Best ways to use 100,000 points

Key takeaways

- It’s possible to earn 100,000 points quickly with a single credit card sign-up bonus, but you could also cobble together a few bonuses to create a six-figure stash of points or miles.

- The best way to spend 100,000 points depends on your travel goals. Maybe you’re angling for an all-inclusive resort stay or an international flight in a lie-flat business seat — both strategies can work.

- Generally speaking, you get more value from airline miles when booking a premium cabin over other types of travel points. However, there are plenty of ways to maximize miles for economy flights or hotel points for a fun trip.

The best ways to use 100,000 points depends on the type of rewards currency you have and how much your points or miles are worth. For example, 100,000 Hilton Honors points may not even be enough for a single night’s stay in one of their top-tier hotels. But the same amount of Chase Ultimate Rewards points or American Express Membership Rewards points can be worth $2,000 (and potentially more) in travel if transferred to the right partner for a high-value redemption.

So, what’s the best way to use 100,000 Amex points? What’s the best use of 100,000 Chase points? And how can someone get a ton of value out of 100,000 airline miles?

If you have 100,000 points burning a hole in your pocket, read on to learn six awesome ways you can redeem them.

Book cheap economy flights to Europe for a family of five

You can use 100,000 points to book five one-way flights to Europe, but only if you use the right program. My favorite airline loyalty program for this purpose is the Air France-KLM Flying Blue program, which happens to be one of the best ways to use 100,000 Chase points, as well as a partner of the American Express Membership Rewards program and Capital One miles.

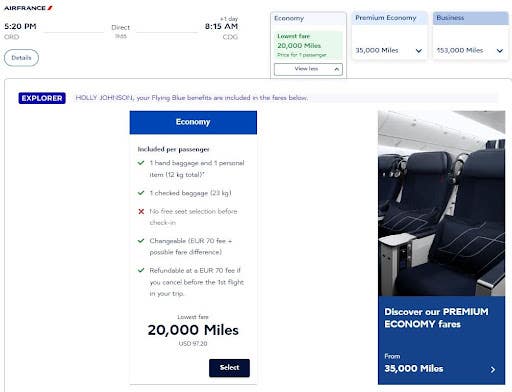

You’ll need to be flexible if you want to find economy award flights at the lowest possible rate, but they’re absolutely out there. For example, my search yielded the following one-way economy flights from Chicago (ORD) to Paris (CDG) for 20,000 Air France miles plus $97.20 per person in airline taxes and fees.

Pay for two business-class flights in a lie-flat seat

If you’re looking for the best way to spend 100,000 American Express points for business-class airfare, the Flying Blue program has options in that realm, too. You’ll have to do some digging to find destinations and dates with the lowest possible rates, but they’re definitely out there.

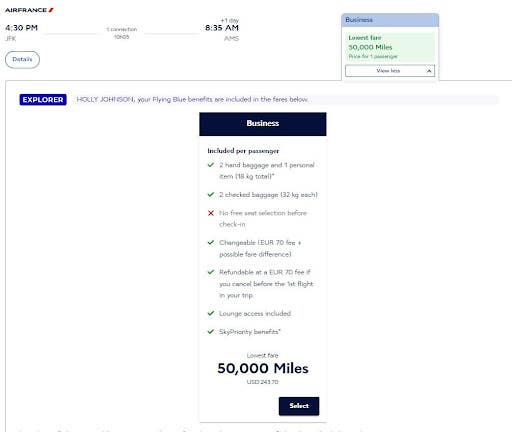

For example, I found one-way business-class flights from New York (JFK) to Amsterdam (AMS) for 50,000 miles plus $243.70 in airline taxes and fees. The longest leg of this flight (New York to Paris) takes place on an Air France Boeing 777-300, which features fully flat-bed seats with a 1-2-1 configuration. This is much better than flying economy for a reasonable number of miles, and having a lie-flat seat will make it easier to sleep peacefully all night while you move toward your destination.

Spend a week in a boutique hotel

You can also spend a week in a hotel almost anywhere with 100,000 points, provided it’s part of a flexible program like Chase Ultimate Rewards or Amex Membership Rewards.

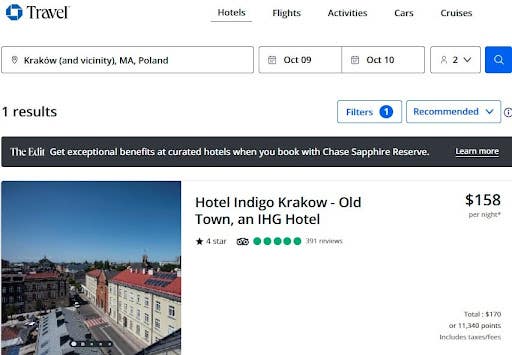

As an example, consider a search I did for a week-long stay in Krakow, Poland. I found rooms at the Hotel Indigo Krakow – Old Town in October of this year smack dab in the middle of this stunning European city for just 11,340 Chase Ultimate Rewards points per night.

Keep in mind this search was made using my Chase Sapphire Reserve® account, so it reflects the fact that Reserve cardholders get 50 percent more value for their points when redeeming for travel.

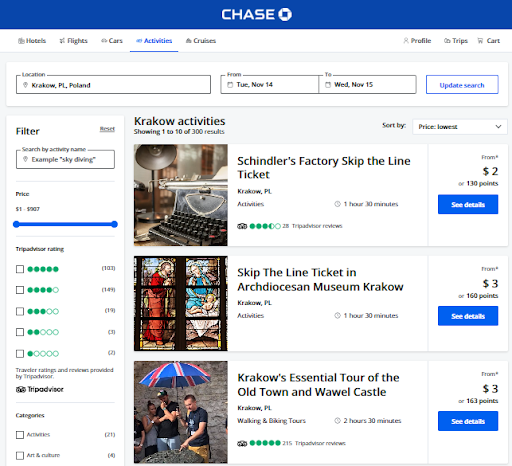

At this rate, you could spend well over a week in this boutique hotel for less than 100,000 points. That would even leave you with enough leftover Chase points to pay for a skip-the-line ticket to Oskar Schindler’s Factory or even a guided walking tour of the city.

Spend a week or longer in a luxury hotel in Europe

Maybe you’re hoping for a luxury hotel stay somewhere fancy and worthy of an Instagram photo shoot. In that case, you could consider booking several nights at the five-star Grand Hyatt Berlin in Berlin, Germany. A one-night stay here with World of Hyatt points would only set you back as little as 15,000 points for a standard room, so 100,000 points are enough for six nights.

This rate gets you a king bed with more than 400 square feet of space, free spa access, free mineral water, fresh apples and luxury Balmain bath products. You would also be within walking distance to the town’s main attractions and all this fantastic city has to offer.

Spend four or five nights at an all-inclusive resort

Also, remember that you can use various types of points to stay in all-inclusive resorts with various brands. For example, you could stay multiple nights at many all-inclusive properties in Cancun, Mexico, with the World of Hyatt program — including the Breathless Cancun Soul Resort & Spa, the Hyatt Zilara Cancun and Dreams Natura Resort and Spa.

Nightly rates at the Dreams Sapphire Resort and Spa with double occupancy even go as low as 17,000 points.

The Marriott Bonvoy program also has a ton of all-inclusive resorts within their brand, including most Royalton properties. That makes them a good option if you have a Marriott credit card or have points to transfer from Amex or Chase Ultimate Rewards.

However, you’ll need to fork over more points for free nights with Marriott Bonvoy than you would with Hyatt. As an example, you can book an award night at the Royalton Punta Cana resort for as little as 55,000 points with double occupancy.

Fly five people round-trip to the Caribbean

Finally, don’t forget all the different ways you can maximize airline miles for flights. A good example comes from the American Airlines AAdvantage rewards program, which offers various web specials that can be booked to destinations around the globe.

While you’ll have to be flexible with your destinations and dates to find these deals, they’re fairly plentiful to some destinations, including those in the Caribbean.

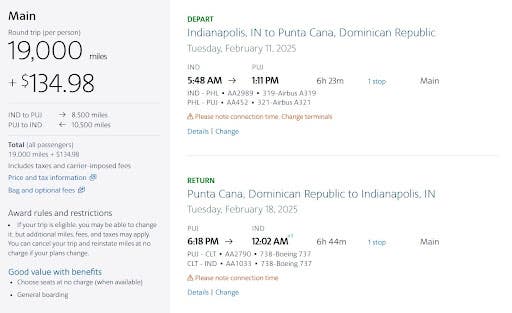

As an example, I found these round-trip flights from Indianapolis, Indiana, (IND) to Punta Cana, Dominican Republic, (PUJ) for just 19,000 miles, plus $134.98 per person in taxes and fees.

Bonus tip: Redeem your points for gift cards

Although the best ways to redeem 100,000 points typically involve travel redemptions, those who are not interested in travel might consider redeeming points for gift cards to be a good option. Most rewards programs allow you to redeem points for gift cards at hundreds of your favorite retailers. You can use those gift cards to purchase things you need or use them to help defray the cost of things like holiday shopping.

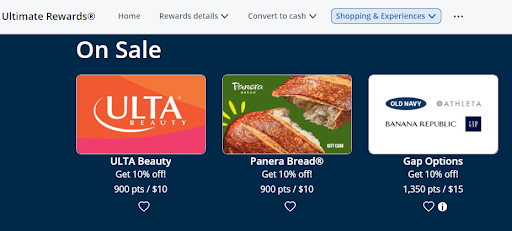

Even better, some rewards programs offer periodic gift card sales — allowing you to secure gift cards for less. For example, during my search, I found ULTA Beauty gift cards available for 10 percent off through Chase Ultimate Rewards. That means your 100,000 Chase points could potentially be worth $1,100 toward gift cards at your favorite retailers.

The bottom line

There are all kinds of ways to get more bang for your buck when it comes to rewards, and that’s true whether you have 100,000 points or 50,000 points to burn. Make sure to look at all your options before you book your next trip, and don’t forget to check all the different ways you can use flexible points. With some research and planning, you can turn 100,000 points into an epic trip you’ll never forget.

Frequently asked questions about credit card points

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.