Does car insurance cover vandalism?

Key takeaways

- Comprehensive insurance is an optional coverage that will generally help cover vandalism claims.

- You may want to consider paying out-of-pocket if the cost to repair the vandalism damage is lower than your deductible.

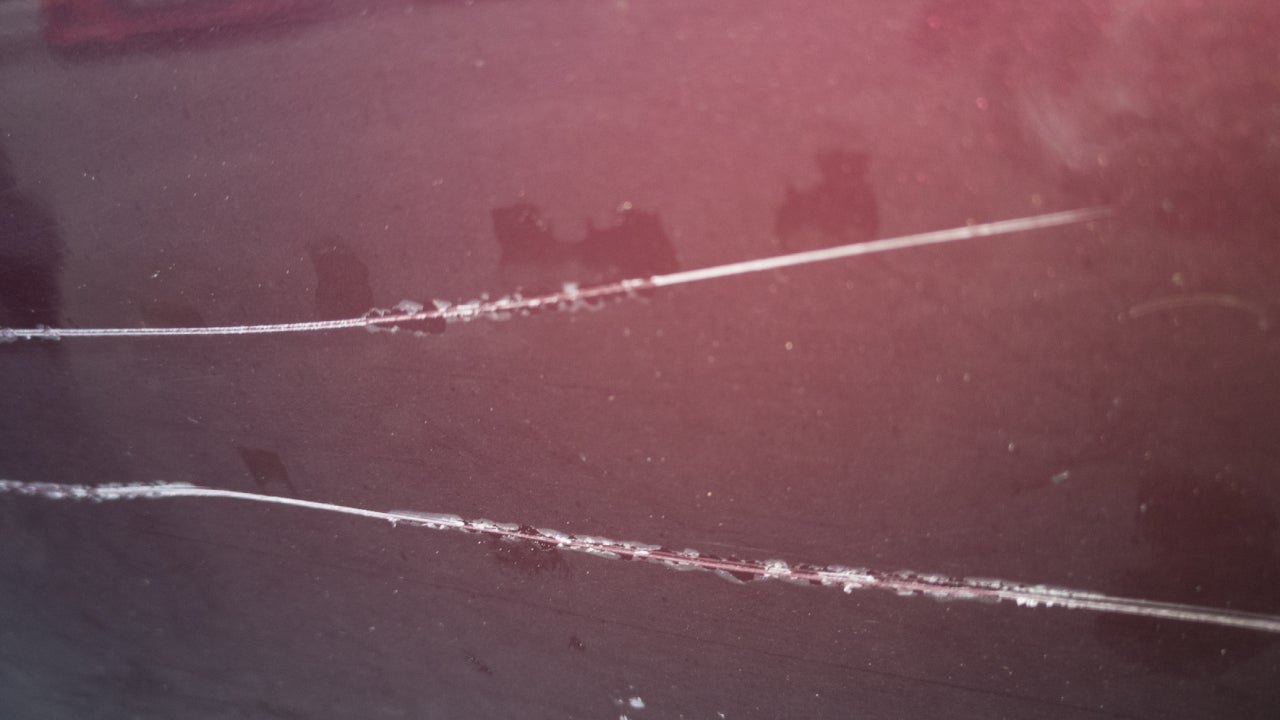

You walk up to your car and your heart sinks — someone has vandalized it. Maybe there’s a spiderweb of cracks across your windshield, ugly scratches down the side or your tires are sitting flat on the pavement. It’s enough to ruin anyone’s day. But here’s the silver lining: if you have comprehensive coverage on your auto insurance policy, you should be able to file a claim for the damage. That said, if the cost to fix the damage is minimal — especially if it’s lower than your deductible — you’re probably better off paying for it out of pocket.

What is auto vandalism?

Car vandalism involves any deliberate damage to your vehicle, and while it’s frustrating to deal with, having comprehensive coverage can help soften the monetary blow. Here’s what you should know about common types of vandalism:

- Paint and body damage: From malicious key scratches to unwanted graffiti, exterior damage is one of the most common forms of vandalism. While minor scratches might buff out with professional detailing, deeper damage often requires costly bodywork or panel replacement — something your comprehensive coverage can help with.

- Broken glass and lights: Shattered windows, smashed mirrors or damaged headlights aren’t just cosmetic issues — they’re serious safety concerns. This damage typically requires complete replacement to ensure your vehicle is safe and legal to drive, which can add up quickly without proper coverage.

- Tire damage: Finding your tires slashed or stolen leaves you stranded and facing unexpected expenses. Beyond replacing the tires themselves, you might need towing services, which may be available through your auto policy if you have roadside assistance coverage.

Does car insurance cover vandalism?

Yes, car insurance typically covers vandalism damage — provided you have comprehensive coverage on your policy. While collision coverage helps repair your car after accidents with other vehicles or objects, comprehensive coverage steps in for non-collision incidents like vandalism, theft and weather damage.

Understanding these differences can help you make better decisions about your coverage needs. Here is how the two compare:

| Coverage type | What it covers | Examples of coverage | Important notes |

|---|---|---|---|

| Comprehensive | Non-collision damage | Vandalism, theft, falling trees, hail, floods and fires | Does not cover personal belongings inside the car. This coverage is optional unless required by a lender. |

| Collision | Damage from crashes and at-fault accidents | Hitting another car, a telephone pole, guardrail, etc. | Does not cover non-collision damage. Also optional coverage unless required by a lender. |

| Roadside assistance coverage | Towing and minor mechanical services for stranded drivers | Battery replacement, spare tire installation, towing and more | This is sometimes available as a policy endorsement. May be helpful if your vehicle is nonoperational due to vandalism |

| Rental car reimbursement | Cost of a rental car, up to your policy limits, while your vehicle is being repaired following a covered claim | Rental car while your vehicle is having a panel replaced after someone keyed your car | This is sometimes available as an endorsement, but is only available if your car is being repaired after a covered claim |

While comprehensive coverage isn’t mandatory unless you’re financing or leasing your vehicle, it could still be a smart investment — especially if you live in areas with higher vandalism rates or extreme weather conditions.

Also, keep in mind that neither comprehensive nor collision coverage protects personal items stolen from your car — that’s where your renters or homeowners insurance comes in. If you are unsure about the depth of your current coverage, talking to your insurance agent can help you find some clarity.

Do I have to pay a deductible if my car is vandalized?

If your car insurance policy includes comprehensive coverage, it will cover damage caused by vandalism minus your car insurance deductible. Depending on your state and insurance provider, a comprehensive deductible can range from zero to $2,500. The most common option selected is usually between $250 and $500.

If you aren’t sure whether your policy includes comprehensive coverage, check the policy details listed on your declarations page, which usually appears at the beginning of your insurance policy packet. You can also call your agent or insurance company to clarify what is covered.

How to file a vandalism claim

Insurance claims for vandalism should be filed as soon as possible after you notice the damage. You may need to file a police report, though, before filing a claim with your insurer. To make sure the claims process goes smoothly, it’s important to know the general steps involved in filing a car vandalism claim.

Pro tip

Am I required to report damage from vandalism to my insurance company?

The decision to file an insurance claim for vandalism is personal and depends on several factors. Unlike car crashes that may involve property damage or injuries, you are not legally required to contact the police or your insurance company. However, if you have a car loan or lease your vehicle, you are likely contractually obligated to repair it.

Another factor to consider is the amount of your comprehensive deductible versus the repair costs. If repairs are not cost-prohibitive, you can forgo using insurance and pay for the repairs yourself. Also, if the repair costs are lower or somewhat even with your deductible, filing a claim wouldn’t benefit you since the cost would be the same.

Does vandalism raise your insurance rates?

Any car insurance claim could potentially raise your insurance rates, but comprehensive claims for vandalism typically trigger much smaller increases than, say, a collision claim for an at-fault accident. If and how much your insurance goes up depends on multiple factors, including your insurance claims history and your insurer’s underwriting process.

Drivers who have filed several claims (small or otherwise) are likely to be deemed “risky” and may see a bigger increase.

A good example is the sudden increase in the theft of Kias and Hyundais that began in 2022 after a social media video showed how easy it is to steal these vehicles due to their lack of an engine immobilizer — a standard manufacturer-installed theft deterrent in most cars sold in the U.S. in the past decade. Some carriers raised comprehensive rates significantly for affected models or stopped insuring these vehicles altogether.

Even if you’ve never personally filed a vandalism claim, a high rate of vandalism or theft in your ZIP code could cause your rates to be higher.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does car insurance cover flooding damage?

Does car insurance cover scratches and dents?

Does car insurance cover windshield replacement?

Does car insurance cover keyed cars?