How to transfer Chase points and make the most of your rewards

Key takeaways

- Chase Ultimate Rewards allows for a higher redemption value of 1.25 cents when redeemed through the portal and 2.0 cents on average when transferred to a high-value transfer partner.

- Points can be transferred between different Chase cards and to household members who are also eligible cardholders.

- Transferring points to a transfer partner can increase their value and provide more flexible redemption options.

Chase Ultimate Rewards is one of the best travel rewards options on the market — and for good reason. With the right Chase card, the points you redeem for travel are worth at least 1.25 cents when redeemed through the Chase Ultimate Rewards portal. These select cards also let you transfer your points to one of Chase’s airline or hotel transfer partners. Based on Bankrate’s latest points and miles valuations, Chase Ultimate Rewards points are worth 2.0 cents on average when transferred to a high-value transfer partner.

On top of transferring to travel partners, it’s also possible to transfer points between some Chase cards. This is a valuable feature that lets you move Chase points from a card that doesn’t offer Ultimate Rewards points to one of Chase’s premier Ultimate Rewards cards, giving you a chance to pool points onto one card for greater value. Not only can this benefit your own Chase points account, but this option extends to anyone in your household who is also an eligible Chase cardholder.

Transferring Chase points is a fairly straightforward process. Here’s what you need to know about Chase cards that let you move your points, how to make a transfer and when it’s a good idea to transfer your Chase points.

How to transfer Chase points

There are only three Chase cards that earn Chase Ultimate Rewards points that you can transfer to an airline or hotel partner:

Chase also has other rewards cards, which earn like a cash back credit card, where each point redeemed is typically worth 1 cent each. With these cards, you can’t transfer directly to one of the Chase airline or hotel partners. But if you have one of the three Ultimate Rewards Chase cards, you can transfer your points to that card. These cards include:

- Chase Freedom Flex®*

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

Here’s how you can transfer points between accounts and to travel partners.

To another Chase account

If you have more than one Chase card, you can transfer Chase points between the cards and combine points. Here’s how:

- Navigate to your Ultimate Rewards portal where you can see your points balance.

- Select the “Manage points” drop-down section and click “Combine points.”

- Choose the sending and receiving Chase accounts and how many points you’d like to transfer.

- Click “Next” to review and confirm the amount of the points transfer.

- You should see a confirmation screen on the next page. Your points should now be visible since the transfer takes place instantly.

To another Chase cardholder

Perhaps you want to transfer Chase points to another member of your household who also has a Chase credit card. According to the Chase Ultimate Rewards terms and conditions, the recipient must be a household member who is listed as an authorized user on your Chase credit card. You can transfer points in increments of 1,000 — similar to transferring travel points.

The first time you transfer points to another household member’s account, you’ll need to call the Chase customer service number on the back of your card. You’ll discuss with an agent that you’d like to combine points with another member of your household and the agent will begin the transfer.

Once the agent has processed the request, the household member’s account should now be visible online to you on the Ultimate Rewards portal. Now you can go through the same process as outlined above and move points between accounts.

To a travel partner

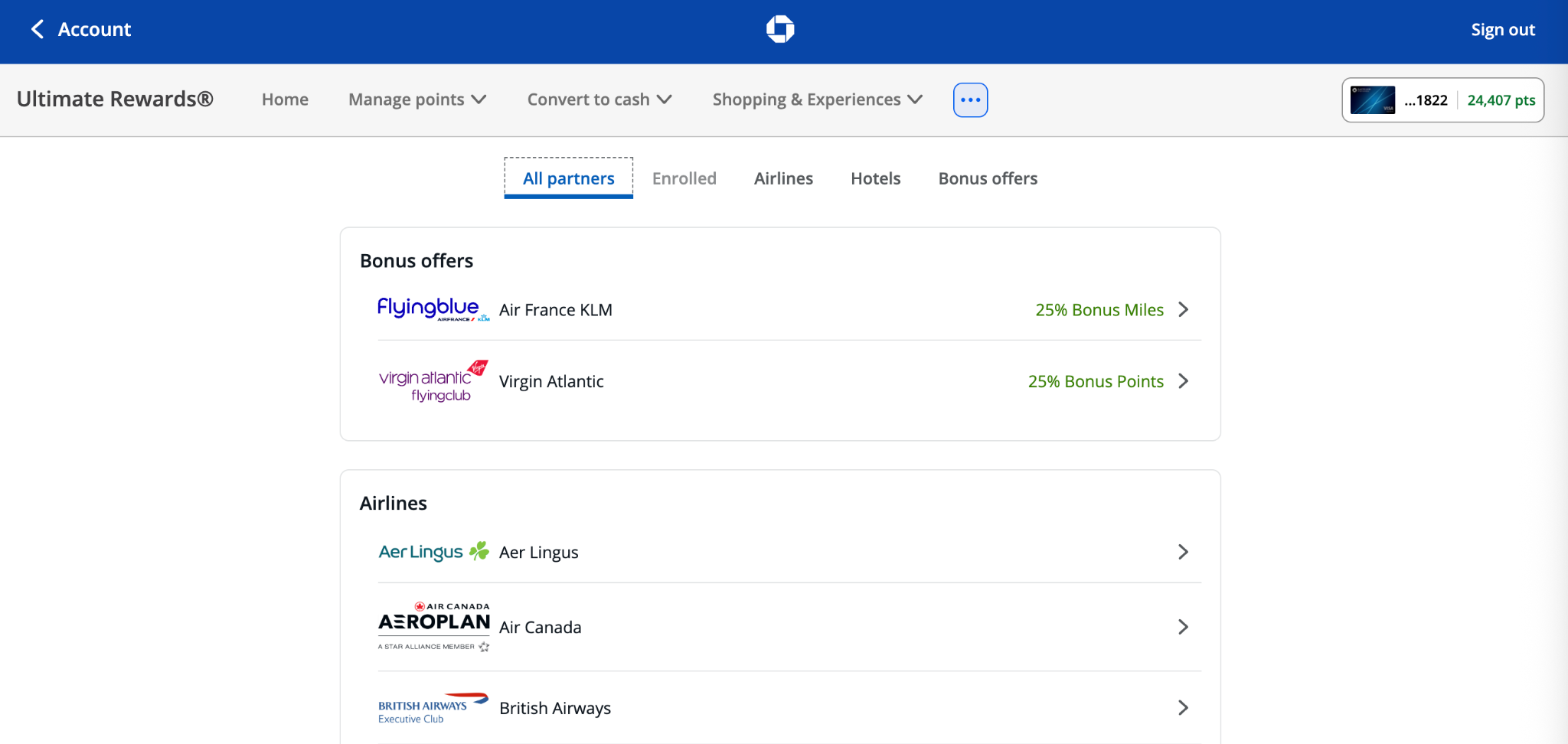

Chase has more than a dozen airline and hotel partners you can choose from, with a transfer ratio of 1:1. This means that 1,000 points transferred to a program will be 1,000 points in that program. But some of these partners actually increase the value of your points when you transfer them to a partner loyalty program. For example, points you earn with the Chase Sapphire Preferred are worth around 2.0 cents each. But if you transfer them to Aer Lingus, you could get around 1.8 cents in value per point.

Here’s how to transfer Ultimate Rewards points to a Chase transfer partner:

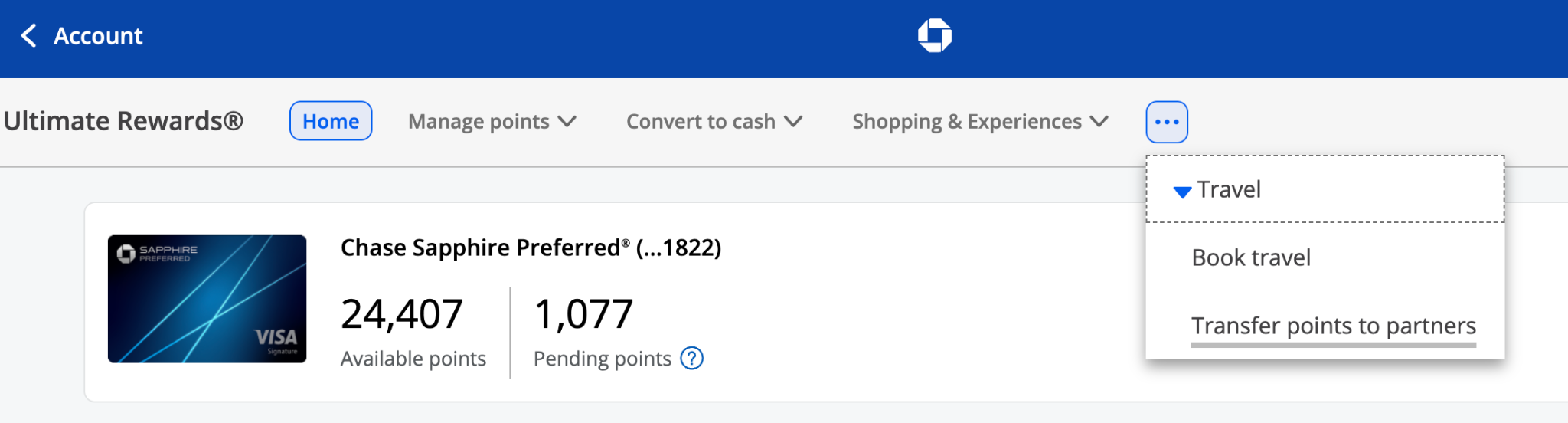

- Log in to your Ultimate Rewards account and select the “Travel” drop down and “Transfer points to partners.”

- Click on the airline or hotel partner you want to transfer to and you’ll be directed to the partner page, where you can read the terms and timeline of the points transfer. Click “Transfer points” to continue.

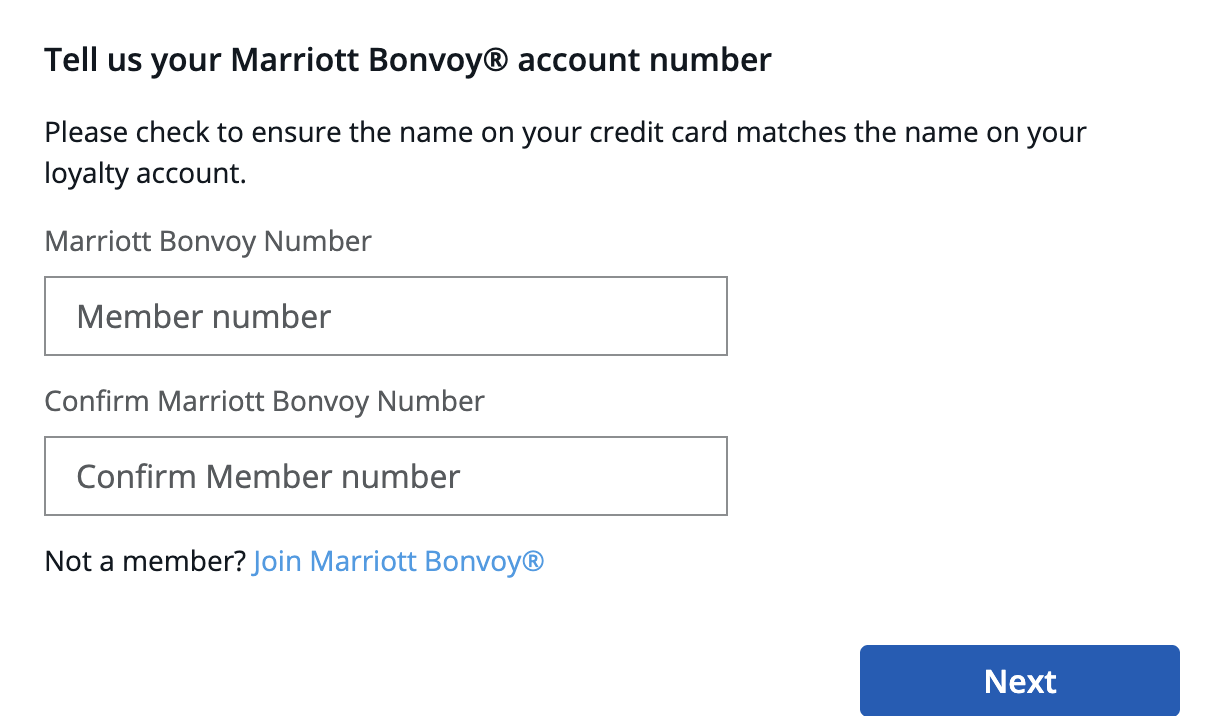

- Enter your loyalty account number for the partner program and click “Next.”

- Finally, enter the number of points you’d like to transfer to the partner (in increments of 1,000), hit “Continue” one more time, then “Confirm & Submit.”

When to transfer points

There are situations where transferring may make the most sense for maximizing the value of the points.

When converting cash back rewards to Ultimate Rewards points

Moving your points from a Chase card that only earns nontransferable points worth a maximum of 1 cent to a premium card that earns Ultimate Rewards points is the best way to maximize your rewards.

For example, with the Chase Sapphire Reserve, points are worth 1.5 cents when redeemed for travel through the Chase Ultimate Rewards portal while the Chase Sapphire Preferred card boosts the value of your points to 1.25 cents in the same portal. For potentially even greater value, transferring your Ultimate Rewards points to the right transfer partner could help you stretch your cash back dollars even further.

When boosting your points for a specific redemption

You may not have enough points for a redemption on your own, but when you transfer to someone else’s account within your household, then your combination of points could be enough for your goal.

When canceling a Chase card

If you have more than one Chase card, then there may come a point where you need to cancel one of the cards. Transferring the points from one account to another is a smart way to ensure you don’t lose any of the Chase points you’ve accumulated. You can either transfer to one of your other accounts or a member of your designated household.

Should you transfer Chase points?

No matter what Chase card you have, you should consider transferring your Chase points, especially if you want added flexibility and the chance to redeem your rewards for maximum value.

If you have one of Chase’s cash back cards, you can enjoy earning bonus rewards in everyday areas like grocery, dining and drug stores. You can then transfer these points to a Chase card that offers Ultimate Rewards points. The Chase Ultimate Rewards program offers impressive value, letting you redeem your rewards through its travel portal for a value not often seen with other travel rewards programs. It also gives you the opportunity to transfer your points to a different loyalty program, which could give your points even more value.

The bottom line

Chase Ultimate Rewards points stand out as a top choice for travel rewards due to their value and flexibility. Whether you’re transferring points between multiple Chase cards or taking advantage of the many travel partners available, transferring your Chase points can greatly enhance their value and provide more opportunities for redemption. Don’t miss out on the opportunity to make the most of your Chase points and consider transferring them for the best possible redemption options.

*The information about the Chase Freedom Flex® has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How to do a balance transfer with Wells Fargo

How to do a balance transfer with American Express