Cashback Monitor guide

Key takeaways

- Cashback Monitor offers a snapshot of earning rates across dozens of shopping portals, so you can easily see which site offers the most cash back, points or miles.

- You can customize the Cashback Monitor site to show your preferred shopping portals and other features, but you need to sign up for an account.

- Using a shopping portal with higher earnings combined with your favorite rewards credit card can boost your earning potential with little effort.

From shopping portals and store loyalty programs to credit card rewards and special offers, there’s no shortage of ways to score a discount while shopping. But how do you know which way is the best? With myriad discounts and rewards to compare, it’s not always easy to know how to maximize your savings.

That’s why savvy shoppers who want the biggest bang for their buck use tools like Cashback Monitor, which helps find the biggest rewards opportunities with online shopping. Combining this tool with a strong rewards credit card aligned with your spending habits can boost your savings even more.

What is Cashback Monitor?

Cashback Monitor is a website that tracks earnings rates across dozens of online shopping portals and cash back sites, making it easy to see which platform earns the most points, miles or cash back at a particular retailer.

Using a shopping portal aggregator like Cashback Monitor saves you the trouble of comparing bonus rewards rates on your own so you can maximize earnings on purchases you’re already making.

How does Cashback Monitor work?

Cashback Monitor is simple to navigate. Here’s a breakdown of its most-used pages and features.

Navigating the homepage

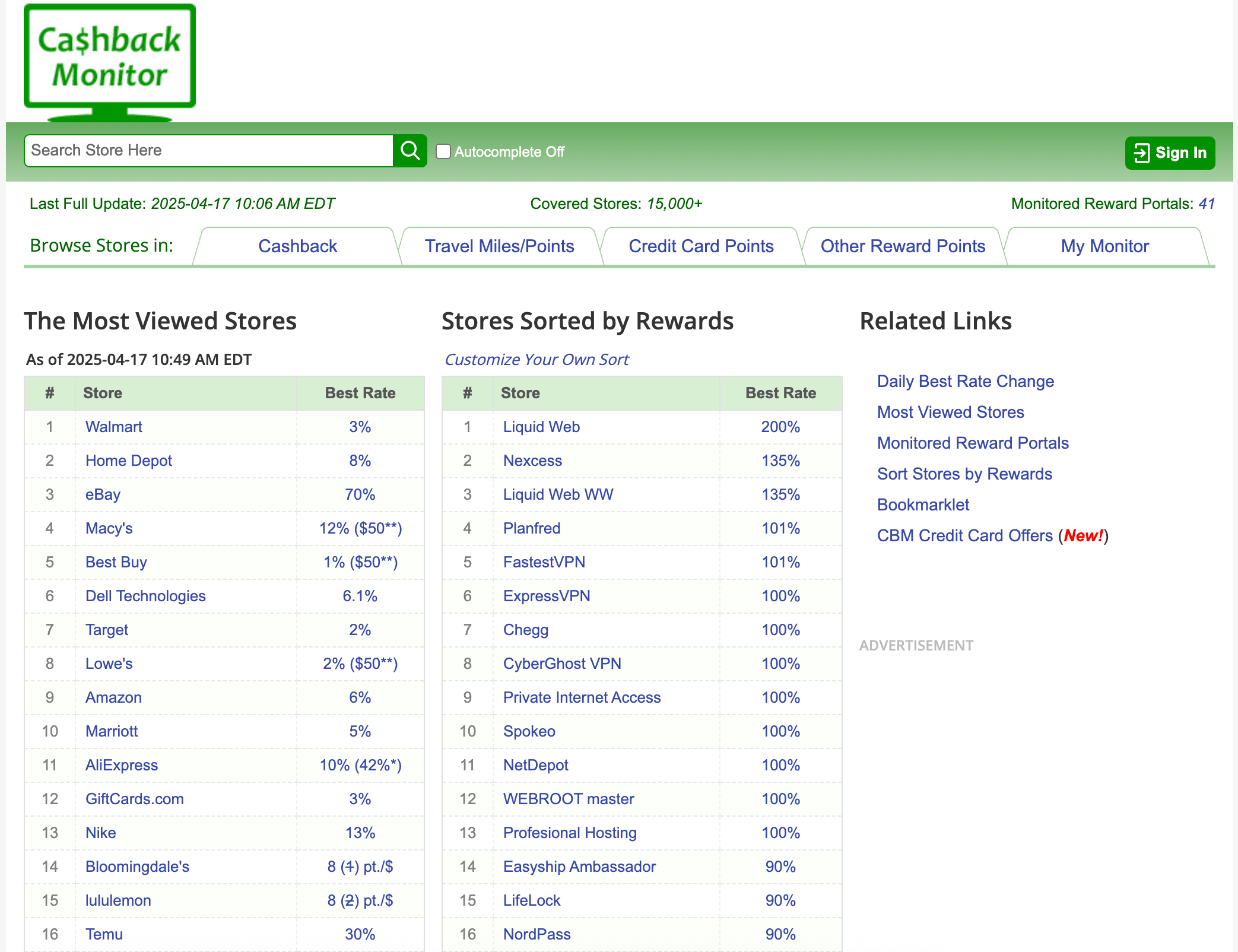

The homepage is divided into two main columns:

- The most viewed stores: The first column displays the best rates available at the most-viewed stores that day, giving you an overview of the most popular deals at any given time.

- Stores sorted by rewards: The second column shows each store’s best rate sorted by the estimated value of the rewards currency issued, whether it’s cash back, points or miles.

Rates are updated at least once a day, typically in the morning.

Searching for your retailer

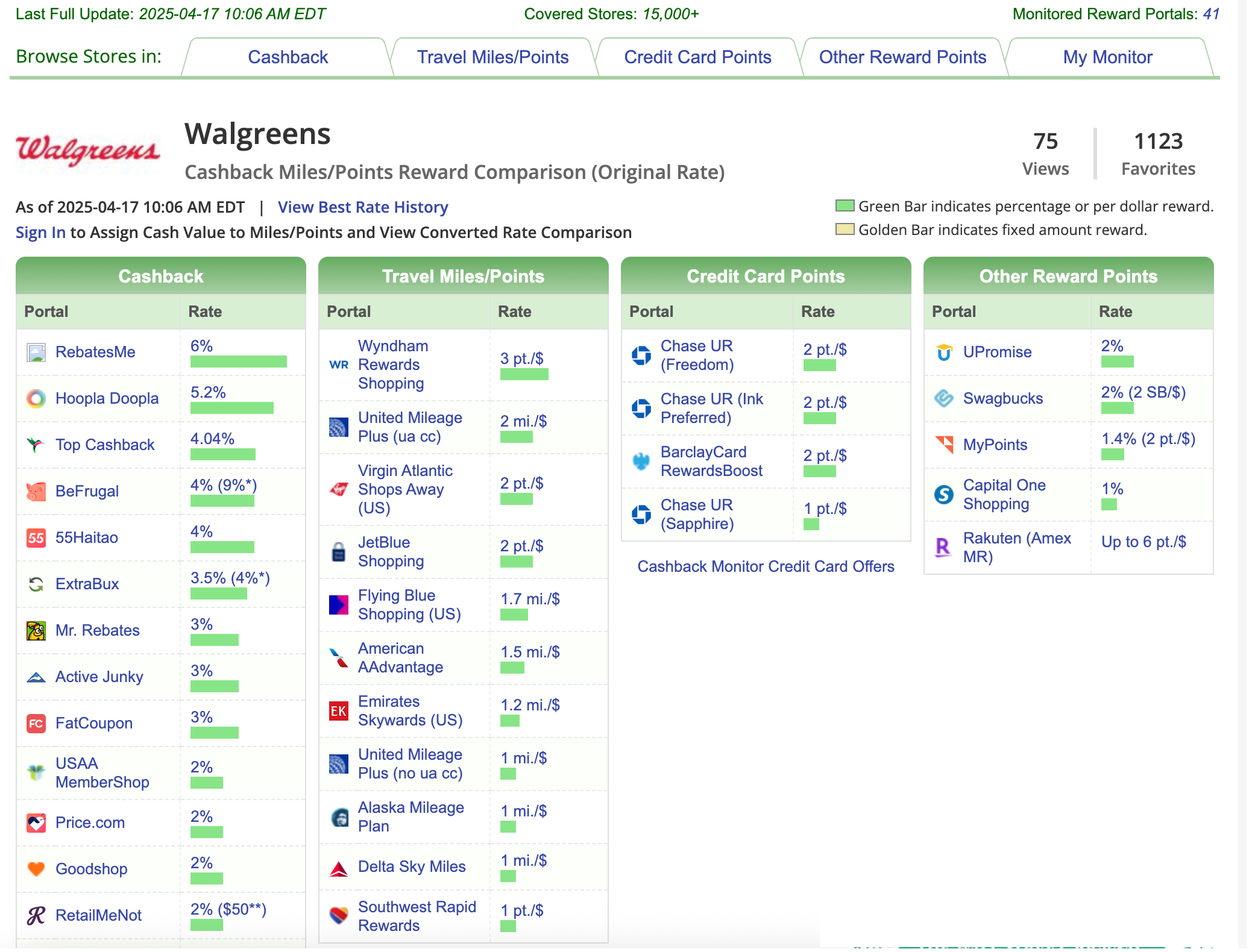

Although you can browse stores and brands by rewards type, the easiest way to use Cashback Monitor for your next online purchase is to enter your retailer of choice into the search bar at the top of the site’s homepage. We’ll use Walgreens as an example.

The search results page lists all the current earnings rates for Walgreens purchases made through any of the 45 shopping portals Cashback Monitor tracks. The site organizes rewards by type — cash back, travel rewards, credit card points and other rewards — with the best deals and bonuses at the top of each column, enabling you to compare portal offers.

The same applies to all other loyalty and shopping programs you see on Cashback Monitor — but you’ll have to be a member or create a new account to earn the offer. This may not be possible for every portal, though: When it’s a bank-operated portal, such as Chase Ultimate Rewards, you’ll need a Chase-issued credit card that earns Ultimate Rewards points in order to access it.

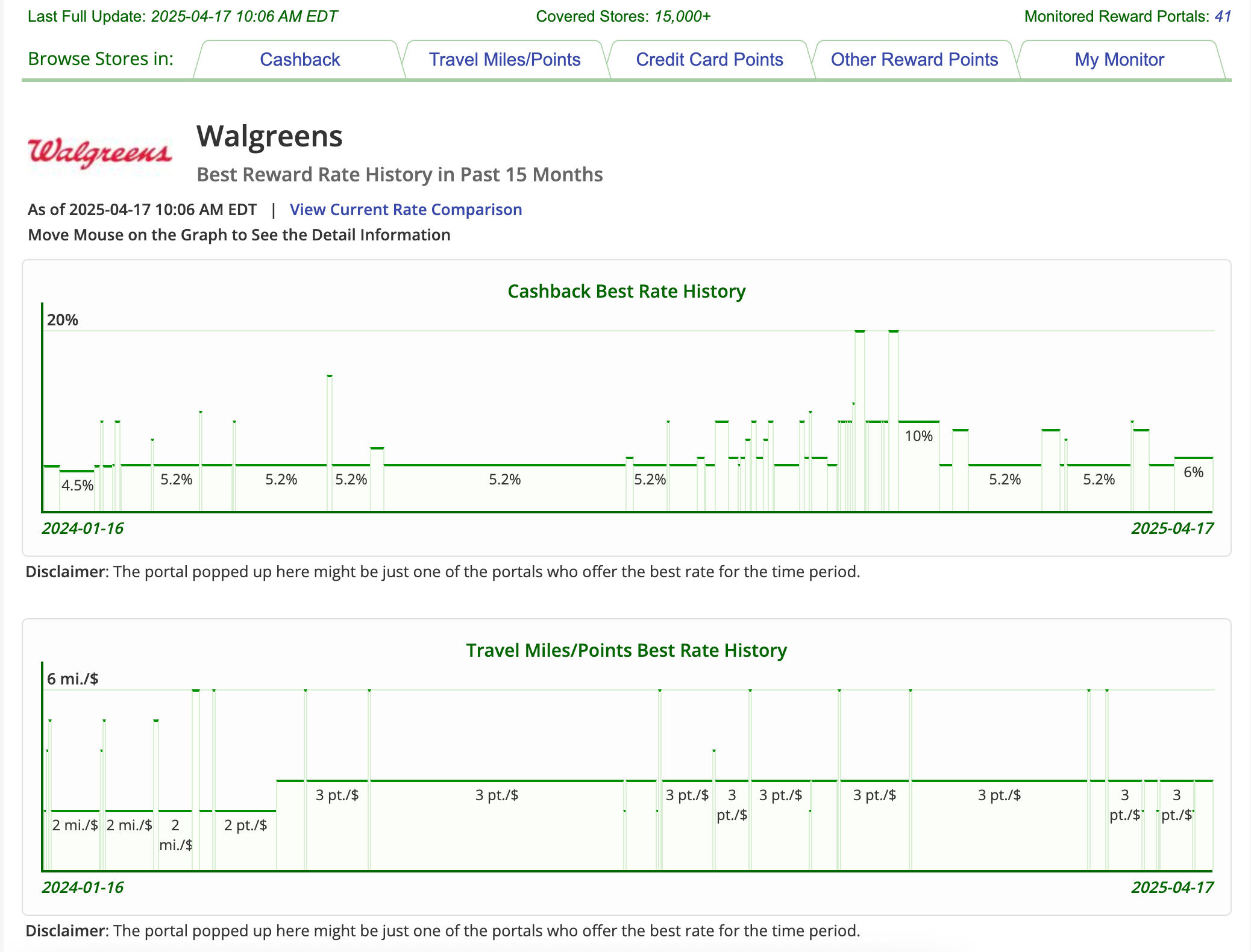

Looking up rewards rate history

Cashback Monitor has a few other handy tools to help you get more out of the platform. For instance, somewhat similar to rotating category credit cards, many shopping portals vary bonus offers throughout the year. By switching to “View Best Rate History” on the search results page, you can see all the earnings opportunities at a retailer over the previous 15 months:

This information can help you decide between taking advantage of that day’s best offer or waiting for a higher rate to come back around.

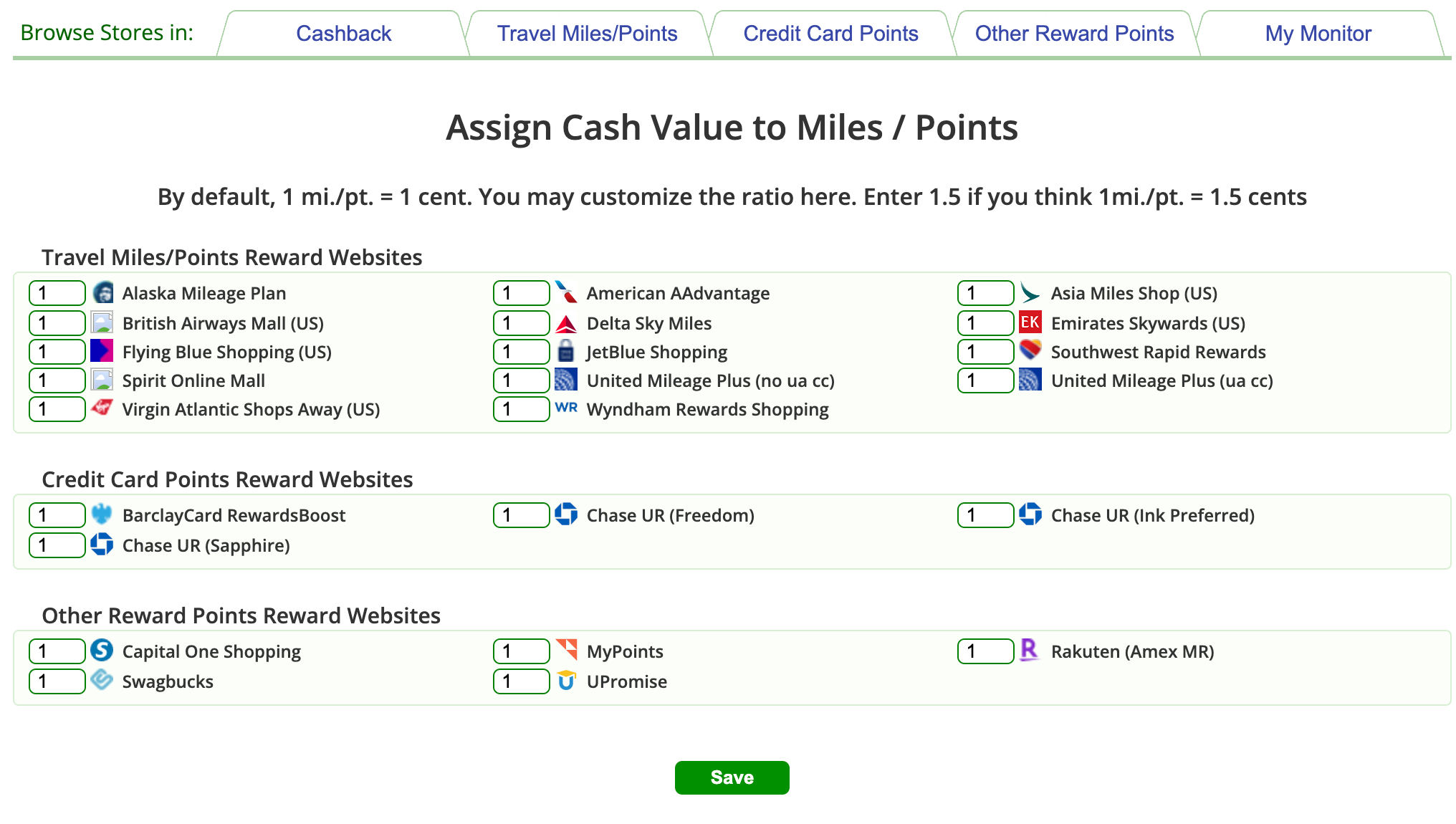

Setting your reward currency values

Another helpful feature is the ability to assign a cash value to any reward currency. You’ll have to create a Cashback Monitor account in order to assign points values, but doing so means you can specify the shopping portals and stores you’re most interested in.

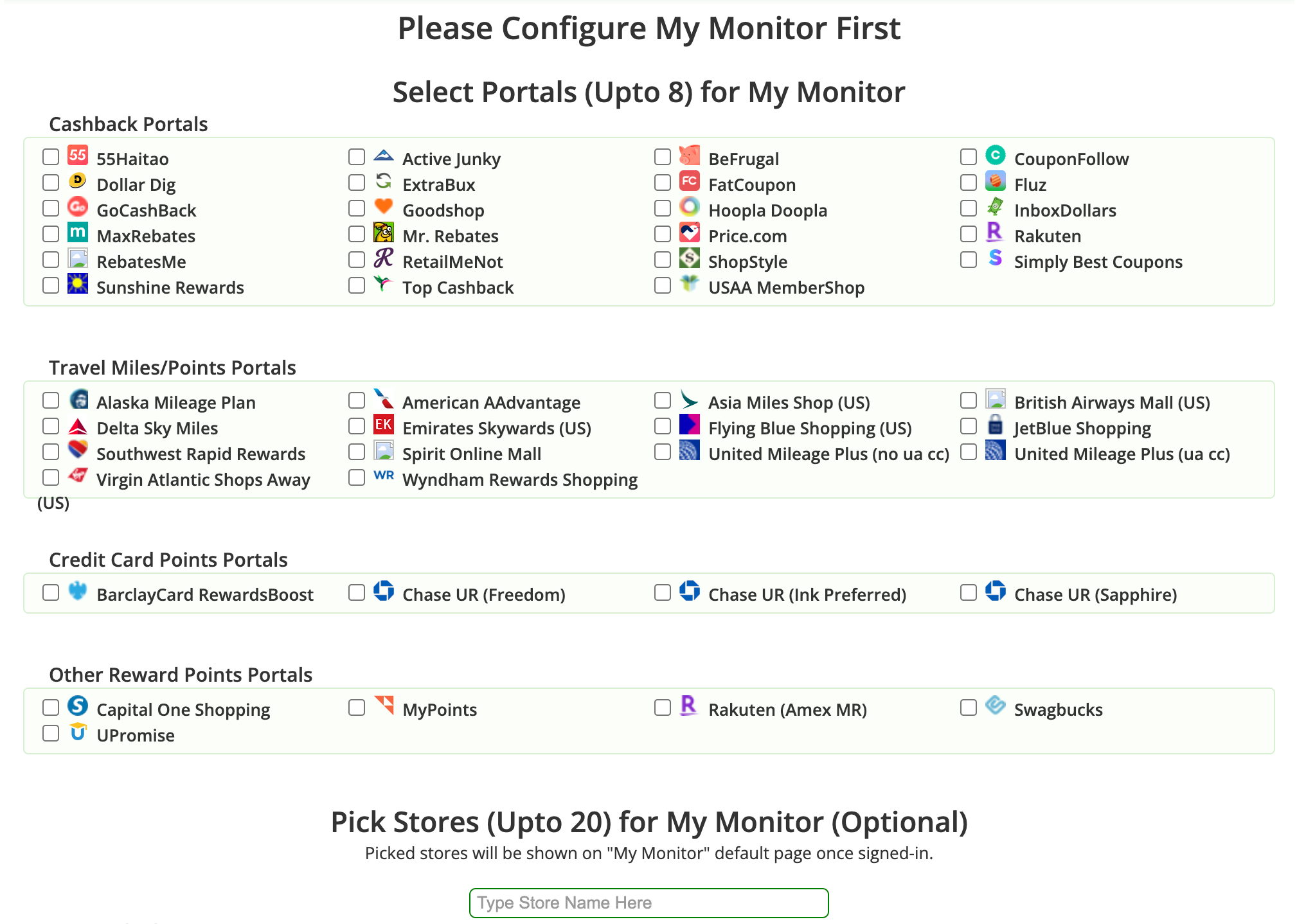

Customizing your interface

A less-crowded interface lets you identify the best deals more easily — and ignore portals you don’t shop through anyway.

To access this feature, select the “My Monitor” tab and log in to your account, then select “Config My Monitor.” (You can pick up to eight portals and up to 20 retailers.)

Once that’s squared away, you can set up alerts to get notified whenever a rewards rate at one of your favorite retailers reaches a specific number in a specific shopping portal. This is especially handy if you’ve been ready to make a non-urgent purchase but have opted to wait for a more lucrative offer to better maximize your earnings.

Stacking Cashback Monitor deals with credit card rewards

One of the best things about using an aggregator like Cashback Monitor is that it helps you find legitimate ways to “double dip” your rewards earnings with little effort. Just pay with a rewards credit card at checkout to earn the points, miles or cash back from your card on top of what the portal gives you.

Let’s say you start your shopping in the TrueBlue shopping portal and use your JetBlue Card* to pay for your purchases at Walgreens. In addition to the 2X points you’ll get in the portal, according to the Cashback Monitor data at the time of writing, you’ll also earn 1X points with the card itself.

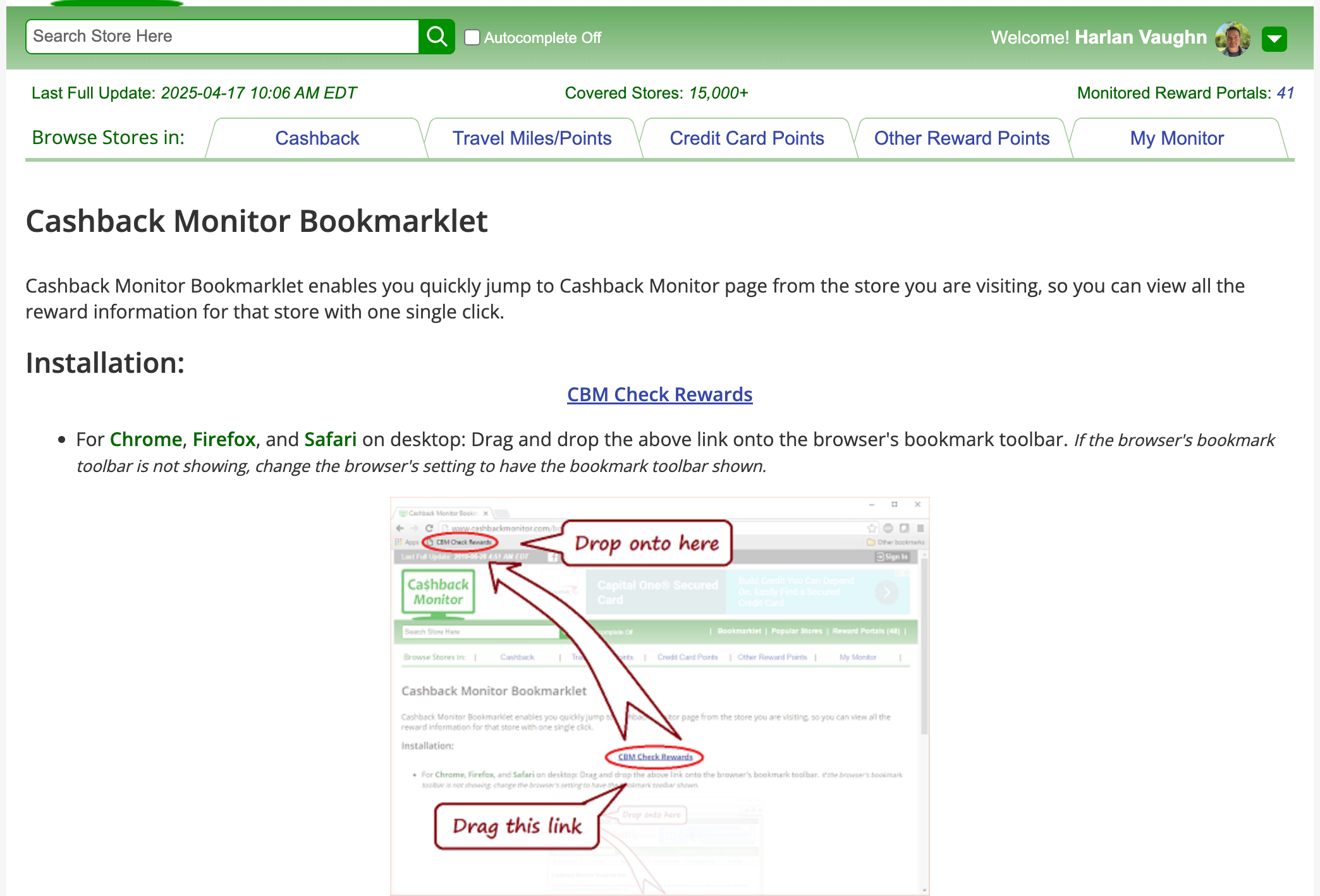

If earning the most rewards possible is your goal, you can also install the Cashback Monitor Bookmarklet. It’s a free browser extension available for Chrome, Firefox and Safari that takes you from whatever retail site you’re shopping on over to Cashback Monitor with just one click, so you can quickly compare all the current offers for that store to make sure you’re getting the best deal.

Cashback Monitor shopping portals and retailers

Cashback Monitor doesn’t keep tabs on every single online shopping portal, but it does monitor dozens of portals that offer everything from cash back to miles to credit card points and more. And while you might not find every single retailer on its site, you’ll likely find most major retailers pretty easily. Below are some examples of which retailers you can find, as well as which shopping portals are being monitored:

The bottom line

If your goal is saving more money, using a site like Cashback Monitor can create a path for super simple savings. This site quickly shows you which shopping portals offer the most rewards, whether you’re looking for cash back, points or miles. You can take advantage of the sites with larger “payouts” and combine it with your favorite credit card, which means you can save more with minimal effort.

*Information about the JetBlue Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.