Guide to United Airlines partners

Key takeaways

- United MileagePlus miles can be earned and redeemed with United Airlines, Star Alliance partners, non-Star Alliance airline partners and a whole slew of other travel partners.

- United miles can be earned through flights on the airline or its partners as well as through credit cards, hotel partners, dining programs and more.

- United offers multiple credit card options to help you earn miles from your everyday purchases.

As a major airline with plenty of partner companies, United Airlines can be a solid option for your upcoming travels. When you fly with United or one of its partner airlines, you can earn United MileagePlus miles. Those miles are redeemable for flights with United or its vast network of Star Alliance partner airlines. You can also redeem them with other partners in the travel and hospitality spaces.

In this guide, we will dive into United’s partners and how to earn and use United miles.

United Star Alliance partners

United Airlines is a member of the Star Alliance, a global network of 25 airlines. These airlines offer flights to more than 1,160 airports in 192 countries. Flying on airlines within the same alliance allows you to accrue more miles and status, which can be helpful for making award bookings and enjoying special perks such as seat upgrades.

Benefits of Star Alliance Gold status

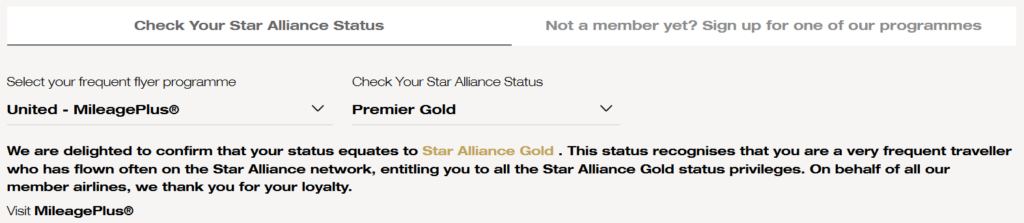

When you meet United’s Premier Gold requirements, you will automatically receive Star Alliance Gold status. This status entitles you to benefits that apply across all airlines within the alliance. Benefits of this status include priority airport check-in, priority baggage handling, access to airport lounges within the alliance network, priority boarding and more. These benefits can be quite helpful and make your next trip a breeze if you fly on airlines within the network.

In fact, meeting status with any of the Star Alliance partner airlines could qualify you for some level of Star Alliance status. You can check whether your airline status qualifies on the Star Alliance website.

Other airline partners

United has several partner airlines outside of Star Alliance. While benefits vary by airline, expect the option to accrue United miles on each airline as well as the ability to access flights to destinations not served by United nor its Star Alliance partners.

For example, through its partnership with Virgin Australia, you can access cities such as Hobart on a single itinerary (with multiple layovers) sold by United and accrue miles for the journey. Keep in mind, since these are not Star Alliance partners, some services such as mobile boarding passes, priority customer service or cabin options may not be available.

United hotel partners

United Airlines partners with several hotel chains, providing yet another way to accrue miles. These partners operate more than 15,000 hotels worldwide, so they likely offer a location near most destinations you could imagine. Benefits can vary by hotel brand and chain.

United rental car partners

In addition to hotels and airlines, you can also earn United miles when you book a rental with the following partner car rental companies:

What are the best transfer partners for United?

When it comes to credit card transfer partners, United is partnered with both Bilt Rewards and the Chase Ultimate Rewards programs. These programs allow you to transfer their points at a 1:1 ratio (unless there’s a transfer bonus) to United to add to your miles balance, which could get you closer to your next award booking.

As of the time of this writing, Bankrate values these points at the following values:

|

Program |

Bankrate Value** |

Estimated value of 50,000 points/miles |

|

0.9 cents |

$450 |

|

|

Bilt Rewards |

2.1 cents |

$1,050 |

|

2.0 cents |

$1,000 |

**Based on weighted average of median point/mile values across economy and first/business class fares for United Airlines MileagePlus, and based on an average of the issuer’s five highest-value transfer partners for Bilt Rewards and Chase Ultimate Rewards (if available).

Given the various points have different values within their respective programs, be sure to review ticket options and choose the partner that works best for you. Keep in mind, however, that United occasionally offers special deals that can make its points even more valuable.

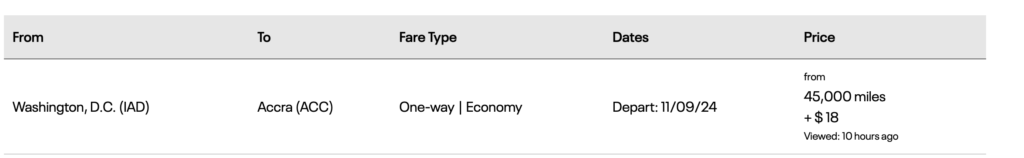

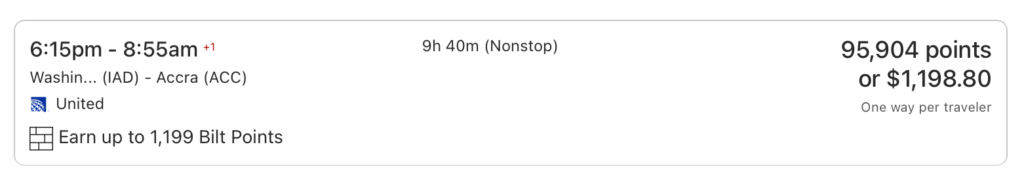

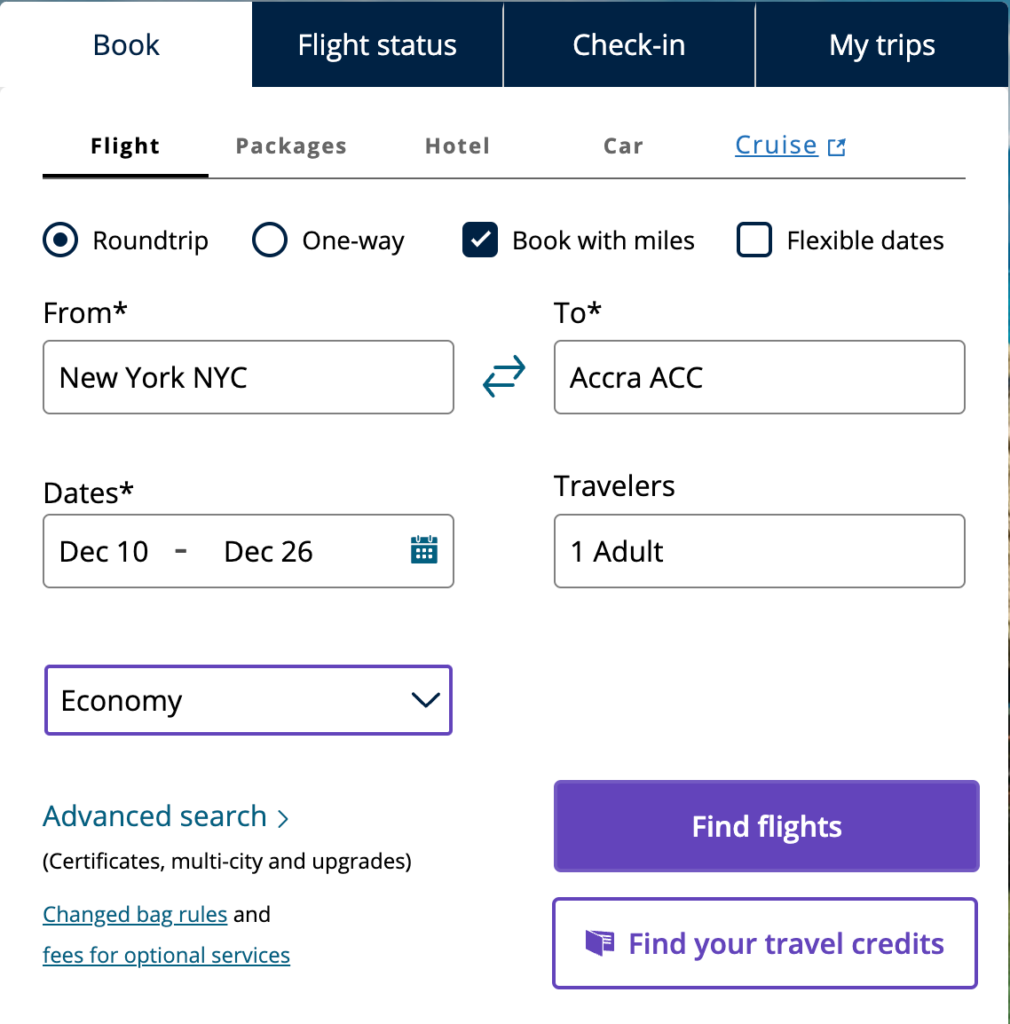

For example, United offers its Featured Awards page where you can find sweet spots within the program. If you were looking to fly between United’s hub in Washington D.C. and Accra, Ghana’s capital, the example below shows United offering an economy ticket for 45,000 points one way.

That same flight through Bilt Rewards would cost 95,000 points, making the booking on a United a much better value and worth transferring points over.

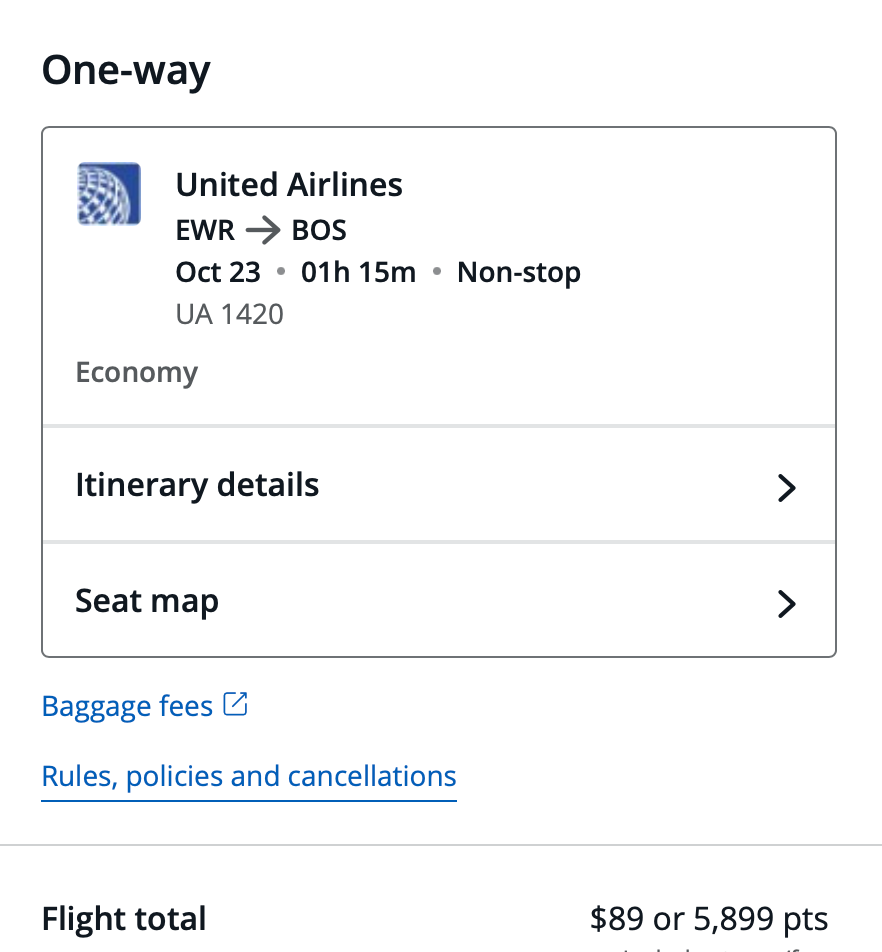

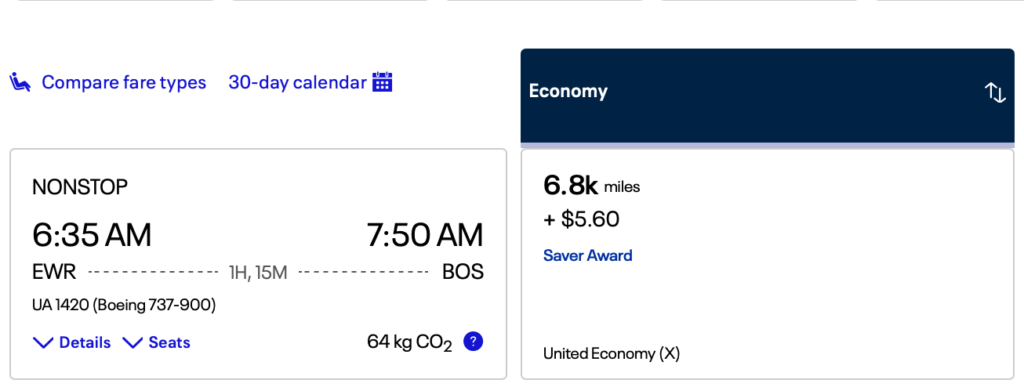

Likewise, there are cases where using an external partner can be a better deal. For instance, since the Chase Sapphire Reserve®’s points can be redeemed at 1.5 cents per point through Chase Travel (through Oct. 26, 2027 for cardholders who applied prior to June 23, 2025 and earned their points prior to Oct. 26, 2025), booking the following flight from New York/Newark to Boston is a better deal on Chase Travel than United’s own website when using points from a Chase Sapphire Reserve card.

In contrast, the same flight is offered for nearly 7,000 United miles, which is a lower redemption value.

Ultimately, like other programs, United points have their unique set of sweet spots. If you are looking to optimize when to transfer to its program, the featured awards page can help in that decision. Be sure to review all the options, however, and make the choices that best work for you. Transfer partner deals can vary and change by day or desired destination.

How to earn miles with United partners

Earn with Star Alliance flights

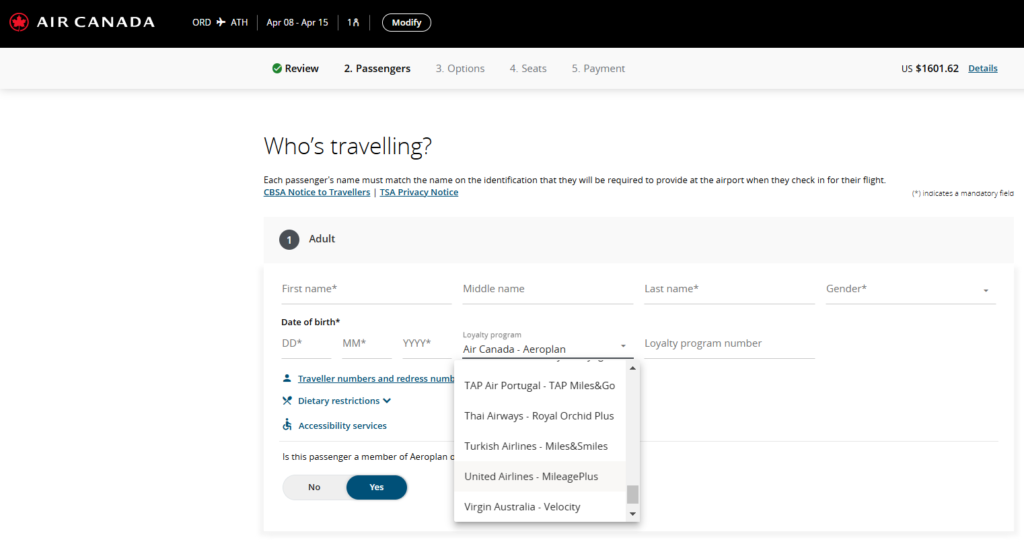

You can earn miles by flying with United partner airlines within the Star Alliance. When you fly with one of United’s airline partners, you can earn United miles simply by adding your MileagePlus number when you book your tickets. This option can often be found in the booking flow as you fill out the passenger information section, as it is for the Air Canada flight example seen below.

Keep in mind that the amount of miles you earn can vary depending on how you booked the partner flight. If you bought your tickets directly from United, you’ll earn miles based on the fare and your MileagePlus status level. When you book a flight through a partner airline, you’ll earn miles according to the distance of your flight and your fare class.

If you’re seeking Premier status with United, Premier-qualifying credits can vary, and not all partner tickets are eligible for Premier-qualifying points. For a full rundown of Premier-qualifying credits with partners, you can visit this page on United’s website.

Lastly, each Star Alliance airline has its own rewards program and points are not exchangeable. If you have United miles for example, you cannot transfer them to Lufthansa’s Miles & More program to book directly through Lufthansa. You can, however, book a Lufthansa flight through United’s website, using United miles (pending availability). The same goes for the rest of United’s airline partners.

Earn with other partner flights

On top of the Star Alliance, United partners with additional airlines around the world, so you’ll have even more options to earn MileagePlus miles. The ease of crediting these flights to United MileagePlus can vary by partner airline so be sure to check at booking or contact the partner airline to ensure it is credited correctly.

Earn with hotel partners

You can earn miles from hotel partners by connecting your MileagePlus account or by booking via United’s travel portal, United Hotels. The amount of points you can earn will vary depending on the hotel partner, amount spent or length of stay. For example, for a stay at select Hyatt hotels, you can earn 500 miles per stay while a stay at a JW Marriott would earn 2 miles per $1 spent. Be sure to review the benefits by hotel to determine the best hotel choice for yourself if you want to maximize earning miles.

If you have existing points in certain hotel partners’ loyalty programs, you may be able to convert those points to United miles. For example, you can convert Marriott Bonvoy points to MileagePlus miles at a rate of 3 points per mile, with a 10,000-mile bonus for every 60,000 points you convert. Conversion rates vary by partner.

Earn with MileagePlus Shopping

You can also earn miles by shopping with eligible retailers through MileagePlus Shopping. To do so, sign up for the free program at shopping.mileageplus.com. There, you can browse the list of participating retailers as well as see how many miles you’ll earn on each purchase. Then, click through to your desired retailer through the MileagePlus Shopping page. Be careful not to click to another website before you make your purchase, or you might not earn the miles. After you make the purchase, the retailer will inform United, who will add the miles to your account.

Earn with MileagePlus Dining

MileagePlus Dining lets you earn miles on dine-in and takeout orders at participating restaurants in the U.S. To do so, first sign up for free at dining.mileageplus.com, then link a credit or debit card to your account. You can search for participating restaurants on the MilePlus Dining site or MileagePlus X app. When you eat at an eligible restaurant and pay with your linked card, you can earn up to 5 miles per dollar spent. This is separate from any rewards from your credit card.

Best credit cards for earning miles with United

When it comes to earning United miles, credit cards can be a great option. United’s co-branded airline credit cards offer a way to earn miles directly from your purchases. In addition, you can use a flexible travel credit card — such as those in the Chase Ultimate Rewards program — that allows you to transfer those points at a 1:1 ratio to United MileagePlus.

These cards provide great opportunities to maximize your MileagePlus miles while allowing you to take advantage of other card perks like no foreign transaction fees or travel protections. Here are a few credit card options you might want to consider:

Chase Sapphire Reserve®

How to redeem miles with United partners

Once you’ve racked up enough United MileagePlus miles to redeem for an award ticket, you can check your options directly through United’s website or mobile applications.

Searching for an award flight is simple. On the website or app, enter your desired departure airport and final destination alongside your travel dates, number of travelers and desired cabin class. Be sure to check the “Book with miles” box in order to see available flights that can be paid for in MileagePlus miles.

From there, you can view all award seats available to your destination with United, its Star Alliance partners and other partner airlines. You can then book your award flight using your miles.

United also allows you to view a 30-day calendar to find which days have the lowest miles costs.

The bottom line

With a global network of partner airlines, hotels and retailers, there are numerous ways to earn and redeem United MileagePlus miles. If you’re a frequent traveler with United, its wide range of airline partners can help you stretch your MileagePlus miles even further with added destinations and access.

Just remember, your United miles will often go furthest when you book United flights directly through United. And to maximize your miles rewards over time, don’t forget to check for additional partner benefits when you book a hotel, rent a car or shop with partner retailers.

*Information about the United Club℠ Infinite Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Frequently asked questions (FAQs) about United Airlines partners

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.