Guide to Amex application rules

Key takeaways

- American Express cards are often seen as a status symbol and known for their rewards potential. But there are a few rules to keep in mind before applying for an Amex card.

- Generally, you can only earn a welcome bonus once on an Amex card. And you can only have five personal or business Amex cards in your wallet at a time.

- When applying for Amex cards, you’ll only be approved for a card once every five days, and only approved for two cards within 90 days.

From generous welcome bonuses to an impressive Membership Rewards program, American Express offers a number of popular rewards credit cards. It can, therefore, be tempting to stock up on Amex credit cards.

However, there are several restrictions around Amex card approvals. Understanding these rules will increase your odds of getting approved and keep you from wasting a hard inquiry on your credit.

But it’s not all about creditworthiness. Amex also bases eligibility on the number of credit card applications you’ve submitted within a specific timeframe and the Amex cards you currently hold. Importantly, there are rules around when you can qualify for welcome bonuses as well.

Here’s our comprehensive guide to current Amex application rules to help take the guesswork out of it.

American Express once-per-lifetime rule

As the name suggests, Amex’s once-per-lifetime rule only allows you to earn a welcome bonus once on a card. So if you apply for The Platinum Card® from American Express and earn the current 80,000-point bonus after spending $8,000 within six months, you won’t be eligible for another bonus on that card.

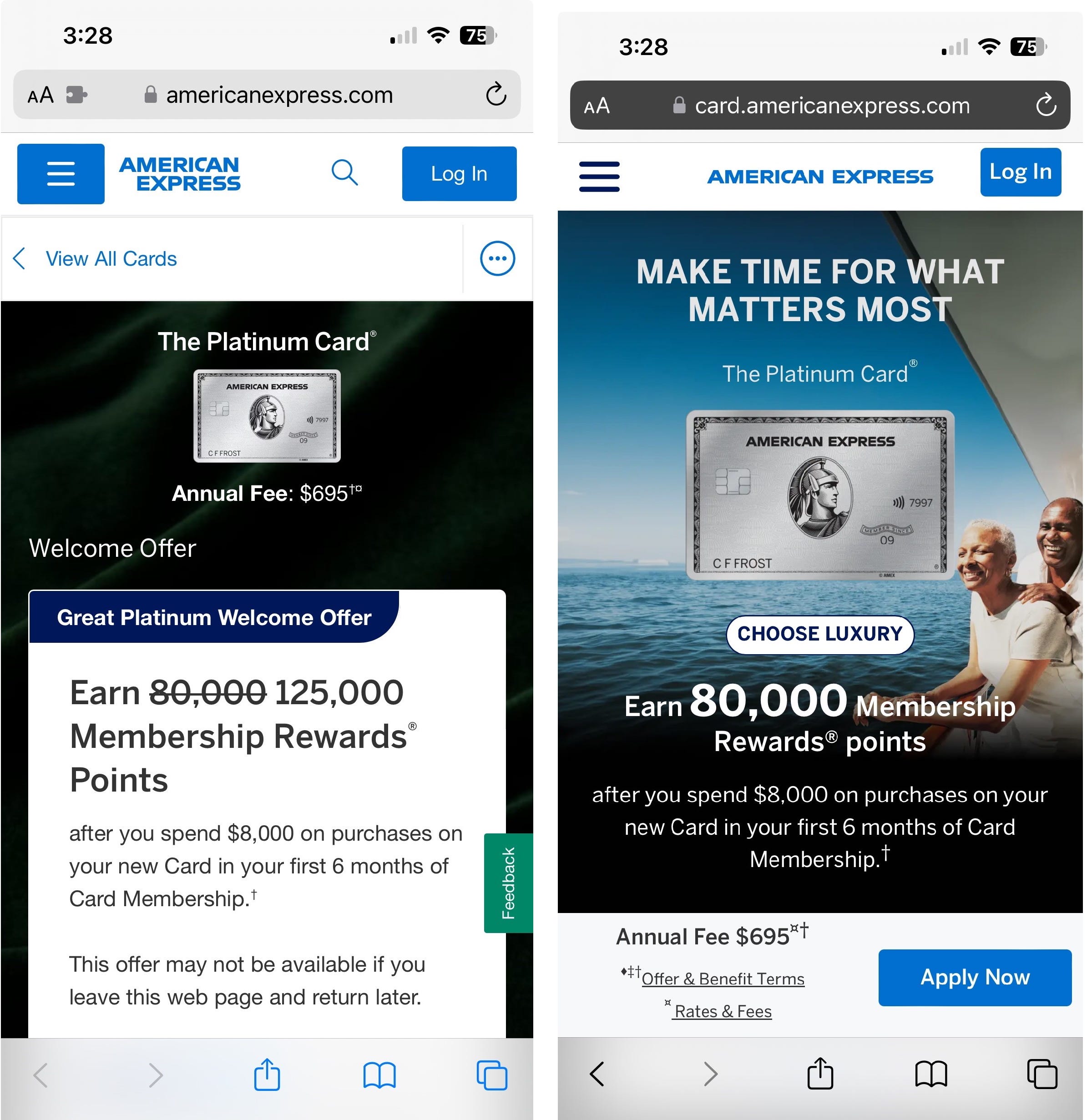

Amex may also offer different welcome bonuses based on the season, search platform and other factors. A quick Google search can help you figure out whether the current welcome bonus on a card is the highest. You might also check the offer on different browsers or in incognito mode.

Here’s an example of two different offers, found at the same time but in different search modes:

You’ll want to apply for the highest welcome bonus you can find — because you only get it once.

Which credit cards are affected by the Amex once-per-lifetime rule?

The once-per-lifetime rule applies to all Amex personal cards and business cards and non-credit or “hybrid” cards. Hybrid cards function largely like charge cards with no pre-set spending limit, but offer some financing options. Contrary to popular belief, charge cards don’t have unlimited spending. They just don’t have a pre-set limit. You may need to get approval for big purchases.

In other words, don’t buy a yacht before clearing it with Amex first.

Exceptions to the rule

Where there are rules, there are exceptions. Even though American Express has the once-per-lifetime rule, people have been targeted with repeat bonus offers that don’t include this language. If you get a targeted offer for an Amex card you’ve had before, check the terms and conditions for the following language:

“Welcome offer not available to applicants who have or have had this card or previous versions of the card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.”

Some existing cardholders have even reported getting offers for second and third bonuses on the Amex Platinum card. Again, check the offer terms for this exclusionary language.

Amex five-card rule

American Express limits cardholders to a total of five personal and business credit cards at a time. But the five-card rule doesn’t apply to hybrid cards, which offers some flexibility if you need more than five Amex cards.

Popular American Express hybrid cards include:

- The Amex Platinum

- The American Express® Gold Card

- The American Express® Green Card*

Amex 1-in-5 rule

The 1-in-5 rule limits Amex card approvals to one every five days. If you’re applying for multiple Amex cards, wait at least six days so you aren’t denied that next card. The rule doesn’t apply to hybrid cards, so you could apply for a hybrid card and revolving credit card within five days of each other.

Amex 2-in-90 rule

American Express restricts card approvals to no more than two within 90 days. This means that even if you follow the 1-in-5 rule above and get two cards more than five days apart, you still can only get those two cards within 90 days.

So far, there are no exceptions to the Amex 2-in-90 rule.

How to find out if you’re eligible for an Amex Card before applying

If you’re not sure where you qualify for an Amex credit card under these rules, there’s a ways to find out — start applying for the card. If you’re not eligible for the card or welcome bonus, you’ll get a pop-up warning before submitting the application.

You can also get preapproved for an American Express credit card. It only takes a soft credit check, which won’t affect your credit score. Getting preapproved doesn’t guarantee you’ll be approved, but it can help you know your odds. You can also check your eligibility through Bankrate’s CardMatch™ tool.

If your credit card strategy involves more than Amex cards, you’ll need to consider that. For instance, if you’re going to apply for a Chase credit card soon, don’t forget about Chase’s 5/24 rule that says you won’t be approved for a Chase card if you’ve opened five or more cards over the last 24 months. That goes for cards with all issuers, including American Express.

The best Amex cards to apply for

The best Amex credit card for you depends on your spending habits and rewards goals. You might want a personal, business or co-branded card. Here’s a look at the types of Amex cards available:

Amex personal cards

If you’re looking for a card with luxury travel benefits, the Amex Platinum card is almost unbeatable. For the $695 annual fee, it offers a number of statement credits, airport lounge access and a hefty welcome bonus — currently 80,000 points after you spend $8,000 within the first six months of card membership. This bonus is worth an average of $1,600 when transferred to a high-value partner, based on Bankrate’s valuations.

If you want a card that rewards your everyday spending, the Amex Gold card might be a better fit. The card earns 4X points on restaurant purchases worldwide (on up to $50,000 in purchases per calendar year, then 1X points) and U.S. supermarket purchases (on up to $25,000 in purchases per calendar year, then 1X points). With these spending categories, you can earn points long after the welcome bonus. Right now, Amex Gold offers as high as 100,000 points after you spend $6,000 on purchases in the first six months of card membership. Bankrate values this bonus at an average of $1,200.

Amex business cards

American Express offers business versions of most of its popular cards. However, if you want a no-annual-fee business card, The Blue Business® Plus Credit Card from American Express is an option. The card earns 2X points on the first $50,000 spent every year. It’s great for people who don’t want to deal with credit card category bonuses, since every eligible purchase earns a flat 2 points per dollar spent.

This card doesn’t always offer a welcome bonus, making the current one worthwhile — 15,000 points after spending $3,000 in eligible purchases within the first three months of card membership.

Amex co-branded cards

Thanks to a slew of transfer partnerships, Amex Membership Rewards points tend not to lose their value. But Amex also has several co-branded credit cards to choose from. If you’re looking to achieve elite status or brand-specific rewards, a co-branded card may be a better choice.

The Hilton Honors American Express Aspire Credit Card* comes with automatic top-tier status. And the Amex Delta cards are great for Delta loyalists who want to accelerate their elite status goals. Amex partners with many popular loyalty programs, so there’s probably a co-branded card that fits your needs.

The bottom line

With good credit and a rewards strategy, you could take advantage of the many perks that come with an American Express card. Just keep these several rules in mind as you apply for an Amex card to increase your chances of being approved.

You can also get prequalified and possibly a higher welcome bonus through Bankrate’s CardMatch tool.

*The information about the American Express® Green Card and Hilton Honors American Express Aspire Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.