How to maximize spending with Amex Offers

Key takeaways

- One of the benefits of being an American Express card member is access to the Amex Offers program, which provides additional rewards and benefits for using your card.

- Amex Offers can be found and activated through the American Express website or mobile app, and feature a variety of rewards such as bonus points, statement credits and extra cash back.

- While Amex Offers can provide value for card members, it’s important to read the fine print and keep in mind any limitations or restrictions, such as enrollment limits and offer expirations.

Being an American Express cardholder comes with tons of perks and benefits, which is probably why you got your Amex card in the first place. But if you aren’t taking advantage of Amex Offers, you could be missing out on extra benefits. In 2023, the American Express card members who enrolled in Amex Offers earned an average of $150 in statement credits on qualifying purchases. For a process that takes very little effort, that’s a valuable reward.

If you’re already collecting Membership Rewards points and welcome offers, then enrolling in Amex Offers is the next logical step to getting the most from your Amex card. To start maximizing your spending, find out how Amex Offers work and how to get them.

What are Amex Offers?

The Amex Offers program by American Express is an activation-based incentive program, meaning you need to activate the offer to receive the incentive. Amex offers are personalized, so you may not see an offer in your account that you read about online or heard about from a friend.

Some Amex Offers give you cash back if you meet a spending requirement with a specific retailer. Others let you rack up American Express Membership Rewards points or points within an Amex partner program like Hilton Honors.

How do Amex Offers work?

To find your eligible offers, you can use the Amex mobile app for iOS or Android and head to the “Offers” tab. If you’re logging in from a desktop, all the Amex Offers you’re eligible for are listed on your online account management page. To activate an offer, find one you like, read the fine print and click “Add to Card.”

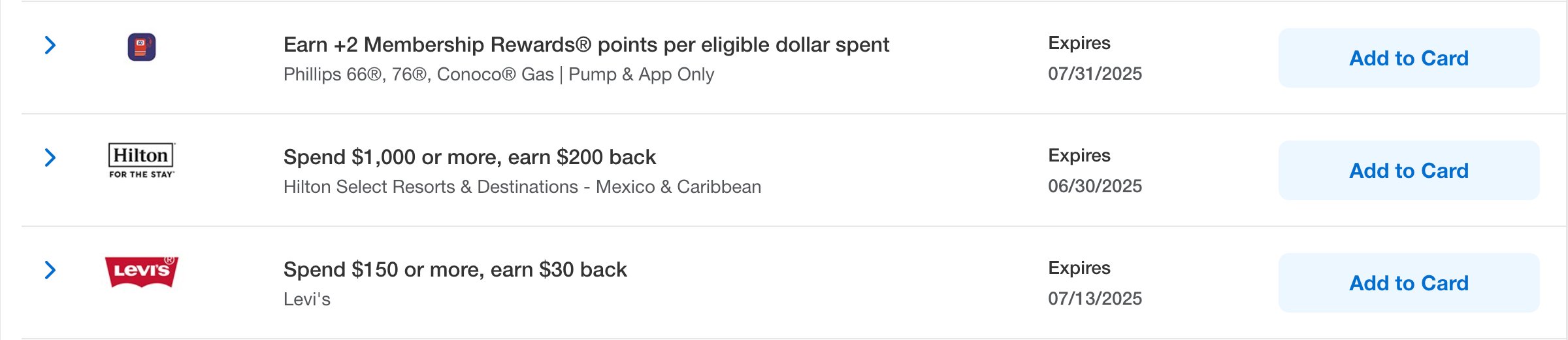

With each Amex Offer you’re eligible for, you’ll have a spending requirement and an offer expiration date. Once you add the offer to your card, you have until the expiration date to meet the spending requirement for the bonus points or cash back. Here are a few examples of recent Amex Offers:

Amex Offers are incredibly valuable since these deals are given out on top of the cash back or rewards you already earn with your Amex card. There are even some Amex Offers you can earn more than once, although the promotion needs to explicitly say so for it to work.

Keep in mind: There are no penalties for forgetting about an Amex Offer and letting it expire. If you add one to your card and realize you can’t use it, there’s no harm.

Amex Offers come in a few different formats. Here’s what you need to know about each of them:

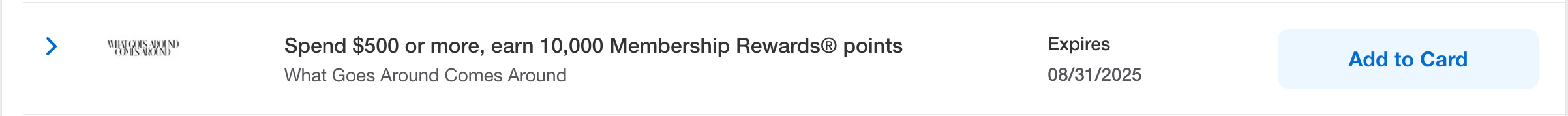

Spend $X, get Y number of bonus points

These offers provide an opportunity to get a fixed number of additional American Express Membership Rewards points when you meet a spending threshold. Once you pass the minimum threshold, you will get the points offered.

This example offer from American Express allows you to earn 10,000 Membership Rewards points when you spend $500 or more.

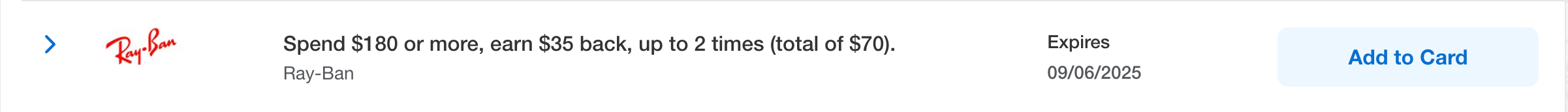

Spend $X, get $Y back

These offers provide a statement credit based on hitting a minimum spend requirement. For example, this offer from Ray-Ban presents the opportunity to earn $35 back (up to two times for a total of $70) when you spend $180 or more.

Get additional points for each dollar spent at a select merchant

These offers provide bonus American Express Membership Rewards points for spending at select merchants. The amount of points you can receive is tied to how much you spend. So the more you spend at that merchant, the more you’ll earn. One of the recent offers like this is for Phillips 66 and Conoco Gas, where you get 2 additional Membership Rewards points per eligible dollar spent.

With an offer like this, you can receive extra Membership Rewards points that you can then redeem for a range of rewards.

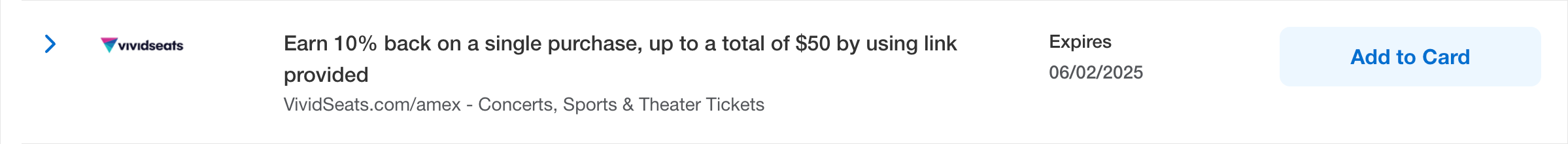

Get X% back by using the link provided

These offers allow you to get a statement credit based on how much you spend with an offer merchant up to a set amount described in the offer. This offer from Vivid Seats allows cardholders to earn 10 percent back on a single purchase (up to $50 back) simply by using the link provided.

Maximize offers with your spending

Amex Offers can provide big value for card members in addition to your included card benefits. Keep these tips in mind to effectively maximize these offers:

1. Immediately add offers you like to your card

American Express does not cap the number of offers you can add per card, but this special offers section will only display 100 Amex Offers at a time. As such, it can be wise to add any Amex Offers that interest you to your rewards card.

Amex has been known to limit the number of card members who can add an offer, so you should not assume an offer will be there later. There’s nothing to stop you from adding every Amex Offer you’re eligible for to your card as new ones are added. But it may make it more difficult to keep track of the ones you actually plan to use.

2. Keep up with new offers

New Amex Offers are added regularly, so check the Offers section for each of your American Express credit cards to stay on top of these incentives. If you have different Amex cards, you’ll want to check the Offers section for each since different offers may populate for each card. Sometimes, one or more of your cards may offer a higher or lower amount of rewards or cash back.

3. Activate offers on cards with bonus categories

Don’t miss the chance to double up on rewards and offers. For example, if you see an Amex Offer for Delta Air Lines and have a co-branded Delta Air Lines credit card (or a Hilton offer for your Hilton co-branded credit card), you may be able to score the Amex Offer and earn points on your spending that can boost the rewards on your co-branded card.

4. Stack rewards using shopping portals

Sometimes you’ll find that shopping portals offer another way to double up on rewards. For example, you may have an Amex Offer on your card for a store that’s also offering bonus cash back through a portal such as Rakuten or Delta SkyMiles Shopping. In that case, you could take advantage of the shopping portal bonus and earn an Amex Offer in one fell swoop.

Limitations to keep in mind

While Amex Offers can present immense value to cardholders, it’s important to understand their terms and conditions to best leverage them.

1. Read the fine print

When adding an Amex Offer, review all terms and conditions. There can be specific requirements — such as purchasing via a specific website — to verify before you complete your purchase.

For example, a recent offer with Alaska Airlines required a ticket be purchased via AmexTravel.com in order to earn $100 back on a minimum $500 purchase. That meant any purchases made via Alaska Airlines’s own website weren’t eligible for the offer. Always be sure to review the terms prior to a purchase.

2. Enrollment is limited

Amex caps the number of card members that can redeem select offers. If you see an offer you like, add it right away. Otherwise, you may not see it again later.

3. You must add an offer and use the same card to redeem

Amex Offers are tied to a specific card. If you add an offer to American Express Platinum Card® but purchase from the merchant using a Blue Cash Preferred® Card from American Express, you will not receive any credit. Be sure to check which card you added an offer to before completing a purchase.

4. One offer per card member across all channels

Amex Offers can only be added to one card on your account. If you have multiple American Express credit cards, be sure to review which card would be the best one for the offer, as you cannot move offers between cards once added.

5. Amex Offers expire

Be sure to review when an offer will expire by viewing the terms and conditions when adding it to your account.

Keep in mind: Amex Offer rewards may not be immediately reflected in your account. It can take up to 90 days after the end of the offer period to see the automatically applied statement credit added to your account.

Which cards qualify?

All U.S. American Express credit cards are eligible for Amex Offers. This includes cash back cards, co-branded credit cards with Delta, Hilton and Marriott, Membership Rewards cards and more. And remember, rewards or cash back earned with Amex Offers are totally separate from the points and rewards you earn with your credit card.

While any Amex card can qualify, you may want to consider using the best American Express credit cards to maximize your offers.

The bottom line

Amex Offers are easy to use and are an included benefit of being an American Express cardholder. These offers can provide additional cash back or Membership Rewards points for your everyday purchases. Other card issuers, including Chase, have similar incentive programs, like Chase Offers, which can be just as valuable.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.