Does car insurance cover hail damage?

Hail season runs from March through September, and with just weeks left, preliminary data from the National Oceanic and Atmospheric Administration (NOAA) shows 2025 is shaping up to be a near-average year for severe hail. Even in an average season, that still adds up to more than 5,000 reports of damaging hail, with some states taking the brunt of these frozen water bullets. Without a private garage, or if you get caught under fast-moving dark clouds, a hailstorm dropping two-inch-plus projectiles can really rough up your vehicle. Fortunately, with the right type of car insurance, you should have coverage. However, as we’ll explain, filing a claim isn’t always the best move depending on your deductible and the extent of the hail damage.

Does your car insurance policy cover hail damage?

Different types of car insurance protect you and your vehicle from a range of risks. If you’re wondering what insurance covers hail damage specifically, that would be comprehensive coverage.

Comprehensive coverage is an optional coverage available for your policy. Along with collision coverage, it is considered part of a full coverage policy. A full coverage policy contains your state’s minimum liability requirements, which pays for injuries and damage to the other car and its passengers, along with collision and comprehensive, which cover damage to your vehicle, no matter who is at fault.

Collision insurance, as the name suggests, pays for damages after you’ve been in an accident. Comprehensive insurance, meanwhile, covers damages from any other cause, whether it’s hitting an animal, car theft or fire. That also includes hail damage.

Comprehensive coverage and hail damage

Comprehensive coverage, sometimes known as ‘other-than-collision,’ helps cover the cost of repairs for damage caused by weather events such as storms, snow, sleet and hail, as well as falling debris and trees. Your state does not legally require this coverage, but your lender will typically require it if you finance your vehicle. Even if your vehicle loan is paid off, you may want to consider this coverage as it could protect your budget from costly repairs.

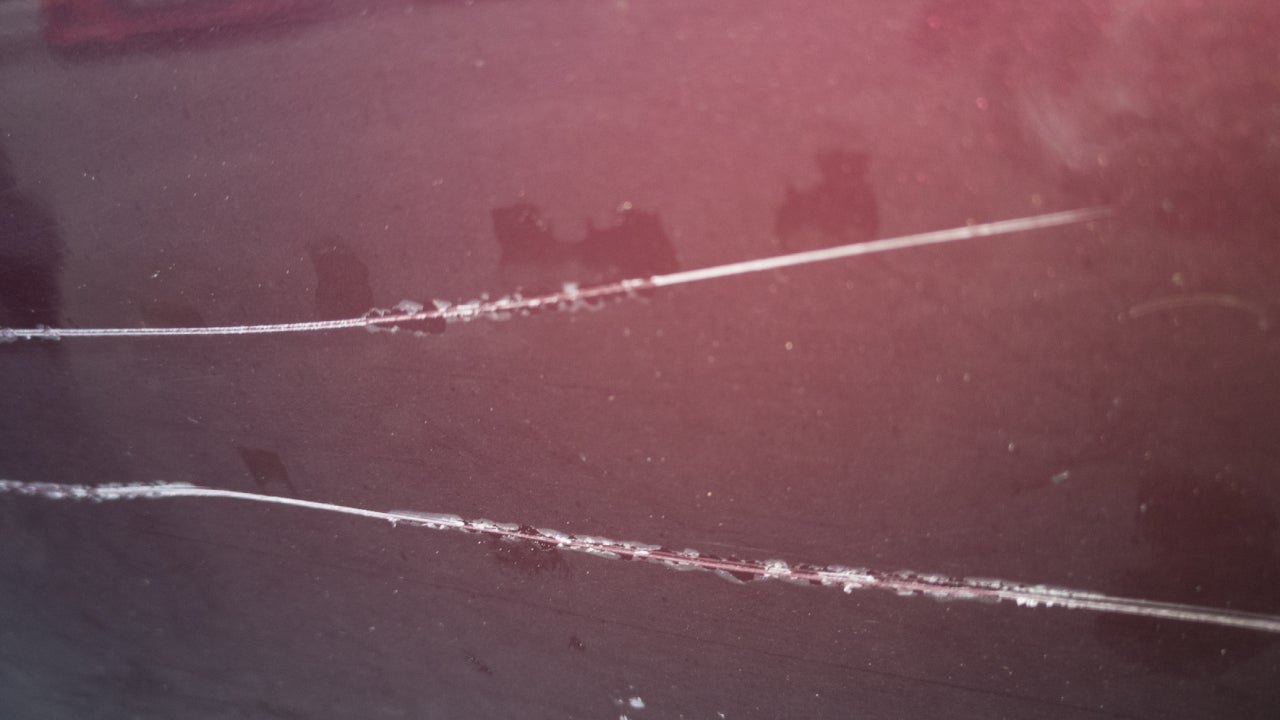

What kind of damage can hail cause to your car?

It’s easy to understand how severe hail, which may be the size of baseballs or larger, can cause damage. Large hail can be the cause of structural damage to the frame or engine, bending or warping metal to the extent that it is no longer functional or handles poorly. Glass windows and mirrors are especially susceptible to damage from hail.

Even smaller hail, however, can cause significant cosmetic damage to your vehicle. One estimate states that any hail that is an inch in diameter, or the size of a quarter, is large enough to chip or crack paint, crack windows and cause dents and dings in the car’s body.

Is it worth claiming hail damage to your car?

Now that you know the answer to ‘does car insurance cover hail damage?’ it’s time to ask yourself if you should file a claim. Considering the range of damage possibilities a hailstorm can bring, your decision requires some context.

Ultimately, you should only file a hail claim if the cost of repairs is more than your deductible. Here’s why — if you have a $1,000 deductible and the hail damage only costs $600 to fix, you won’t get any money from your insurance company because your deductible will cover the repairs in full. Unfortunately, you would have no choice but to pay out-of-pocket. And filing a claim could drive up your insurance premium.

However, it’s entirely possible that hail can render your car undrivable. If you’re not sure how extensive the damage is, take your car to a local auto body shop and have them evaluate it. You can even request a price quote for the repairs and bring it to your insurance company when you file the claim.

Protecting your car from hail

The best way to avoid a hail claim is to protect your car from damage in the first place. Some states face more hailstorms than others. For example, according to the Triple-I, the top five states that had major hail events in 2024 include Texas, Kansas, Missouri, Nebraska and Oklahoma. While hailstorms tend to be unexpected, there are some ways that you can take precautionary measures, especially if you live in a high-risk area.

- Park in a garage: Instead of parking outside, try to find parking in a garage if you know a storm is coming.

- Find shelter during a storm: If you’re driving when a hailstorm hits, find shelter as soon as you can. Either pull off and find a covered parking structure, or even park your car under the nearest bridge or overpass.

- Get a hail car cover: If you don’t have a garage at home, consider buying a car cover that puts a barrier between your car and the elements.

- Buy a carport: Setting up a carport in your driveway is a great way to protect your car at home without adding a garage.

- Check the weather: Before you leave home, check the weather to see if any storms are predicted in your area.

Taking a few steps to prevent potential damage can keep you from needing to shell out money for repairs.

Frequently asked questions

Additional resources:

- The Average Cost of Car Insurance

- The Cheapest Car Insurance Companies

- Comparing Car Insurance Quotes

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

When should I drop full coverage from my car insurance?

Comprehensive car insurance coverage

Does car insurance cover keyed cars?

Does car insurance cover your parked car?