The best home remodels for aging in place: making modifications to fit your needs as a senior

Key takeaways

- Home modifications – renovations and remodels geared towards seniors — can help people age in place, living independently for longer and in safety.

- Aging-in-place modifications can range from simple, inexpensive upgrades to larger-scale, bigger-budget projects that make the home more accessible.

- Financing for home modifications can come from the equity seniors have built in their homes, personal loans and public or private housing assistance programs.

As they get older, many — even most — Americans prefer to remain in their own homes as long as they can, or “age in place.” But to do that, many will need to make their residences safer and easier to navigate by making home modifications.

Home modification is the official term (taken from the Americans with Disabilities Act) for renovations and remodels geared towards the aged or the impaired. It means physically changing your home, removing potential hazards and making it more accessible, so you can continue living in it independently. Examples include anything from installing a shower bench to an entire ground-floor primary suite, so you don’t have to walk up and down stairs.

Home modifications can be expensive, typically ranging from $3,000 to $15,000, with the average spend nationally being $9,500, according to Fixr, the cost-quoting site that connects home remodelers with licensed service professionals. But it can be a worthwhile investment, especially if the only other option is moving into a facility.

The reality is that assisted living or a retirement community, depending on the level of care provided… can be quite expensive.— Mark Hamrick, Bankrate Senior Economic Analyst and Washington Bureau Chief

Here’s what you need to know — for yourself or for loved ones — about making the right kinds of home modifications for aging in place.

Types of home modifications for aging in place

The best aging-in-place home modifications align with “universal design,” an architectural term for features that are easy for all to use and adaptable as needs dictate. This includes additions and changes to the exterior and interior of a home.

Simple home modifications

These can often be DIY jobs.

- Adding easy-grip knobs and pulls, swapping knobs for levers

- Installing adjustable handheld shower heads

- Rearranging furniture for better passage

- Removal of trip hazards such as carpeting or floor saddles

- Installing mats and non-slip floor coverings

More complex home modifications

Most of these probably would need a professional contractor, especially if you want them done correctly and up to code.

- Installing handrails

- Adding automatic lighting outdoors

- Installing automatic push-button doors

- Smoothing out flooring

- Installing doorway ramps

Home modifications by room

- Bathroom: Grab bars and railing, non-slip flooring, curbless shower, roll-in tub, shower bench

- Kitchen: higher countertops, lever or touchless faucets, cabinet pull-out shelves

- Bedroom: bed lower to the ground, non-slip floor, walk-in closets, motion-activated lights

- Outside the house: ramps, porch or stair lifts, automatic push button doors

- Throughout the house: well-lit and wider hallways and doorways, first-level primary suite, elevators or chair lifts, “smart” window shades/thermostats/lighting, simpler windows

66%

Source: 2023 U.S. Houzz Bathroom Trends Study

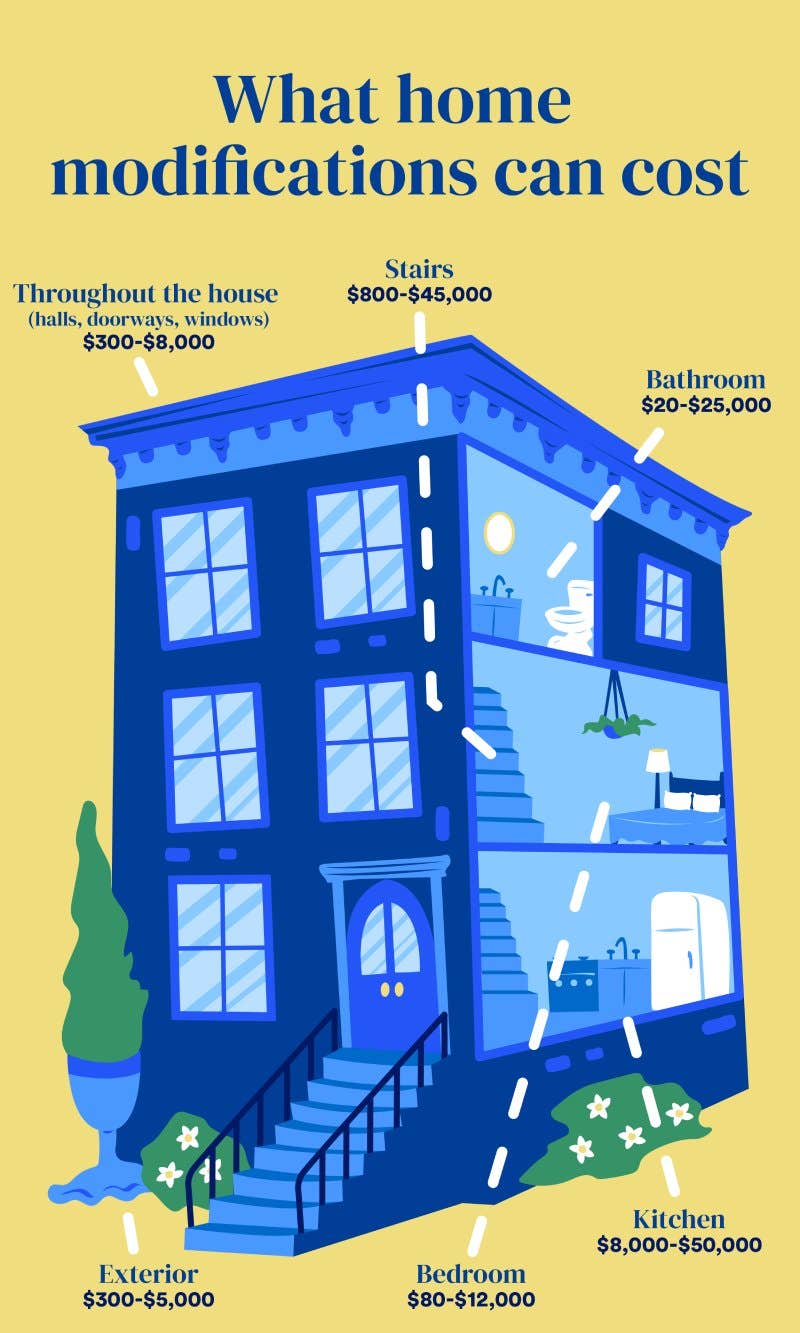

How much do home modifications cost?

Obviously, the costs of aging in place can range greatly, depending on the types of modifications you need to make: as little as $20 for a motion-sensor light, as much as $20,000 to raise a kitchen counter. While Fixr cites an average range of $3,000 to $15,000, you can end up spending as much as $50,000 or more, if you want to remodel your entire home or make significant structural changes to it.

Here are some costs for several of the most common types of aging in place modifications, according to Fixr:

- Grab bars: $90 to $300

- Open shelves: $400 to $600

- Wider doors: $300 to $2,500

- Wider hallways (without structural changes): $800 to $1,400

- Ramps: $1,400 to $3,000

- Curbless shower: $2,500 to $9,000

- Walk-in tub: $3,000 to $25,000

- Stairlift: $4,000 to $8,000

Are home modifications tax deductible?

Some home modifications may qualify as medical expenses, and so be eligible for a deduction on your income tax return (you’d have to itemize deductions). A home modification may be tax-deductible as a medical expense if it is made to accommodate the disabilities, preferably documented by a physician or other health care provider, of someone who lives in the home, according to the IRS.

7.5%

Source: Internal Revenue Service

What counts as a home modification for tax purposes? As the IRS outlines, capital expenditures for installing special medical equipment or making reasonable home alterations to accomodate a health or medical issues can be fully tax-deductible, as long as they don’t add to the property value.

Permanent home improvements that do increase the value of your property may still be partially deductible as a medical expense — the cost of the improvement minus the increase in the property value is the amount that can be considered.

How do home modifications affect home value?

Speaking of increasing property value: Like home improvements, home modifications can increase the functionality of the home and the quality of life for those residing there. Whether they increase its worth is another story.

Sometimes a home modification overlaps with a fashionable home renovation: Lots of homeowners are swapping bathtubs for super-sized, curbless showers, going in for remote-controlled window shades or installing smart security systems these days. But in many cases, the changes may not enhance property value if the alterations aren’t permanent — or if they mean the new homeowners will have to make significant alterations when they move in.

Overall, aging-in-place remodels can positively impact (or at least maintain) home value if the modifications involve state-of-the-art tech and/or look stylish — vs. giving off an institutional or medical vibe. Rather than scream “earmarked for the elderly,” they should appeal to all ages. And of course, they should be, and look, well-done.

“As our survey data indicates, a cross-section of the population lacks sufficient funding for retirement,” says Mark Hamrick, senior economic analyst and Washington bureau chief for Bankrate. “The reality is that assisted living or a retirement community, depending on the level of care provided, if any, can be quite expensive.” And these costs are ongoing — as opposed to the one-time expense of home modifications. “The housing component of affordability is just one to be balanced along with caregiving, and the cost of health care, among others,” Hamrick adds.

How to pay for home modifications

There are a number of ways to pay for home modifications. You may choose to borrow against the equity you’ve built in the property, or you could choose another sort of financing.

- Home equity line of credit – If you own a good portion of your home outright (as opposed to owing a lot on a mortgage), you can use it to establish in a home equity line of credit (HELOC). HELOC interest rates tend to be lower than those of unsecured personal loans, since your home is collateral for the loan, and you can draw funds from it on an as-needed basis.

- Home equity loan – A home equity loan also consists of funds borrowed against the equity you’ve built in your home, only they’re released in a lump sum, which you repay in installments. Like HELOCs, home equity loans tend to have relatively lower interest rates because your home backs the debt. With both a home equity loan and a HELOC, you can deduct the interest on up to $750,000 of the loan if the funds are used to “substantially improve” your home, according to the IRS.

- Personal loan – Best for those with good credit, a home improvement loan — a type of personal loan — from a bank, credit union or online or peer-to-peer lender generally doesn’t require a lien to be placed on the home.

- Reverse mortgage – If you’re 62 or older and own your home outright (mortgage paid off), you may be eligible for a reverse mortgage, which converts a portion of your equity to cash while allowing you to continue living in the home. You don’t make monthly repayments; the debt’s due only when you sell or permanently vacate the home.

- State housing finance agency loans – State agencies often offer financial assistance for seniors, as do nonprofit organizations such as Rebuilding Together. There are also funds that may be available through the Older Americans Act, distributed by Area Agencies on Aging (AAA). Often, there are income-limit requirements. Check for an HFA in your area to learn your options.

When should I make home modifications?

Getting older is a process, so it’s likely you’ll need to adapt your home more than once as your needs change. You can make changes gradually or all at once, if finances allow. Sometimes it’s more cost-effective to add aging-in-place home modifications as part of other planned renovations, such as building an addition or remodeling a kitchen.

Keep in mind that as technology evolves, you may identify and invest in assistive tools in the future that haven’t even hit the market yet.

Bottom line on remodels for aging in place

Making modifications and other accessibility upgrades to a home can help seniors and retirees age in place more comfortably and safely. They can also boost property value, when done professionally in conjunction with general renovation projects.

Admittedly, aging-in-place remodels can get expensive, a valid concern for those on or near to fixed retirement incomes. But there are various financing options, including ones that tap the homeowners’ equity — something that seniors and retirees often have in abundance. Also, “what not everyone considers is that you can save money by doing the right home modifications,” says DeDe Jones, a certified financial planner and managing director of Innovative Financial in Lakewood, Colorado. “The longer you can safely live in your home, the less you will need to pay for assisted living care, something that is not cheap.”