IHG One Rewards guide

Key takeaways

- IHG One Rewards is a free loyalty program for the InterContinental Hotels Group that lets members earn points toward free hotel stays and other types of redemptions.

- Program members who climb the elite status tiers also get additional perks like late check-out, early check-in and complimentary upgrades when available.

- IHG One Rewards members can boost their earnings even further by signing up for co-branded credit cards, which let them earn extra points with every purchase.

InterContinental Hotels Group (IHG) includes 20 hotel brands and over 6,000 hotels and resorts around the world. A stay with IHG could include a luxury vacation at a Kimpton location, an InterContinental resort property or even a Crowne Plaza. It could also include a quick stop at a local roadside hotel like a Holiday Inn, Holiday Inn Express or Staybridge Suites, among others.

By signing up for IHG One Rewards, the hotel group’s loyalty program, you could make your vacation even better with savings and on-property benefits like room upgrades and free internet access. In this guide, we explain how the IHG One Rewards program works, how to earn points and the best ways to use them.

IHG One Rewards basics

When IHG Rewards revamped its loyalty program in early 2022, the name of the program changed to IHG One Rewards. Other updates made the program more generous and useful overall as it now offers more benefits, redemption methods and elite status tiers.

Members still earn points on hotel stays and other qualifying activities, which can then be used for free nights, airline miles, merchandise and a handful of other redemption options. There are also numerous ways to earn IHG points, including with paid hotel stays at IHG properties, spending on co-branded credit cards and travel bookings with partners.

How many points do you need for a free hotel night?

As of May 2025, free hotel stays within the 6,000+ hotels associated with IHG One Rewards start at just 5,000 points. You can also pay for a hotel stay redemption, typically called a Rewards Night, entirely with points or with a combination of points and cash. And like other hotel programs, IHG One Rewards has elite status tiers you can earn, which come with more travel perks and opportunities for rewards.

How to sign up for IHG One Rewards

To sign up for IHG One Rewards, follow these simple steps:

- Head to the IHG website and select IHG One Rewards at top right.

- Scroll down on the rewards page and select Join for free.

- Enter information like your name, email address, home address, country of residence and password to create your account.

Once you provide the information required to create an account, you’ll receive an email with your new loyalty account number that you can use on the IHG One Rewards login page. You can then begin earning points on hotel stays (and more) right away.

Who is IHG One Rewards best for?

Anyone who wants to earn points for free stays at InterContinental Hotels Group properties should sign up for this program. After all, membership with IHG One Rewards is absolutely free.

After you join IHG One Rewards, you can get on the fast track to earning elite status and award stays in no time. This is especially true if you sign up for a co-branded hotel credit card and begin earning points on hotel stays, travel and other spending.

While you’d get more out of it if you traveled often, it’s still a good program to join if you travel less frequently. This is because joining the program is free and easy to do, so you’ll have nothing to lose by signing up.

IHG hotel partners

IHG Hotels & Resorts offers 20 different brands and over 6,000 locations around the world. From luxury hotels to roadside favorites, here is a list of IHG’s current hotel partners.

How to earn IHG One Rewards points

As an IHG One Rewards member, you can earn points in a variety of ways, including the following:

Book hotel stays at IHG properties

IHG One Rewards members earn up to 10X base points per dollar at most IHG hotels and 5X points per dollar at Staybridge Suites and Candlewood Suites. Also, note that you can earn more points depending on your elite status. The following chart shows how many bonus points you can earn for each membership level:

| Membership level | Club Member | Silver Elite | Gold Elite | Platinum Elite | Diamond Elite |

| Bonus points | N/A | 20% | 40% | 60% | 100% |

Claim Milestone Rewards

The IHG One Rewards program also offers Milestone Rewards, which reward you for frequent stays. After you’ve stayed 20 qualifying nights, you’ll be able to choose one reward for every 10 additional nights you stay. Note that select qualifying nights will receive a bonus choice reward, meaning that you’ll be able to choose two rewards instead of one.

Here are the rewards you can choose from:

| Number of qualifying nights stayed | Rewards options |

|---|---|

| 20 nights |

|

| 30 nights |

|

| 40 nights (bonus choice eligible) |

|

| 50 nights |

|

| 60 nights |

|

| 70 nights (bonus choice eligible) |

|

| 80 nights |

|

| 90 nights |

|

| 100 nights |

|

Take advantage of IHG promotions

IHG One Rewards members can earn points through special promotions the loyalty program offers. For example, a recent promotion allowed members to save up to 30 percent on select stays at hotels in East Asia and the Pacific.

Utilize IHG partners

You can also earn IHG One Rewards points with products and packages from IHG partners, including Iberostar Beachfront Resorts stays, Hertz car rentals, dining reservations with OpenTable and dining with restaurant partners.

Earn points with the right credit card

IHG offers several co-branded hotel credit cards with Chase as the card issuer. Depending on the card, cardholders can enjoy automatic elite status with the hotel brand, plus additional perks like a fourth night free on award bookings (when booking four consecutive nights with points) and free anniversary nights.

It’s also important to note that IHG One Rewards is a Chase Ultimate Rewards transfer partner, as well as a travel partner with the Bilt Rewards program. This means you can sign up for an elite travel credit card like the Chase Sapphire Preferred® Card or the Bilt Mastercard® and earn points that transfer to your IHG One Rewards account.

How to transfer points to IHG

If you have a credit card with rewards that transfer to IHG One Rewards, you’ll want to think long and hard before you transfer your points. After all, flexible rewards currencies like Bilt Rewards and Chase Ultimate Rewards are worth considerably more than points in hotel loyalty programs, especially with IHG One Rewards. This means you may only want to transfer your rewards in specific situations, such as if you are short a few thousand points for a redemption you want to make with IHG One Rewards.

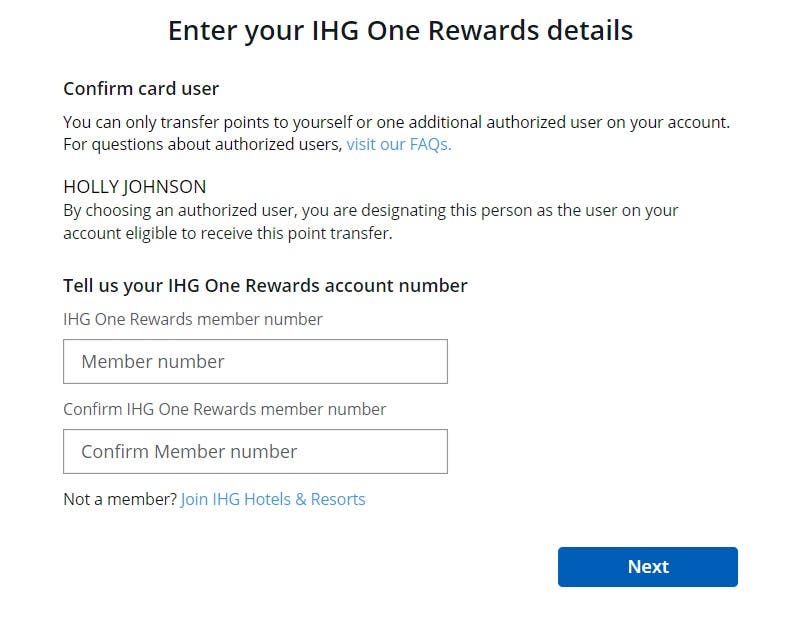

If you do want to transfer points to IHG One Rewards, you can do so through your online account. Here’s an example of the steps required to transfer points from Chase Ultimate Rewards to IHG One Rewards:

- Log into your Chase credit card account dashboard and head to the section where your rewards balance is listed.

- Once at the Chase Ultimate Rewards portal, you’ll click on the top of the page where it says “travel,” then on “transfer points to partners.”

- Choose IHG One Rewards as the transfer partner, and decide how many points you want to transfer. Keep in mind that transfers must be made in increments of 1,000 points.

- Make the transfer and wait for your rewards to show up in your IHG One Rewards account.

If you have never transferred points to IHG One Rewards before, you’ll also need to enter information like your IHG One Rewards membership number before you can move forward.

Chase saves your loyalty program information after you submit it the first time, so you shouldn’t have to enter it next time you want to make a transfer.

IHG One Rewards Elite status

There are five IHG One Rewards membership levels. The following chart shows the benefits you’ll receive with each tier, plus the requirements to achieve each level of elite status:

| Club | Silver Elite | Gold Elite | Platinum Elite | Diamond Elite | |

|---|---|---|---|---|---|

| Number of stays or points needed to earn status | N/A | 10 stays | 20 stays or 40,000 points | 40 stays or 60,000 points | 70 stays or 120,000 points |

| Bonus points earned | N/A | 20% | 40% | 60% | 100% |

| Earn points for reward nights | Y | Y | Y | Y | Y |

| No blackout dates for reward nights | Y | Y | Y | Y | Y |

| Member rates and promotions | Y | Y | Y | Y | Y |

| Free internet | Y | Y | Y | Y | Y |

| Late 2 p.m. checkout | Y | Y | Y | Y | Y |

| Points don’t expire | Y | Y | Y | Y | |

| Rollover nights for next year’s status | Y | Y | Y | ||

| Hertz Gold Plus Rewards® Status | Five Star | Five Star | President’s Circle | ||

| Complimentary room upgrades when available | Y | Y | |||

| Guaranteed room availability | 72 hours (blackout dates apply) | 72 hours (blackout dates apply) | |||

| Welcome amenity at check-in | Points or drink/snack | Free breakfast, points or drink/snack | |||

| Early check-in when available | Y | Y | |||

| Reward night discounts | Y | Y | |||

| Dedicated Diamond status support | Y |

How to redeem IHG One Rewards points

The IHG One Rewards program doesn’t have as many redemption options as other programs, but it still offers several ways to redeem your points, such as:

Free hotel stays

The best redemption option with IHG One Rewards is by far their Rewards Nights. As mentioned before, hotel stays start at 5,000 points per night, and you can also pay for your hotel stay with a combination of points and cash.

Experiences and events

You can also redeem your IHG One Rewards for travel experiences and tours. Additionally, IHG One Rewards Access provides exclusive access to hard to get tickets at major events — like concerts, sporting events and more.

Gift cards or merchandise

You also have the option to redeem your points for merchandise or gift cards. However, you won’t get as much value out of your points with this redemption method.

Digital rewards

Another option is to redeem your rewards for digital books, games, movies, music or magazine subscriptions. Note that digital rewards may change based on your location. As with gift cards or merchandise, we don’t recommend this option since you’ll get less value out of your points.

Airline miles

You can also turn your IHG One Rewards points into airline miles, but again, this isn’t a good use of your points. Most airline partners let you turn 10,000 IHG points into 2,000 airline miles, which is a poor transfer ratio. However, there are quite a few airline partners to choose from, and this option could make sense if you need to book an award flight but you’re short on miles.

Charitable donations

If you’d rather donate your points to charity, IHG has several nonprofit partners. For example, you can donate your points to the American Red Cross, Just a Drop or Action Against Hunger, among others.

How much are IHG One Rewards points worth?

According to Bankrate’s latest valuations, IHG One Rewards points are worth about 0.7 cents each. Keep in mind that, while some hotel loyalty points are definitely worth a lot more, they aren’t as easy to earn.

How does IHG One Rewards compare to other programs?

| Hotel program | Average point value* |

|---|---|

| IHG One Rewards | 0.7 cents |

| Best Western Rewards | 0.6 cents |

| Hilton Honors | 0.6 cents |

| Marriott Bonvoy | 0.7 cents |

| Radisson Rewards Americas | 0.4 cents |

| World of Hyatt | 2.3 cents |

| Wyndham Rewards | 0.9 cents |

*Valuations provided by Bankrate

IHG One Rewards transfer partners

IHG One Rewards has more than 40 airline partners. While you can earn miles or points with all of the following partners, some partners don’t allow you to transfer IHG One Rewards points to airline miles/points.

Here are all of IHG’s airline partners you can earn or transfer rewards with, as well as their transfer rewards rates:

| Airline | Transfer rate |

|---|---|

| Aeromexico | Redeem 10,000 IHG One Rewards points for 2,000 Aeromexico Rewards Points |

| Air Canada | Redeem 10,000 IHG One Rewards points for 2,000 Aeroplan Miles |

| Air China | Redeem 10,000 IHG One Rewards points for 2,000 PhoenixMiles |

| Air France/KLM (Flying Blue) | Redeem 10,000 IHG One Rewards points for 2,000 Miles |

| Air Miles | Redeem 10,000 IHG One Rewards points for 250 miles |

| Air New Zealand | Redeem 10,000 IHG One Rewards points for 25 Airpoints |

| Alaska Airlines | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| ANA | Redeem 10,000 IHG One Rewards points for 2,000 ANA Mileage Club miles |

| American Airlines | Redeem 10,000 IHG One Rewards points for 2,000 AAdvantage miles |

| Avianca Airlines | Redeem 10,000 IHG One Rewards points for 2,000 LifeMiles miles |

| British Airways | Redeem 10,000 IHG One Rewards points for 2,000 Avios points |

| Cathay Pacific | Redeem 10,000 IHG One Rewards points for 2,000 Asia Miles miles |

| China Airlines | Transfers unavailable |

| China Eastern | Redeem 10,000 IHG One Rewards points for 2,000 China Eastern points |

| China Southern | Redeem 10,000 IHG One Rewards points for 2,000 Sky Pearl Club Kilometers |

| Delta Air Lines | Redeem 10,000 IHG One Rewards points for 2,000 SkyMiles |

| Emirates | Redeem 10,000 IHG One Rewards points for 2,000 Skywards miles |

| Etihad Airways | Redeem 10,000 IHG One Rewards points for 2,000 Etihad Guest Miles |

| Eva Airways | Transfers unavailable |

| Finnair | Transfers unavailable |

| Gulf Air | Redeem 10,000 IHG One Rewards points for 2,000 Falconflyer miles |

| Hainan Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Fortune Wings Club points |

| Iberia Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Avios |

| InterMiles | Redeem 10,000 IHG One Rewards points for 2,000 InterMiles |

| Japan Airlines | Redeem 10,000 IHG One Rewards points for 2,000 JAL Miles |

| JetBlue | Redeem 10,000 IHG One Rewards points for 2,000 TrueBlue points |

| Korean Air | Redeem 10,000 IHG One Rewards points for 2,000 SKYPASS miles |

| Lufthansa | Transfers unavailable |

| Malaysia Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Enrich Points |

| MilleMiglia | Redeem 10,000 IHG One Rewards points for 2,000 MilleMiglia miles |

| Qantas Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Qantas Points |

| Saudia Airlines | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| Singapore Airlines | Redeem 10,000 IHG One Rewards points for 2,000 KrisFlyer miles |

| South African Airways | Redeem 10,000 IHG One Rewards points for 2,000 Voyager miles |

| TAP Air Portugal | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| Thai Airways | Redeem 10,000 IHG One Rewards points for 2,000 Royal Orchid Plus miles |

| Turkish Airlines | Transfers unavailable |

| United Airlines | Redeem 10,000 IHG One Rewards points for 2,000 MileagePlus miles |

| Virgin Atlantic | Redeem 10,000 IHG One Rewards points for 2,000 Virgin Points |

| Virgin Australia | Redeem 10,000 IHG Rewards points for 2,000 Velocity Points |

The bottom line

The IHG One Rewards program has a lot to offer, especially given that it’s free to sign up for. With 20 brands included under the IHG umbrella, there are plenty of opportunities to stay at one of their properties and earn points towards a free Rewards Night.

Because IHG partners with multiple airlines, it’s also easy to earn points that can transfer to your favorite airline — though the transfer rate between IHG One Rewards and airline loyalty programs isn’t very high.

A co-branded IHG credit card can help you earn even faster, especially given the generous rewards structures of their card offerings. But if you won’t be booking hotel stays often enough to earn the free nights or higher rewards tiers, a hotel credit card may not be your best option. You might even do better with a traditional travel rewards credit card that lets you redeem points for additional options outside of hotel stays.

Whether you decide to boost your rewards points with a credit card or not, you have nothing to lose by signing up for this free program.

Frequently asked questions about IHG One Rewards

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.