Chase launches Sapphire limited time bonus: Here are 10 ways to use it

Chase just announced a new limited time offer of 75,000 Ultimate Rewards points for both the Chase Sapphire Preferred Card® and Chase Sapphire Reserve® — making two of our favorite travel credit cards even more valuable right now. (These offers are no longer available.)

You can take advantage of this offer for either card by spending $4,000 within three months of card opening.

The offer is worth more than $930 for Preferred cardholders and $1,125 for Reserve members when redeemed for travel through the Ultimate Rewards portal, but that’s not all you can do with those points — and it may not even be the best redemption value.

Check out our list of 10 things you could do with this limited time bonus.

1. Book a flight to Europe

You can redeem 75,000 points for a round-trip ticket from the U.S. to Europe on multiple partner airlines. For example, at the time of publishing, 68,000 points transferred to the Iberia Plus program could be redeemed for a round-trip flight between the U.S. east coast and Spain on Iberia airlines. For 50,000 points you can find a one-way business class flight from the U.S. to Europe on Air France or KLM via the Flying Blue program. Transferring points can be a great way to get value for your newly-acquired points when you have a specific trip in mind.

2. Convert your points into 75,000 points with any of Chase’s partners

In fact, Chase offers transfers to 11 partner airlines and three hotel chains at a 1:1 ratio, so Europe doesn’t have to be in your plans to put this redemption option to good use. You can leverage your Ultimate Rewards points for hotel stays and award tickets with any of these partners. According to Bankrate’s valuations, Ultimate Rewards points are worth an average of 2.0 cents each when redeemed this way, which means your 75,000-point bonus could be worth about $1,500.

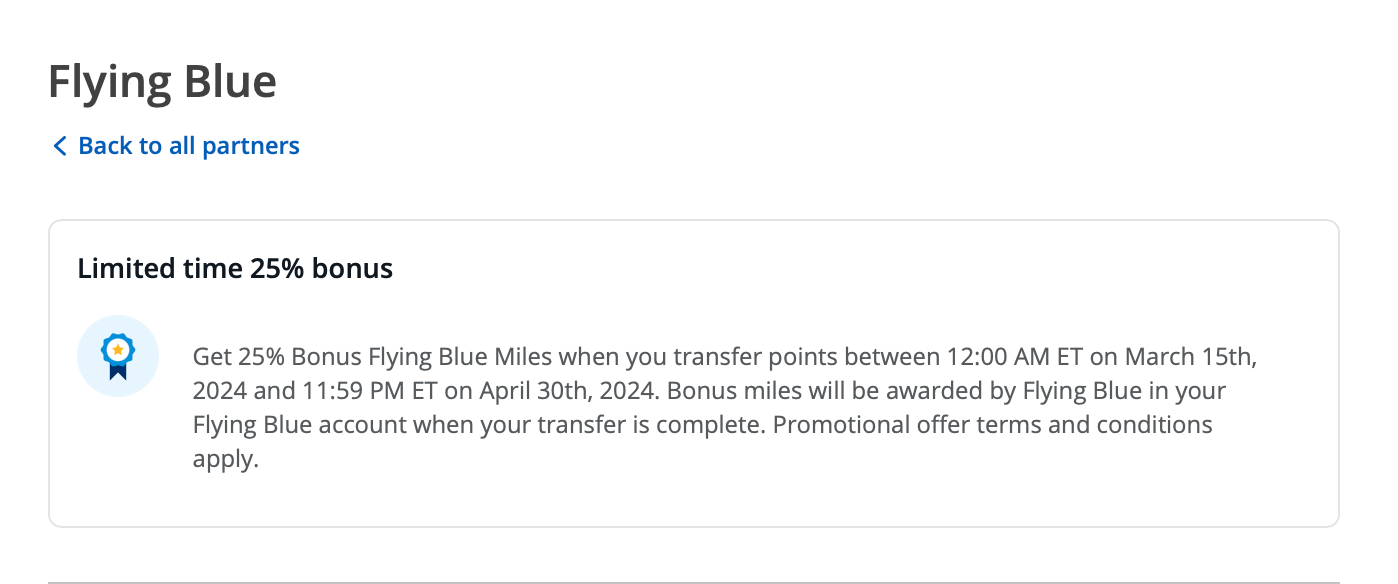

From time to time, Chase even offers transfer bonuses to select partners. Most recently, there was a 25 percent transfer bonus active for transfers to Flying Blue, the frequent flyer program for Air France and KLM. Transfer bonuses can come every now and then. In this case, the bonus would have turned 75,000 Ultimate Rewards points into 93,750 Flying Blue points. For reference, at the time of publishing, a summer KLM flight from Chicago to Athens, Greece, came in at $719 round-trip, but just 48,000 Flying Blue points plus taxes and fees.

Transfer bonuses can help extend the reach and value of your points when transferring to partner airlines and hotels.

3. Redeem for boosted flat-rate value on Chase Travel

For Chase Sapphire Preferred cardholders, points are worth 25 percent more when redeemed for travel through the Chase portal, which makes this 75,000-point offer worth $937.50.

If you apply for a Chase Sapphire Reserve card, your Ultimate Rewards points are worth 50 percent more when redeemed that way, so this limited time 75,000-point bonus is worth $1,125 in that instance.

With both cards, this boosted redemption value alongside the elevated sign-up offer could cover or help discount how much you spend on your next travel purchase within the portal.

4. Spend four nights in Mondrian Mexico City Condesa Hotel

With 75,000 points you can spend four nights in a 4.5 star hotel in a beautiful neighborhood in Mexico City. Best of all, if you have a Chase Sapphire Reserve card, you can double the benefits as the Mondrian is part of “The Edit” program. These handpicked hotels include special benefits on every stay, including daily breakfast for two, a $100 property credit that can be used at hotel restaurants and spas, room upgrades if available, early check-in and late checkout, and complimentary WiFi. With so much to explore, your newly acquired points can make your next trip a reality.

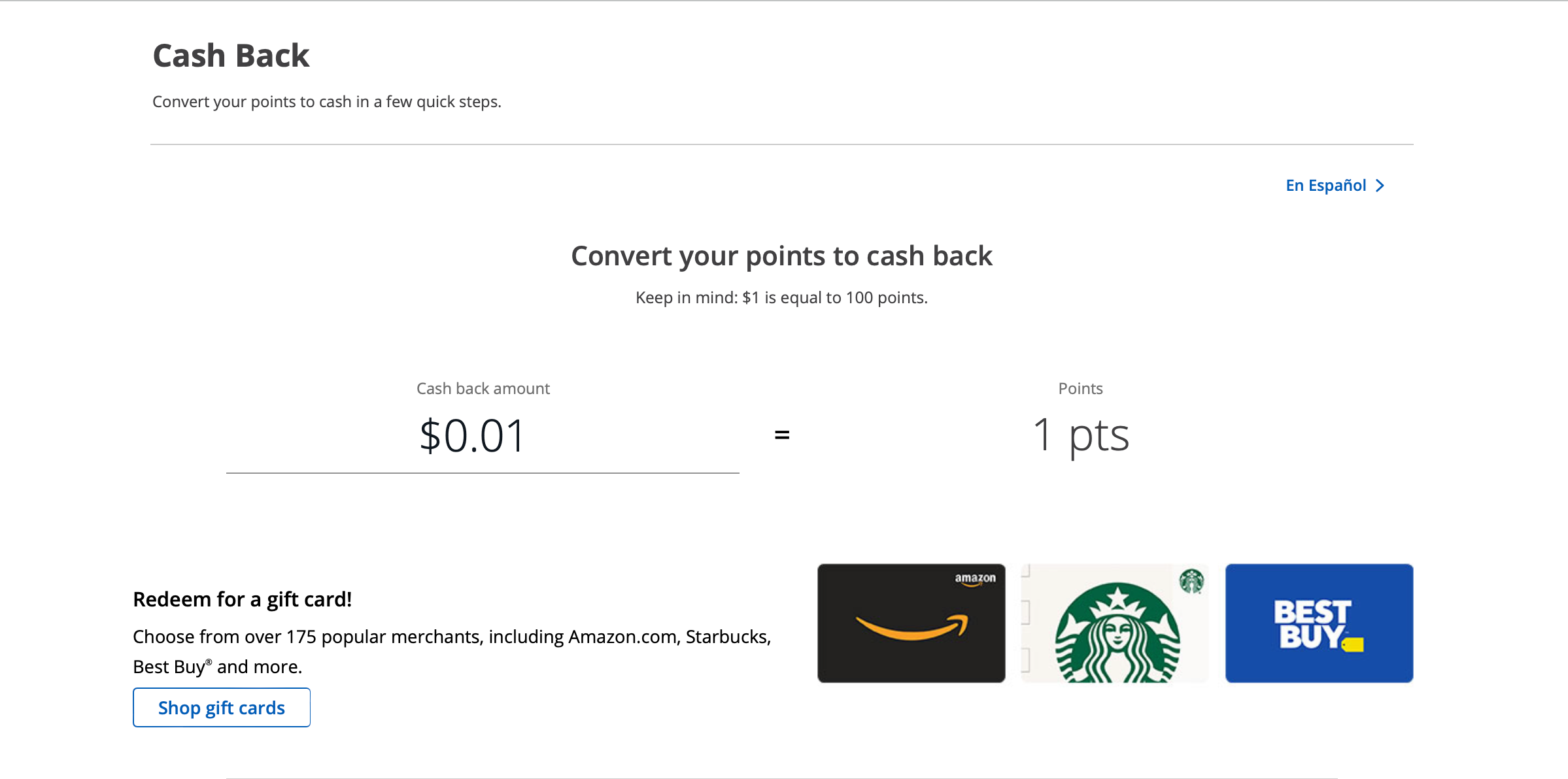

5. Redeem for $750 cash back

Chase allows you to redeem Ultimate Rewards points for cash back at a redemption rate of 1 cent per point. With 75,000 points you could receive $750 in the form of statement credit or a deposit into most checking or savings accounts. Alternatively, you could choose to redeem your points toward gift cards at leading retailers and shops such as Starbucks, Amazon and Best Buy, once again at a one point equals 1 cent rate. Therefore, you could redeem 75,000 points for $750 worth of gift cards.

6. Pay Yourself Back

Chase offers the ability to pay yourself back for certain purchases. With this option, you can apply Ultimate Rewards points to cover recent qualifying purchases on your Chase credit card. The purchases that will qualify differ depending on which card you hold.

This redemption option allows you to select up to 12 recent purchases from within the last 90 days and the site will show you the number of points required to cover the cost. In addition, Chase also provides regular bonus categories that can reduce the number of points required for a purchase. For instance, there’s often a 25 percent boost for charitable donations to certain organizations. These bonuses are listed on the site and are automatically applied if a selected purchase falls under the bonus category. Pay Yourself Back will appear as a statement credit on your account within three business days of selection.

If you choose to use the option, be sure to review the points required before submitting as changes are not allowed after it goes through. Likewise, while you can apply partial points toward a purchase, once any points have been redeemed toward a purchase for a statement credit, you will not be able to apply more points to that specific purchase in the future.

7. Book a dinner reservation through Chase Dining

Chase Dining is a program that allows cardholders to redeem points toward dining experiences with exclusive reservations at restaurants, wineries, bars, and pop-ups across the country. Points are worth 1 cent each with this redemption option, so 75,000 points could more than score you a date night for two at a Michelin-starred restaurant dining event that costs $275 (so 27,500 points) per person.

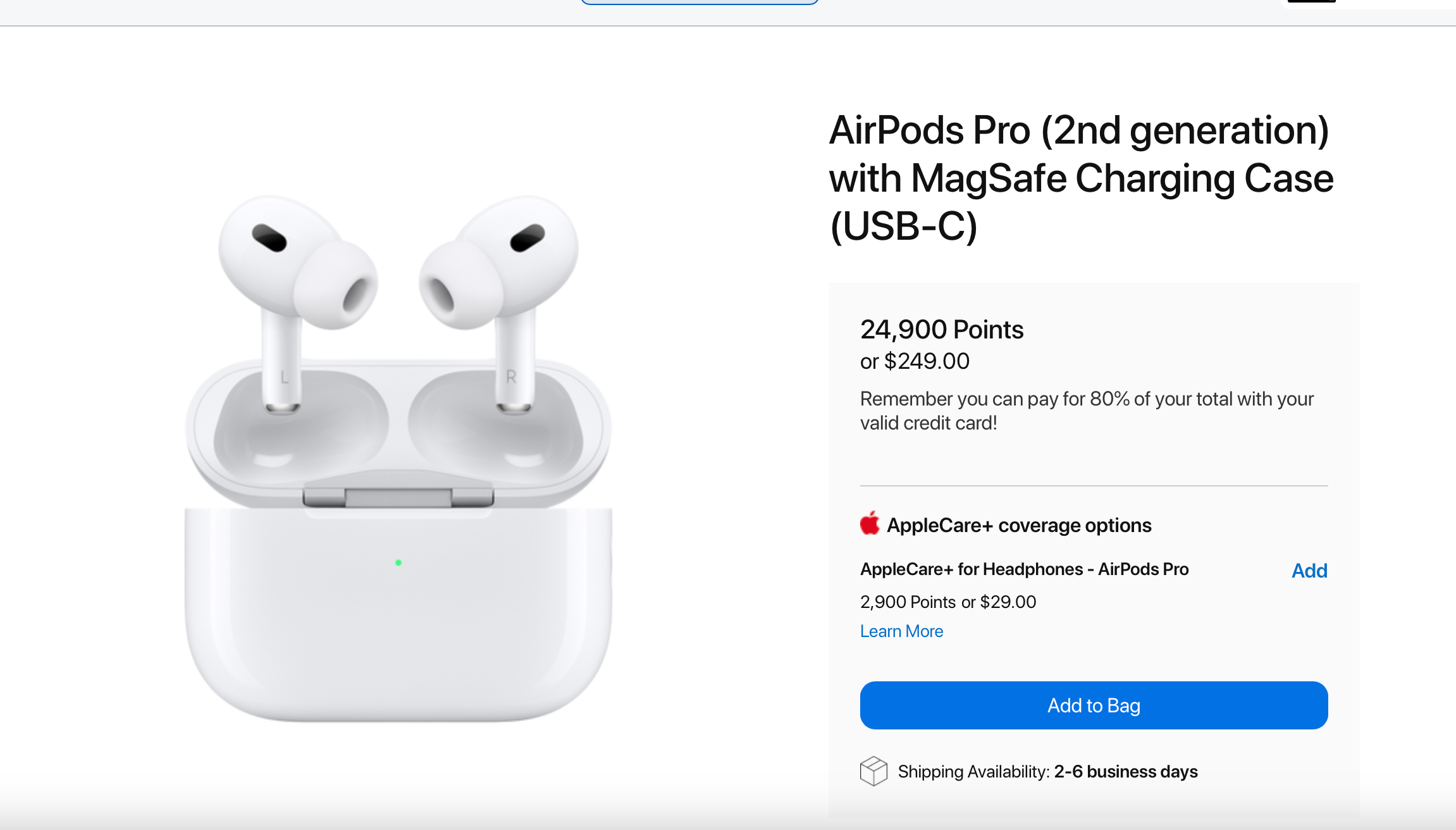

8. Purchase a new Apple product

Chase Ultimate Rewards points can be redeemed directly through the Ultimate Rewards portal to purchase various products from Apple. Points can be redeemed towards Apple purchases generally at a rate of one point being equivalent to one cent. Shipping is free on all orders. While this is not the best use of Ultimate Rewards points, it can be helpful if you already have a planned Apple purchase in mind.

For example, you could redeem 75,000 Ultimate Rewards points for three pairs of the latest Apple AirPods Pro to ensure you and your family or friends have headphones when on the go.

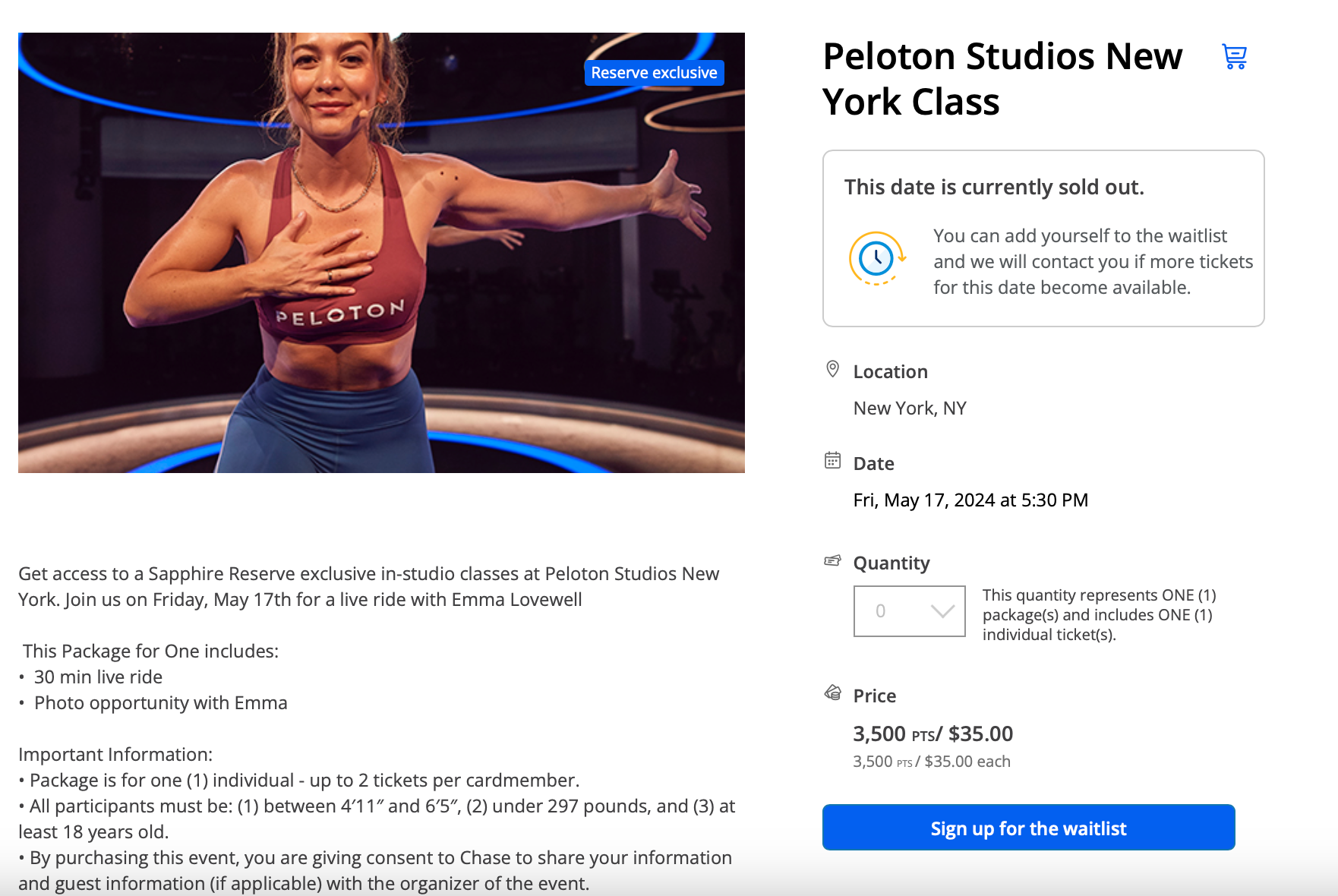

9. Redeem for a Sapphire Reserve exclusive experience

Chase Sapphire members can use their points toward unique and exclusive experiences around the world. These can range from summer concerts to dining experiences to athletic tournaments. Chase Sapphire Reserve members are eligible to use their points to snag exclusive seats in Peloton live classes at the Peloton studios in New York and other limited time events around the world. This can be a great benefit and is an exclusive benefit of the Reserve card benefits.

10. Combine points with others in your Ultimate Rewards account

Chase allows cardholders to combine points across their accounts or with a designated household member. This can help you pool points to redeem for even larger redemptions using Ultimate Rewards points. This pooling opportunity is what makes a Sapphire card — either Preferred or Reserve — a key component of the Chase trifecta.

The Chase trifecta calls for strategically pairing three Chase cards to maximize rewards. Pair your Sapphire card with Chase Freedom Unlimited® and Chase Freedom FlexSM*, for instance, to earn top rewards across multiple spending categories and combine all your points under your Sapphire account to maximize your redemption value and options.

The bottom line

Chase is offering a limited time offer providing applicants for the Chase Sapphire Preferred and Reserve cards 75,000 Ultimate Rewards points after spending $4,000 within three months of card opening. Both of these credit cards, some of the best Chase credit cards available, offer benefits focused around dining, travel and top consumer protection perks.

Furthermore, Chase offers a plethora of ways to redeem points and this offer could help you get immense value from your regular purchase habits. Be sure to look into this limited time offer before it’s too late.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.