How to close a Chase credit card

Key takeaways

- Chase allows customers to cancel their credit cards over the phone, by mail and online.

- Closing a credit card account may negatively impact your credit score, so it’s important to carefully consider your options.

- There are alternatives to closing your Chase credit card, such as requesting a product switch, keeping your card but not using it or asking Chase to waive an annual fee you don’t want to pay.

You may think about closing your Chase credit card when the day comes that it no longer fits your lifestyle. Maybe the rewards structure isn’t quite right for your current spending and goals, or perhaps you aren’t getting enough value from the card to justify the annual fee. Whatever the reason, before taking the steps to close the card you should also look into the alternative options that achieve the same goal (such as avoiding an annual fee) without the downsides that come with closing your account completely.

While ditching your card might ultimately make sense, the Chase 5/24 rule and other limitations from Chase can make getting a new rewards credit card from Chase more difficult if you change your mind.

This guide explains how to close a Chase credit card account, as well as some alternate steps you could take instead. But before we get into how to close the card, let’s go over what you need to do before you close that card.

What to do before closing your Chase credit card

Canceling a Chase credit card — or any credit card — isn’t a decision to take lightly as it can have larger implications on your overall finances. With many Chase cards, though, you’ll also need to think about your rewards balance.

Consider these questions before closing your card.

- What is the potential impact on your credit score? Closing a credit card can negatively impact your credit score in a couple of ways, including reducing your available credit (which affects your credit utilization ratio) and decreasing your average age of credit (if the card is one of your oldest ones). If you’re in the market for another loan, such as a mortgage or car loan, it may not be a good time to close your card and take the credit score hit.

- What will happen to your rewards? This answer will depend on what kind of rewards you’re earning. If you’re earning Chase Ultimate Rewards points and have another Chase card that earns these rewards, you can simply move your rewards to that account. If you don’t have another card, however, you’ll want to cash in those rewards before you close the card. If you have a co-branded card, such as a Chase-issued Southwest or Marriott card, your card’s rewards are automatically transferred to your loyalty account for that brand after each billing cycle. After closing your card, you’ll keep all points that have already been transferred but lose any points that haven’t yet been transferred.

- Will Chase refund your annual fee? Chase will typically refund your annual fee if you cancel within 30 days of the fee posting to your account. If it’s after that, you might be out the annual fee for the year — in which case it may not make sense to cancel the card right away.

- Have you properly updated any auto payments? If you’re closing a card that you’ve set up to automatically pay some bills, such as a utility or streaming subscription, don’t forget to change the card information on those accounts so you don’t miss any payments.

How to close a Chase credit card

Chase doesn’t make it difficult to close your credit card account if that’s what you really want to do. Here are the steps you can take to close down your credit card account altogether.

Call Chase

If you’re wondering how to close a Chase account over the phone, you can begin the process by calling the customer service number on the back of your credit card. Let them know you want to close your credit card account altogether. While you’re on the phone, you’ll need to share information like your ZIP code, name and account number to prove your identity.

You can also reach Chase’s customer service line at 1-800-432-3117.

Cancel your card online

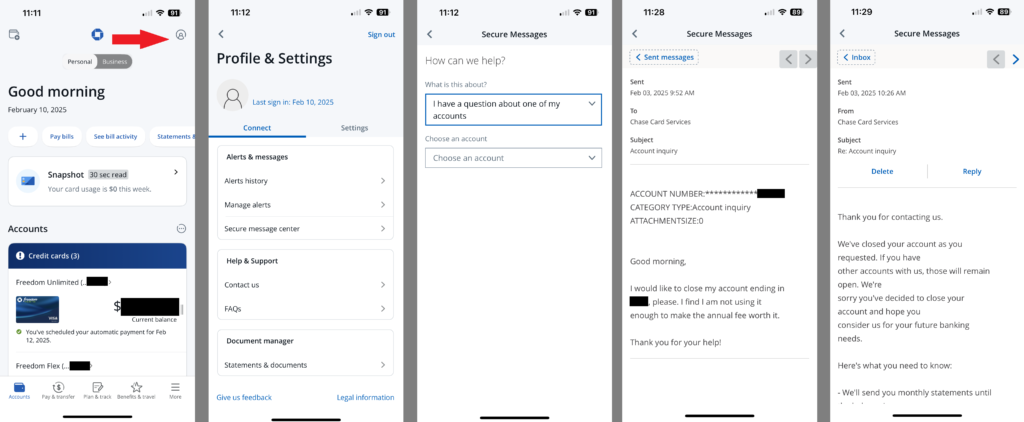

Chase doesn’t offer an online chat feature like American Express does, but they do offer a secure way for you to contact them online. If you bank or manage your credit card account using Chase.com, you can ask Chase to cancel your card through their secure messaging system.

You’ll have to log into your Chase online account management page to do so. From there, head to your “secure messages” from the drop-down menu on the left side of the screen. Then, select the option that says “I have a question about one of my accounts.”

At that point, you’ll select the credit card account number for the card you want to close and write a simple message stating you want your account closed. You can provide additional information if necessary.

Send a letter in the mail

You can also send a letter to Chase in the mail, which may make sense if you don’t manage your account online or don’t feel like calling in to speak to someone. In your letter, you’ll want to include your name, account number, address and a brief message that says you want your Chase credit card account closed right away.

You can use the following address:

Chase Card Services

P.O. Box 15298

Wilmington, DE 19850

Does closing a Chase credit card affect your credit score?

Yes, closing a credit card account can hurt your credit score — even if the card is rarely used. There are two main reasons this is true.

First, depending on how long you’ve held the card, closing a credit card account could shorten the average length of your credit history, which makes up 15 percent of your FICO score.

Let’s say you want to close the card you opened when you were in college 12 years ago. You’ve opened two other cards since then, one four years ago and another two years ago. With all three cards, your average age of credit is six years (12 + 4 + 2 = 18; 18 / 3 = 6). By closing your 12-year-old card, you reduce your average age of credit to just three years.

Second, and most importantly, closing a credit card can reduce the amount of open credit you have and raise your credit utilization considerably.

Since this factor makes up 30 percent of your FICO score, raising your credit utilization rate through account closure should be your biggest concern. But, how would this factor come into play?

Imagine for a moment you currently have two credit cards — a Chase credit card and a Citi credit card, each with a limit of $10,000. That means your total credit is $20,000.

Now, imagine you just paid off the balance on your Chase credit card, but you still have $4,000 in debt on your Citi credit card. At this moment in time, your credit utilization rate is 20 percent since you owe $4,000 with a total credit limit of $20,000. However, closing your Chase credit card would leave you owing $4,000 in debt across $10,000 in total credit limit, so your credit utilization rate would increase to 40 percent overnight.

Options to consider before canceling your Chase credit card

If you are worried about damaging your credit score or you don’t necessarily want to ditch your Chase credit card altogether, there are a few smart options to consider:

Ask for Chase to waive the annual fee

If you are canceling your credit card because you don’t want to pay an annual fee, you can always call Chase and ask them to waive the fee. They may not approve your request, but the worst they can do is say “no.”

Request a product change

You can also request a product change to another Chase card, a popular move among those who want to avoid paying high annual fees on premium credit cards from Chase. Product changing lets you keep your rewards, your account history and your card’s credit line.

For example, you could call and ask to switch from the Chase Sapphire Reserve® with its $795 annual fee to the Chase Sapphire Preferred® Card with its $95 annual fee. This would let you save hundreds of dollars per year, yet you could continue earning Chase Ultimate Rewards points.

You could even product change to a cash back credit card with no annual fee, such as the , which technically also earns Ultimate Rewards points even though it’s marketed as a “cash back card.”

However, you can’t product change a Chase co-branded card (like the Southwest Rapid Rewards® Priority Credit Card) to one of Chase’s own Ultimate Rewards-earning cards (like the Chase Sapphire Preferred), or vice versa.

Keep in mind: You will not be eligible for any welcome bonuses or intro APR periods when you complete a product change.

Safely store your credit card

Also, remember that you don’t have to close your credit card just because you don’t want to use it. You can store your card in a safe or a sock drawer, and you don’t have to get it out unless you really want to. For an extra layer of security, you can digitally lock your card through your Chase online banking account or mobile app, which will prevent any new transactions from going through. If you need to use your card, you only need to click a few buttons to unlock it again.

By keeping your credit card open without any activity, the account is still helping to lengthen your average credit history and contribute to your overall available credit. You should use your card once in a while (once a year is fine) to prevent it from being automatically closed due to inactivity.

The bottom line

Closing a credit card can sometimes be the right move, but there are situations where you’re better off switching products or stashing your card away in a sock drawer. Make sure you consider all the options, as well as potential consequences you’ll face if you close your Chase card account for good. There’s no real “right” or “wrong” answer that applies to everyone, but you should make an informed decision.

Closing a Chase credit card frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.