The state of Black homeownership in 2025

When my husband and I bought our home in 2004, the social significance was not lost on us. We were among the millions of households who purchased homes that year, pushing Black homeownership and overall homeownership to record highs. An improving job market, low mortgage rates and looser lending standards made homes affordable for more Americans, especially Black Americans.

Yes, it was a milestone, but that milestone was incredibly deceptive. Black homeownership hit an all-time high of 49.7 percent of the U.S. Black population in 2004, adding up to more than 18 million households. However, that was still well below the national homeownership average, which peaked at 69.4 percent that same year. And not much has changed since: As of Q4 2024, the Black homeownership rate was 46.4 percent, vs. 65.7 percent for the U.S. overall.

What’s more, the percentage of black homeowners has consistently trailed that of every ethnic group tracked by the Census Bureau: Hispanics, Asians and, of course, whites.

Black homeownership has remained stubbornly low for a variety of reasons: a history of discrimination, lower wealth accumulation, unequal access to mortgages, and high housing/financing costs. Black History Month seems an appropriate time to examine why the American Dream of homeownership remains elusive for many Black Americans.

Housing discrimination thwarts Black homeownership

The road from being property to the ability to own property has not been an easy one for Black Americans. After slavery ended in 1865, the Civil Rights Act of 1866 gave Black people the right to buy, own and sell homes. By 1900, 20 percent of the Black population were homeowners, compared to 46 percent of whites – remarkable progress for a formerly enslaved people.

Throughout the 20th century, however, that progress was hobbled. Weak enforcement of the Civil Rights Act, the passage of Jim Crow laws, and systemic racism have all combined to keep the disparity in Black and white homeownership consistently broad. Black homeownership has been held back – not just by social prejudice, but by government-sponsored discriminatory policies and practices.

The destructive impact of redlining

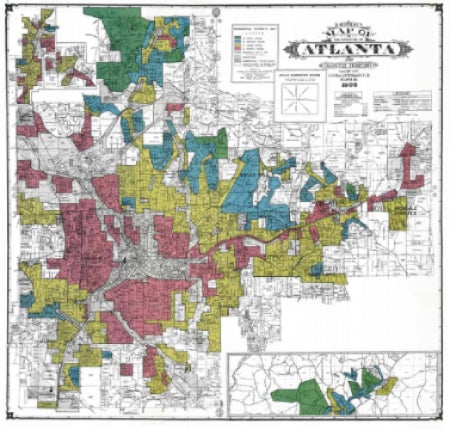

For decades, the practice of redlining blocked Black people and other minorities from being able to purchase property. In 1938, the government-backed Home Owners’ Loan Corporation (HOLC) created color-coded maps to assess lending risk in specific neighborhoods. Red lines were drawn around predominantly Black and minority neighborhoods, deeming the highlighted areas “hazardous” – essentially warning off lenders from financing properties there.

“This did two things: the first one is it limited the ability of Black people to get a mortgage in order to purchase a home,” says Michael Neal, senior fellow at the Urban Institute. “It also limited the amount of investment that was going into that community. That matters ultimately, not just to homeownership, but to the value of the home. It matters for the value of the community, of the other businesses and other types of potential activity that could have occurred in those communities.”

Some historians have argued that HOLC’s color-coded maps just recreated assessments already being made by local banks, appraisers and other real estate professionals. However, there’s evidence that the Federal Housing Administration (FHA) had its own discriminatory grading system for lending, according to a 2021 working paper published by the National Bureau of Economic Research. From the early 1930s — prior to the HOLC maps — the FHA did not insure mortgages in low-income urban neighborhoods predominantly inhabited by Blacks. Remember: This was a New Deal organization established to boost the economy and increase homeownership opportunities for all Americans.

According to 2017 research from the Federal Reserve Bank of Chicago, not only did redlining reduce Black homeownership rates in the decades after it was banned, but it also depressed house values and rents in the targeted neighborhoods, and increased racial segregation. And, while now illegal, redlining is by far a vestige of the past. As recently as 2024, the Department of Justice announced reaching settlements with at least two lenders on allegations they engaged in redlining against Black communities.

Post-war restrictive covenants

“Redlining is an example of how we’ve used federal policy to disadvantage black people, but by no means was it the only tool used to lessen the value or to devalue Black people overall,” says Andre Perry, senior fellow and director of the Center for Community Uplift at Brookings.

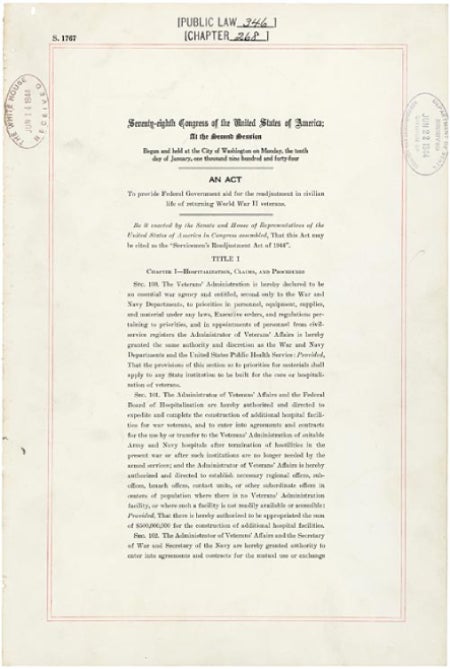

Other tools included restrictive covenants and zoning laws that literally made it legal to bar non-whites from buying homes in certain communities and private developments. It’s those same covenants that would thwart Black World War II veterans from fully benefiting from the low-interest home loans offered through the Servicemen’s Readjustment Act of 1944, aka the “GI Bill of Rights.” Even with financing, they couldn’t purchase homes in many of the new suburban neighborhoods springing up.

Not that getting the financing was easy, either. While the GI Bill did not explicitly exclude Black veterans, it was rife with discrimination: One research paper estimates that the Act could have created 400,000 Black homeowners if the government fairly implemented it.

Overall, Black veterans received fewer mortgages than any other racial group. As a result, Black households didn’t participate in the post-war housing boom to the same degree as their white counterparts. By 1960, almost 65 percent of white people owned their homes, compared to 38 percent of Black people. That 20-to-30 percentage point disparity has existed ever since.

Subprime mortgage fallout

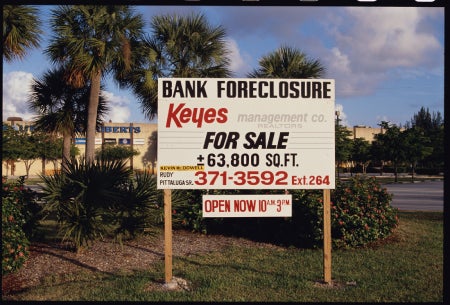

The 2006-07 subprime mortgage crisis delivered a severe blow to Black homeownership.

The early 2000s were marked by an expansion of credit for borrowers with below-average credit histories. Lenders disproportionately targeted Black people with loans with predatory features. “Those mortgages oftentimes were what we now know as onerous,” says Neal. “They were often mortgages that did not require you to pay down any principal.” Partly as a result, Blacks bought homes during the peak of the housing bubble more than any other racial group.

So, when the housing market crashed in 2008, Black families bore the brunt of the impact. They experienced higher foreclosure rates and lost half of their wealth as homeownership rates fell. “For many Black homeowners, they wound up being underwater on their mortgage, owing more on the property than the value itself,” says Neal.

“Black Americans were more likely to have lost their job during this period. So they couldn’t even pay their mortgage, even if they may have wanted to. That meant that they were more likely to lose their home, which had already been stripped of all of its wealth.”

By 2019, the Black homeownership rate dropped to 40.6 percent, its lowest level ever.

The state of Black homeownership today

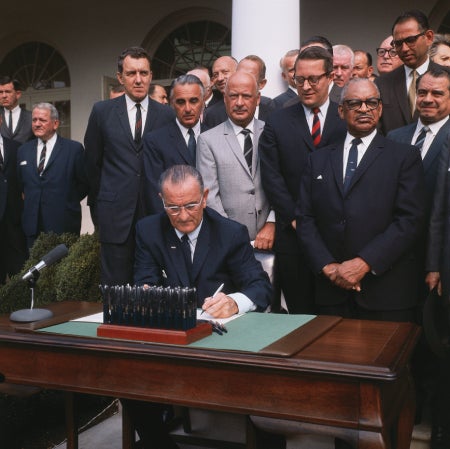

The Fair Housing Act of 1968, signed into law in the wake of Dr. Martin Luther King Jr.’s assassination, was intended to put an end to discrimination and unfair practices that locked Black Americans and other minorities out of homeownership. Yet, more than 50 years later, Black homeownership has never risen past 50 percent. Ironically, the Black-white homeownership gap is wider today than when the law passed: 46.4 percent vs. 74.4 percent.

“The Fair Housing Act certainly established a floor, but other factors that are hard to regulate, the attitudes and the perceptions, still persist,” says Perry.

Racial wealth gap

The racial wealth gap is at the heart of Black people’s homeownership challenges. The typical Black family has about six times less wealth than a comparable White family. In real numbers, this adds up to $285,000 for white families in 2022 and $44,900 for Black families, a difference of more than $200,000. This makes it next to impossible for them to save for the much-needed down payment.

Student loan debt is also crippling for Black families, who carry the highest debt burden compared to other racial groups. “We particularly see this with Black women who are the matriarchs of their families,” says Dr. Courtney Rose, president of the National Association of Real Estate Brokers (NAREB). “And guess what? When you go buy a house and try to qualify, that debt is right there” — and hardly helping the likelihood of approval.

Credit and financing challenges

No matter who you are, credit is critical to getting approved for a mortgage. For Black people, this has been an ongoing obstacle. According to the Urban Institute’s most recent data, Black and Native Americans have the lowest median credit score of all ethnic groups, with more than 40 percent of Black Americans falling into the subprime category.

“A lot of members of our community, through systematic racism and other things, have not built proper credit, [meaning] the credit score is too low to qualify,” says Rose. “Also, they don’t have any credit at all or they have what’s called thin credit, where it’s not strong enough to buy a home.”

NAREB’s State of Housing in Black America Report estimates that more than 2 million Black homeowners are mortgage-ready, meaning they have credit scores and financial profiles needed to purchase a home. Yet, even when controlling for credit scores and income, Black mortgage applicants are denied conventional mortgages at twice the rate as white people. “This points to the subjective nature of underwriting in this country and the perception of black people as being risky,” says Perry. “It’s seeing race as risk and not racism.”

Even if they do qualify for a mortgage, Black people are more likely to be housing cost-burdened. “The user cost of homeownership is significantly higher for Black homeowners,” says Neal. “If I’m a homeowner, I’m not just on the hook for the mortgage. I’m also on the hook for making updates to the home. Black homeowners are more likely to live in physically inadequate homes. They also typically will face relatively higher property tax assessments [compared to their homes’ values] in many areas of the country.”

How to close the Black homeownership gap

Boosting Black homeownership must involve tackling the root causes of the disparity: the legacy of discrimination, mortgage financing challenges, wealth disparities and housing affordability.

One way to level the playing field is through Special Purpose Credit Programs (SPCPs). SPCPs are credit assistance services designed for groups who are economically disadvantaged or who have experienced ongoing discrimination.

Perry also emphasizes that if zoning laws were reformed, it would improve the outlook for all aspiring homebuyers. “The single-family zoning ordinances really restrict increasing housing supply, which would help many low-wealth, low-income families find a home that they can afford,” he says. Additionally, there are Community Land Trusts (CLTs), a type of shared-equity ownership that allows homeowners to buy a home at a lower price because they are just buying the house, not the land. While CLTs are still relatively rare — totaling 308 in 2024 — they are becoming more common. Increasing their numbers could help.

Can we count on federal support?

Finally, if we really want to move the needle in Black homeownership, support from the government is essential. “We need federal agencies to weigh in because they’re the only ones with the amount of capital to really increase homeownership among low-wealth individuals at a scale,” says Perry.

Enforcement of the Fair Housing Act, in particular, is critical. While the number of fair housing complaints and those related to race or color increased in 2023, they are only a fraction of the incidents that actually occur. One of the biggest challenges is the inadequate funding for public and non-profit fair housing organizations, which process the majority of housing complaints.

Yet, I fear that enforcement could weaken as fair housing gets caught up in the Trump administration’s stance against diversity, equity and inclusion. As the ACLU points out, if civil rights protections of housing laws and other areas are decreased, it’s historically marginalized groups — like Black people — who stand to lose the most. Conversely, increasing Black homeownership lifts the overall economy and the nation’s collective wealth.

When I think about the four walls that make up my home, I am reminded of how much homeownership has meant to me and my husband. We’ve amassed over two decades of equity, housing wealth (and, of course, many memories), but we are by no means special. I want every person who wants to achieve homeownership to have the same opportunity as I did, regardless of their race or color. It’s time to make that a reality.

Questions, comments or thoughts about this article? Email me your feedback at lbell@redventures.com.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.