How to get an Apple Card credit limit increase

Key takeaways

- Increasing your credit limit on your Apple Card* can provide more budget flexibility and improve your credit score.

- Goldman Sachs, the card’s issuer, considers your income, credit score and credit utilization ratio when determining eligibility for a credit limit increase.

- If your request is denied, focus on improving your credit score and income before trying again.

Whether you’ve signed up for the Apple Card* to take advantage of the special financing terms on Apple products or its Daily Cash back rewards, you might be wondering how to increase your credit line on the card.

Increasing your credit limit can be a smart step. First, it increases your buying power and allows more budget flexibility. Second, it can improve your credit score by decreasing your credit utilization ratio (how much you owe on your card in relation to your credit limit), so long as you pay off your card on time and in full each month.

Goldman Sachs, the Apple Card’s issuer, doesn’t provide official eligibility requirements for a credit limit increase. However, there are certain steps you can take to improve your chances of being approved for a higher credit line.

What to consider before you apply for a credit increase

Generally, cardholders seek a higher credit limit for two reasons:

- They’re looking to make a big purchase.

- They’re working to improve their credit score.

However, it’s a good strategy to apply for a credit limit increase regularly — about every six months. Having more available credit not only looks good on your credit report, but also helps your financial stability by providing more room in case of an emergency expense that you need to use a credit card for in the moment. Just make sure a higher credit limit doesn’t tempt you to spend more than you can repay, particularly for nonemergency expenditures.

Before you apply for a credit limit increase with your Apple Card, here are a few questions to ask:

1. What is your current credit limit?

Knowing your current credit limit can help you determine how much of an increase you should ask for based on how much credit you already have and how much of it you’re using.

If you’re using a low percentage of your credit, Goldman Sachs might decide against offering you more. On the other hand, if you’re often close to your credit limit, this might serve as a red flag to the issuer that you’re not managing your debt properly.

2. How much credit do you want?

While it can be tempting to request a significant increase, know that if you ask for a large amount, there’s a higher chance the issuer will decline your request.

For example, if you have a $3,000 credit limit, it might be a better idea to ask for a $1,000 dollar increase rather than request to raise your limit to $6,000. While the issuer might double or even triple your credit line, it’s best to ask for a 10 to 20 percent increase to avoid creating the impression that you’re trying to secure credit in a difficult financial situation.

3. Are you eligible for an increase?

While Goldman Sachs doesn’t list specific requirements for a credit limit increase, Apple’s support page notes that the issuer determines credit limits based on many of the same factors assessed in your credit card application, including your credit score and credit utilization ratio. Additionally, Goldman Sachs looks at your income and the minimum payments associated with your existing debts.

Based on this information, you can do a few things to potentially improve your odds of being approved for a credit limit increase:

- Make all your payments on time. Your payment history is the most crucial factor in your FICO Score and is considered in all credit decisions.

- Be a cardholder for at least six months. Apple states in its “financial health” info that you can make a credit limit request after having your Apple Card for four months. But, according to the support page, Goldman Sachs uses your credit history with Apple Card to inform any request for credit limit increases, and this can take six months or more.

- Avoid requesting more credit too often. As mentioned, this can serve as a sign to the issuer that you’re experiencing financial issues.

While you might get the decision almost instantly, other times it might take up to 30 days for Goldman Sachs to process your request.

How to request a higher credit line with the Apple Card

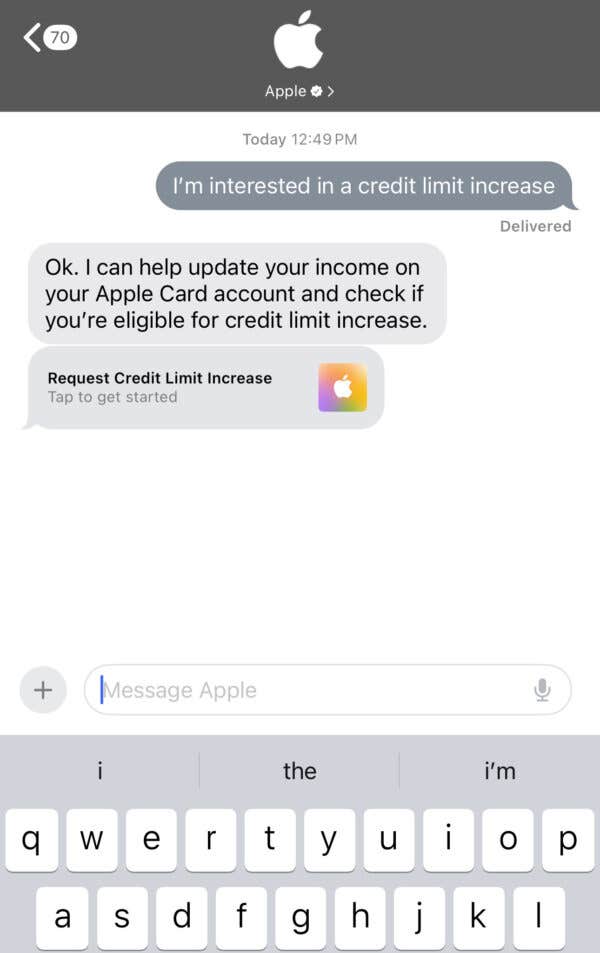

You can request an increase on your Apple device by chatting with an Apple Card customer service representative:

- Open the Wallet App on your Apple device and tap the three-dot icon in the upper right corner.

- Tap the “Card Details” option, which will bring you to a screen full of information about your Apple Card.

- Tap the “Message” icon to connect to a Goldman Sachs representative.

- You can send a message requesting a credit limit increase. The representative will ask a few questions related to your request to determine your eligibility.

Bankrate’s take: Whether a credit limit increase request triggers a hard inquiry or not varies for the Apple Card, so it might be a good idea to ask the representative before you apply.

What to do if your Apple Card request is denied

If your request for a higher credit line is declined, it’s best to wait before requesting again. Take a few months to work on your credit score and improve your overall debt and financial situation before you give it another try.

1. Increase your income

Since Goldman Sachs considers your income when reviewing your request for more credit, increasing your income can improve your chances of being approved.

So, after you’ve secured a raise or a new, better-paying position, or maybe you have taken on a side hustle, make sure to mention that to the representative when requesting a higher credit line with the Apple Card.

2. Improve your credit score

Your credit score is a major factor in all credit decisions, so raising it can improve your chances of getting a higher credit limit. Work on building your credit by paying all your credit card and loan bills on time, reducing your debt and keeping your credit utilization ratio under 30 percent — or better yet, in the single digits.

3. Apply for a credit card from a different issuer

Instead of waiting to apply for more credit on your Apple Card, you can try to get a credit card from a different issuer to boost the overall amount of credit available to you.

However, make sure you’re strategic about your credit card applications. Every time you apply for a credit card, a hard inquiry appears on your credit report which can cost you a few credit score points. Hard inquiries affect your scores for a year and stay on your credit report for two. One hard inquiry isn’t likely to hurt your credit much, but multiple ones can do more damage.

The bottom line

Overall, your chances of being approved for a higher credit line with Goldman Sachs — or any credit card issuer — come down to your credit habits and overall financial health. If you have a history of managing your debt responsibly, credit card issuers offering comparable cash back credit cards may be more likely to extend you more credit.

*Information about the Apple Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.