state’s minimum required amount. Purchasing supplemental liability insurance may be worth considering if you need coverage because your personal auto policy has limitations due to weight. This add-on may be especially beneficial if you are planning to drive a long distance, which could increase the risk of loss or damage.

Personal accident insurance

Personal accident medical coverage, commonly referred to as MedPay, helps pay for your medical bills and your passenger’s injuries if you get hit by another driver in your rental truck or cause an accident up to its coverage limits. If you were to get injured in an accident, this coverage might take care of the ambulance fees, emergency room fees, X-rays, rehab costs and related expenses.

Cargo protection insurance

Cargo protection insurance covers the items you are transporting, such as furniture, clothing or equipment. This coverage can be beneficial, but there is usually a limit, which is the highest amount of money the rental company would pay if your items were damaged or stolen while you were transporting them in the rental truck.

Typically, the cargo protection coverage limit is low, and it may not cover your items in full. Additionally, valuable items like jewelry, collections or electronics may not be covered at all. Before you purchase cargo insurance, see if the limits are adequate for the items you are hauling or if you have coverage elsewhere, such as through a homeowners or renters policy. Otherwise, you might be able to skip it.

Auto tow protection

Auto tow protection helps cover your personal vehicle if you choose to tow it behind a moving truck. This coverage generally applies for damage due to windstorms, fire, hail, landslides, floods, overturns and collisions, and there is usually a deductible.

Deciding on the right coverage

Determining the right amount of moving truck insurance to purchase depends on what isn’t covered under your other policies and your comfort level in terms of coverage. Before purchasing, contact your auto insurance provider and your credit card company to check if they offer any type of coverage during the rental period. Once you identify the gaps, consider purchasing as much relevant coverage offered by the truck rental company as you can afford. Most protection plans limit the risk of liability to others, large repair bills and cargo protection. Without a protection plan, you would be responsible for any damage out of pocket should a loss arise.

What does moving truck insurance not cover?

Moving truck insurance may not cover all of your costs, especially when it comes to cargo insurance. This type of coverage typically excludes certain categories, such as antiques, jewelry, business property and documents or deeds. Additionally, televisions usually aren’t covered by a cargo insurance policy for a rental moving truck.

To make sure that your belongings are covered, you may want to speak with your homeowners insurance or renters insurance company to determine whether your policy will cover these items while they’re in transit. If neither your regular property insurance nor the rental truck’s cargo insurance policy will cover these belongings, you may want to consider an alternative mode of transport for those items.

Coverage options from popular truck rental companies

Several national truck rental companies, such as U-Haul, Budget, Penske and Enterprise, offer moving truck insurance with a variety of coverage options to protect you during your move. For example, U-Haul offers insurance packages like Safemove and Safemove Plus, which include coverage for damage to the rental truck and your personal belongings, as well as medical and life coverage. Penske offers various insurance bundles, including physical damage protection, liability coverage, cargo insurance and personal accident insurance.

How much is rental truck insurance?

The cost of rental truck insurance varies by geography and the specific coverage options you choose. For example, U-Haul’s Safemove protection begins at $15 per day, while its Safemove Plus with additional liability coverage costs $28 per day. Insurance experts recommend reviewing your potential protection plans and their rates to make an informed decision.

Is purchasing moving truck insurance worth it?

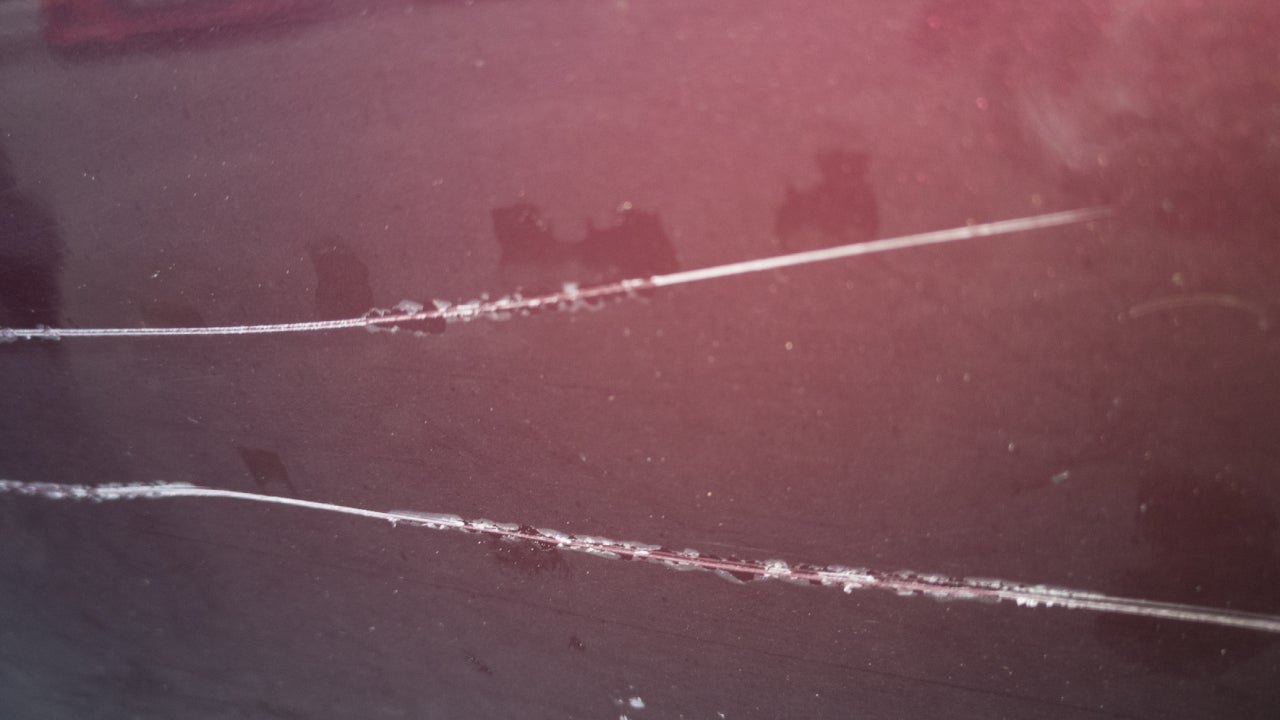

Driving a moving truck without sufficient insurance could expose you to significant financial losses. If your personal auto insurance won’t cover a rented moving truck, you may be responsible for paying out of pocket for any damage you cause or sustain while behind the wheel of your rental — whether it’s a scratch on the moving truck or a collision with another vehicle. If you cause significant damage and another party chooses to open a lawsuit, you could also face steep legal costs.

You should take these risks very seriously, especially if you’ve never driven a truck before. To make an informed decision about your moving truck insurance, consider the following steps:

- Talk to your insurance agent: You may have some coverage through your auto, home or renters insurance policies — or you and your belongings may be completely uninsured in your rental truck. Start by talking to any agents who manage your regular insurance to determine your coverage needs.

- Review coverage options from your rental company: Take a look at the coverage offered by the company you’re renting the truck from and compare it with the circumstances of your move. For instance, while supplemental liability insurance may be a good investment regardless of the type of move you’re embarking on, roadside assistance might not be worth it unless you’re planning to drive across a significant distance.

- Take stock of your personal belongings: Try to estimate the total value of the personal property you plan to move, and keep track of any unique items, such as TVs or valuables, that are not covered by your moving truck insurance.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does car insurance cover keyed cars?

Does car insurance cover hurricane damage?

Does car insurance cover hitting a deer?

Does car insurance cover your parked car?