How to close a Citi credit card

Key takeaways

- Closing a Citi credit card is easy, and you can do so online or over the phone.

- There are alternatives to closing your Citi card, such as requesting a product change or stashing the card away.

- Closing a credit card can negatively impact your credit score, so you should consider all options before making a decision.

- Citi ThankYou points are automatically forfeited when closing a Citi credit card unless another Citi card is held that offers this rewards currency.

Citi is an advertising partner.

Citi offers several different types of credit cards, including cash back credit cards, cards that earn points in the Citi ThankYou program and a selection of popular balance transfer credit cards. There are plenty of ways you can use their credit cards to accomplish specific goals, yet there are also situations where you may not want to keep your Citi card for the long haul.

Maybe you are tired of paying your Citi card’s annual fee, or maybe you just need an option with a lower fee requirement. Perhaps you used a Citi balance transfer credit card to pay down debt, but now you’re done and know you’ll never use the card again. Whatever the reason, you should know it’s fairly easy to close a Citi credit card.

How to close a Citibank credit card account

Here are the steps you can take to close your Citi credit card for good:

Close your Citi account online

To close your Citi credit card account online, all you have to do is log into your Citi account and open the online chat feature. From there, tell the representative that you want to close your account and answer any questions they have.

It’s possible Citi will let you cancel through the online chat, but the chat representative may also require you to call and cancel your account over the phone.

Close your Citi account over the phone

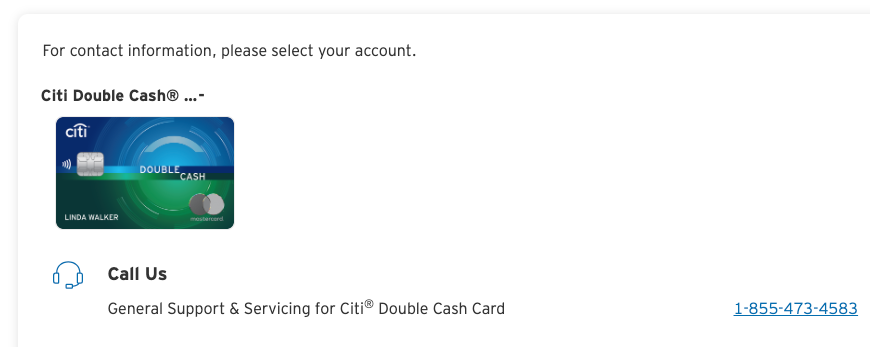

Ultimately, you’ll most likely need to call Citi to cancel your card. To find the appropriate phone number to call, navigate to the Contact Us page on the Citi website while logged into your account. Citi makes it easy to ensure you call the right number by providing a phone number based on the account or product you wish to discuss:

When you get the chance to speak with a representative, tell them you want to close your account and provide any information they require.

You’ll typically need to prove your identity before you can close your account. Be ready to offer information such as your name, account number, address, ZIP code and security code or account PIN if you have one.

Take care to explore all of your options with the Citibank customer representative, says Harlan Vaughn, Senior Editor of Credit Cards at Bankrate.

“You can sometimes get a valuable retention offer to keep your card. Or, you can change it to a card with no annual fee in the same “family” of cards, which preserves your account history and costs you nothing.”

What to do after closing your Citi credit card

After you close your Citi credit card, continue making payments on any remaining balance you have. After all, any remaining debt you have on your Citi credit card won’t disappear just because you close your account.

Once your account balance is down to zero, you can unlink your card from your online account management page if you prefer. This step is fairly easy within your online Citi account page. All you have to do is find the closed account you want to unlink and click on the prompt that says “Unlink this account from my User ID.”

Alternatives to closing a Citibank credit card

If you’re not sure you want to close your Citi credit card, there are a few alternatives to consider. These options could help you reach your goal, whether that includes getting away from credit cards with an annual fee or avoiding an impact to your credit score caused by account closure.

Request a product change

Citi is one of the most flexible card issuers when it comes to product changes. With a product change, you could switch to a card that better fits your lifestyle. For example, if you’re no longer traveling as much as you used to, you might want to change from a travel card to a simpler cash back rewards card that lets you earn cash back on everyday purchases. In this case, you might drop a card like the Citi Strata Premier® Card with its $95 annual fee and switch to a rewards card with no annual fee, like the Citi Strata Premier® Card .

Regardless of what you hope to accomplish, you can call Citi using the number on the back of your card to request a product change. The customer service representative you’re speaking with can let you know your options, and you can decide whether you want to move forward.

Stash your card away somewhere safe

If you have a Citi credit card with no balance and no annual fee, you can also consider stashing your card away somewhere safe. Doing so can help boost your credit score since the length of your credit history is one of the factors credit bureaus consider. Also, keep in mind that the available credit on your card is helping your credit utilization rate if you’re carrying debt on other cards.

Keep in mind: If you do not use your card for a long enough period of time, Citi might choose to close your account anyway. Consider making occasional small purchases on it to keep the account active.

The bottom line

You have the right to close a credit card account any time you want, but there are definitely pros and cons to consider. Many people wind up keeping old accounts open just so they don’t hurt their credit score, and there’s certainly nothing wrong with putting your old, unused card in a safe or sock drawer. But if you prefer to use the tools in your wallet, you could always consider a product change to a new type of credit card from the same issuer altogether.

Closing a Citi credit card: FAQ

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How to settle credit card debt

How to close a Discover account