Sick of surcharges? Sadly, they’re just getting started

Airlines are notorious for nickel-and-diming their passengers. It wasn’t too long ago that you could check bags for free. But in 2008, American Airlines became the first major U.S. carrier to implement checked bag fees. Others quickly followed, and the fees haven’t stopped there. Many airlines now impose fees for carry-on luggage, seat selection and more. It’s not uncommon to be charged for sodas on some flights, as my family was on a recent Frontier Airlines flight.

Numerous other industries have followed the same model, essentially finding ways to raise prices while hiding behind the illusion that they’re not actually raising prices. Some surcharges are hidden and others only become apparent so late in the process that the consumer gives in rather than starting from scratch. We end up paying more, yet companies bat their eyes and tell us they didn’t raise prices, they merely added a “convenience fee” or tacked on a surcharge to account for market conditions.

Additionally, merchants are increasingly charging for fees that they, in the past, have considered the cost of doing business. This includes fees for using credit cards, packaging, tariffs and more.

Have a question about credit cards? E-mail me at ted.rossman@bankrate.com and I’d be happy to help.

From food to flights, surcharges are everywhere

There are individual merchants that charge extra for certain items, but there’s also a rising number of businesses assessing blanket charges based on your method of payment.

Nationwide, credit card surcharges are becoming much more common. About a third (34 percent) of small businesses charge consumers extra when they pay with a credit card, according to J.D. Power. In 2021, less than 5 percent of small businesses assessed credit card surcharges. In 2016, the figure was less than 2 percent. Merchants love to complain about credit card fees (the average interchange fee is about 2 percent), so many of them (especially small businesses) are passing those costs onto consumers as an extra line item.

That isn’t helpful when you’re also dealing with other surcharges, whether for an item or for a specific reason.

Want eggs at Waffle House? Add 50 cents per egg on top of the menu price to account for “the unprecedented rise in egg prices,” the company says. During the pandemic, COVID surcharges caught on. Around the same time, some San Francisco restaurants implemented a climate change surcharge. I recently encountered an additional levy for employee benefits at a San Francisco International Airport restaurant. (Apparently San Francisco really likes surcharges.)

The hotel industry is another area embracing the extra fee method of raising prices without raising prices. Resort fees at major hotel brands can range into the hundreds of dollars for a multi-night stay and supposedly cover everything from pool and fitness center access to a welcome drink at check-in. The reality, though, is that those things were once included as part of the nightly room rate or were optional add-ons (WiFi in your room, for instance). In this case at least, there are some ways to avoid resort fees, especially if you have certain hotel credit cards in your wallet.

The danger of consumer backlash

Surcharging is a shortsighted business practice that can backfire. For example, J.D. Power says 41 percent of credit cardholders decided not to use a card payment method due to a business implementing a surcharge. No big deal, right? That means the businesses got what they wanted. The problem, though, is that most people are carrying a lot less cash these days, so a credit card surcharge can limit sales. If I only have $20 in my wallet and don’t want to pay a surcharge, I’m only going to spend $20 at the business when I may have been willing to spend $50 on my credit card.

Surcharging also plays poorly in the court of public opinion; sometimes people tell all their friends on social media that they didn’t like the surcharge and won’t be going back.

As costs have risen across the board in recent years, businesses and consumers have engaged in a delicate dance. Fed up with inflation, consumers believe they’re paying enough already. But businesses have endured higher costs of their own, ranging from raw materials to labor, rent and more. As a result, they’re looking for ways to push more of the cost burden onto customers but with a sleight-of-hand claim that they didn’t actually raise prices.

Tipping can be looped in with surcharges

Tipping is a surcharge of sorts, even if businesses don’t necessarily want us to view it that way. And we have seen tremendous tip creep in recent years, such as being asked to tip at coffee shops, food trucks and other locations where tipping wasn’t commonplace in the past. I’ve even been asked to tip at a self-checkout machine at Newark Airport and a pick-your-own strawberry farm.

We grumble about tip creep, yet many of us tip anyway. In 2022, shortly after rolling out automated tip prompts, Starbucks said about half of credit and debit transactions involved a tip. That has to be way more than the percentage who put bills or coins in an old-fashioned tip jar. I don’t begrudge workers the extra money, I just wish companies would be more transparent.

Bringing hidden fees into the light

Transparency was the goal of a Consumer Financial Protection Bureau initiative during the Biden presidency. The former president and his former CFPB director, Rohit Chopra, waged a war on “junk fees.” These are additional charges that are often hidden and of questionable value. Some examples include credit card late fees that far exceed the financial institution’s costs, booking fees for short-term home rentals and ticketing fees for concerts and sporting events. The CFPB won some notable concessions from event ticketers and home rental platforms, many of which have begun to deliver more “all-in” pricing from the get-go. The fees didn’t go away, but at least they are often disclosed more clearly, which is a start.

It seems that’s really the best we can hope for as consumers.

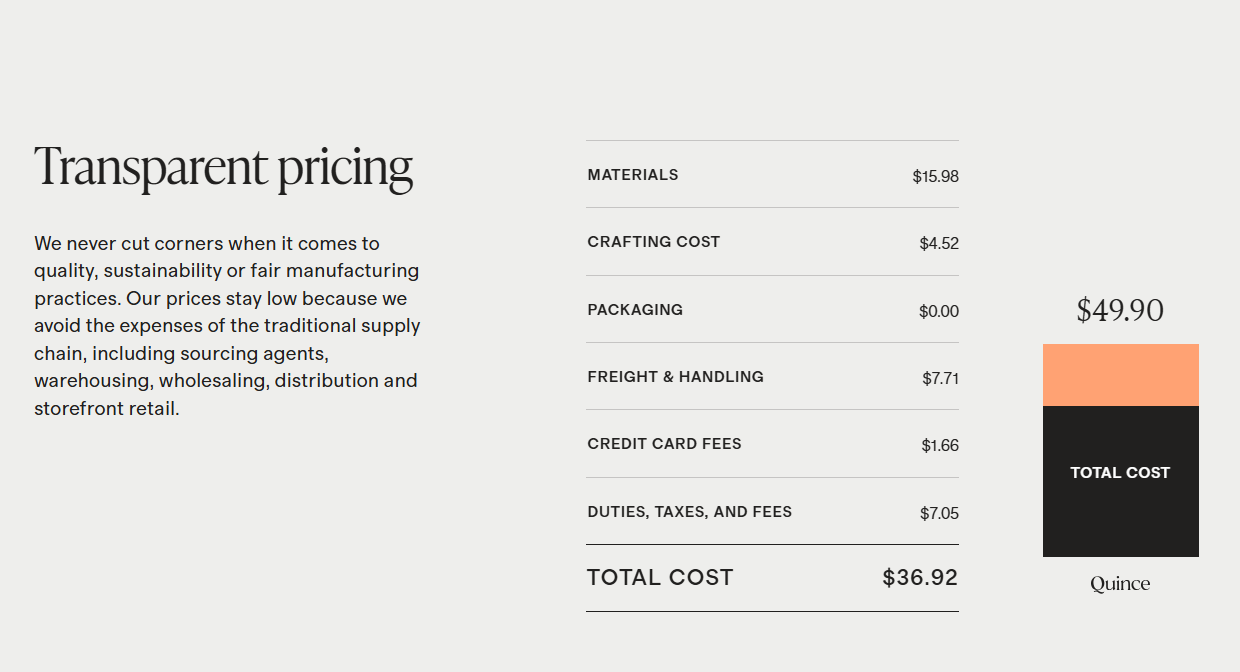

Quince, a clothing retailer, has the most transparent pricing I’ve ever seen. The company breaks out separate line items for just about everything. For example, a 100 percent European linen shirt dress is priced at $49.90. According to Quince’s pricing breakdown, $36.92 of that comes from $15.98 in materials; $4.52 in crafting costs; $7.71 for freight and handling; $1.66 in credit card fees; and $7.05 in duties, taxes and fees. The remainder is presumably profit though the site doesn’t explicitly state that.

This feels well-intentioned, but it’s overkill. I could envision this attempt at openness inviting more scrutiny on individual segments of the bill. For instance, is that $7.71 in “duties, taxes and other fees” a tariff surcharge? Amazon was reportedly considering listing a tariff surcharge on at least some products, until President Donald Trump got upset about it. Tariffs could represent the ultimate “don’t blame us, blame the government” add-on from retailers.

By the way, can you imagine if restaurants offered the same pricing breakdown as Quince? You would get customers saying things like, “I asked for no onions, so you need to take that charge off.” Or “I didn’t like the music, I’m not paying for that part of the bill.” Or “I didn’t even use the bathroom, why did you include a restroom servicing fee?”

How can consumers insulate themselves against increased surcharges?

Credit card rewards can offset some or all of the surcharges imposed by businesses. For instance, my favorite local pizza place imposes a 3 percent fee when I pay with a credit card. My Chase Freedom Flex®* gives 3 percent cash back on dining purchases, so when I pay with that card, it’s essentially the same as using bills and coins and getting the lower cash price. It’s still a bummer, because those rewards used to put extra money back in my pocket, but at least I’m not losing out. And I don’t carry much cash, so using my credit card means I don’t need to make a special trip to the ATM every time I want pizza.

Airline credit cards often award various perks that can lower the bite of certain fees. For example, checked bag fee waivers are common. The Citi® / AAdvantage® Platinum Select® World Elite Mastercard®* gives a free checked bag to cardholders and up to four companions traveling on the same reservation. Compared with the normal fee of $35 per bag, this card could pay for itself in just one trip (the annual fee $99, waived for first 12 months).

Hotel credit cards dole out some nice freebies as well. The Hilton Honors American Express Surpass® Card ($150 annual fee) includes Gold elite status, entitling members to free Wi-Fi, complimentary water bottles and continental breakfast, along with a “fifth night free” promotion on rewards stays of five consecutive nights or longer, plus some other benefits. If you’re loyal to a particular hotel chain or airline, it can pay to sign up for one of their branded credit cards.

Separately, it’s worth noting that you can sometimes ask to have certain charges lowered, or maybe even waived entirely. There are no guarantees, but there’s no harm in asking.

The bottom line

I don’t begrudge businesses’ efforts to turn a profit. We may bristle at higher prices as consumers, but many of us are also employees, and we want our efforts to be compensated fairly. In the end, fairness is all we’re asking for, and it starts with transparency (just not as transparent as Quince, perhaps).

Businesses should offer one price for their goods and services, and then consumers can decide whether it’s worth it. We don’t need to see every single input, but give us one price, take it or leave it. Don’t tell us it’s one thing and then charge something else. It’s getting a bit ridiculous. Because if we continue down this path, at some point companies are going to start charging extra for the air that we breathe.

The information about the Chase Freedom Flex® and Citi® / AAdvantage® Platinum Select® World Elite Mastercard®has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

Bankrate's Expert Contributors

Our Expert Contributors are a select group of creators, experts and thought leaders who share first-person perspectives on finance and its intersections with our lives.

Meet our experts