How to maximize your credit card rewards with shopping portals

Key takeaways

- Credit card shopping portals are offered through most of the major card issuers, and some airlines have dedicated portals of their own.

- An online shopping portal can help you ‘stack’ more cash back or points with the rewards you’re already earning with a credit card.

- To use an online shopping portal, you typically only need to log into your account and click through before making a purchase.

If you’re looking for ways to earn more rewards on everything you buy, credit card shopping portals are an absolute no-brainer. Not only do shopping portals let you earn more points or cash back on everyday purchases, but they’re free for users and only require a few simple steps to get started.

The best part? Most major credit card companies have their own shopping portals that offer additional points, cash back, discounts or statement credits for purchases you’re planning to make anyway. Here’s everything you need to know to get the most out of credit card shopping portals, regardless of which rewards credit card you have.

How credit card shopping portals work

Credit card shopping portals are relatively easy to use since most issuers let you access them via your online account or mobile app. To begin, visit the shopping portal landing page, your credit card homepage or your rewards account and log in. From there, you can browse available retailers and stores to find promotions you’re interested in.

Once you find an eligible store with a deal you’d like to access, click on the link to the deal with that store to begin shopping. After completing your purchase, your issuer will track your purchase through the code embedded in the link you clicked to ensure you receive your rewards. Note that you should have cookies enabled on your browser so your purchases can be tracked correctly.

In some scenarios, you may have to add certain cash back or statement credit offers to your card by clicking on them to activate or sign up. Offers and point amounts also change frequently, and you may get further savings or additional offers around popular shopping times like the holidays.

Why use credit card shopping portals?

You should use credit card shopping portals because there’s no cost involved in doing so, first and foremost, but also because they give you something else back for purchases you were planning to make anyway.

These portals are some of the best, most underutilized ways to get cash back and other rewards. You click through your credit card portal and go through to a retailer’s website. It’s the same site experience that you would get if you typed in the URL directly, but because of this referral, they give you extra cash back or points.— Ted Rossman, senior industry analyst

Credit card shopping portals allow you to earn extra rewards for very little extra work. You’re getting additional perks for something you’d be doing already, like buying household supplies, and it “takes just 15 seconds,” says Rossman.

Popular credit card shopping portals

Shop Through Chase

Chase offers the Shop Through Chase portal, where you can earn Chase Ultimate Rewards points for every purchase you make. This portal is available to cardholders of select Chase cards like the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card, Chase Freedom Flex®* and other eligible cards.

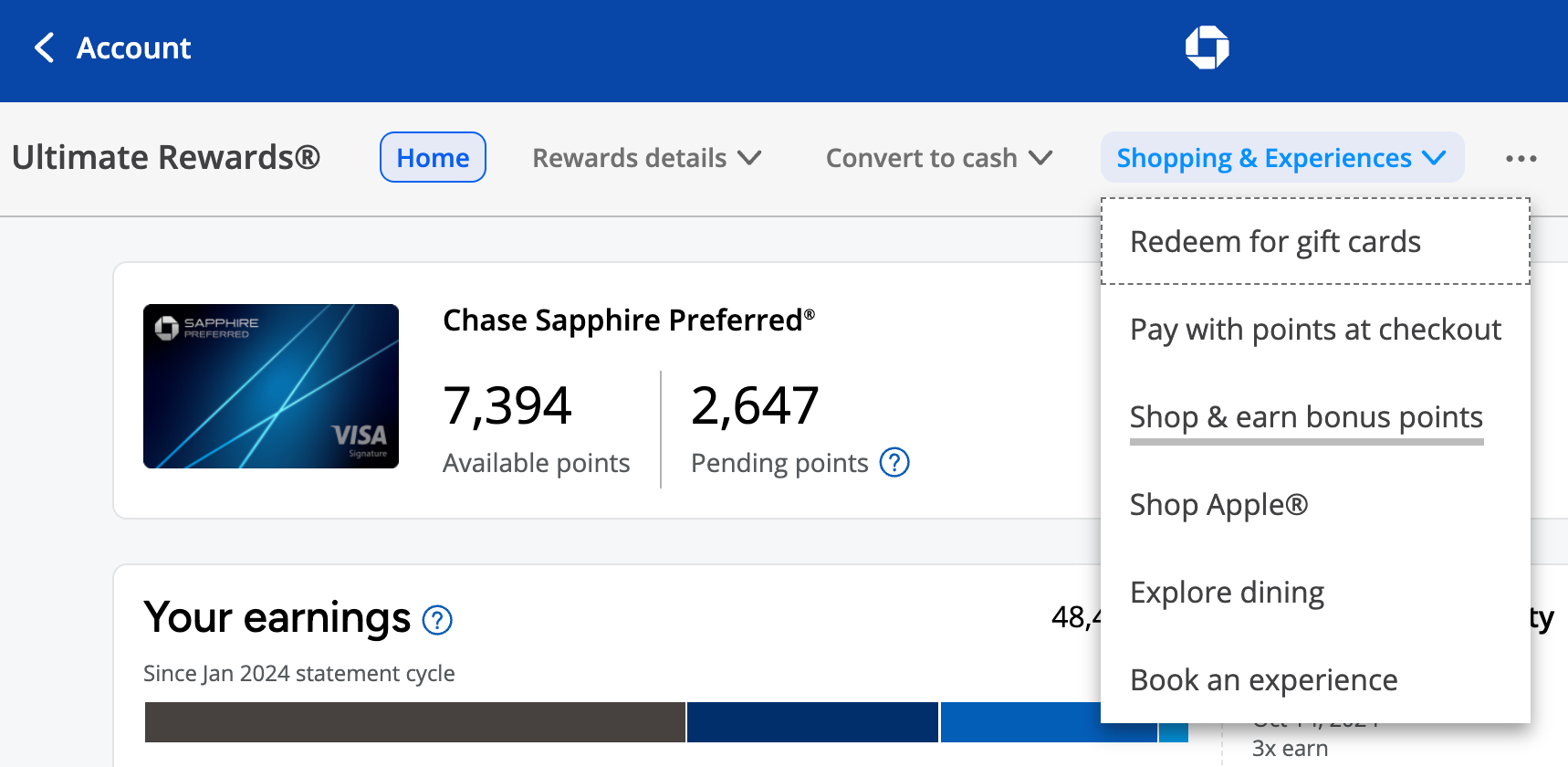

Connect by logging into your Chase account and visiting the rewards section, then hovering over “Shopping & Experiences.” The Shop Through Chase portal can be found under “Shop & earn bonus points.”

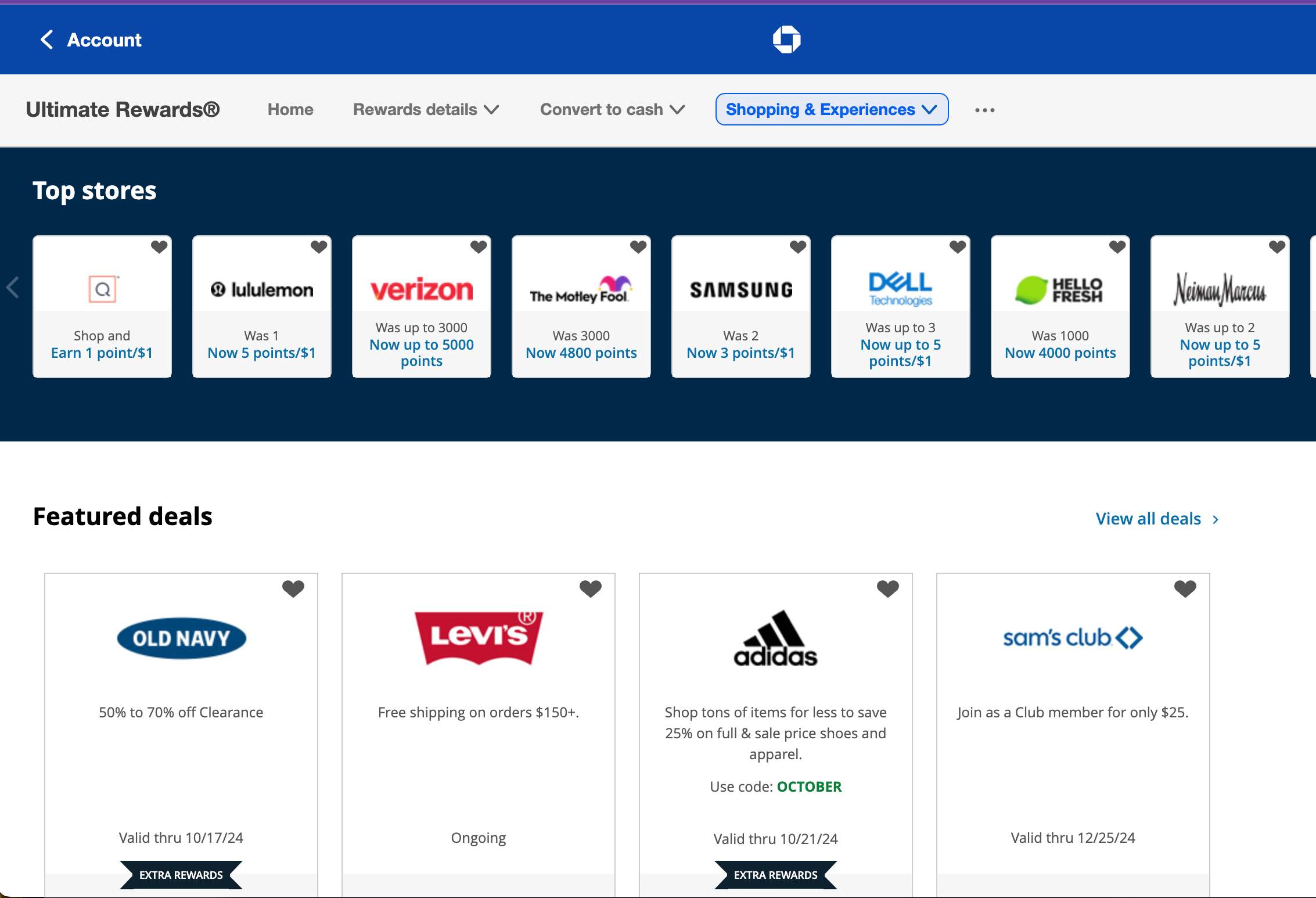

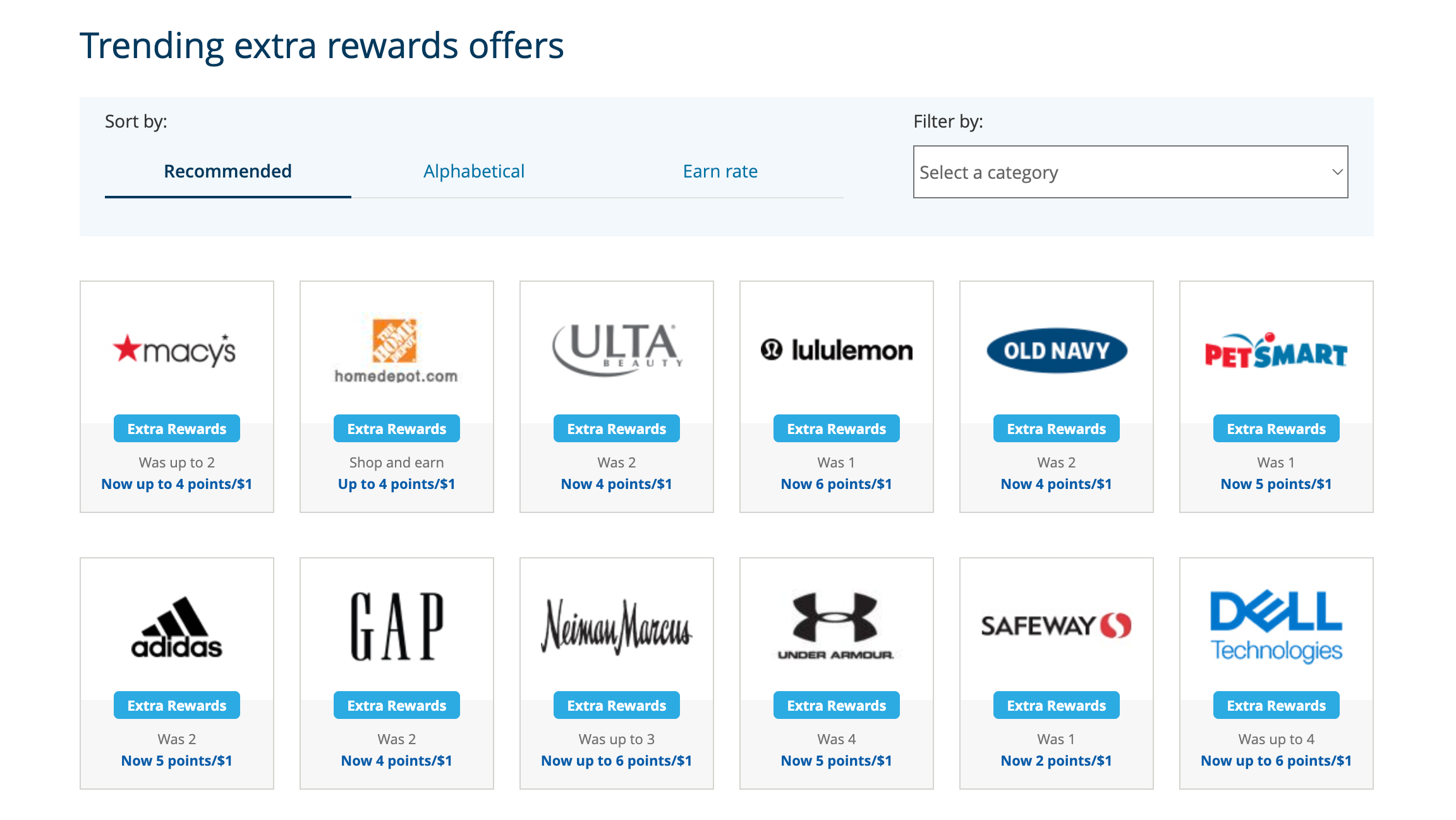

Once logged in to Shop Through Chase, you’ll discover all sorts of stores, including office stores and department stores, as well as shops that sell beauty products, home goods, clothing, electronics and accessories. Sample offers include earning 5 points per dollar spent at Lululemon, 3 points per dollar spent at Dell Technologies, and up to 5 points per dollar spent at Neiman Marcus.

Another easy way to earn more rewards is to combine Shop Through Chase with Chase Offers, which are discounts that give you statement credits for making purchases at specific retailers. Chase Offers are targeted, and you’ll have to activate them within your online account space before making your purchase.

For example, if you have a targeted Chase Offer to get 5 percent back at Gap, make sure to activate that offer before visiting Shop Through Chase and clicking through to that same retailer to earn both cash back and bonus points when shopping. Also, note that Chase Offers come with expiration dates and earning caps. Make sure to read the fine print before completing your purchase.

Barclays Rewards Boost

Although Barclays points are less versatile than Chase Ultimate Rewards, they still have value. Shop the Barclays Rewards Boost portal to find deals like 6 points per dollar spent at Lululemon and 4 points per dollar spent at Home Depot.

Citi

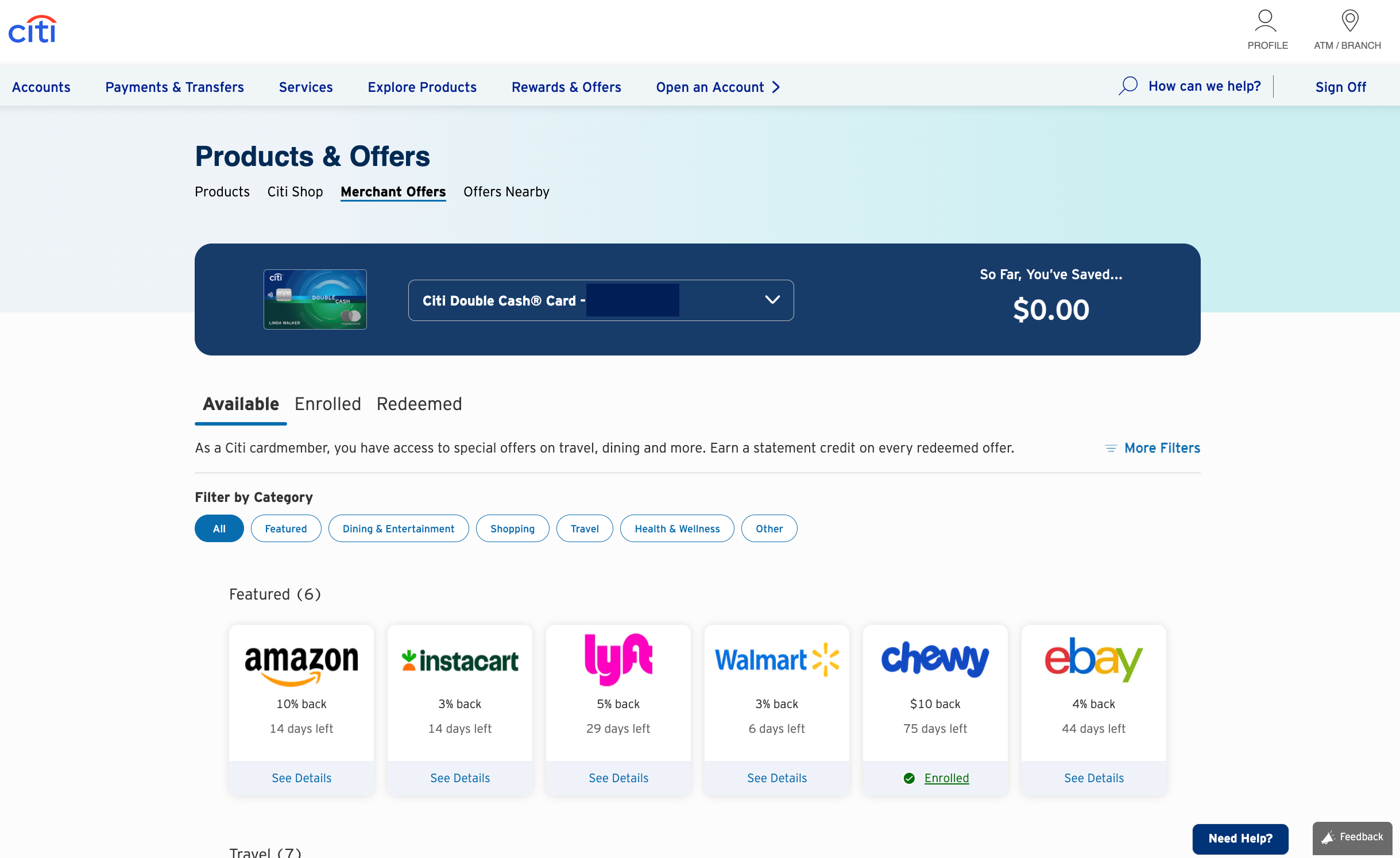

The Citi Merchant Offers site allows Citi cardholders to earn cash back at hundreds of online stores. Sample offers at the time of publishing include 10 percent bonus cash back at Amazon or 5 percent bonus cash back at Lyft. Remember that rewards earned through this portal can stack up with any rewards earned with your Citi credit card.

Capital One

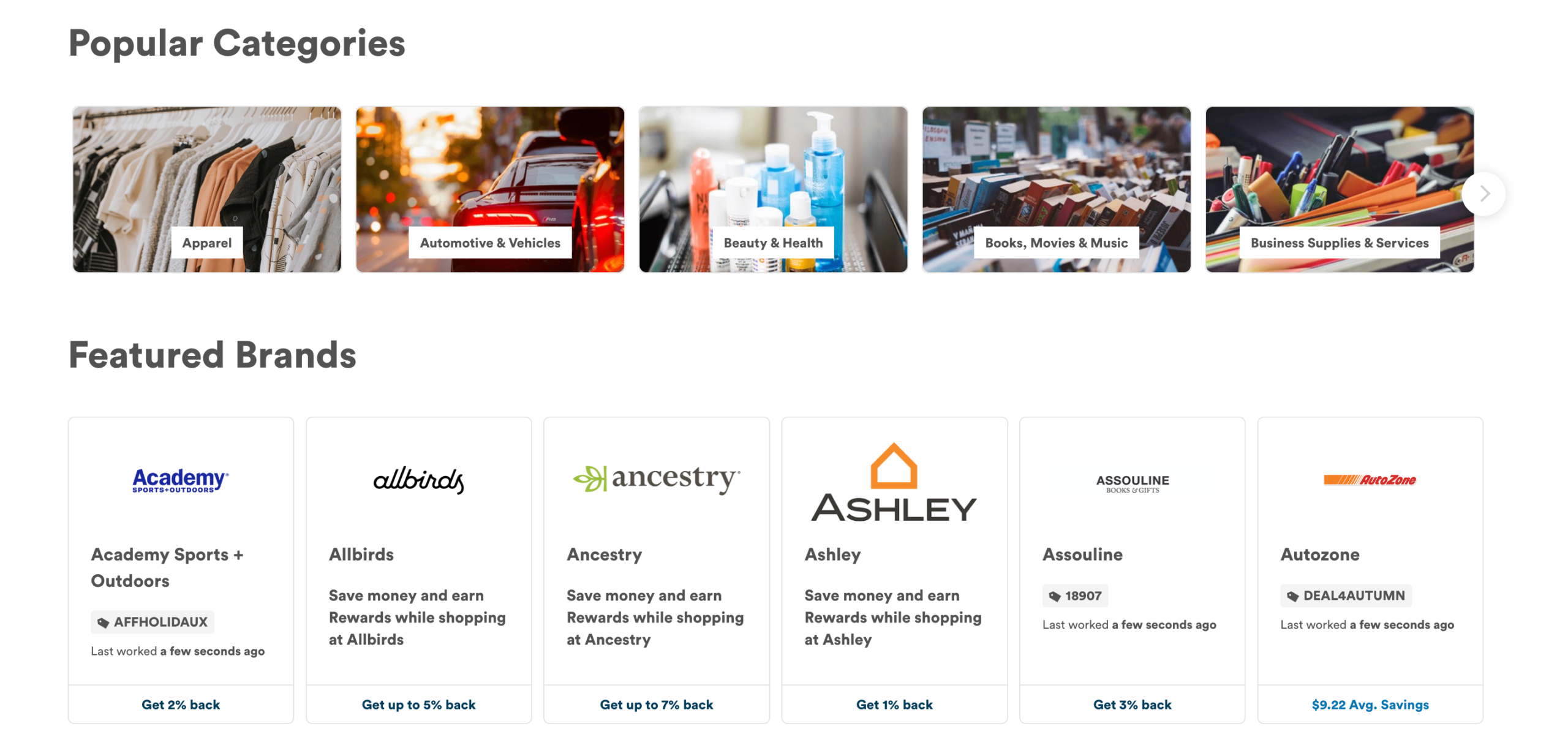

While Capital One Shopping is a separate cash back portal that isn’t connected to rewards credit cards from this issuer, you can use the portal to earn cash back on eligible purchases. However, the rewards you earn will be issued to your Capital One Shopping account, not directly to your credit card.

That said, Capital One does have an “offers” program similar to Chase Offers. This program lets you activate offers targeted to you and earn additional cash back or bonus rewards on eligible purchases. Current offers that could be available in your account include up to 5 percent cash back at Allbirds and 7 percent cash back at Ancestry.

American Express

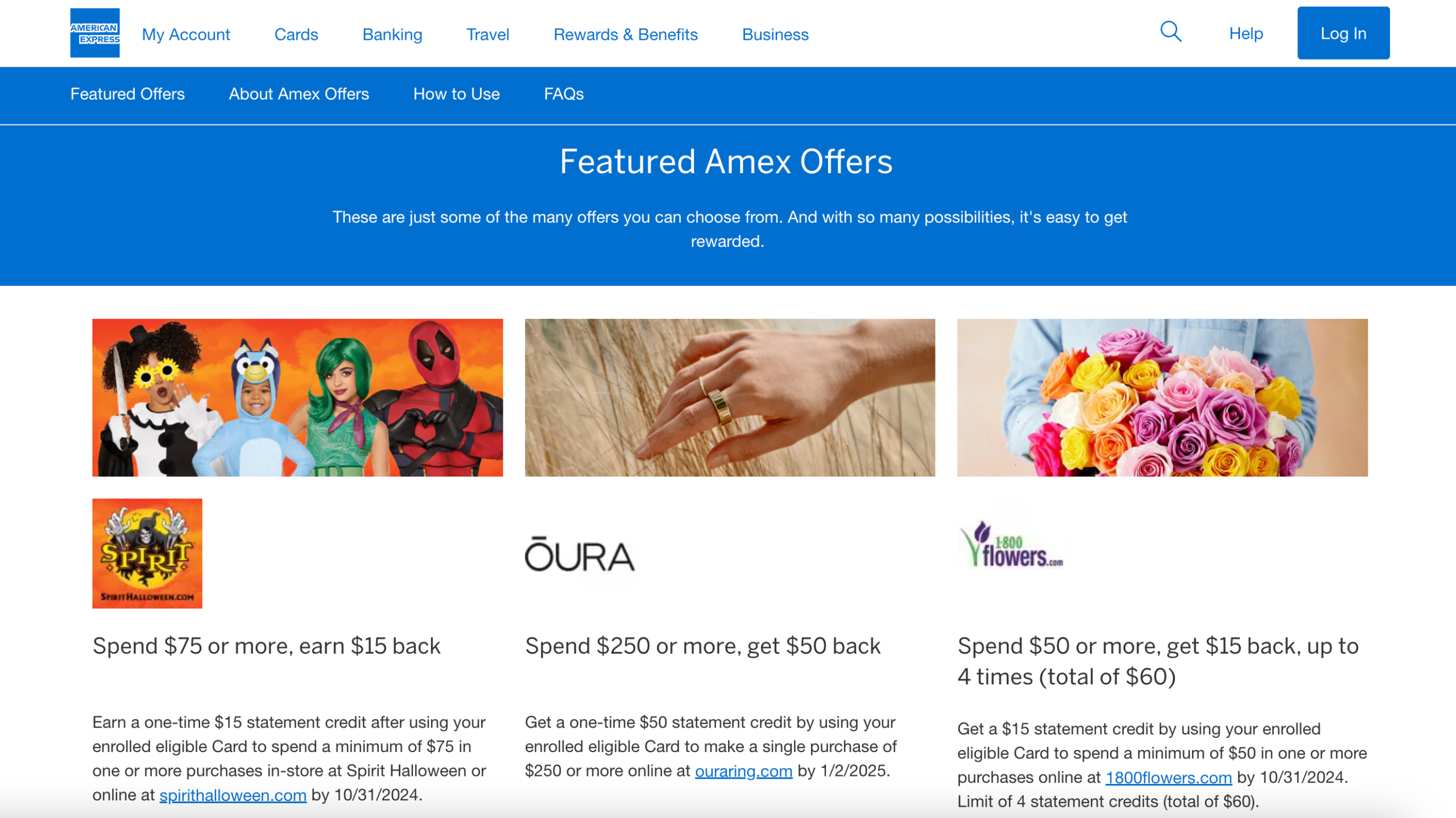

American Express features targeted Amex Offers, where you can get statement credits for shopping at specific retailers or with various brands. In your account, you may see options like “Spend $500 or more, get $100 at Hilton Nevada locations” or “Spend $100 or more at Madewell, get $20 back.”

Again, make sure to read the fine print on these offers, discounts and point bonuses, as you may need to activate the offers before shopping. Although Amex doesn’t have its own shopping portal, you can earn even more Membership Rewards using Rakuten, described in more detail below.

Airline shopping portals

In addition to the major credit card issuers, you can also shop at airline credit card portals to earn frequent flyer miles. Here are some of the most popular ones:

- AAdvantage eShopping

- Delta SkyMiles Shopping

- JetBlue TrueBlue Shopping

- United Mileage Plus Shopping

- Southwest Rapid Rewards Shopping

One of the best perks of airline shopping portals is the opportunity to double dip. This means that you’ll earn a certain number of points or miles per dollar spent at retailers, as well as whatever credit card points you earn from the card you use to purchase.

Even better, if you can activate or add Amex, Chase or Capital One offers to your card, you may be able to stack those earnings for even more benefits, such as getting cash back, credit card points or airline miles just by making regular, planned purchases.

Additional credit card shopping hacks

The bottom line

At the end of the day, credit card shopping portals make it possible to earn extra cash back or rewards points each time you shop online. And if you’re going to make online purchases anyway, there’s really no reason not to take advantage of the extra cash.

The key to maximizing the benefits of these portals is knowing which ones you have access to based on the cards you hold and checking them regularly to take advantage of available deals. Then, log in to your account and click through to eligible stores every time you shop to maximize your rewards.

*The information about the Chase Freedom Flex has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.