Can car insurance companies deny coverage?

Can a car insurance company refuse to insure you? Yes, there are several reasons why a car insurance company can deny coverage, but if you are turned down by one company, you may still have options for coverage. Every carrier has its own rules about who it will cover, so if one company denies you coverage, you may still have options.

Can car insurance companies deny coverage?

Yes, car insurance companies can deny coverage to any driver who presents a higher risk than they are willing to assume. This may be the case if you have multiple moving violations on your record, for example. Regional regulations, which vary from state to state, may also play a role in determining who can and cannot be denied coverage. Some states, for example, prohibit carriers from denying coverage based on age, gender or credit rating.

To find the best coverage for your needs, consider asking for quotes from a range of insurers. Since each company has its own proprietary method for determining rates, you are likely to end up with a number of potential rates. This may be especially important if you have rating factors that make you a more high-risk applicant.

Reasons you may be denied car insurance

You may have your insurance application denied for a variety of reasons, many of which are tied to personal factors:

- You have several moving violations and a less-than-perfect driving record

- Your license has been suspended or revoked

- You drive a fast, high-performance vehicle

- You are too young to buy your own insurance policy

- You live in an area with a high number of vandalism incidents and car thefts

- You have a lapse in coverage

- You lack a previous insurance record

We recently found a thread on Reddit where a user was complaining about losing coverage:

“So back in January my car got totaled (not at fault), and I ended up cancelling my policy with Liberty Mutual, since I didn’t have a car. Obviously now I know that that was a horrible decision to make. I still don’t have a car yet, but I’ve been trying to get a new non-owners (or whatever they are called) policy, but every place I try to get quotes from denies me, even Liberty Mutual even though I’ve had them before. What are my options right now to get insurance? I know I’m more than likely going to have to pay a big premium, but I’m close to being able to get another car again so I need it asap. I’m in Pennsylvania if that helps.”

Other users seemed to have similar experiences, with one suggesting calling an independent broker who can help shop for companies. Another user had a good experience using Carvana’s car insurance.

What do I do if I am denied coverage?

Almost every state requires drivers to carry a minimum amount of insurance to drive legally. Even if you are denied coverage through traditional insurance options, you are still expected to find and purchase at least minimum coverage through a provider, such as a high-risk insurer. If you are involved in an accident or caught driving without insurance, there may be serious financial and legal consequences for not having coverage.

If you find your car insurance coverage denied by a standard carrier, you might want to contact high-risk insurance companies. High-risk insurance companies have different underwriting guidelines, and while they may not be the cheapest option, you might be more likely to get approved for coverage.

You could also consider asking a family member to add you as a driver to their policy, but this may only be an option if you live with them. However, depending on your relationship, you might not be able to add your vehicle to their policy (especially if you’re the sole owner). There’s also no guarantee that you will meet your family member’s carrier’s underwriting guidelines. If you don’t, it may also deny you coverage.

Several states, including California, New Jersey, Hawaii and Maryand, have low-income car insurance programs. If you are a driver in one of these states and are having trouble finding coverage, you may be able to qualify for affordable coverage through your state’s programs. They differ from each other, however. In California, for example, your income must fall within 250 percent of the federal poverty level. New Jersey, meanwhile, has “dollar a day” insurance, with a premium capped at $365 a year, for anyone who is enrolled in Medicaid.

Carriers that may extend coverage to high-risk drivers

If you’ve been denied coverage from several carriers, you may need to seek other options. Fortunately, several national carriers may be more willing to extend coverage to high-risk drivers.

Progressive

Progressive Insurance offers SR-22 certificates when needed and has a broad array of discounts to help you keep premium costs in check. It also offers robust coverage options that range from rideshare coverage to loan/lease payoff insurance. If you prefer to do your insurance business online, it has good digital functionality through the website and highly rated apps for Android and Apple products.

Allstate

If you’re looking for incentives to improve your driving record, Allstate may be another good option. The carrier’s Safe Driving Bonus may reward you with a check or credit to your insurance policy for every six months without an accident. The carrier also offers a robust telematics program, Drivewise, that may lower your rate for passing safe driving challenges. Unlike some other high-risk auto insurance companies, Allstate offers a fairly comprehensive list of endorsements that may appeal to drivers looking to customize their coverage.

The General

The General is a national insurance provider specializing in high-risk drivers’ coverage. It also offers quotes and possible coverage for drivers who need SR-22 filing. As a high-risk insurance company, The General’s average rates may be high for drivers with multiple incidents on their driving record or other high-risk rating factors. However, you may be able to lower your rate with potential discounts for taking a defensive driving course, being a good student, owning a home and more.

Geico

Geico is the 2025 winner of a Bankrate Award for Best Auto Insurance Company for High-Risk Drivers. The company has low average rates for drivers with moving violations in their record, and a generous list of potential discounts may make further savings possible. It advertises SR-22 certificates for those who require them, and may be more willing to work with drivers who have speeding tickets, DUI convictions and other driving infractions. Ultimately, you’ll need to ask for a personalized quote to see if the carrier is willing to insure you.

How to avoid being denied car insurance coverage

If you’re concerned about the potential for being denied in the future, or if you’ve got a past denial and want to be sure it doesn’t happen again, there are several strategies you can adopt to help make you more desirable as a potential policyholder to carriers. Consider the following:

Drive safely

Although insurers consider multiple factors when determining whether to insure you, perhaps no factor is more important when determining your premium than your driving record. A clean record will likely earn you a favorable rate that may be below average in your region. If you are making an effort to drive carefully and safely, you may even want to consider enrolling in your insurer’s telematics program, which could reward you with significant discounts for avoiding hard stops, speeding and other risky behavior.

Consider a defensive driving course

Got some marks on your license, but you’re ready to turn over a new leaf behind the wheel? Many insurers offer a discount to drivers who participate in a state-mandated defensive driving course. In some cases, these courses are even available online so that you can take them from the comfort of your home. Generally, there is a small charge for the course, but they are usually inexpensive, and you’re likely to more than make up the difference when you factor in your anticipated discount.

Work on your credit score

In most states (California, Hawaii, Massachusetts and Michigan are the exceptions), insurers can consider your insurance credit score when determining rates. Insurance companies often give preferential rates to those with high scores since they are statistically less likely to file claims, making them more low-risk to insure. Is your credit score on the low side? It doesn’t happen overnight, but you can improve your score over time by paying bills on time and keeping your credit utilization ratio low.

Think carefully before buying a car

If you were denied coverage because your car is considered too high-risk, you might want to consider a different vehicle. By choosing wisely, you may find a car that is likely to be very insurable at a relatively low cost.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does car insurance cover theft?

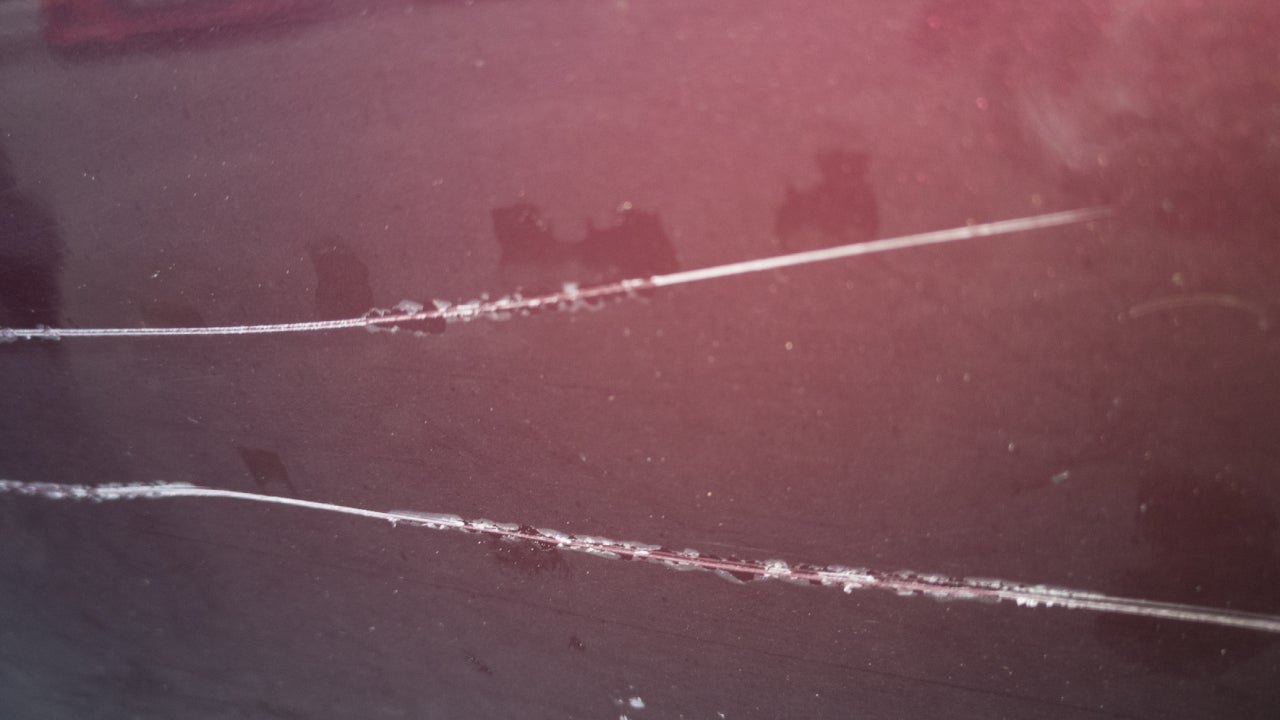

Does car insurance cover keyed cars?

Are car insurance rates negotiable?

What to do if a car insurance company denies your claim