How to maximize cash back with your credit card

Key takeaways

- Maximizing cash back with a credit card requires moves on both ends of the spectrum — choosing the best credit card for your needs and getting the most value each time you redeem rewards.

- Flat-rate cash back cards, bonus category cash back cards, cash back apps, shopping portals and issuer-specific offers can all help you maximize the rewards you earn.

- Some strategies can help you secure better redemption values for your rewards, but these often vary by card and rewards program.

There’s more to maximizing cash back than just using a rewards credit card for spending and bills. You’ll also want to make sure you have the right cash back credit card to begin with and that you have a handle on the best redemption options available — and when to make them.

Here are some simple moves to get more cash back from your credit cards.

Choose the right cash back cards

The first step is ensuring you choose the absolute best card (or cards) for the way you spend. You can choose from flat-rate cash back credit cards and bonus category cards.

Many people use a few different cash back credit cards to earn more rewards on everything they buy.

Review your spending habits

Before you switch up your credit card spending strategy or open a new credit card, analyze your cash flow. How much money are you spending per month? Per year? What categories do you spend the most in? What do you ultimately want from a rewards credit card?

Start by using a budgeting app (or a pen and paper) to determine how much you spend each month and on what. Some issuers break down which category you spend the most in every month on your billing statement. Whether you’re ordering food delivery every Friday night or traveling with your favorite airline each month, make sure you understand where your money is going.

Understanding this helps you estimate what your rewards yield will be each year — making it easier to determine if an annual fee is worth it. If you don’t spend enough on a credit card to offset a card’s annual fee, that card is probably not the best option, so opt for a card without an annual fee instead.

Once you’ve noted how you’re using your credit card, you can identify which type of credit card best suits your lifestyle and typical spending habits.

Compare sign-up offers

If you’re in the market for a new cash back card, an initial sign-up bonus or welcome offer can accelerate your earnings. Fortunately, most cash back credit cards have excellent welcome offers with easy-to-meet minimum spending requirements.

Some of the best cash back sign-up bonuses available right now include:

-

Blue Cash Preferred® Card from American Express:

- Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

-

Wells Fargo Active Cash® Card:

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months

-

Discover it® Cash Back:

- Intro Offer: Unlimited Cashback Match for all new cardmembers. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

-

Ink Business Unlimited® Credit Card:

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

Your rewards yield will likely be higher the first year you have the card than it will be for the following years, so keep that in mind as you compare sign-up bonuses. The card you choose should still suit your spending habits and provide long-term value, regardless of what bonus it offers.

Combine boosted category cards with flat-rate cards

One of the most popular strategies for maximizing cash back is to pair a flat-rate cash back credit card with one that earns boosted rewards in certain spending categories.

This could mean pairing a flat-rate card with one that earns elevated rates in everyday categories like grocery shopping or gas station purchases, or with one that has rotating bonus categories. Rotating category cards require activation but offer high rates of cash back in return. Let’s break down these two strategies further:

Flat-rate cash back cards and boosted category cash back cards

The best flat-rate cash back credit cards typically offer between 1.5 percent and 2 percent cash back on all purchases with no spending caps. These pair nicely with cards offering cash back in select bonus categories because these cards typically earn more for the purchases you spend on the most.

But, which cards should you pair? Let’s say that you chose the Wells Fargo Active Cash for your flat-rate card, which offers 2 percent back on all purchases, and that groceries are your biggest expense each month. To get the most out of a card, you’d want to choose one that gives solid cash back on grocery purchases.

The no annual fee Blue Cash Everyday® Card from American Express is one of the best credit cards for groceries:

- Earn 3% cash back at U.S. supermarkets, 3% cash back on U.S. online retail purchases, 3% cash back at U.S. gas stations, on eligible purchases for each category on up to $6,000 per year in purchases (then 1%).

- Earn 1% cash back on all other eligible purchases.

If you spent $500 on groceries and $1,000 in miscellaneous purchases each month, then you’d earn $15 in cash back from your Blue Cash Everyday card and $20 from your Active Cash card. That would be a total of $35 in cash back each month ($420 a year), and that’s not including any cash back from purchases that could fall into the Blue Cash Everyday card’s gas station or online retail purchase categories.

Ryan Flanigan, a credit cards expert and writer at Bankrate, likes to use this strategy for two of his Bank of America credit cards and two of his Chase cards. For others looking to pair a flat-rate card and a boosted category cash back card this way, he offers the following advice:

Bankrate staff insights

Flat-rate cash back cards and rotating category cash back cards

For this strategy, you’ll use your flat-rate cash back card for nearly everything except purchases that can be covered by your rotating category card. Rotating category credit cards work by changing what categories can earn cash back, usually per month or per quarter.

These cards require activation to earn rewards, so it’s important to keep a close eye on your issuer’s cash back calendar and activate the bonus categories when it’s time.

Let’s say that you still have your Wells Fargo Active Cash, and you’ve paired it with the Discover it Cash Back, which offers 5 percent cash back on up to $1,500 in activated rotating bonus category spending each quarter (then 1 percent).

If you were able to max out your spending cap each quarter by spending $500 in your activated bonus category each month, you’d earn $25 monthly. If you also spent $1,000 on other purchases with your Active Cash card, you’d earn an additional $20. That would be a total of $45 each month and $540 per year.

These cards are great for pairing with other cards, but they’re also ideal for people who have no desire to keep track of rotating categories or earning caps and just want one card for all purchases.

To ensure you’re earning the maximum cash back value from your flat-rate cards, look for bills you can pay with a credit card. Consider paying your insurance premiums, utility bills, rent and subscriptions with your flat-rate card — provided there’s no processing fee involved. If there is, you could wind up canceling out the rewards you earn.

You can also:

- Activate any offers or deals attached to your card.

- Shop online through a shopping portal.

- Use your card’s benefits, such as cellphone insurance or extended warranty coverage.

Stay organized when it comes to your cards

If you’re using multiple cards as part of your cash back strategy, it’s important to remember which cards are best used when. To stay organized, give each card a helpful nickname in your digital wallet or slip a hand-written legend into your wallet so you’re prepared to use the right card at the right moment.

Apps like CardPointers and MaxRewards can help track and manage your rewards cards. You can also use Google Sheets or Excel to organize your spending and rewards. Just be sure to update them on a regular schedule.

Take advantage of issuer shopping deals

Before you shop, whether in-person or online, look for card-linked offers from your credit card issuer. Some popular shopping portals include:

-

Shop Through Chase: Stores in the Chase shopping portal frequently include options like Walmart, Sephora, Best Buy and Macy’s.

-

Barclays RewardsBoost: At the time of writing, you can find deals for Nike, CVS, Lenovo and more through the Barclays shopping portal.

- Capital One Shopping: Unlike other issuer shopping portals, Capital One Shopping doesn’t require you to be a cardholder to access the portal. At the time of writing, you can find deals from brands like Adidas, Chewy and Target.

Some issuers offer additional rewards opportunities, as well. American Express, Chase and Capital One have programs — Amex Offers, Chase Offers and Capital One Offers, respectively — through which you can opt in to earn additional cash back from select retailers.

Keep in mind: These offers often have limited redemption windows and must be accepted individually. Cash back percentages vary from store to store, and there are usually limits that cap how much additional cash back you can earn.

Make the most of cash back apps

If you want to earn more cash back for online purchases, you often can increase your earnings through the use of cash back apps and websites.

Cash back apps and sites like Upside, Ibotta and Rakuten give you a percentage of your spending back on qualifying purchases — on top of the cash back you’re earning on your credit card. For example, Rakuten lets you earn additional cash back when you click through the website before you shop with stores like Kohl’s, Macy’s, Nordstrom, Old Navy and Priceline.com.

Spend your cash back wisely

While maximizing cash back earned on spending is important, that’s only part of the equation.

Redeem your cash back as statement credits

One of the easiest ways to redeem cash back is for statement credits to your account. This redemption effectively lowers the amount you owe on your credit card bill, thus helping you save money over time.

If you earn 2 percent cash back on all purchases and redeem your rewards for cash back, for example, you would ultimately save 2 percent on everything you buy with your card.

Bankrate staff insights

Just remember that rewards only get you “ahead” if you pay your credit card bill in full each month and avoid interest. If you’re paying 20 percent or more in credit card interest, for example, only to be earning 2 percent cash back, you’re not doing yourself any favors.

Save your cash back for a big purchase

You can also save up your rewards for a purchase you want to make down the line, whether it’s a splurge purchase you don’t want to cover in cash or you need to buy something for your everyday life.

Either way, most cash back credit cards let you grow your rewards balance over time until you’re ready to use it.

Weigh the value of your points before a purchase

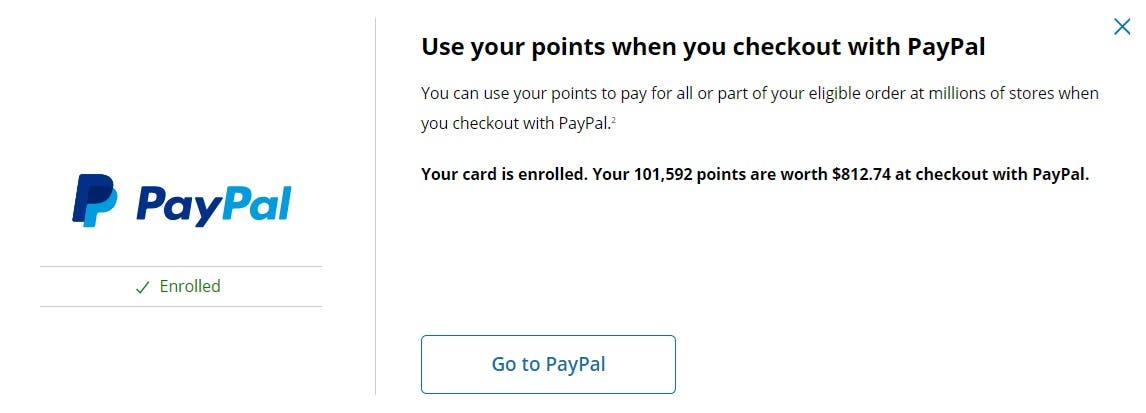

Using rewards for merchandise won’t always get you the best value. You’ll want to be strategic if you go this route. With some Chase cards, for example, 1 cent of cash back earned is equal to 1 cent of cash back redeemed for statement credits. But each cent of cash back you earn is worth only 0.8 cents for purchases through Amazon.com or PayPal.

If you wanted to use rewards for an Amazon or PayPal purchase, it would make more sense to pay for the purchase with your card outright, and then redeem rewards for statement credits after the fact.

Use your cash back to pay down debt

You can also use rewards to pay off some types of debt, either directly depending on the card you have or indirectly by redeeming for cash back. In terms of options that let you redeem rewards for debt payments, some Wells Fargo credit cards (including the Wells Fargo Active Cash® Card) let you redeem cash back toward a Wells Fargo mortgage in addition to options like gift cards and statement credits.

Many cash back credit cards also let you redeem rewards for a check in the mail, which you could deposit into a bank account and use for debt payments.

The bottom line

If you spend strategically, you’ll be raking in cash back rewards before you know it. You can maximize cash back from your credit card by using one of the best cash back credit cards on the market for as many of your everyday purchases as possible.

In the meantime, you’ll also want to avoid carrying a balance so you won’t have to pay interest on your purchases. With the average credit card APR currently over 20 percent, racking up rewards won’t make any sense if you also rack up long-term debt.

The Bank of America content in this post was last updated on May 21, 2025.

*Information about the Chase Freedom Flex has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.