Can closed accounts be removed from your credit report?

Key takeaways

- Accounts that have been closed for years often remain on your credit report.

- Closed accounts with a history of on-time payments may continue to boost your credit score slightly.

- You can try to remove closed accounts from your credit profile by asking a creditor for a “goodwill removal” or waiting for them to disappear on their own after 10 years.

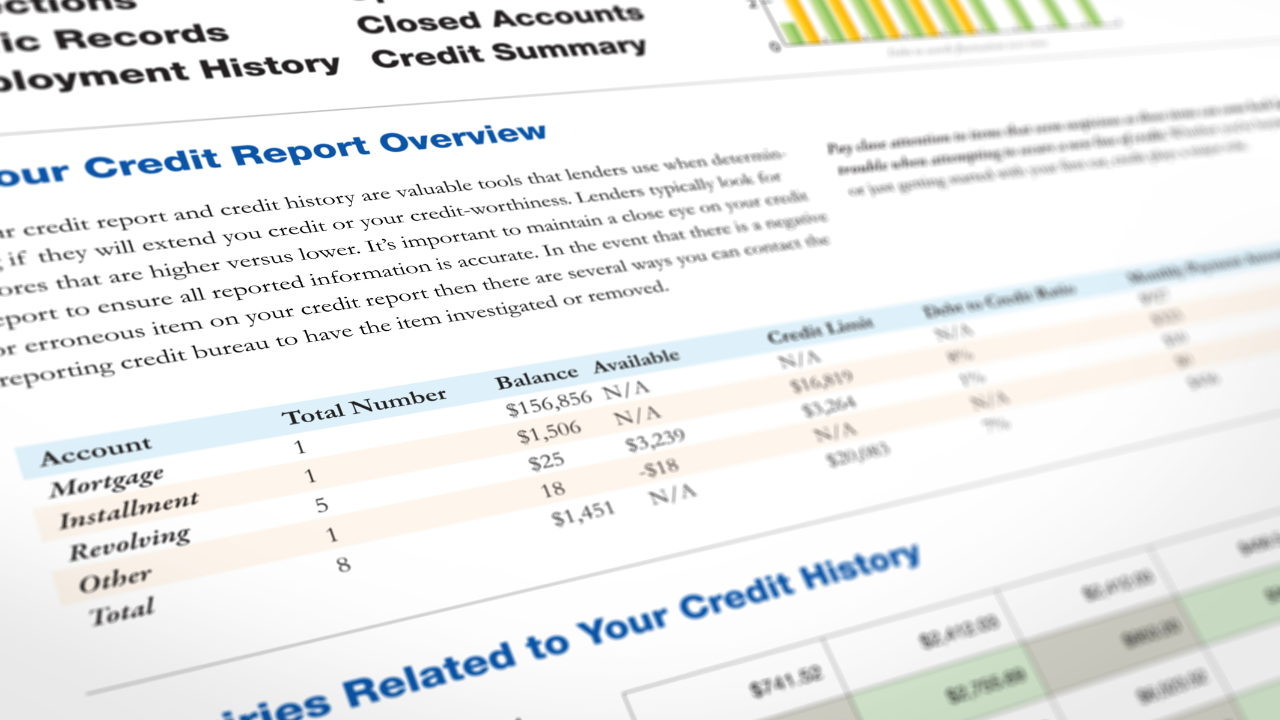

Your credit report is essentially a timeline of your financial decisions. It provides lenders with important information needed to evaluate whether you’re likely to repay a loan on time. This includes a summary of the total amount of debt you’re carrying, the amount of time you’ve had credit lines and your history of on-time payments.

Many people are surprised to see their report also includes accounts that have been closed for years. If you’ve made all your payments on time, these accounts aren’t hurting anything — they may even improve your credit. Old accounts that show a history of late payments or defaults, however, could also be dragging down your credit score.

When to remove a closed account from your credit report

You may want to take some steps to remove a closed account that is negatively impacting your credit score. This would include accounts that include late payments or other negative remarks.

You do not need to remove a closed account from your credit report if it is in good standing. An account that has a history of on-time payments and responsible management can have a positive impact on your overall score — especially since payment history makes up 35 percent of your FICO credit score.

Keep in mind: When you eliminate a closed account that was in good standing from your credit profile, you’re erasing a positive part of your credit history. It’s often best to leave these types of accounts on your credit profile for as long as possible.

How to deal with negative closed accounts

If a closed account is hurting your credit score, you have a few options for trying to remove this old debt from your credit report. Removal isn’t guaranteed unless the account contains a true error, as it ultimately depends on each credit bureau’s policies. The options outlined are also not limited to addressing closed accounts. Some of them can also be used to address incorrect information you find on your credit report.

Option 1: Formally dispute inaccuracies on your credit report

Many consumers are surprised to learn how common it is for credit reports to contain inaccurate information. A 2024 Consumer Reports study found that almost half of volunteers who could access their credit reports (44 percent) noted errors in their credit reports. Most errors are simple, like a wrong middle initial or address, and don’t negatively affect your credit.

Some mistakes, however, can negatively impact your credit. In fact, the same Consumer Reports study found that more than a quarter of the volunteer participants who could access their reports found serious errors involving debts that could damage their credit scores.

To dispute errors on your credit report, including inaccuracies about closed accounts, you need to contact the credit bureaus reporting the error and ask them to correct the record. In addition to your contact information, you’ll want to include the following in your dispute:

- The account number for the account in question.

- A written explanation of the incorrect information and why it’s wrong.

- A copy of your credit report with the incorrect information highlighted.

- Any documents that prove your dispute is valid, such as receipts of payment.

Credit reporting agencies are legally required to investigate your claim within 30 days and notify you of their response. According to the Consumer Financial Protection Bureau (CFPB), you should also contact the creditor who reported the information.

If the credit bureau determines the account doesn’t belong to you, it will likely be removed from your report. For other types of errors, the account may stay on your report with corrected information. With the correction made, the account may actually improve your credit rather than lower it.

Option 2: Ask the creditor for a “goodwill” removal

If the information on your closed account is accurate but it’s lowering your score, you can try requesting its removal by sending the creditor a goodwill letter.

Goodwill letters are requests to have information removed from your credit report. They’re typically used when a borrower has missed a single payment due to unexpected and unavoidable consequences. You could use the letter to ask for the closed account to be removed completely, or you could ask for the negative marks to be removed from that record.

Keep in mind: While you may get the result you’re hoping for, there are no guarantees.

When seeking a goodwill removal, there’s no need to contact the credit bureaus directly. They won’t remove accurate information upon request. If your creditor agrees to your goodwill request, they can ask the bureaus to remove the negative information from your report. But keep in mind that the bureaus may not agree.

Option 3: Wait for the information to disappear on its own

Closed accounts on your report will eventually disappear on their own. Generally, negative information on your reports is removed after seven years, while accounts closed in good standing will disappear from your report after 10 years.

If you’re curious about which accounts are still on your report or want to monitor the information on your reports over time, it’s easy to get a copy of your credit reports. Federal law allows you to request a free weekly credit report by visiting AnnualCreditReport.com.

When to consider credit repair services

If you’re feeling overwhelmed by the idea of filing disputes with the credit bureaus or writing goodwill letters to creditors, you can consider hiring a credit repair company to handle it. These companies may also offer additional services, such as credit score monitoring, identity theft insurance and sending cease-and-desist letters to debt collectors.

Credit repair companies won’t dispute accurate information, and they can’t do anything to improve your credit that you can’t do yourself. If you don’t have time for DIY credit repair — and have room in your budget to hire someone — hiring a company may help. You may also find some benefit in working with experts who may have established relationships with creditors or credit bureaus and more experience disputing errors.

Unfortunately, with so many Americans struggling with credit score issues, credit repair scammers have emerged to take advantage of people who need help. If you decide to hire assistance, choose your credit repair company carefully.

How closed accounts affect your credit score

Knowing which factors influence your credit score can help you decide which closed accounts might be worth removing. Your FICO credit score, which is the most common model used by creditors, is based on the following five factors:

- Your payment history, 35 percent.

- Your credit utilization ratio, 30 percent.

- The average length of your credit history, 15 percent.

- New credit, 10 percent.

- Your credit mix, 10 percent.

The three credit bureaus — Equifax, TransUnion and Experian — compile your credit information. Credit-scoring companies then use it to calculate your credit score.

As a result, a closed account that shows a history of on-time payments may continue to boost your credit score slightly for up to 10 years after the account was closed. On the other hand, closed accounts that show late payments, missed payments or balances going to debt collections can negatively impact your credit score for up to seven years.

Bottom line

There’s no need to remove closed accounts in good standing from your credit report. They can positively influence the average length of your credit history and your on-time payment rate, helping to boost your credit score until they naturally fall off your report.

If you believe an old account is pulling down your credit score, however, you can take some steps to try to remove it. Still, it’s important to keep in mind that removing old, negative accounts may give your credit score a quick little boost, but it typically takes years to build good credit. Responsibly managing your debt and making payments on time can positively impact your credit well into the future.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.