Does car insurance cover hitting a deer?

Across America, drivers filed roughly 1.8 million animal collision insurance claims between July 2023 and June 2024, according to the Insurance Information Institute. With the nation’s deer population hovering around 36 million, these graceful but unpredictable creatures pose a more significant road hazard than many motorists realize. The results of these collisions can be devastating for the deer and your vehicle, leaving you with the headache of repairs, insurance claims and possible medical bills. The Bankrate team will review the aspects of insurance coverage for deer collisions, from detailing how comprehensive and collision coverage applies to these incidents to exploring practical steps for protecting yourself and your vehicle on the road.

Does liability insurance cover hitting a deer?

The liability portion of your car insurance does not cover damage to your own vehicle caused by hitting a deer. Liability insurance only covers bodily injury and property damage that you cause to another person or people in an accident. If you hit a deer, your liability insurance policy will cover any damage (up to policy limits) that the collision causes to another person’s vehicle or property, but it will not cover the cost to repair your own vehicle.

Does full coverage car insurance cover hitting a deer?

A full coverage policy, which bundles both collision and comprehensive insurance, does offer protection if you collide with a deer. But here’s the key detail. It’s actually your comprehensive coverage that handles these incidents. Before you breathe that sigh of relief, though, there’s one important factor to consider: your deductible. This out-of-pocket amount needs careful thought, as it’s what you’ll pay before your insurance steps in to help.

While raising your deductible might tempt you with lower monthly premiums, ask yourself: could you comfortably cover that amount if you found yourself face-to-face with a deer tomorrow? Having comprehensive coverage as part of your full insurance package isn’t just about checking a box — it’s about giving you the ability to drive in peace, knowing you’re prepared for those unexpected wildlife encounters that can happen on any given drive.

What happens if I swerve to avoid a deer?

It’s a split-second decision that can change everything. When a deer suddenly appears in your headlights, your instincts might scream to swerve, but here’s the reality. That natural reaction often leads to far more devastating consequences. When you swerve, you’re not just changing direction. You’re dramatically increasing your risk of losing control, potentially triggering a rollover or, worse yet, colliding with oncoming traffic, trees or guardrails.

The insurance implications add another layer of complexity. Should your evasive maneuver result in a collision with another vehicle or roadside object, you could find yourself legally at fault. While your collision coverage would typically step in to repair your vehicle, you’d need a good amount of liability insurance to cover any damage or injuries you cause to others.

You can try hitting your brakes as hard as you can (in a controlled manner, of course) or honking your horn to get the deer to move out of the way faster. But if push comes to shove, a controlled impact with a deer, while certainly not ideal, is often the safer choice.

Yes, you might end up with vehicle damage, but you’ve likely avoided the more unpredictable and potentially catastrophic outcomes that come with sudden swerving maneuvers.

Does hitting a deer raise your insurance?

The impact on your car insurance rates after a deer collision isn’t quite as bad as you might fear. Since these incidents fall under comprehensive coverage, they generally trigger smaller rate increases than typical accidents (if they affect your rates at all). That said, your specific situation matters: insurers look at factors like your claims history and the repair costs when making these decisions. Some companies even offer accident forgiveness programs that could keep your rates stable after a single deer incident. Your best bet is to chat with your agent about how your policy handles these natural encounters so you are armed with knowledge should it ever happen to you.

Is it illegal to hit a deer and drive off?

The legality of leaving a deer collision scene varies by state, and it’s not as straightforward as you might think. While you won’t face hit-and-run charges like you would after a typical accident, many states do require or recommend that you report the incident — especially if the deer is injured or becomes a road hazard. Even where reporting isn’t mandatory, it’s wise to notify law enforcement or animal control. This creates an official record of the incident (which your insurance company will appreciate) and ensures any safety hazards are properly handled.

Does hitting a deer go on your driving record?

Perhaps some good news out of all of this is that colliding with a deer typically won’t stain your driving record. Insurance companies and state authorities generally view these encounters as unavoidable accidents — after all, you can’t exactly negotiate right-of-way with wildlife. However, if you swerve to avoid the deer and hit something else, that secondary collision could appear on your record. While easier said than done, stay calm, maintain your lane, and if an incident occurs, report it properly to keep everything above board with both law enforcement and your insurer.

How can I avoid hitting a deer?

Deer move quickly and can be unpredictable. This means that if you live in an area with large deer populations, you may be at risk for hitting a deer even if you’re driving safely. These tips may help you avoid a collision with a deer.

- Reduce your speed: Most deer collisions occur in the fall around dusk and dawn. Reducing your speed during these times, especially on roads with low visibility, may give you more reaction time if a deer does cross in front of you.

- Scan the roadway for deer: Keep your eyes moving — there’s a rhythm to reading the road ahead. Deer rarely travel solo, so when you spot one crossing or grazing nearby, count on its companions being close behind. That first deer is often your warning sign to slow things down.

- Use your high beam headlights: If there are no other vehicles around, using your high beam headlights may help improve visibility and give you more reaction time to potential deer in the road.

- Use your horn: The Insurance Information Institute recommends using a single long horn blast to scare a deer off the road if you are at risk of colliding with them. However, this should only be done if the deer is already on the road; otherwise, you risk scaring it into the road. Be mindful of other vehicles if you do this as well.

- Watch for reflective eyes: Nature gave deer highly reflective eyes for a reason, and they’ll catch your headlights long before you see the animal itself.

- Drive defensively in deer-prone areas: Those yellow deer-crossing signs aren’t just roadside decorations. Pay special attention around wooded areas and known crossing zones. These spots have earned their reputation as deer hotspots, and a little extra caution goes a long way.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Car insurance after a hit-and-run in Tennessee

Car insurance after a hit-and-run in Washington

Car insurance after a hit-and-run in California

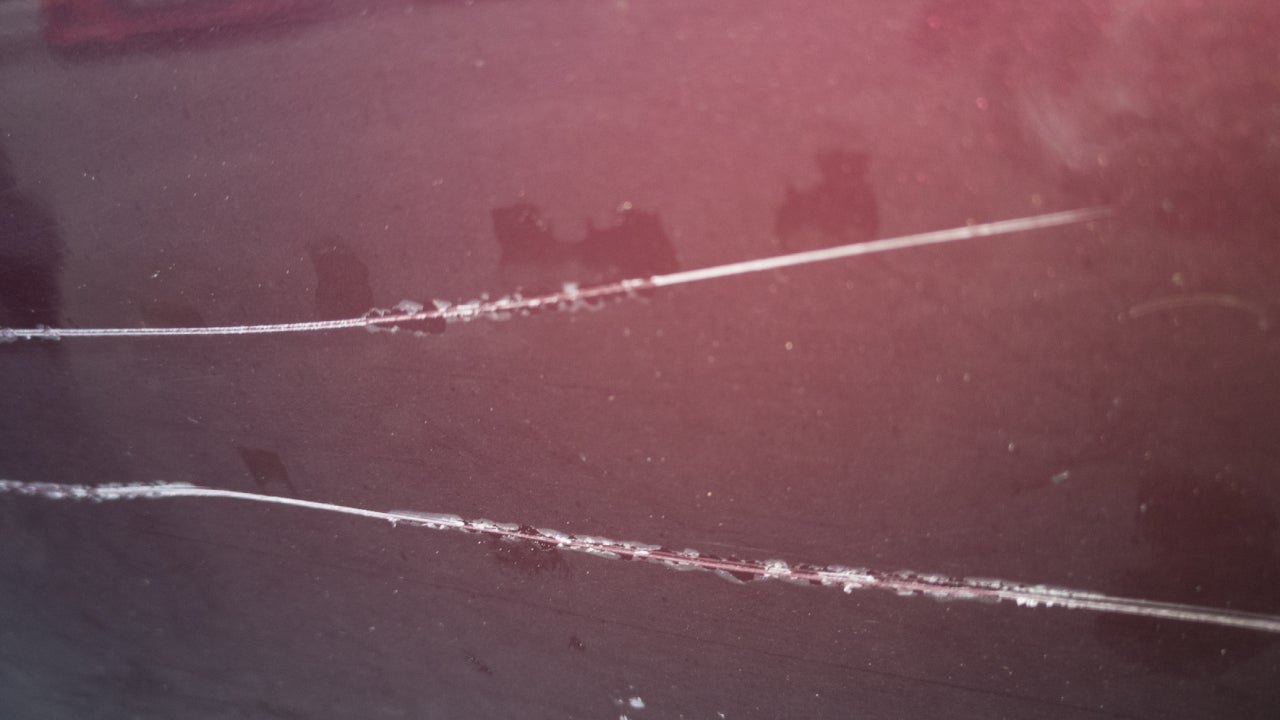

Does car insurance cover keyed cars?