How returning to the office can impact your finances

American workers are gradually returning to the office, at least on a part-time basis. In conjunction with the back-to-office influx, many workers are giving a second look at workplace-related personal expenses that have decreased or even vanished amid the COVID-19 pandemic.

In August 2021, just 13.4 percent of American workers telecommuted because of the COVID-19 pandemic, according to the U.S. Bureau of Labor Statistics. But among American adults still working remotely, 38 percent indicated they’d feel uncomfortable going back to the office, a September 2021 survey by Morning Consult shows. Thus, there continues to be a divide between the work-from-home and work-at-the-office camps.

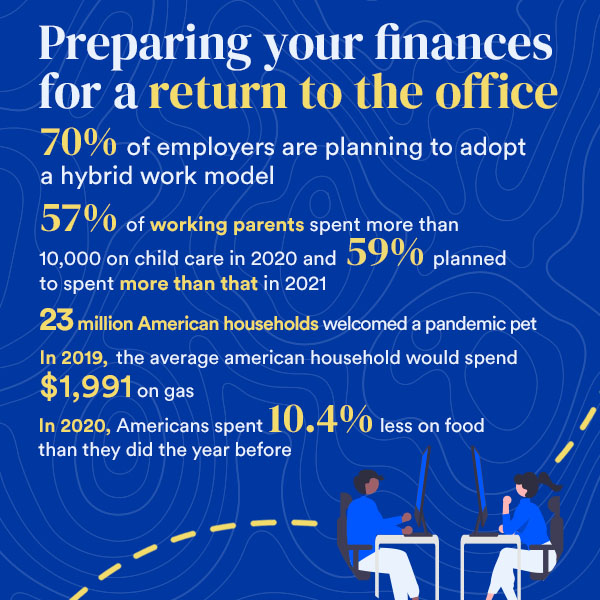

A recent survey by HR consulting firm Mercer suggests some employers may be trying to bridge that divide. In the survey, 70 percent of employers who had made return-to-office plans were adopting a hybrid work model, with some time spent at home each week and some time spent at the office. Other employers, meanwhile, are sticking to remote-only work arrangements or are requiring workers to make a full-time return to the office.

Even if you’re heading back to the office only on a part-time basis, you might find yourself faced with expenses that had practically disappeared from your budget during the pandemic. For instance, you may have spent next to nothing on child care, pet care, gas, car maintenance or restaurant food while working remotely. In a May 2020 survey commissioned by TD Ameritrade, 62 percent of respondents said they had saved money on child care because of pandemic shutdowns, and 55 percent said they had pocketed some extra cash because they weren’t commuting to work during the pandemic.

But if your workday once again involves commuting to the office, the added expenses may strain your finances. As such, it’s more important than ever to develop and stick to a household budget.

Preparing your finances for a return to the office

For most folks, some expenses tied to a return to the office can’t be avoided. For example, you may need to gas up your car more regularly because you’re now traveling between home and work. Fortunately, you can embrace ways to cut these costs and steer clear of returning to your pre-pandemic spending behavior.

Child care

Before the pandemic struck in 2020, many parents depended on daycare providers and other caretakers to watch their kids while they were at work. But after the pandemic forced workplace and school shutdowns, many work-from-home parents assumed these duties, saving money in the process but also fraying their nerves.

However, nearly 20 percent of working-age adults in the U.S. reported in July 2020 that they weren’t able to work because the pandemic had disrupted their child care arrangements, according to the U.S. Census Bureau. Of those not working, women ages 25-44 were almost three times as likely as men to not be working due to childcare demands.

For those parents who still had access to child care, a survey by Care.com shows 57 percent of them spent more than $10,000 on child care in 2020 (over $830 a month) and 59 percent planned to spend more than $10,000 in 2021.

Care.com offers these suggestions for slashing your child care bill:

- Review your options. Look at lower-cost alternatives to traditional child care, such as taking your kids to an in-home daycare center, hiring a part-time babysitter or sharing a nanny with other parents.

- Know the costs. When you’re shopping for child care, arm yourself with information about the going rate for child care in your area. CareLuLu offers a calculator that can help you find the average cost of daycare where you live.

- Open a flexible spending account for child care. Your employer may offer what’s known as a dependent care flexible spending account (FSA). This type of account lets you use pre-tax dollars for qualified expenses, such as preschool or daycare, and ultimately reduces your tax burden.

- Explore the child care and dependent care tax credit. It allows families to claim a percentage of child care or dependent care expenses on their federal tax return, depending on their adjusted gross income. If you qualify for the tax credit, it can save thousands of dollars.

- Look into free or low-cost providers. Various nonprofit organizations, such as churches and community centers, provide child care that won’t take a huge bite out of your budget.

Pet care

A lot of pet parents once turned to animal daycare or dog-walking services to ensure their furry friends were safe and sound while mom or dad was at the office. But because so many pet parents wound up working from home during the pandemic, they were able to keep an eye on their furry companion all day, eliminating the need for pet minding services.

On top of that, an estimated 23 million American households—about 1 in 5—welcomed a “pandemic puppy” or “pandemic kitty” after COVID-19 became a health crisis, according to the American Society for the Prevention of Cruelty to Animals.

Whether you’re a new or longtime pet parent, going back to the office means figuring out daytime arrangements for your pup. Chances are, your cat will be OK by itself during the day. But dogs need more attention, such as potty breaks.

According to Rover, the popular pet services marketplace, a full day of doggy daycare at a commercial location will set you back around $30. Meanwhile, dog-walking services on Rover can cost $18 to $20 per walk. If you spend $30 every weekday for doggy daycare, that amounts to $600 a month. To hire a dog walker to take your dog out five times per week at $20 per walk, your tab would be $400 each month.

So, how can you trim the cost of caring for your pooch or kitty? Jenna Mahan, director of claims and underwriting at Embrace Pet Insurance, gives these pointers:

- Shop around. Compare prices online to find the best deals on pet products and services.

- Consider subscribing. Look into subscription-based services that supply discounts for regularly scheduled orders of pet food, treats and medication.

- Request a discount. Ask your doggy daycare provider or dog walker whether they’ll offer a discount if you buy services in bulk.

- Keep an eye on your pet’s health. Don’t skip routine visits to the veterinarian. The vet can catch health problems before they become worse — and more expensive to treat.

- Emphasize quality. “Just because a product or service is cheaper doesn’t mean it’s better,” Mahan says. “Read reviews and do your research before doing things like changing food or switching daycare providers just to save a few bucks.”

Commuting

During the pandemic, millions of Americans put the brakes on driving due to the rise in work-from-home arrangements. But as office workers increasingly gear up to hit the road on a more regular basis, it may dawn on them that commuting expenses, like gas and car maintenance, will be cranking up again.

The GasBuddy app estimated that in 2019, the year before the pandemic, the average American household would spend $1,991 on gas. Car maintenance and repairs eat up much less of our budgets — an average of $397 a year, according to a 2019 survey commissioned by financial services company Ally.

For many of us, returning to the office might cause some sticker shock as we realize just how much it costs to drive between home and work. Yet car expenses need not drive you up a wall. Here are some tips for tapping the brakes on gas, car maintenance and car repairs.

- Investigate credit card rewards. Gas credit cards can fill up your account with rewards that might take the sting out of filling up your gas tank. Look for 2 percent or 3 percent cash back at gas stations.

- Search for the lowest gas price. Mobile apps, such as those from GasBuddy and Gas Guru, can help you track down the lowest fuel prices when you’re on the go.

- Sign up for loyalty programs. Many grocery stores that sell gas, like Harris Teeter and Kroger, offer rewards if you fill up your tank there.

- Consider transportation alternatives. To reduce your gas bill and reduce wear and tear on your car, replace some of your road trips by switching periodically to public transportation, carpooling, biking or walking.

- Go over your auto insurance policy. Make sure you’ve got adequate coverage in case you’re involved in a wreck and your car needs to be fixed. A hefty repair bill that’s not covered by insurance can put a huge dent in your budget.

- Be a better driver. Avoiding aggressive driving and resisting the temptation to speed are just two ways you can make your gas last longer.

- Take care of your car. Regular oil changes, proper inflation of your tires and routine maintenance are three of the roads you can take toward lower vehicle costs.

Food

In 2020, Americans spent 10.4 percent less on food than they did the year before, according to the U.S. Bureau of Labor Statistics. That’s primarily because spending on outside-the-home dining plummeted 32.6 percent, largely due to pandemic-related restaurant closures. The 32.6 percent drop was partly offset by a 6.4 percent jump in at-home spending on food.

Working from home has let many people prepare their meals at home and save money, as opposed to eating out during the workday. A return to work might reverse some of those savings, though. The majority of office workers fork over anywhere from $3 to $10 per lunch, according to a 2019 survey by QuickBooks. On the high end, that amounts to $50 per week if you go out for lunch every day.

To slice your food budget, consider:

- Making lunch at home and taking it to work. “Meal prep is a great way to save you both time and money. By planning your weekly meals ahead of time, you’re less likely to overspend from regularly ordering out during lunch breaks,” says Rebecca Gramuglia, a consumer expert at TopCashback.com.

- Leaning on leftovers. Perhaps that lasagna from last night’s dinner could be a tummy-satisfying, at-the-office lunch the following day.

- Packing some snacks. Tuck enough snacks into your backpack or purse to keep you fueled throughout the workday, suggests Michelle Keldgord, co-founder of BakingHow, a website dedicated to baking. “Since you’re not working from home anymore, don’t be tempted to hit the snack machines or cafeteria. Pack everything, and you will save several dollars through the week,” she says.

- Dining out with credit cards. If you do go out or order out for lunch, you might want to pay for it with a credit card that provides rewards for restaurant purchases.

- Joining rewards programs. If any of your favorite lunch spots serve up rewards for frequent diners, be sure to sign up for these programs.

The bottom line

Navigating the return-to-work world can be overwhelming. But you can ease some of the stress by paying attention to expenses that may have slipped off your radar while you’ve been working remotely. If you come up with a plan to attack these costs, you stand a better-than-remote chance of making it easier to get back into the office groove.