Does car insurance cover theft?

Car theft is an unfortunate reality, and while modern security features have improved, thieves continue to find ways to bypass them. If you’re concerned about your car being stolen — or dealing with the aftermath — understanding how car insurance comes into play can help. Not every policy includes coverage for stolen vehicles, so understanding which type of insurance protects against theft and what steps to take if it happens can make a big difference.

Here’s what you need to know about car insurance and theft — what’s covered, what’s not and how to handle a stolen vehicle claim.

Does car insurance cover vehicle theft?

Car insurance can cover theft, but only if your policy includes comprehensive coverage. If your car gets stolen and isn’t recovered, this coverage helps pay for a replacement. But if you only have liability insurance, theft won’t be covered — liability only kicks in for damages or injuries you cause to others, not your own vehicle.

If your car is stolen, comprehensive coverage will pay out its actual cash value (ACV) at the time of the theft, minus your deductible. However, since vehicles depreciate over time, the payout might not match what you originally paid. If you’re still making payments on a loan or lease, gap insurance can step in to cover the difference between what you owe and your car’s ACV — so you’re not stuck paying for a car you no longer have.

Does car insurance cover items stolen from your car?

The type of policy you have, the coverage you choose and your insurance company will determine if your car insurance will cover items stolen from your car. Typically, your comprehensive coverage covers permanently installed items if they are stolen from your car, such as:

- Radios

- TVs in the headrests

- Navigation system

- Custom wheels (additional limits may apply)

- Vehicle battery

- Catalytic converter

If you have aftermarket items installed in your car, like rims, a stereo or a custom paint job, you may want to consider custom parts and equipment coverage. Companies like Progressive offer this optional endorsement but be prepared to provide details and receipts at the company’s request.

Items not permanently installed, like clothes, a laptop, phone or camera left in the vehicle, are not covered by your auto insurance unless the company offers special coverage that you add to your policy before the incident occurs.

For example, Erie offers personal items coverage, which will pay up to $350 for personal items stolen from the vehicle. Without this type of coverage — which is rarely offered — your home or renters insurance policy would typically cover these items stolen from your vehicle, subject to that policy’s deductible. It’s worth noting that if someone damages your vehicle while breaking into it, like busting out a window to get to your personal items, damage to your vehicle would still be covered by comprehensive coverage in most scenarios.

What to do if you are a victim of theft

Having your car stolen is stressful, but acting quickly can make a huge difference in recovering it and getting your insurance claim processed smoothly. Whether your vehicle was stolen outright or later found damaged, following the right steps can help you maneuver through this situation a bit easier.

What to do if your vehicle has been stolen

Before jumping to conclusions, rule out other possibilities:

- Was it towed for a parking violation?

- Could your lienholder have repossessed it due to missed payments?

- Was it impounded for any reason?

If none of these apply, it’s recommended you take the following actions as soon as possible:

- Report the theft to the police: Call law enforcement and provide details like the make, model, year, VIN, license plate number and any unique features. If your car has a GPS tracker like LoJack or OnStar, let the police know — it might help them track it down faster.

- Notify your insurance company: Contact your car insurance company as soon as possible. Have your police report number ready and provide all requested details to start your claim.

- Inform your lender or leasing company (if applicable): If you’re financing or leasing, your lender needs to be in the loop, as they may coordinate with your insurer.

- Check for security footage: If your car was parked near surveillance cameras or doorbell cams, ask for any footage that might show the theft in progress.

- Monitor online listings: In some cases, stolen vehicles or their parts end up for sale online. Keep an eye on resale platforms and report anything suspicious.

What to do if your theft claim is denied

Insurance claims don’t always go smoothly, as one Reddit user learned when their mother’s 2017 Lexus ES 350 was stolen and totaled — and initially denied coverage by their car insurance provider. The reason? The insurer argued there was “no evidence” of theft, citing the car’s intact ignition and factory-installed engine immobilizer that should have prevented unauthorized access to the car. Worse, the insurer hinted at possible fraud, referencing policy clauses that exclude coverage in cases of misrepresentation.

Frustrated but determined, the policyholder took these steps to fight the denial:

- Secured additional proof: A neighbor’s Ring camera confirmed the car was stolen in the early morning hours.

- Filed a complaint: They escalated the issue with their state’s department of insurance, which forced the insurer to revisit the claim.

- Challenged the denial: They kept pushing, eventually leading to a full payout for the totaled car.

The lesson in this is to not assume that just because a claim is denied, that it is the final decision. Insurers can make mistakes. So, if you believe your claim is valid, following similar steps like the Reddit user took, could help you validate your claim. If you can’t break ground on your own, considering legal help could help you expedite the process.

What to do if your personal items have been stolen

If your personal belongings are stolen from your car, the first step is figuring out which insurance policy — auto, homeowners or renters — might cover the loss. Most auto insurance policies only cover factory-installed features, like built-in navigation systems, while personal property such as laptops, bags or clothing is typically covered under a home or renters insurance policy. Here are a few steps you can take after a theft:

| Step | What to do | Why it matters |

|---|---|---|

| Check your coverage | Contact your auto insurer to see if personal items are covered. If not, check with your home or renters insurance. | Auto insurance typically only covers permanently installed items. Personal belongings are likely covered by home or renters insurance. |

| Evaluate deductibles vs. costs | Compare replacement costs of stolen items and vehicle repairs against your deductibles. | If costs are close to or lower than your deductible, paying out of pocket may be more cost-effective to avoid potential premium increases. |

| Understand coverage limits | Ask your home/renters insurer about category limits for valuables like electronics, jewelry or cash. Consider scheduled personal property coverage for high-value items. | Standard policies often cap payouts for certain items. Adding extra coverage can prevent gaps in protection. |

| Document and report the theft | File a police report for stolen items, especially if the theft involved forced entry. Take photos of vehicle damage and keep receipts for stolen belongings. | Proper documentation helps with the claims process and may be required by insurers. |

How to prevent car break-ins

There are ways to help prevent the risk of theft of your vehicle or personal items, whether the car is parked in your driveway or a parking lot. Besides not leaving items in plain sight (or in your car at all), here are some ways to prevent car theft:

- Park in well-lit areas or under a streetlight

- Park in a locked or security-manned garage

- Place a spotlight or motion-activated light over your driveway

- Buy a car with a vehicle recovery system or have one installed

- Photograph your car and record identifying details

- Install an audible or visible alarm device

- Use a steering wheel lock or other anti-theft device that physically prevents the car from being driven

- Keep the doors locked at all times and activate the alarm using your key fob, if applicable

- Roll up windows and never leave the key or fob in or around the vehicle

Certain theft-prevention measures, like an anti-theft device or parking the vehicle in a locked garage, may also save you money on your car insurance policy. In addition to reducing the risk of filing a theft claim and increasing your premium, you may earn a discount for having these preventative measures. Ask your insurance agent or company what anti-theft discounts might be available to you.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does homeowners insurance cover appliances?

Can car insurance companies deny coverage?

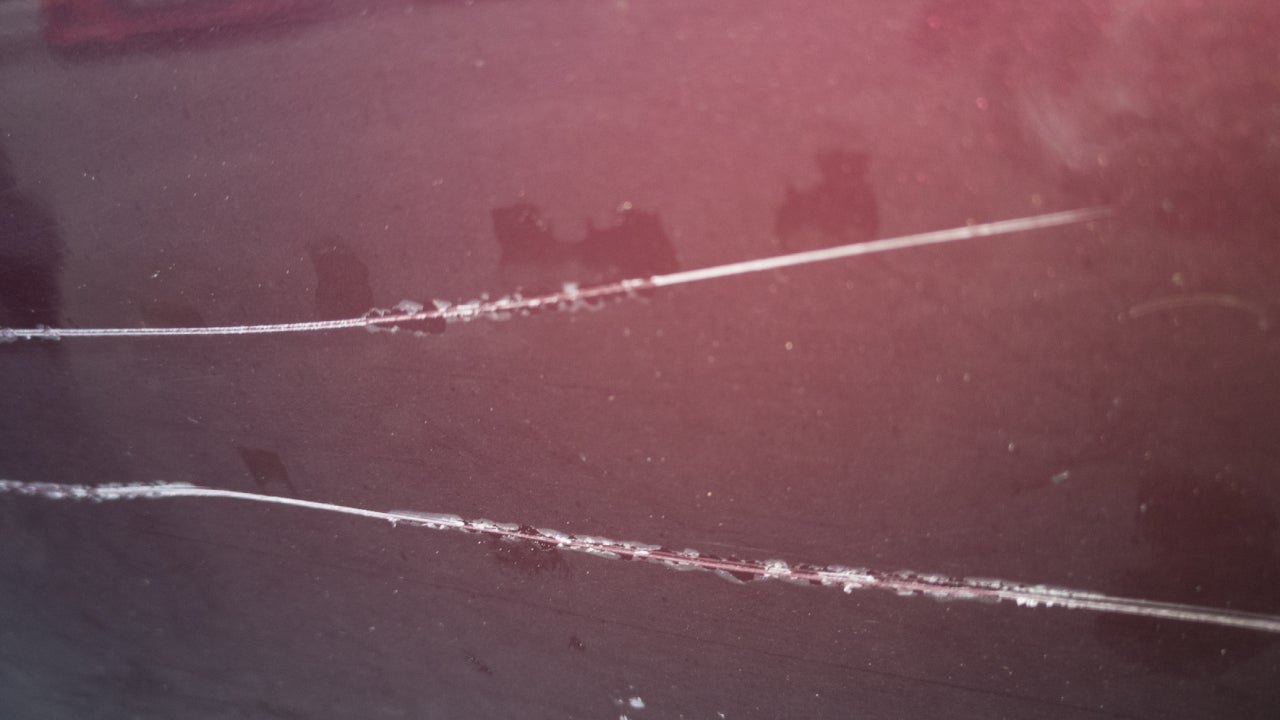

Does car insurance cover scratches and dents?

Does car insurance cover keyed cars?