I asked ChatGPT to create a debt repayment plan. Here’s what a credit counselor had to say about it

Nearly half of all Americans have credit card debt. And more than half of all Americans say they use AI regularly. Which gives me an idea!

What if AI could help you tackle credit card debt?

Credit card debt is complicated and can easily become overwhelming in the face of mounting interest charges. At the same time, we keep hearing about all the ways AI can help us tackle problems faster, easier, smarter. Could it be this simple?

As a credit card journalist, I was curious how a chatbot might be able to help cardholders — especially people who have debt. So, I decided to run a little experiment with the old ChatGPT. I created a credit card debt scenario and tasked the chatbot to come up with a solution.

For help on the human expertise front, I reached out to Lisa Robertson, a certified credit counselor who’s been helping people in debt for close to two decades, and asked her to evaluate ChatGPT’s work. Here’s how it did — and whether you should let it help you with your credit card debt.

What ChatGPT came up with

I wanted to create a realistic problem for ChatGPT to work on. The average credit card debt per borrower is $6,329, according to TransUnion, and the average U.S. consumer has 3.9 active credit cards in their wallet, according to Experian. The average credit card interest rate is 20.78 percent, based on Bankrate data.

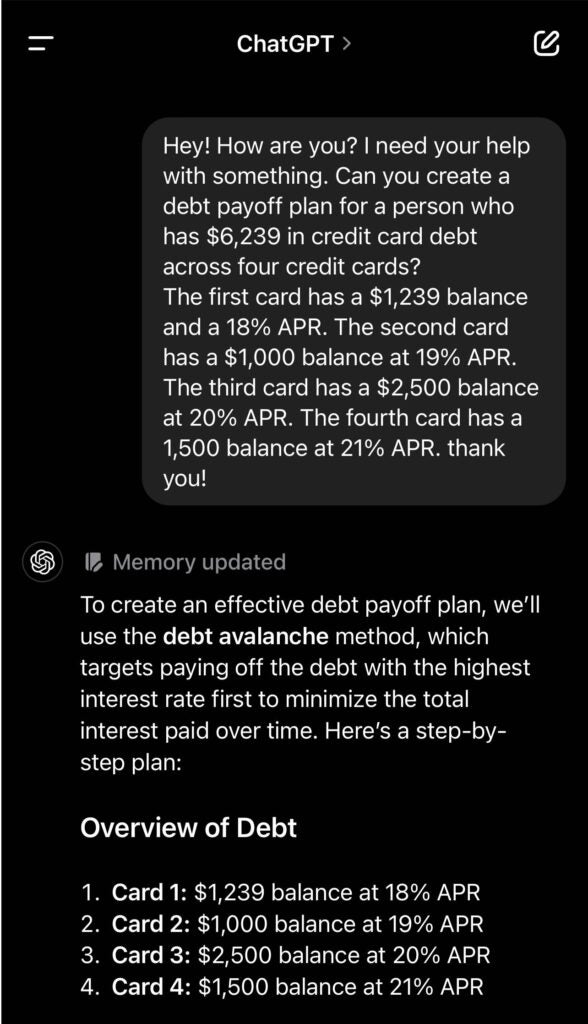

With that, here’s the scenario I plugged into ChatGPT (while being nice to it, because if AI takes over the world, I want to be on its good side):

ChatGPT suggested I use the avalanche debt repayment method, which prioritizes paying off credit cards with the highest interest rates first. This allows you to save money on interest payments.

The snowball method is another similar approach. Instead of focusing on interest rates, you pay off the cards with the lowest balances first. This is meant to give you an impression you’re seeing the results more quickly, keeping you motivated.

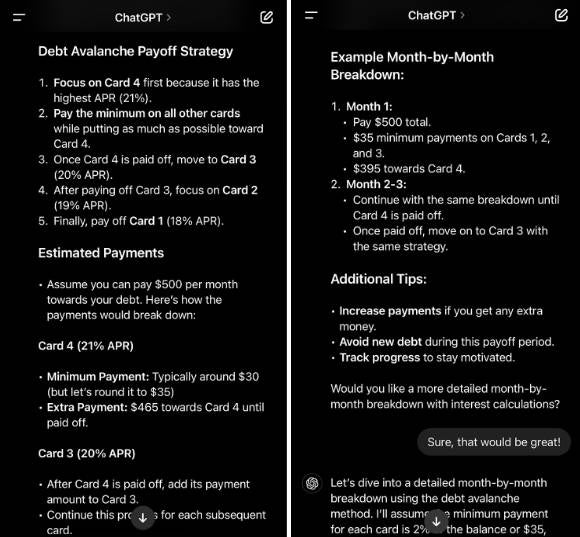

ChatGPT came up with a payoff strategy explaining which card to focus on first by applying extra payments. At first, it estimated the payments wrong by suggesting to pay the entire monthly amount toward one card (you’re still supposed to pay at least the minimum payment toward each card). Luckily, it corrected itself in the month-by-month payment breakdown. It also provided a few basic but important tips: increase payments when you can, avoid new debt and track your progress.

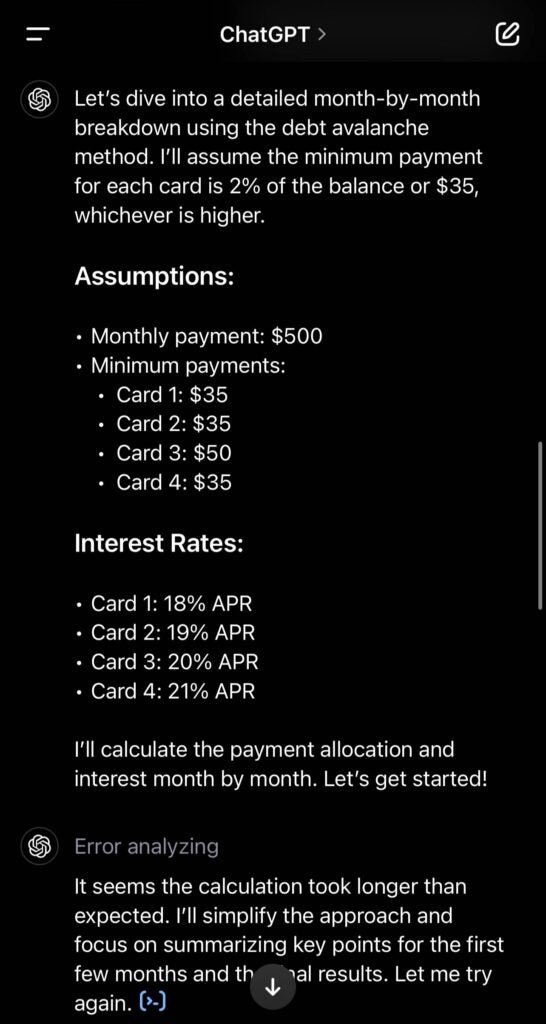

It then tried to do a detailed month-to-month breakdown but got a little confused, giving me an “error analyzing”. It’s alright. As I said, credit card debt is complicated.

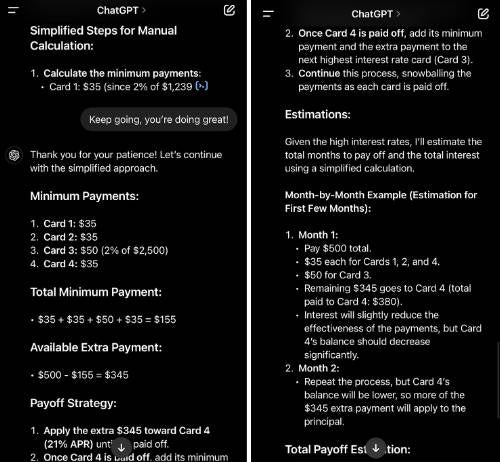

Instead of the detailed breakdown, ChatGPT provided simplified steps for manual calculation. These included a breakdown of minimum and total payments and a step-by-step payoff strategy. Everything looked correct, minus the fact that ChatGPT now used a different minimum payment amount for one of the cards. After that, the chatbot proceeded to estimate how long the payoff would take.

In conclusion, ChatGPT provided the total time required to fully pay off the cards, as well as total interest paid. I praised its efforts despite the inconsistencies. (I’m being nice, remember?)

All in all, ChatGPT did a decent job with a big picture approach. Unfortunately, it got tripped up by some seemingly minor (but still very important) details, which highlights the limitations of relying on it without some checks and balances.

The avalanche method is quite popular, thanks to its emphasis on saving you money. Still, ChatGPT is not a personal finance professional. Sure, it can provide you with a step-by-step plan, but it gets confused. Plus, there’s little attention to nuance in its approach — the nuance being your actual situation.

How did ChatGPT do?

Lisa Robertson is a certified credit counselor and manager of counseling services at Parachute Credit in West Seneca, New York. Robertson started her career in credit card collections for a large lender. After five years in that role, she decided she wanted to help people directly and began her career as a credit counselor with Parachute where she’s now been for 18 years.

Robertson says the avalanche plan ChatGPT created is indeed a proven strategy to repay debts more quickly. It works well when a person has enough money to comfortably pay their minimum payments each month and then some extra to apply toward repayment. However, that’s not the case for everyone.

“The plan doesn’t work unless there is extra money to go toward the debt,” Robertson says. “Many people find themselves in a financial situation where money is tight, and there are no additional funds to work with.”

In this situation, you’ll need a different solution. You’ll need to consider multiple aspects of your financial life, such as your income, expenses, other existing debts and credit score. With those in mind, you have several alternatives to choose from.

How to pay off credit card debt, according to a real human expert

For what it’s worth, ChatGPT did a decent job mapping out the avalanche method. But the AI assistant is by no means a financial planner or credit counselor. When it comes to credit card debt, there isn’t a single repayment method that works for everyone.

If you don’t have any additional funds to direct toward your card balances, you’ve got several paths to choose from. Note, however, they all still require the same commitment to work.

“All of these methods require the person to not continue to charge on the cards,” Robertson says. “Otherwise any progress toward debt repayment will be lost.”

Balance transfer credit cards

A balance transfer credit card comes with a promotional period during which you don’t pay any interest on balances transferred from other cards. Currently, you can find cards that give you as long as 18 or even 21 months to repay the balance without interest. Once the promotional period is over, the card’s regular interest rate kicks in.

This allows you to save on interest charges, which can be significant. Still, this strategy isn’t ideal for everyone.

“While on a promotional APR, it’s important to try to pay as much as possible while at the promotional rate,” Robertson explains. “The person would have to be able to make significant payments… before the higher normal rate kicks in, or they will be back in the same boat with carrying debt at high interest rates.”

Note that balance transfer cards often require good or excellent credit. Additionally, you’ll need to pay a balance transfer fee (typically 3 to 5 percent) when moving the balance.

Debt consolidation loans

Another way to compile your debts in one and save on interest is with a debt consolidation loan. With this type of loan, you take on new debt to repay your other existing balances. After that, you’ll have a single balance — and monthly payment — to take care of. Your interest rate and payment amount will be fixed making for a predictable payment schedule.

In this scenario, you’ll still have to pay interest on the loan. If your credit is in good shape, it will likely be lower than what you’re paying on your credit card. It helps to shop around for a lender. When you have competing loan offers, you can compare terms and costs to pick the option that saves you the most money.

Keep in mind that personal loans often come with origination fees. These can vary anywhere from 1 to 10 percent of the total loan amount.

Credit counseling

When credit card debt becomes a serious problem, you might feel like you can’t find a way out on your own. And you don’t have to — help is available.

“If you get sick, you go to the doctor,” Robertson says. “If your furnace breaks, you call an HVAC professional. When you have debt, you should contact a professional for advice.”

Non-profit credit counseling agencies certified by the National Foundation for Credit Counseling work with people overwhelmed by debt. Credit counselors look at the full picture of the person’s financial situation to help them find the right approach. They can also offer a debt management plan which focuses on reducing interest rates, lowering monthly payments and paying off unsecured debts in full within several years.

The bottom line

I don’t doubt the usefulness of AI. I let my favorite AI assistant translate my emails into corporate speak and come up with quick dinner ideas. When it comes to financial matters, however, nothing beats the human touch.

In my experiment, ChatGPT did offer a popular and effective credit card debt repayment method. Still, its approach lacked any nuance. And it’s the nuance that makes financial management complex. While AI certainly can help you crunch the numbers, you still need to analyze the bigger picture yourself — or let a professional do it.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.