Cryptocurrency: What it is and how it works

Cryptocurrency is a kind of digital currency that is intended to act as a medium of exchange. Cryptocurrency has become popular in the last decade, in particular, with Bitcoin becoming the most widely tracked alternative currency. Typically, cryptocurrency is digital-only and does not have a physical form — that graphic on this page is just an artist’s vision of digital currency.

Cryptocurrency appeals to many people because of its ability to be managed without a central bank and therefore concerns around secrecy and subterfuge. It appeals because of its potential ability to hold value and not be inflated away by central banks that want to print money. It’s also very difficult to counterfeit due to the blockchain ledger system that manages the currency.

Cryptocurrencies have gained popularity in the investment world due to the significant appreciation seen by some coins since they were first introduced. Cryptocurrencies saw significant declines as the Federal Reserve raised interest rates in 2022, impacting speculative investments particularly hard. Bitcoin and Ethereum, two of the most popular coins, fell by more than 70 percent from their all-time highs in 2022, but recovered in 2023 and soared in 2024 when Bitcoin’s price first broke $100,000.

Here’s what cryptocurrency is, how it works and its significant risks.

How cryptocurrency works

Cryptocurrencies are produced, tracked and managed through what’s called a distributed ledger such as blockchain. In a distributed ledger, the currency’s movement is processed by computers in a decentralized network to ensure the integrity of the financial data and ownership of the cryptocurrency. Think of it like a giant never-ending receipt of all the system’s transactions that is being constantly verified by everyone who can see the receipt.

This decentralized system is typical of many cryptocurrencies, which eschew a central authority. That’s part of the appeal of cryptocurrencies such as Bitcoin – it keeps governments and central banks out of the currency system, reducing their interference and political maneuvering.

To this end, in some cryptocurrencies, the number of units of currency is limited. In the case of Bitcoin, the system is organized so that no more than 21 million bitcoins can be issued.

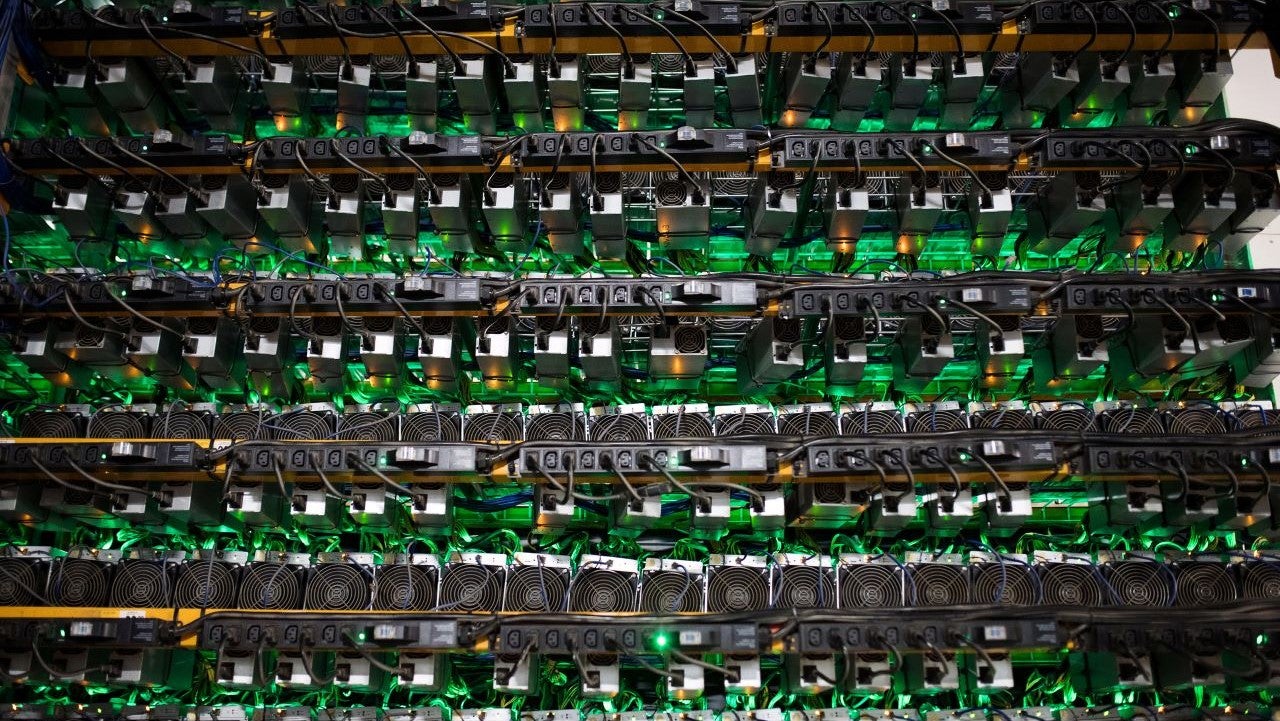

But how exactly does cryptocurrency come to exist? One key way is through what’s called mining, to use a metaphor related to the old monetary system based on gold or silver. Powerful computers, often known as miners, perform calculations and process transactions on the ledger. By doing so, they earn a unit of the currency, or at least a part of a unit. It requires a lot of expensive processing power and often a lot of electricity to perform these calculations.

Owners of the currency may store it in a cryptocurrency wallet, a computer app that allows them to spend or receive the currency. To make a transaction, users need a “key,” which allows them to write in the public ledger, noting the transfer of the money. This key may be tied to a specific person, but that person’s name is not immediately tied to the transaction.

So part of the appeal of cryptocurrency for many is that it can be used somewhat anonymously.

There’s literally no limit to the number of cryptocurrencies that could be created. The range of them is astonishing, and literally thousands of currencies popped up in the last few years, especially after Bitcoin soared into mainstream popularity in 2017. Some of the most popular cryptos include Bitcoin, Dogecoin, Ethereum, Tether and XRP.

A financial advisor can work with you to create a balanced portfolio that meets your short- and long-term goals — and Bankrate’s AdvisorMatch can help you connect with a CFP® professional.

List of the 10 largest cryptocurrencies

The size of a cryptocurrency depends on two factors: how many coins are in existence and the price of those coins. Multiply these two numbers together and you get the currency’s market capitalization, or the total value of all those coins. So when experts talk about the largest cryptocurrencies, this is the figure they’re referring to — not the price of an individual coin.

Here are the top cryptocurrencies and their approximate market cap, according to CoinMarketCap, as of mid February 2025. Given the volatility in cryptocurrencies, these numbers can fluctuate a lot even in a short period of time.

- Bitcoin – $1.9 trillion

- Ethereum – $330 billion

- XRP – $159 billion

- Tether – $142 billion

- Solana – $98 billion

- BNB – $94 billion

- USDC – $56 billion

- Dogecoin – $40 billion

- Cardano – $28 billion

- TRON – $20 billion

What is cryptocurrency used for?

A cryptocurrency can be used for a variety of different things, but it depends on what it was created for. While the term cryptocurrency conjures images of a payment system, it’s more useful to think of it as a token that enables you to do some action, like a token in a video arcade. You buy some tokens and feed them to the machine, and it allows you to play the game.

For example, Bitcoin’s purpose is to send money, enabling the crypto to function as a currency. But while it can function that way, very few merchants actually accept it as currency, and it’s actually relatively slow compared to other payment networks.

Similarly, the cryptocurrency Ethereum allows users to create “smart contracts,” a kind of contract that self-executes once its terms have been met. The cryptocurrency Internet Computer allows users to create apps, websites and other web-based services. Those digital currencies stand in contrast to Dogecoin, which was created literally to spoof the silliness around Bitcoin.

While these cryptocurrencies may have real-world use cases (or not), one of the biggest uses for them is as a means of speculation. Speculators drive the prices of these coins back and forth, hoping to make a profit from others who are similarly trading in and out of the assets.

Although the coins may enable a user to perform a certain action, many buyers are only interested in flipping them for a profit. For many, that’s the real use case for cryptocurrencies.

Can you convert crypto to cash?

Cryptocurrencies can be relatively easily converted into regular currency such as dollars or euros. If you own the currency directly, you can trade it via an exchange into fiat currency or into another cryptocurrency. Typically you’ll pay a significant fee to move in and out, however.

But you may also own crypto through a payment app such as PayPal or CashApp, and you can easily trade it for dollars. You may even be able to use a Bitcoin ATM to access dollars.

Those who own crypto via Bitcoin futures can readily sell their positions in the market when it’s open, though you’ll want to look for the best brokers for crypto if you’re trading regularly.

But if you need to access your money immediately, you’ll have to take whatever price the market offers at that time, and it may be a lot less than what you’ve paid for it. The volatility in crypto is even greater than for other high-risk assets. On top of that, there are often substantial fees for moving in and out of the market, and you’ll face tax implications from doing so.

Biggest risks of cryptocurrency

While proponents have a good story to tell about digital currencies such as Bitcoin, these currencies are not without serious risks, at least as currently configured. That doesn’t mean you can’t make money by selling them to someone else at a higher price than you paid. However, some drawbacks do make Bitcoin and other currencies virtually useless as a currency, a means of exchange.

Bitcoin and other cryptos have real detractors, including some of the world’s top investors, such as multi-billionaire Warren Buffett. Buffett has called Bitcoin “probably rat poison squared,” while his longtime business partner Charlie Munger has said cryptocurrency trading is “just dementia.” Buffett said in 2022 that he wouldn’t buy all the Bitcoin in the world for $25 because, unlike stocks, real estate and farmland, it doesn’t produce anything for its owners.

Some of the biggest risks of cryptocurrency include the following issues.

Mining the currency is expensive and polluting

One of the most significant negatives to cryptocurrency is that it is “mined” by computers. Mining isn’t free, of course, and requires substantial amounts of energy to create a coin. While miners consume and pay for energy to run their rigs, it also creates significant pollution and waste.

If Bitcoin were a nation, it would use more electricity than Poland (a nation of 36.8 million people) as of late 2024, according to the Cambridge Bitcoin Electricity Index. In terms of greenhouse gas emissions, it would place 61st.

This high use has generated backlash from those who see cryptocurrency as a frivolous use of energy in the midst of a climate emergency.

The supply of some cryptocurrencies is fixed

Proponents of Bitcoin tout the currency’s fixed number of coins as a positive, saying that it will ensure that the currency cannot be devalued, for example, by central banks. However, by limiting the total amount of currency, cryptocurrency would act like a gold standard, exposing an economy to potentially destructive deflationary spirals, if implemented on a widespread basis.

When money flows freely in an economy during a boom, no problems may arise. But when times get tough, consumers and businesses often hoard money to provide a buffer against instability and job loss. By hoarding, they slow the movement of money through the economy, potentially leading to a destructive deflationary spiral. At its worst form, consumers end up not spending, because goods are expected to be cheaper tomorrow, plunging the economy into crisis.

This problem is exactly why modern countries have moved away from the gold standard and to fiat currency. Free from the gold standard, central banks can increase money flowing through the economy in tough times, even if consumers and businesses hoard it, preventing the economy from seizing up.

A volatile currency is unusable

The limited number of coins, speculative mania and a good story have combined to make the price of Bitcoin and other digital currencies volatile. That may be fine if you’re looking to trade them, but it makes them useless as currency. Currency is valuable only if consumers can rely on it to retain purchasing power.

Imagine going to a restaurant where your meal costs $10 one day but $20 the next. You might be tempted to spend only on the days when your meal is cheap, but economies as a whole can’t function like that. Instead, they need a medium of exchange that is stable, so participants can trade one thing for another and can understand the value of what they’re trading.

So to the extent that Bitcoin and other cryptocurrencies are great for traders — that is, they’re volatile — they’re terrible as a currency.

Regulation and access to crypto can vary

Cryptocurrency is also subject to government regulation, which may hurt the prospects of some digital currencies, though it may also help them, depending on the scope of regulations.

Government regulation has the ability to drastically curtail the viability of cryptocurrencies, if regulation consists of outright or de facto bans. A ban — like China opted for — could make a cryptocurrency effectively useless within a given country, if not subject individuals to criminal sanctions, depending on the laws.

Recently, Donald Trump’s re-election and the prospect of a pro-crypto administration has caused crypto prices to soar, pushing Bitcoin to a recent all-time high of nearly $110,000.

While the Trump administration’s support is there, crypto regulation varies across federal agencies and even state to state. The Securities and Exchange Commission, the Commodities Futures Trading Commission and the Internal Revenue Service all have different ways of classifying and defining crypto.

Some states, like New York, have stringent requirements for crypto companies. Other states are friendlier to crypto, such as Wyoming, which is establishing its own stablecoin and trying to attract crypto-adjacent businesses.

Differences aside, government regulation may help create a more level playing field that’s less subject to fraud and malfeasance. Such a scenario may allow market participants to develop greater trust in the system and have clearer legal recourse if something unfortunate does happen. This kind of regulation helps tame the “Wild West” nature of cryptocurrency, making crypto safer for those who want to use it honestly.

Other drawbacks

Cryptocurrencies have other drawbacks as well, including the lack of security in digital wallets for holding currencies, its use in crimes, and its slowness in processing transactions, compared to near-instantaneous processing from traditional networks such as Visa and Mastercard.

In addition, because the IRS has labeled Bitcoin an asset and not a currency, every transaction with Bitcoin has the potential to create a taxable capital gain, meaning you must report it on your tax return. If you spend bitcoins at a price higher than you purchased them, you’ll owe tax.

Bottom line

While cryptocurrency certainly has some potential benefits, it also has serious drawbacks that so far make it unusable as a currency. Investors are probably best advised to take a cautious approach with cryptocurrency, given its volatility and various risks. If you want to just test it out to see what it’s all about, keep your position size small and don’t put in more than you can afford to lose.

— Note: Bankrate’s Brian Baker and Logan Jacoby contributed to updates of this story.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.