Guide to American Express purchase protection

Key takeaways

- A range of credit cards from American Express offer purchase protection against damage or theft, although limits on this benefit vary by card type.

- This coverage applies when a purchase is damaged or stolen within a specified timeline and charged to an eligible card.

- Some American Express credit cards offer related benefits like guaranteed return protection and extended warranties.

While many consumers sign up for travel and rewards credit cards in order to rack up points and miles, the built-in consumer protections some cards offer can be worth much more than rewards. Of course, this is only the case for those who actually know what their benefits are — and for those who use them.

Purchase protection is a good example because it comes with high limits (typically up to $50,000 per year) that can be useful when you buy a lot of big-ticket items. Fortunately, many American Express credit cards offer this perk, although coverage limits vary depending on the specific card you’re approved for.

What is Amex purchase protection?

American Express purchase protection is similar to protections offered by other top rewards and travel credit cards. With Amex purchase protection, you gain basic protection against damage or theft for items you pay for with your credit card within a specific period of time.

Benefits from Amex purchase protection are meant to reimburse you for the repair cost or replacement cost of your item, which is often easier to determine since you just paid for it with your credit card.

Keep in mind: Like other purchase protection benefits afforded through credit cards, Amex purchase protection is good up to a specific amount for each claim. Annual claim limits also apply, although all Amex limits for this coverage tend to be on the generous side.

Which credit cards offer Amex purchase protection?

American Express makes it easy to find out which of their credit cards offer purchase protection via its website. Generally speaking, nearly all Amex rewards and travel credit cards come with this perk, including cards that earn American Express Membership Rewards points and cards co-branded with Delta Air Lines and Hilton Honors.

With that being said, you won’t get the same amount of coverage from all American Express credit cards, and some are a lot more generous than others.

What kind of purchases are covered?

According to American Express, a “covered event” is a situation where a “covered purchase” is affected by damage or theft. For a purchase to qualify, it only needs to be paid for using an American Express credit card that offers this important coverage.

Even if you only charge a portion of your qualifying purchase to your American Express card, you are still eligible for the purchase protection benefits. However, you’ll only be reimbursed up to the amount charged to your card.

Specific examples where purchase protection could come in handy could include:

- You purchased a new set of home appliances, but you realize they have considerable damage and denting after they were already delivered and installed.

- Someone breaks into your car and steals your recently purchased laptop computer.

- You buy a new home audio system and you drop it on accident, rendering it unusable.

- You buy a new piece of artwork for your living room and an earthquake knocks it off the wall, creating a major tear that cannot be repaired.

What does Amex purchase protection not cover?

While American Express purchase protection covers quite a few circumstances, there are plenty of situations where your coverage will not apply. These are listed explicitly in the terms of the policy you receive with your American Express credit card, but we’ve highlighted the major instances and situations that are not covered by purchase protection, below:

- Acts of war

- Government confiscation of your property

- Damage due to participation in a riot, civil disturbance or protest

- Damage that takes place when a third party has your item in their possession

- Stolen items that were not safeguarded (i.e. valuable goods left in an unlocked car)

- Normal wear and tear

- Items that mysteriously disappear

- Fraud, dishonesty or criminal acts or omissions

- Damage caused by alteration of any kind

- Items covered by an unconditional satisfaction guarantee

- One-of-a-kind pieces of art or furniture

- Items that are not purchased but rented, leased or borrowed instead

- Lands or buildings

- Most motorized devices

- Items you discarded

- Items purchased for resale

- Medical or dental devices or equipment

Before you rely on this coverage for an item you plan to buy, make sure to read through your coverage terms and conditions to make sure your purchase will qualify.

Imagine you buy a laptop computer from a company like Best Buy with an especially restrictive return policy. Just to give you some perspective, the store website says its standard return window for most items is just 15 days.

The store’s fine print on returns also says the following: “Items need to be returned in a like-new condition. Items that are damaged, unsanitary, dented, scratched or missing major contents may be denied a return.”

If you drop your laptop within a few days after you buy it and it becomes damaged, Best Buy wouldn’t take it back after purchase due to their policy. If the laptop has some sort of operational problems and you want to return it, you likely won’t have that option after 15 days.

But if you paid with an eligible American Express credit card, on the other hand, you could use the purchase protection offered through your card since “damage” is covered. The American Express Gold Card purchase protection is worth up to $10,000 per eligible purchase, which should be enough to have your laptop adequately repaired or completely replaced.

Does Amex offer other types of shopping protection?

In addition to the purchase protection described above, a handful Amex credit cards also offer return protection and extended warranty protection. Cards that offer this benefit include:

- American Express Platinum Card®

- Hilton Honors American Express Aspire Card*

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- Blue Cash Preferred® Card from American Express

- The Amex EveryDay® Preferred Credit Card*

Amex return protection

In essence, the return protection benefit compensates cardmembers when a store doesn’t accept an eligible item for return within 90 days of purchase. When this happens, Amex will refund the entire purchase price, up to $300 per item, less shipping and handling charges. This benefit is limited to $1,000 annually.

There are many ineligible items that do not qualify for this protection, like live plants, firearms, seasonal items, jewelry and more. Be sure to read your card’s terms and conditions to know exactly what qualifies for the return protection benefit.

Amex extended warranty protection

Amex’s extended warranty protection matches a manufacturer’s warranty of less than two years and extends warranties of up to five years by an additional one to two years. The length of the extension depends on your Amex card.

This coverage is secondary to the manufacturer’s warranty, so it only applies when the original warranty has expired. The coverage is limited to $10,000 per claim and $50,000 in total claims per calendar year.

How to file a claim

To file a claim with Amex purchase protection, you can do so online or by calling 1-800-228-6855.

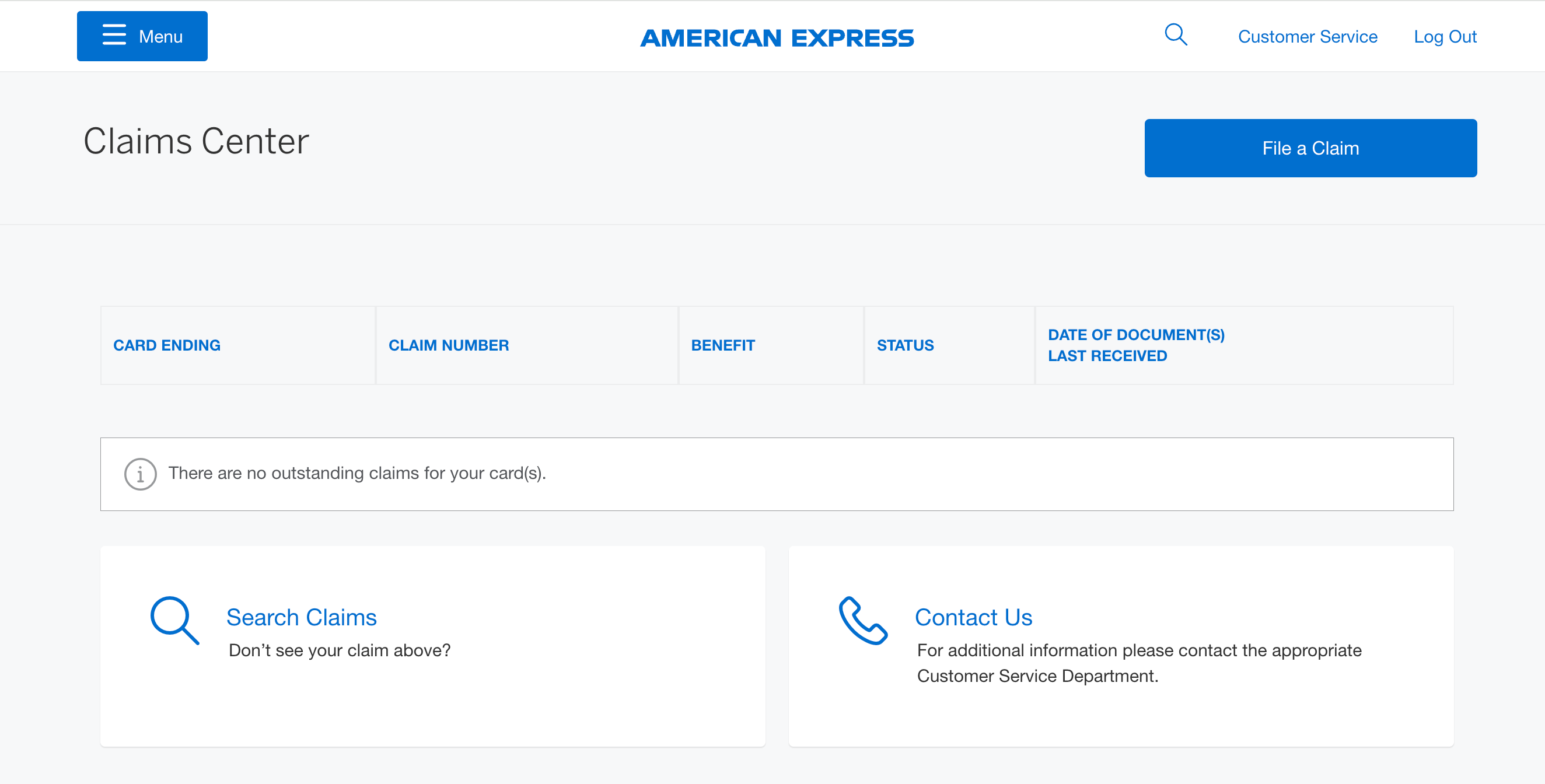

If you file a claim online, you’ll first log into your Amex account, then head to the Claims Center, where you can click on the “File a Claim” option.

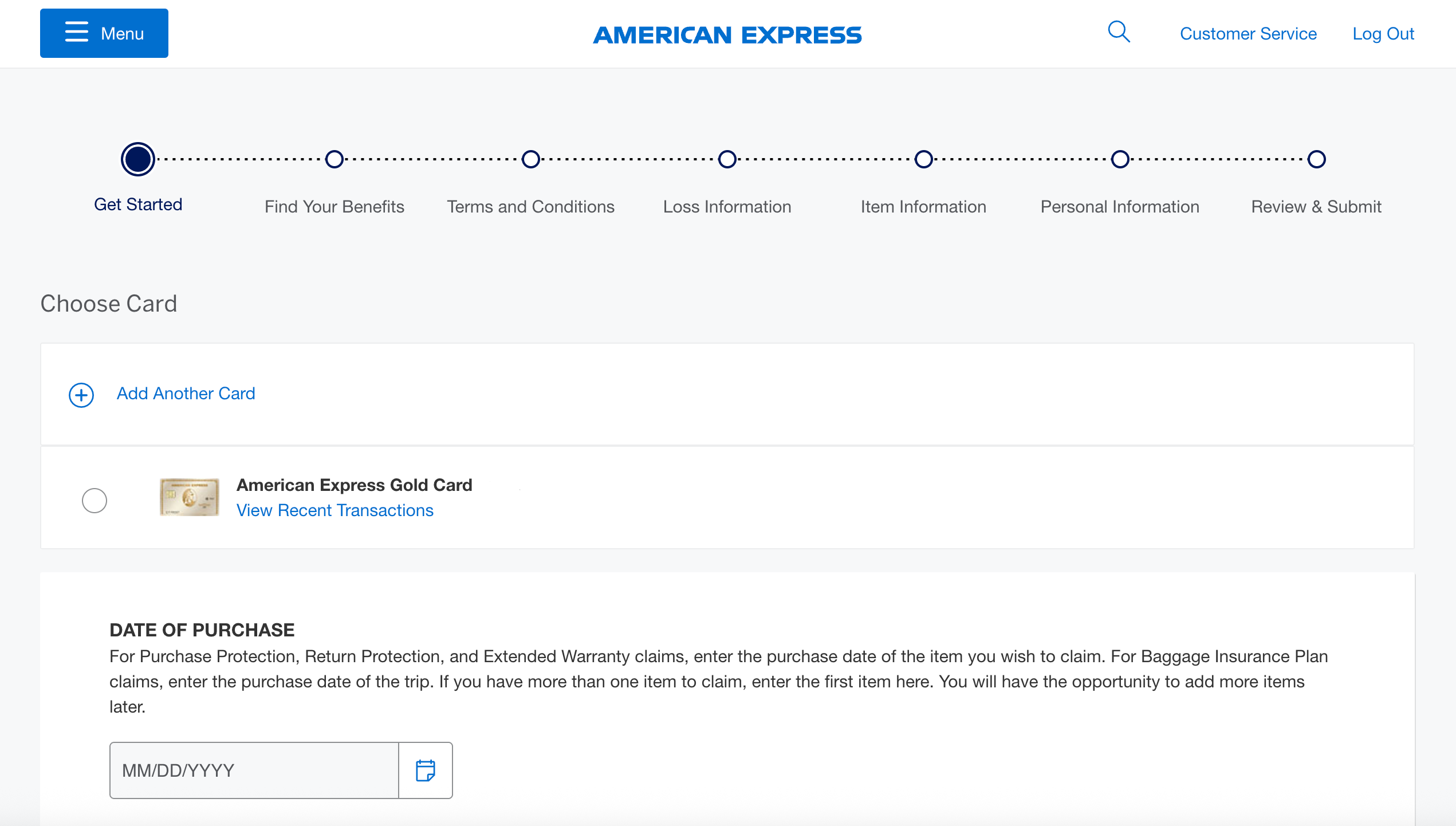

From there, you’ll be asked a series of questions regarding the credit card you purchased the item with, the date of purchase, item information and personal information. You can then review and submit your claim.

For return protection, you have to file a claim within 90 days of your original purchase. For purchase protection or extended warranty claims, notice of the claim should be filed with American Express within 30 days of the loss or as soon as possible. Claim forms will likely be sent to you within 15 days after you report a loss, at which point you’ll provide American Express with all the information you can about your specific claim.

American Express notes that proof of your loss needs to be submitted to them within 60 days, if possible. This may include:

- An original itemized store receipt showing the purchase you’re filing a claim for

- A copy of any insurance declaration agreement

- A photograph that shows damage to your item

- A completed repair estimate form or a written police report for theft

- Vandalism claims

In some cases, you may even have to return the actual damaged or irreparable item to Amex.

How long does an Amex purchase claim take?

Once American Express receives all the information required to process your claim, they’ll conduct an investigation and determine if your purchase qualifies for repair or replacement. Amex states that it takes an average of 45 days for a claim to reach a final decision.

Generally speaking, qualified claims will receive the lesser of the cost to repair the item, the cost to replace the item or full reimbursement of the item in question. The one exception is natural disasters, in which case claims are limited to $500 in reimbursement regardless of the purchase price of the item.

The bottom line

Amex purchase protection can be a valuable benefit for cardholders, especially since most cards offer coverage in amounts up to $50,000 per year. Other notable protections from this card issuer include Amex return protection and extended warranties, both of which can help you get your money back if something goes wrong with a purchase after the fact.

Just remember that these benefits only apply when you pay for eligible purchases with an eligible Amex credit card. Also make sure you understand the limits for coverage your specific card has, and that you read over the fine print to learn about exclusions that apply.

*The information about the Amex EveryDay® Credit Card, Hilton Honors American Express Aspire Card and Amex EveryDay® Preferred Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.